Cryptocurrency News

September 28th Hot Topics:

1. SEC filed a settlement charge against the entity operating the crypto trading platform Mango Markets.

2. Federal Reserve Board Member: Data indicates that the US economy remains strong.

3. CME's open interest in Bitcoin futures contracts increased by 5.51% in the past 24 hours.

4. JupiterExchange initiates a vote on the proposal for "unclaimed 215 million JUP tokens," ending on October 1st.

5. 21 new members, including Plume Network, a16z, and GalaxyDigital, join the Tokenized Asset Coalition, dedicated to promoting the on-chainization of assets exceeding $1 trillion.

Trading Insights

The pain of retail investors in a bull market:

- The pain in a bull market lies in not knowing when to enter midway.

- Unable to judge the oscillating market, leading to frequent operations during oscillations.

- Unable to fill orders, resulting in increasingly higher prices, and when filled, the price drops even further.

- Unable to determine the relative high point, thus missing the opportunity to reduce positions.

- Purchases do not rise, and selling causes the price to soar.

- Understanding in theory but unsure how to overcome the dilemma between holding coins and making effective stop-losses.

- Biased understanding of trading, believing that not making money is due to insufficient technical mastery, insufficient learning, and unclear understanding of the underlying logic of trading.

- Mistakes in stop-loss design, always leading to one-sided losses after a stop-loss.

- Buying at high points and selling during a rally.

- How to identify coins with sudden surges.

LIFE IS LIKE A JOURNEY ▲

Below are the real trading signals from the Da Bai Community this week. Congratulations to the friends who followed. If your operations are not going smoothly, you can come and give it a try.

The data is real, and each signal has a screenshot taken at the time.

Search for the public account: Da Bai Lun Bi

BTC

Analysis

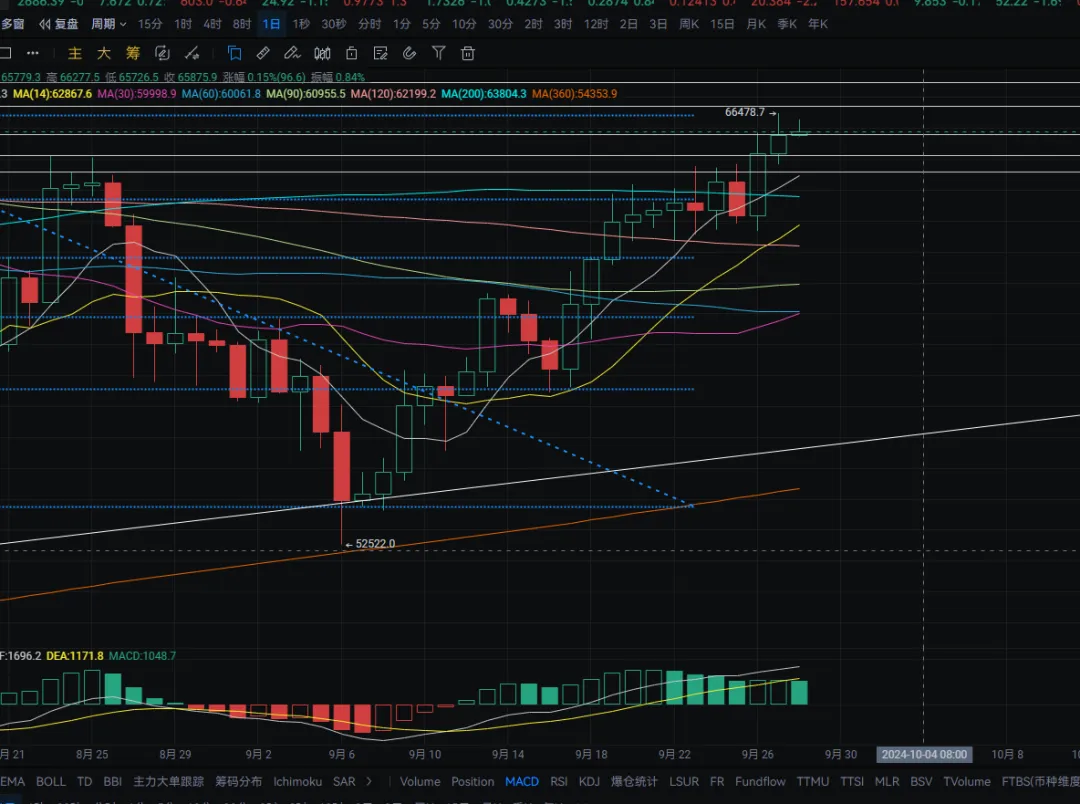

Bitcoin's daily chart rose from around 64800 to near 66450 yesterday, closing near 65800. The resistance above is near 66500, and the support below is near the MA7 moving average. A pullback can be made near this level. The MACD is showing an increase in the bullish trend. The four-hour trend tends to be oscillating, with support below the MA7 moving average. If it falls below, it may see the MA14 level, with the bottom near the MA30. A pullback can be made near this level. The MACD shows a decrease in the bullish trend. There are signs of a death cross. In the short term, buying near 65120-64580 can be considered, with a rebound target near 65800-66700. Rebounding to 67350-68300 can be considered for short selling. The pullback target can be seen near 65800-64850.

ETH

Analysis

Ethereum's daily chart rebounded from around 2615 to near 2730 yesterday, closing near 2695. It briefly broke through 2700. The resistance above is near the MA360 yearly average, and the support below is near the MA7 moving average. If it falls below, it may see the MA60 level. A pullback can be made near this level. The MACD shows an increase in the bullish trend. The four-hour resistance is near 2700, and the support below is near the MA7 moving average. If it falls below, it may see the MA14 level. A pullback can be made near this level. The MACD shows a decrease in the bullish trend, with signs of a death cross.

Disclaimer: The above content is purely personal opinion and is for reference only. It does not constitute specific operational advice, nor does it bear legal responsibility. Market conditions change rapidly, and the article has a certain lag. If there is anything you don't understand, feel free to ask for advice.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。