Hello everyone, I am your friend Lao Cui Shuo Bi, focusing on the analysis of cryptocurrency market trends, striving to deliver the most valuable market information to the majority of coin friends. Welcome to the attention and likes of all coin friends, and refuse any market smokescreen.

The change in the market is always so incredible. Ethereum finally broke through the high of 2700 in the early morning today, and Lao Cui finally let go of his hanging heart. He has been urging everyone to be brave in going long. After several days of continuous pullback, Lao Cui's private messages were almost overwhelmed. Finally, today, the clouds have cleared and we can enter the next stage of trend analysis. Today's market is the best to analyze. Generally, after experiencing the trend of a big market, especially under the fierce impact of the bulls, a short-term pullback will occur today, coinciding with the National Day holiday, which also provides an opportunity for everyone to enter the market. There will definitely be more retail investors entering the market in the near future. From the perspective of fund size, it can also be seen that the daily flow of the entire coin market exceeds billions, proving that the fund level has not been blocked. In the later stage, the overall bullish direction will not encounter a premature end. Let's move on to the technical analysis for today.

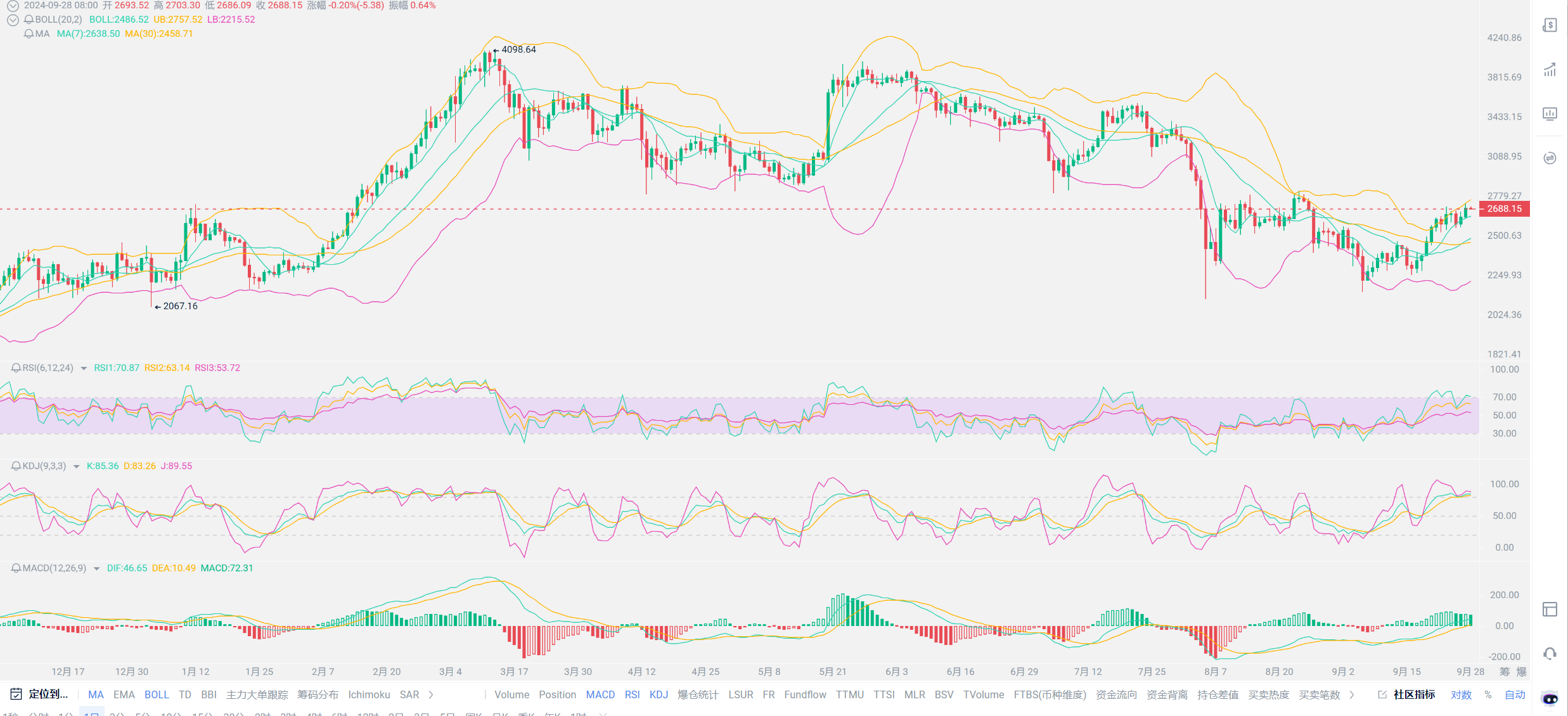

From the daily chart, the seven-day moving average and the thirty-day moving average both show clear bullish signals, and the buying intention is far higher than the selling intention. A crossover was formed on the 22nd, and the seven-day moving average is significantly higher than the thirty-day moving average, proving that the short-term bullish force is still strong. From the perspective of the Bollinger Bands, the upper, middle, and lower bands are all turning upwards. Currently, the market is running near the upper band, and the pressure level of the upper band is around 2750. Once it breaks through the technical level, it is likely to head straight to around 2800. The moving average level is still dominated by the bulls. At such a fierce growth of the bulls, the RSI and KDJ values still show normal performance without oversold conditions, which is enough to prove the strong bullish momentum. The performance of the MACD is relatively stable, with the two lines often entangled. After forming a crossover on September 10th, it has been rising all the way. Under the current volatility, it will probably take some time for the next crossover to occur. The performance of these three lines indicates a bullish trend. From the perspective of the daily chart, it can be basically determined that the long-term target is to bravely go long, which can help spot users to hold and win.

Everyone needs to pay attention to the four-hour chart, where there are no obvious bearish signals. Simply put, the Bollinger Bands in the four-hour chart show an opening shape, and the MACD shows a golden cross shape. There are basically no signs of bearishness, which is quite terrifying. The depth of the short-term pullback may not be too large. It is possible that after the bullish accumulation, there will be a push to the high point. For short-term contract users, you must not easily attempt to enter short positions. At the technical level, the overall situation will not provide much help, and it still requires cooperation from the news level. Let's talk about the recent hot topics. Many friends have privately messaged, thinking that the rise of A-shares will attract a large amount of capital into the coin circle. Everyone is a bit self-deprecating. Remember, the largest capital in the coin circle comes from Japan, South Korea, and Europe and the United States. The capital intervention in our country basically cannot influence the overall situation. This doubt has been removed since the four major banks issued a ban in 2021, which has removed a lot of domestic bubbles.

Indeed, A-shares will attract a large amount of capital, but more comes from the central bank's liquidity injection. Lao Cui does indeed agree with the short-term rise, but the difference between A-shares and the coin circle lies in the fact that the growth in the coin circle is supported by capital and the market, and there are no hidden dangers. The difference between A-shares and us lies in the short-term stimulus, but the fundamental reasons have not been resolved. When looking at the growth of a region, we cannot just look at surface data. Employment and unemployment rates, industrial foundation and the income of ordinary people, GDP, high-tech development, and infrastructure improvement, etc., only by combining all the data can we reflect a true trend. It is obvious that for the long term, China does not have the conditions for long-term growth. It would be perfect if we can get through this year. If we want to stimulate the circulation of funds, we must make the lower-level people dare to consume, and the premise of daring to consume must be having funds in hand. So, for short-term profit during the National Day holiday, it is indeed possible to invest, but for the long term, Lao Cui does not support everyone to invest. A-shares waited for four years for such a rise, while Ethereum only needed half a year. Compared to the risks and investments in the coin circle, they are not proportional at all.

Lao Cui's views yesterday were already very clear. As long as there are no fatal news in the short term for the coin circle, the bull market is basically open. The continuous devaluation of USDT is basically the fault of the United States. Remember, it is not the United States announcing an interest rate cut, and we will not have so many corresponding measures in China. Only when the United States injects liquidity can we have a chance to catch our breath. The regulation in our country and other strategies have not had a big impact on the coin circle, only the economic measures of the United States will have a certain impact on the coin circle. Don't think too seriously about our strategies. What we need to solve now is the real estate and stock markets. Basically, we don't have the power to respond to the trend of the coin circle. So, for the entire coin friends in China, this is also good news. Under normal trading conditions, it cannot be regulated. As long as everyone can avoid contact with illicit assets and find a stable way in and out, there will not be too many problems. Don't worry too much.

Lao Cui's conclusion: Whether it is the linear indicators at the technical level or the impact at the news level, for the entire coin circle, the bullish trend will not change temporarily. The three growth elements mentioned at the beginning of the year have all been achieved at this stage. The listing of Ethereum, the interest rate cut by the United States, and the downward trend of the exchange rate are the prerequisites for stimulating the coin circle to start a new round of bull market. The only thing to worry about is the level of funds. How much can flow into the coin circle? From the current inflow situation, nearly billions will enter every day, and this flow rate is enough to support the upward trend of the coin circle. So, all you need to do is hold steady and wait for the opportunity to get off. The depth of the short-term pullback should not affect you. When the bull market comes, there will be short-term pullbacks, and even a one-third drop in a day is normal. These are all tricks used by the big players. Whether you are a spot or contract user, the only direction is to go long. Contract users can also enter the market with small positions to seek large profits. You can enter the market in batches. In short, you don't need to enter the market with large positions to obtain considerable profits. Don't be affected by other aspects. Just hold on. If contract users are uncertain about the entry points in the short term, you can directly ask Lao Cui, and Lao Cui will reply to everyone when he sees it.

Original article created by the public account: Lao Cui Shuo Bi. For assistance, you can contact directly.

Lao Cui's message: Investment is like playing chess. Masters can see five steps, seven steps, or even a dozen steps ahead, while those with lower skills can only see two or three steps. The master considers the overall situation, plans for the general trend, and does not focus on individual moves or territories, with the ultimate goal of winning the game. The lower-level player fights for every inch, frequently switching between long and short positions, only fighting for short-term gains, and frequently gets trapped in the end.

This material is for learning and reference only and does not constitute buying or selling advice. If you buy or sell based on this, you do so at your own risk!

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。