Author: The DeFi Investor, Crypto KOL

Translation: Felix, PANews

This article will introduce the current stage of the crypto cycle and explain why there is optimism about the near-term outlook.

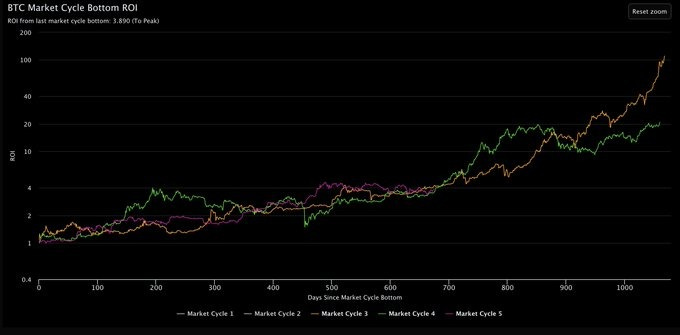

BTC Cycle Investment Return Rate is Currently at Normal Levels for This Cycle Stage

In terms of BTC performance, this market cycle is very similar to the bull markets of 2016 and 2020.

Financial markets often have cyclical nature because human nature never changes. That's why it seems unlikely that BTC has already peaked.

The past two bull markets have two common points:

- The real BTC uptrend began about 170-180 days after the Bitcoin halving

- The BTC cycle peak was reached about 480 days after the Bitcoin halving

Since the 2024 BTC halving event, only 160 days have passed.

Given the past situations, it is very likely that there are only a few weeks left until BTC resumes its uptrend.

Although this is assuming that history will repeat itself, there is also no indication that this bull market is any different.

Exchange BTC reserves are declining at a record pace

Since January 2024, over 500,000 BTC have been withdrawn from exchanges.

When whales withdraw their tokens from exchanges, it usually indicates that they plan to hold for a period of time rather than sell in the short term.

The above chart shows that whales have been withdrawing a large amount of BTC over the past few months.

If this hoarding continues, a situation of supply shortage is imminent.

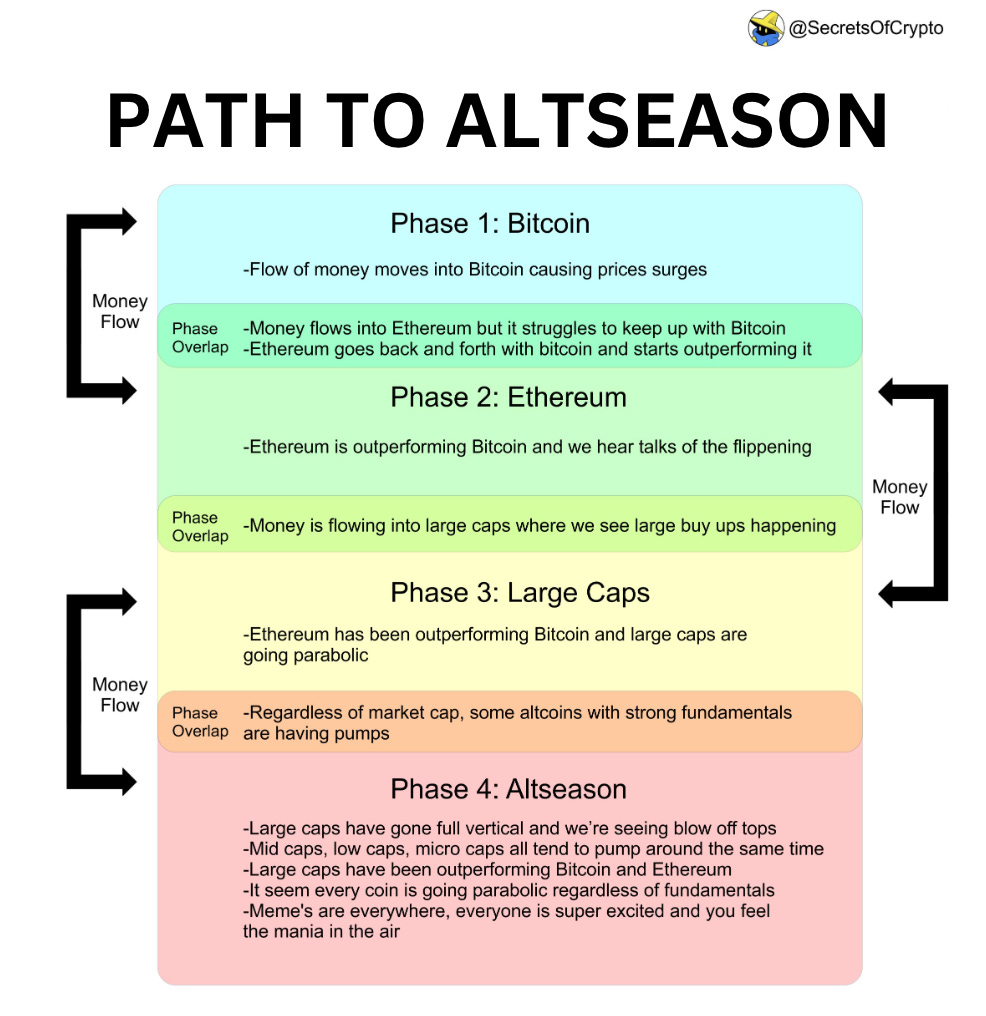

Historically, the Bitcoin season is the first stage of each cycle

The above chart was made many years ago, but it summarizes well what happened in the 2016 and 2020 cycles.

- First, BTC rebounds and its dominance rises

- Then, market attention begins to shift to mainstream coins (ETH, SOL, etc.)

- Finally, almost every altcoin starts to rise, regardless of market value or fundamentals

Recently, BTC dominance has reached a new high in many years.

This may indicate that we are still in the first stage. Historically, the altcoin season only begins after BTC dominance starts to decline. The crypto industry is about to enter the second stage.

Based on all the above charts and historical data from previous bull markets, BTC is likely to reach a historical high in the fourth quarter.

However, there are still some macro uncertainties at present.

If a global economic recession begins, cryptocurrencies will be severely affected.

However, it is unlikely that an economic recession will occur in the near term due to this year being an election year in the United States.

In order to give Harris a chance to win the US presidential election, the Democratic Party will do everything possible to delay it.

Although a US economic recession may start at some point in the next 3-4 years, it will not happen in 2024.

Therefore, there is optimism about cryptocurrencies in the fourth quarter. Hopefully, faith and patience will soon be rewarded.

Related reading: BTC Successfully Breaks Through $65,000, Investors Focus on US PCE Data

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。