October non-farm payrolls are coming, the interest rate cut continues to be on the table, will Bitcoin see a major bull market?

On September 6, the U.S. Bureau of Labor Statistics reported that the number of new non-farm jobs in August was 142,000, lower than the expected 165,000. The cumulative revision for July and August was reduced by 86,000. The almost disastrous non-farm data in August led the Federal Reserve to announce on September 18 that it would cut the federal funds rate target range by 50 basis points. This is the first rate cut by the Federal Reserve since March 2020, marking a shift from a period of monetary policy tightening to a period of easing in the United States.

Cryptocurrencies are being driven by the favorable impact of the U.S. interest rate cut, and the bull market is heating up. Within 24 hours of the U.S. interest rate hike, Bitcoin surged from a high of $59,000 to above $62,000, breaking through the $62,000 mark, and Ethereum also rose from $2,200 to over $2,400.

Bitcoin's price is expected to rise significantly

As a decentralized digital asset, Bitcoin is gradually being seen as an effective tool to combat inflation and economic uncertainty. Analysts generally believe that if Bitcoin can continue to maintain its current price level, the likelihood of breaking through historical highs will significantly increase.

CryptoQuant: Bitcoin's "profitable supply" level indicates further potential for growth

CryptoQuant pointed out that the price of Bitcoin rose nearly 8% after the Federal Reserve cut interest rates by 50 basis points. Its "profitable supply" indicator has broken through the 365-day moving average, indicating the potential for further growth. The indicator shows that an increasing number of Bitcoin holders are in a profitable state, which may alleviate selling pressure and boost market confidence. However, Bitfinex analysts cautioned that the initial rise in Bitcoin was driven by purchases in the spot market, but the slowdown of this activity may lead to consolidation or partial retracement in the short term.

BlackRock's cryptocurrency chief: BTC is a "safe haven" asset

Robbie Mitchnick, head of digital assets at BlackRock, recently emphasized the potential of Bitcoin as a "safe haven" asset, despite its performance often being similar to that of U.S. stocks. In an interview with Bloomberg, Mitchnick compared Bitcoin to gold, pointing out that its decentralization and limited supply are the main differences from traditional assets. He emphasized that despite short-term volatility, the long-term behavior of Bitcoin and gold is similar.

Chief Research Analyst at CF Benchmarks: Bitcoin is expected to break out in Q4

Gabriel Selby, chief research analyst at CF Benchmarks, stated in a report that digital assets are expected to continue to grow in the fourth quarter against the backdrop of macro changes and institutional adoption, as sovereign balance sheets come under pressure and investors seek long-term hedging tools like Bitcoin. Selby stated that after the U.S. presidential election on November 5, there may be significant changes in the U.S. regulatory landscape, creating a favorable environment for cryptocurrency innovation. We have seen conditions that enhance investor confidence and drive capital formation.

Ryan Lee, chief analyst at Bitget Research, also has a bullish view on Bitcoin's performance in the last quarter. He stated that Bitcoin's performance in October is expected to surpass that of September, with a target price range of $58,000 to $72,000. Lee pointed out several notable signs in the derivatives market, including multiple instances of negative funding rates for Bitcoin futures in September, and the fear and greed index lingering in the extreme fear zone. Historically, these factors often herald the arrival of a major rebound.

Will Bitcoin see a major bull market in October?

October non-farm data is coming, can Bitcoin usher in a bull market with just one move

The highly anticipated October non-farm data is set to be released tomorrow. If the employment data continues to disappoint, with non-farm employment and wage growth both below expectations, it would mean that the 50 basis point rate cut in the United States represents an economic recession, and the Federal Reserve may take more aggressive rate cuts to stimulate the economy. The unexpected weakness in non-farm data in July led to global market volatility, and cryptocurrencies also plummeted, even briefly falling below $48,000.

If the employment data improves and the non-farm data and wage growth meet expectations, achieving the desired effect of the Federal Reserve's rate cut, it would mean that the 50 basis point rate cut in the United States was more of a precautionary measure, and Bitcoin will usher in a major bull market with this wave of rate cuts. If the non-farm data and wage growth exceed expectations with a significant increase, leading to a substantial decrease in the probability of a rate cut by the Federal Reserve or even a rate hike, the cryptocurrency market may usher in a bull market, but its sustainability will decrease significantly. Data released by the U.S. Department of Labor on September 26 showed that the number of initial claims for unemployment benefits in the week ending September 21 was 218,000, lower than the expected 223,000 and the previous value of 219,000, providing a positive signal for the improvement of October non-farm employment data.

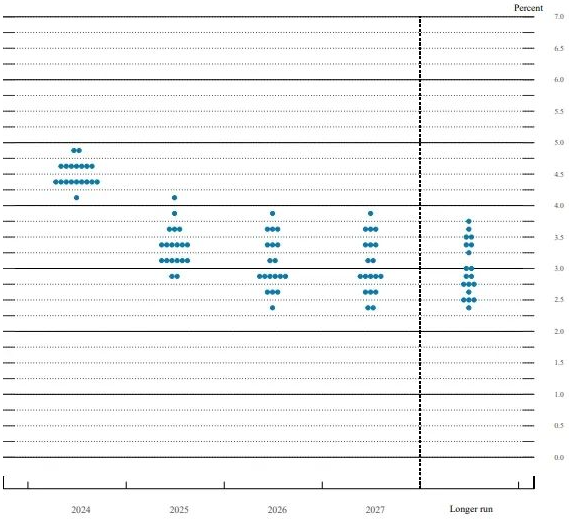

The median of the Federal Reserve's dot plot shows that the Federal Reserve is expected to cut rates by 100 basis points by 2024. After the 50 basis point rate cut in September, there is still an expectation of a 50 basis point rate cut.

Caroline Mauron, co-founder of Orbit Markets, a provider of liquidity for digital asset derivatives trading, stated, "Macro factors are currently driving the rise in cryptocurrency prices, and this trend is likely to continue throughout the Federal Reserve's easing cycle, unless we see specific black swan events specific to cryptocurrencies."

Founder of Reflexivity: Bitcoin needs to break through the $65,000 level to confirm the continuation of the bull market

Will Clemente, founder of the cryptocurrency analysis firm Reflexivity Research, stated on social media that it is very difficult psychologically to shift from trying to cut profits during rebounds to letting winners continue to rise. In my opinion, the threshold for confirming a change in market structure for Bitcoin is above $65,000. As of September 27, Bitcoin has risen all the way to break through the $65,000 mark, reaching the level of the bull market continuation mentioned by Will Clemente. Click to view the latest Bitcoin market data: Bitcoin Market Data

Currently, whether it is the expected improvement in non-farm data, the Bitcoin that has already broken through the $65,000 mark, or the just released data on jobless claims, all indicate that Bitcoin is highly likely to usher in a major bull market in October.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。