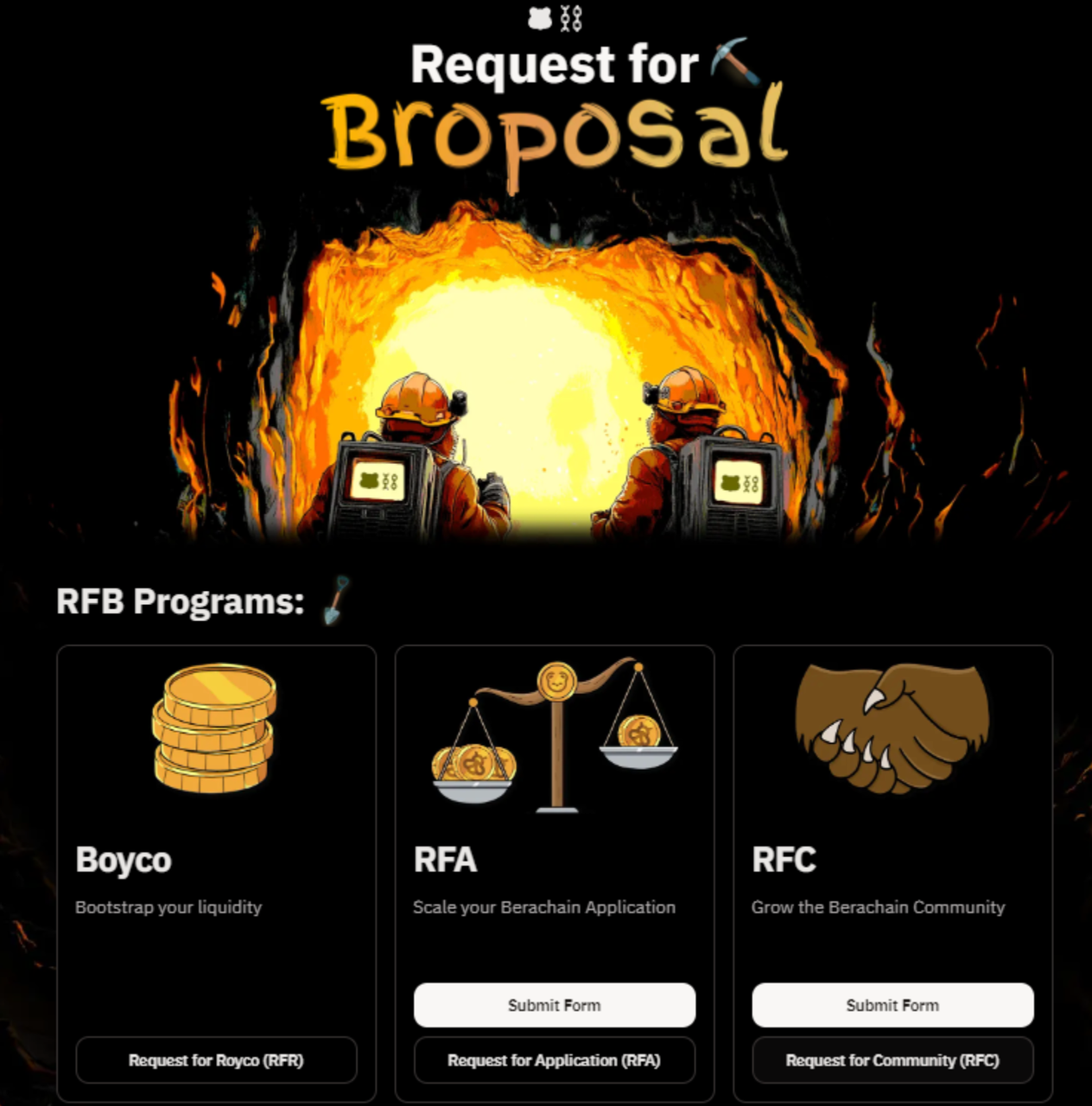

On September 26th, Berachain officially announced the launch of the Request For Proposal (RFP) incentive program. The program aims to provide liquidity support for projects and testnet developers within the Berachain ecosystem, helping these projects with their initial launch.

According to the announcement, projects already deployed on the Berachain testnet can apply to participate in the RFP program before October 9th and have the opportunity to join the Boyco project simultaneously. The Boyco project, by connecting to the Royco Protocol, allows projects to directly access liquidity support from Berachain, enabling them to focus more on project development and community operations. This incentive mechanism provides developers with a great opportunity to achieve faster ecosystem development.

01 Main Challenges Facing DeFi

In the field of DeFi, many projects are facing serious challenges that often limit their development potential.

Firstly, the cold start problem remains a major obstacle for most emerging applications. Many DeFi applications struggle to attract users for trading due to a lack of liquidity upon initial launch, making it difficult for the projects to gain initial recognition.

Additionally, the issue of centralized liquidity supply is quite prominent. Many applications often rely on a few high-net-worth investors and market makers (MM) to provide liquidity, exacerbating liquidity inequality and greatly reducing the participation opportunities for ordinary users.

Furthermore, many applications have adopted complex point and reward mechanisms to incentivize users, but the transparency of these mechanisms is insufficient. Users often find it difficult to understand the actual value of points, leading to a gap between expectations and actual returns, thereby affecting user trust.

Lastly, high transaction fees and network congestion issues still exist on many chains, making small transactions uneconomical and limiting widespread user participation.

02 Boyco Protocol Ensures Adequate Liquidity

In response to these challenges, Berachain has introduced the Boyco protocol, which can simplify the process of obtaining liquidity and enhance transparency. The main components of this protocol are as follows:

Pre-release Liquidity Market: The Boyco protocol supports applications in creating pre-release liquidity markets, allowing users to deposit funds into upcoming dApps on the Berachain mainnet before their official launch. This enables applications to have sufficient funds to support their operations upon official launch.

Liquidity Incentive Negotiation: In the Boyco market, applications can directly negotiate with liquidity providers (LP) to ensure they obtain the required liquidity on the first day. For example, an LP can propose "I will provide $10 million in liquidity in exchange for 1000 XYZ tokens," and the application can accept or negotiate based on market conditions. This mechanism not only reduces the cost of obtaining liquidity for applications but also allows users to choose suitable liquidity providers based on their individual needs.

Transparency and Trust: The Boyco protocol emphasizes transparency, allowing users to clearly understand the liquidity status of their deposits and expected returns, while applications can effectively manage their fund flows. This transparency not only enhances user trust in the platform but also reduces risks associated with trust assumptions.

The workflow of the Boyco protocol is also quite simple.

Firstly, create a market.

Applications create liquidity markets through Royco.org, defining the conditions they want users to pre-approve. These conditions include the steps to bridge to Berachain and the requirements for depositing into the application's smart contract.

Secondly, incentive mechanism.

Applications can provide incentives for potential LPs in the market or choose to accept the intentions proposed by LPs. This process encourages cross-incentives between multiple projects, enhancing the overall level of liquidity supply.

Asset locking.

Once an LP fills out an intention form, their assets will be locked until they are deposited into the application's smart contract. The lock-in period and terms will be clearly communicated to users before deposit, increasing the transparency of fund usage.

Finally, liquidity guarantee.

After the Berachain mainnet is launched, the pre-deposits will be bridged and directly deposited into the application's smart contract. This mechanism ensures that applications can smoothly obtain the required liquidity upon launch.

The Boyco protocol not only simplifies the process of obtaining liquidity but also promotes collaboration within the ecosystem. Through Boyco, applications can directly collaborate with LPs instead of competing for the same pool of liquidity. This collaborative model not only enhances user experience but also strengthens interaction among various projects within the ecosystem.

For example, applications can jointly create multi-platform integrations to improve the efficiency of cross-chain transactions. By sharing liquidity, multiple projects can offer users more competitive transaction fees, thereby attracting more user participation.

Conclusion

In summary, the Boyco protocol, by addressing the cold start problem, enhancing transparency, and promoting collaboration within the ecosystem, not only provides applications with adequate liquidity assurance but also offers users a better participation experience. With the support of this mechanism, Berachain is expected to build a more open and efficient DeFi environment, driving the continuous development and prosperity of the entire ecosystem.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。