Author: Grayscale Research

Translator: Felix, PANews

Key Points

- According to the FTSE/Grayscale Crypto Industry Index, the cryptocurrency market consolidated in the third quarter of 2024.

- Changes in the FTSE/Grayscale index series highlight emerging themes in the digital asset industry, including the rise of decentralized AI platforms, efforts to tokenize traditional assets, and the popularity of meme coins.

- Despite Ethereum's performance being less than Bitcoin's so far this year, it is better than the smart contract platform index. Grayscale Research believes that despite fierce competition in the smart contract platform field, there are multiple reasons why Ethereum can maintain its position.

- The top 20 tokens summarized by Grayscale Research have been updated. The top 20 represent a diversified asset portfolio in the cryptocurrency industry. These assets have high potential in the next quarter. The newly added assets for this quarter are SUI, TAO, OP, HNT, CELO, and UMA.

- The listed top 20 assets have high price volatility and should be considered high-risk; the U.S. presidential election may also be a significant risk event for the cryptocurrency market.

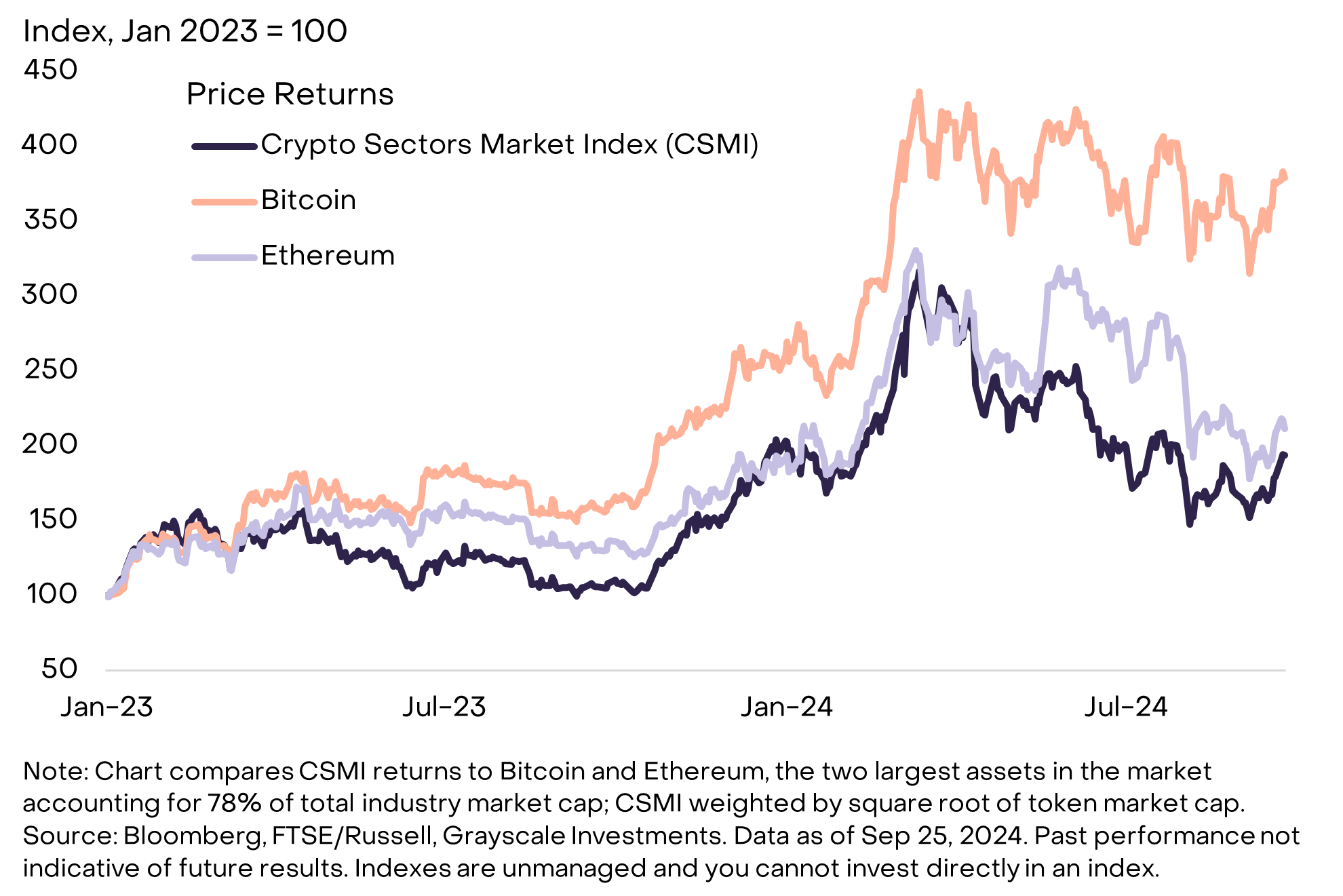

The Grayscale Crypto Sectors provide a comprehensive framework for understanding the range of investable digital assets and their relationship with underlying technologies. Based on this framework and in collaboration with FTSE Russell, the FTSE/Grayscale Crypto Industry Index series has been developed to measure and monitor cryptocurrency asset categories (Chart 1).

Chart 1: Index measuring asset category performance in the cryptocurrency industry

The cryptocurrency framework is designed to be updated with evolving market dynamics and adjusted at the end of each quarter. The latest adjustment process concluded on September 20. Since the beginning of this year, the index adjustment process has reflected new listings, changes in asset liquidity, and market performance. This year's update of the cryptocurrency industry index series has highlighted emerging themes in the digital asset industry, including the rise of decentralized AI platforms (such as TAO), efforts to tokenize traditional assets (such as ONDO, OM, and GFI), and the popularity of Memecoins (such as PEPE, WIF, FLOKI, and BONK).

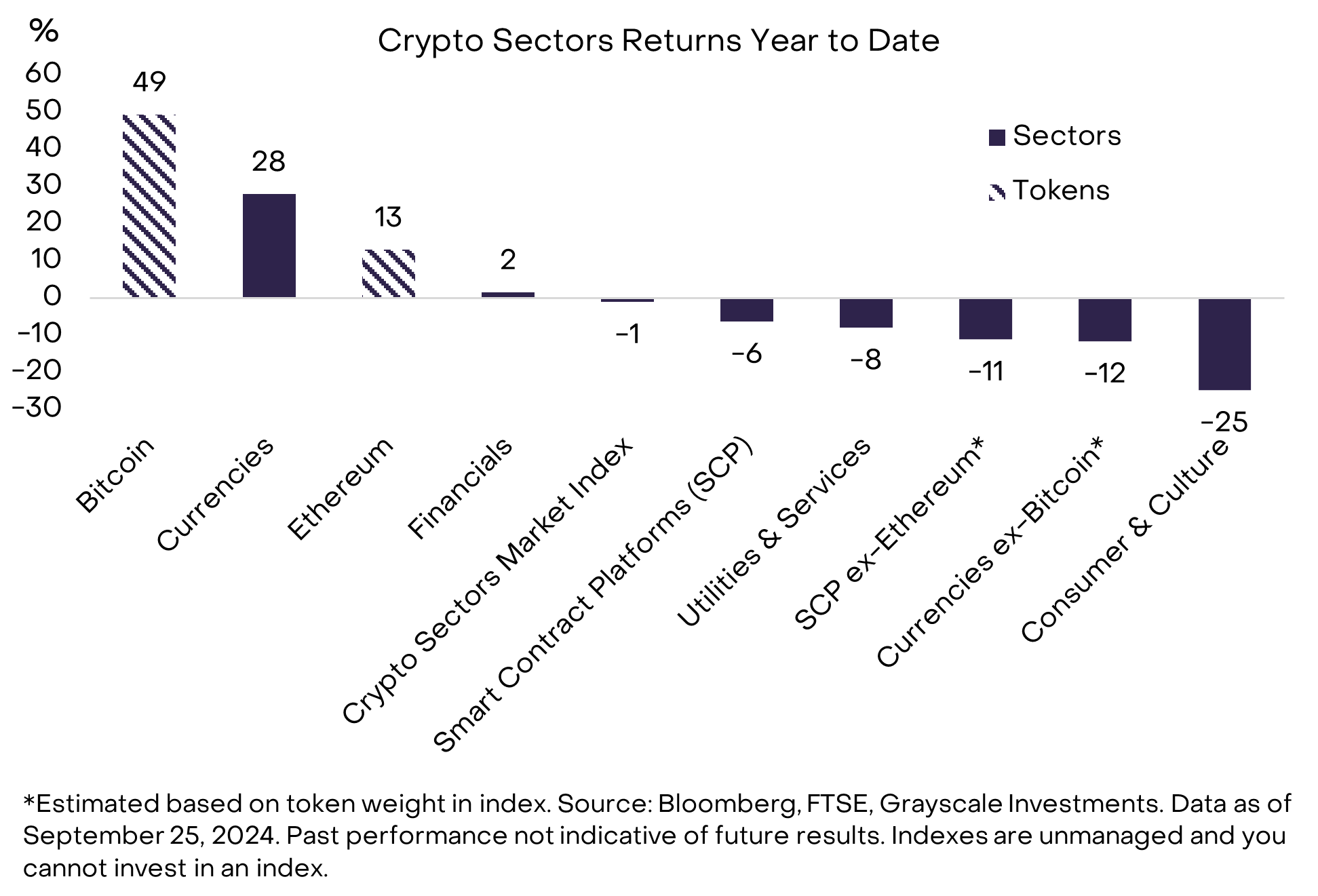

From a return perspective, Bitcoin has outperformed other submarkets in 2024 (Table 2), which may reflect the successful launch of spot Bitcoin exchange-traded products (ETPs) in the U.S. market and the favorable macro backdrop for the asset.

Table 2: Bitcoin's Strong Performance This Year, But Ethereum's Performance Remains Decent

Ethereum's performance this year has lagged behind Bitcoin, with a 13% increase, but it is better than most other cryptocurrency assets. For example, the Cryptocurrency Sector Market Index (CSMI), which measures the return of the entire asset category, has declined by about 1% this year. In fact, excluding Ethereum, the smart contract platform cryptocurrency industry index has fallen by about 11%, so Ethereum's performance is significantly better than its submarkets. Among all assets within the cryptocurrency framework, Ethereum has a return of approximately 70-75% year-to-date. Therefore, despite Ethereum's lower appreciation compared to Bitcoin, its performance this year remains decent compared to the cryptocurrency industry and the broader CSMI.

Focus on Smart Contract Platforms

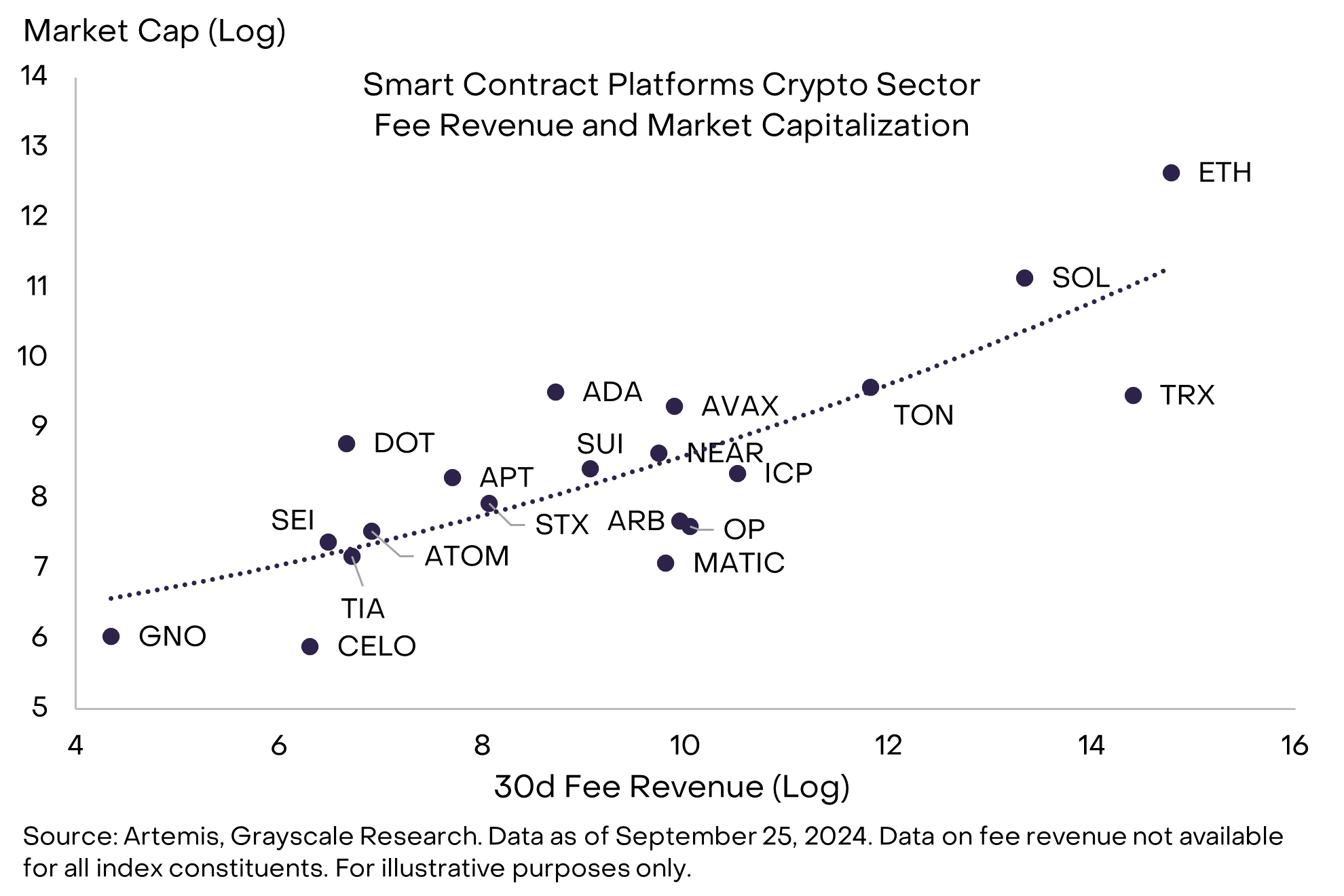

Unlike Bitcoin, which dominates the cryptocurrency field, Ethereum faces fierce competition in the smart contract platform arena. This year, many alternative smart contract platforms have gained attention, including Solana, Toncoin, Tron, and Near, as well as new platforms like Sui. These assets are all competing for fee revenue, and the "smooth" user experience offered by some smart contract platforms may lead to a decrease in Ethereum L1's fee market share.

At the same time, Ethereum has various comparative advantages to support its dominant position (Table 3). Most importantly, Ethereum remains a leader with the most applications, the most developers, the highest 30-day fee revenue, and the most locked value. When including the largest Ethereum L2 networks, Ethereum has the second-highest daily active users, second only to Solana.

Table 3: Ethereum Leads in Smart Contract Platform Fee Revenue Category

With the continued adoption of public blockchain technology, the entire smart contract platform is expected to experience growth in users, transactions, and fees. This may to some extent benefit all assets in this category. Due to Ethereum's existing network effects, it will benefit from the continued growth of smart contract platforms. For this reason, even though Ethereum faces fierce competition, it remains an attractive asset in the cryptocurrency field.

In addition, Ethereum benefits from certain specific features that may temporarily keep it ahead of its competitors. These features include high network reliability, high economic security, high decentralization, and a clearer regulatory status in the United States. Encouraging adoption trends have also emerged in the Ethereum ecosystem, including tokenization, prediction markets, and the construction of projects by major companies such as Sony. For all these reasons, Grayscale Research continues to view Ethereum as a very attractive investment theme.

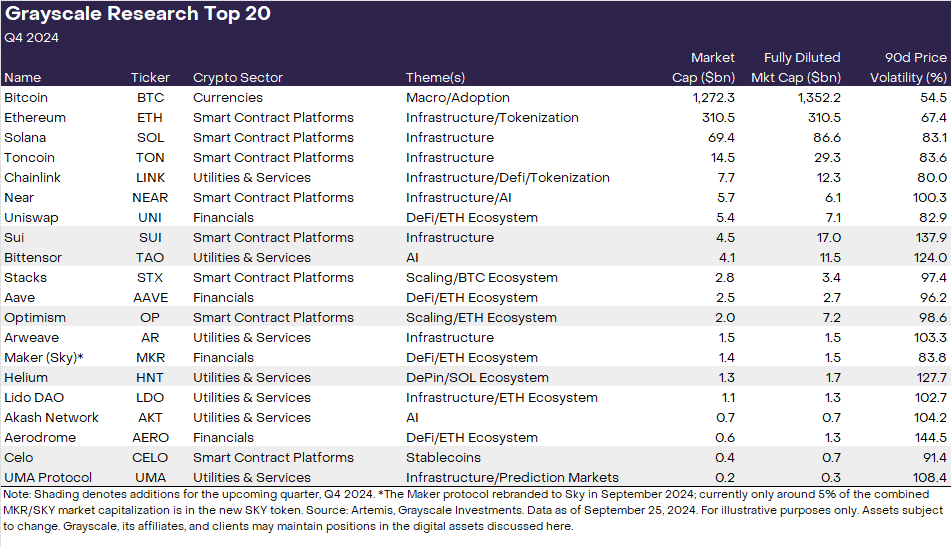

Top 20 Assets

The top 20 assets summarized by Grayscale Research represent a diverse range of assets in the cryptocurrency industry, with high potential for the next quarter (Table 4). The ranking method considers a range of factors, including network growth/adoption, upcoming catalysts, the sustainability of fundamentals, token valuation, token supply inflation, and potential tail risks.

Six new assets will be included in the fourth quarter:

Sui: A high-performance L1 smart contract blockchain that offers innovative applications.

Bittensor: A platform that promotes the development of open and global AI systems.

Optimism: An Ethereum scaling project based on Optimistic Rollups.

Helium: A decentralized wireless network running on Solana, a leader in the decentralized physical infrastructure (DePin) category.

Celo: A blockchain project designed for mobile devices, transitioning to the Ethereum L2 network, with a focus on stablecoins and payments.

UMA Protocol: An Optimistic oracle network that serves leading blockchain-based prediction market Polymarket (and other protocols).

Table 4: High Potential Cryptocurrency Assets in Q4 2024

The newly added blockchains reflect several cryptocurrency themes of interest to Grayscale Research. Sui and Optimism can both be seen as examples of high-performance infrastructure. Sui is a third-generation blockchain developed by a former Meta engineering team. Two months ago, Sui underwent a network upgrade, increasing transaction speed by 80%, surpassing Solana, which has recently seen increased adoption. Optimism is an Ethereum L2 that is helping to scale the Ethereum network and has developed a framework for building scalable solutions called "Superchain." Coinbase's L2 network Base and Sam Altman's Worldcoin-built L2 are both using this framework.

Celo and UMA both benefit from unique adoption trends: the use of stablecoins and prediction markets. Celo is a blockchain focused on developing stablecoins and payments in developing countries, gaining attention in Africa through the MiniPay application in the Opera browser. Celo has recently surpassed Tron to become the blockchain with the highest daily usage of stablecoin addresses. It is currently transitioning from an independent blockchain to the Optimism superchain framework on the Ethereum L2. UMA is an oracle network used by Polymarket, a breakthrough application in the cryptocurrency election year. UMA provides an on-chain solution for recording the outcome of each Polymarket event contract and facilitates voting on disputes over Polymarket outcomes, ensuring solutions are not subject to centralized, arbitrary, or biased interference.

Helium is a leader in the DePIN (decentralized physical infrastructure network) category, efficiently allocating wireless network coverage and connectivity resources using a decentralized model and rewarding participants who maintain network infrastructure. Helium has expanded to over 1 million hotspots and 100,000 mobile users, with network fee revenue exceeding $2 million year-to-date.

Although it has been focused on the decentralized AI theme for some time, Bittensor has only recently been included in the cryptocurrency framework due to improvements in market structure (especially more available pricing sources and higher liquidity). Bittensor has become a participant in both the cryptocurrency and AI fields, aiming to establish market dominance by creating a global decentralized platform for AI using economic incentives.

Grayscale Research has rotated the following projects from the top 20 this quarter: Render, Mantle, ThorChain, Pendle, Illuviu, and Raydium.

Investing in cryptocurrency assets involves risks, some of which are specific to cryptocurrency assets, including smart contract vulnerabilities and regulatory uncertainty. Additionally, all assets in the top 20 have high volatility and should be considered high-risk, and may not be suitable for all investors. Finally, broader macroeconomic and financial market developments may affect the valuation of cryptocurrency assets, and the U.S. election in November should be considered a significant risk event for the cryptocurrency market. President Trump has expressed a welcoming attitude towards the digital asset industry, while Vice President Harris recently stated that her administration "will encourage innovative technologies such as artificial intelligence and digital assets, while protecting consumers and investors." Given the risks associated with this asset class, any investment in digital assets should be considered in the context of an investment portfolio and the investor's financial goals.

Related reading: A Crazy Bull Market Is Coming, But Don't Forget Risk Management

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。