Author: @long_solitude

Compilation: Deep Tide TechFlow

Since 2016-2017, the phenomenon of entrepreneurship in cryptocurrency has been ongoing. In each cycle, the popularity of cryptocurrency continues to rise, with more and more people entering the field, while the potential returns gradually decrease. So far, everyone has heard of cryptocurrency.

Like any emerging industry, the most promising ideas do not necessarily require huge capital. But after the initial excitement and amazing returns, the accessibility of capital increases and the threshold for investment ideas decreases. As long as capital flows, everyone can become a founder.

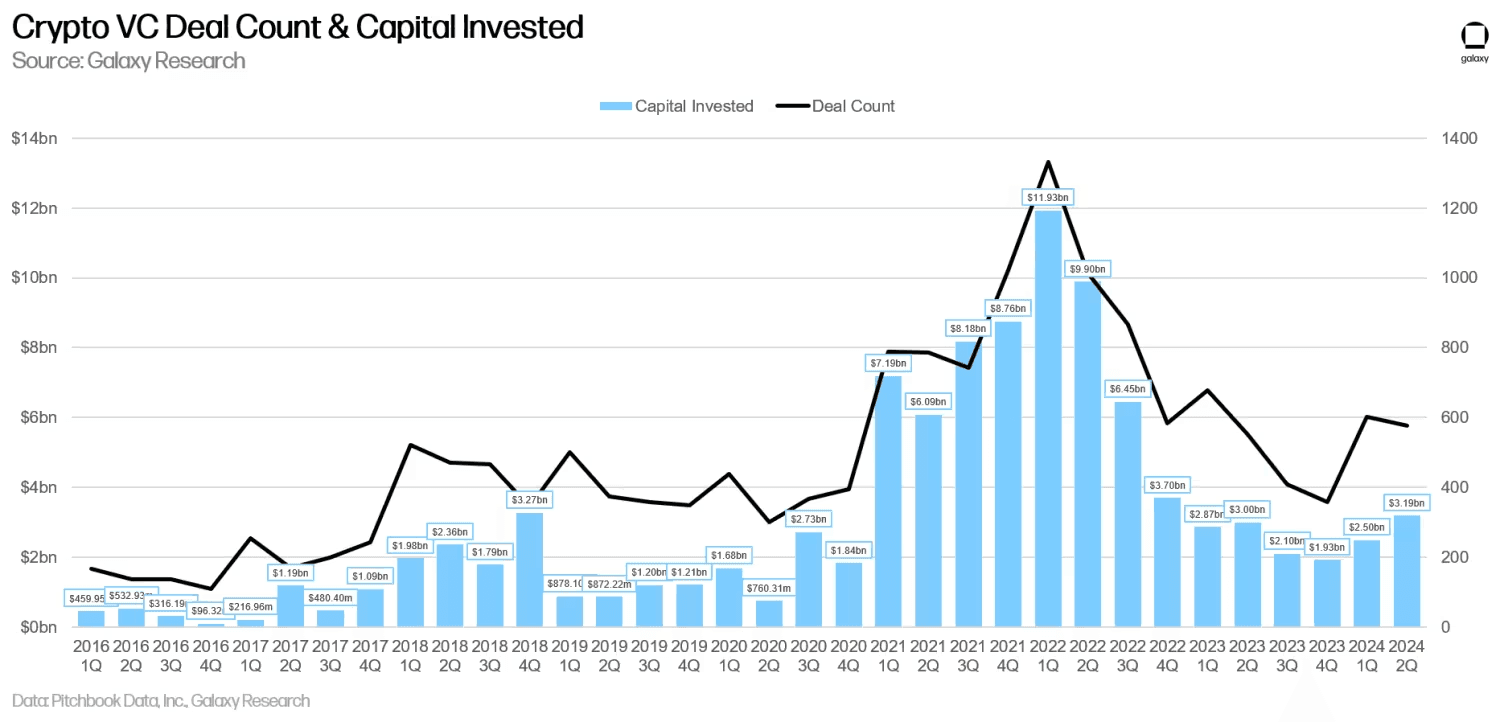

Since 2016, $100 billion in venture capital has been injected into the private cryptocurrency market, and founders have used tokens to enter almost every possible industry. As Abraham Maslow said, "If the only tool you have is a hammer, you tend to see every problem as a nail." This torch has now been passed to AI.

From finance and payments to identity, social networks, media and entertainment, gaming, cloud computing, artificial intelligence, healthcare and science, supply chain, storage, gambling, art, various types of physical infrastructure networks, and even satellites in space—cryptocurrency has spread across all fields. No field is overlooked.

Today, in addition to Bitcoin (BTC) and Ethereum (ETH), the circulating market value of other altcoins is $700 billion, and Coinbase's market value is $40 billion. For simplicity, assuming investors own 30% of the network and ignoring any unattributed tokens; in the case of Coinbase, investors own about 50% of the shares when it goes public.

This means that the liquid value available to venture capital (VC) investors is approximately $230 billion. Of course, this is not entirely accurate because we have not considered all listed companies, nor have we considered companies that have not issued tokens, or the situation where investors sell at different times in different cycles.

But the reality is that most of the $230 billion (out of the $100 billion investment) is driven by some outliers, such as Solana and Coinbase, initial coin offerings (ICOs), and meme tokens that venture capital (VC) does not have exclusive distribution. Calculate for yourself and see the importance of outliers in cryptocurrency, which may be as high as or even higher than in other areas.

Unique Properties of Cryptocurrency

It should now be clear that cryptocurrency is not a panacea for solving all global problems. The blockchain distributed system we refer to has some very unique properties, which have remained largely unchanged since the invention of Ethereum.

The foundation of blockchain is a powerful financial element to ensure network security, so it is not surprising that sustainable use cases must also move in this direction. This is why certain categories of projects can produce lasting winners, while others cannot.

Dean Eigenmann:

From 2017 to 2018, tens of billions of dollars flowed into cryptocurrency products, including finance and consumer products, and the only products that survived were essentially financial products.

The current major trend has returned to the consumer and social fields, but the surviving products are still limited to financial products.

The less attractive truth, lost in the void of CT

What are these unique properties? Although this list is not exhaustive, we believe the main ones are:

- Permissionless capital formation, and the token distribution that extends from it;

- Global consensus on distributed ledgers for financial assets.

Permissionless capital formation is the most important and universally applicable product market fit (PMF) for cryptocurrency. This is why ICOs were successful overall. This is also why pump.fun brought a bull market to the entire Solana ecosystem and made more money in 8 months than 99% of all cryptocurrency projects combined. This is why cryptocurrency capital is funding network states and longevity experiments. The creative space is infinite, and all funded assets will be stored on the chain, ensuring the source of their owners.

Global consensus and distributed ledgers make open and permissionless finance possible. Founders have built all financial components in decentralized finance (DeFi)—lending, savings, trading, payments/stablecoins, and debit cards for consumption. From Blackstone, major banks to VISA and Mastercard, they are all paying attention to the characteristics of cryptocurrency and DeFi, and looking for ways to integrate them into their own businesses. Perhaps one day, bureaucracy can be outsourced on a large scale to global consensus.

Therefore, when we see founders complaining about the Ethereum Foundation's antagonistic attitude towards decentralized finance (DeFi), we cannot help but question whether it is ready to give up the second-best product market fit (PMF) discovered by cryptocurrency so far, second only to Bitcoin's value storage.

kain @ Mainnet:

If the only thing that has supported your chain in the past five years is DeFi, and the best you can do is barely tolerate it, then you are anti-DeFi. I'm sorry, but the default position should be absolutely to support and encourage it.

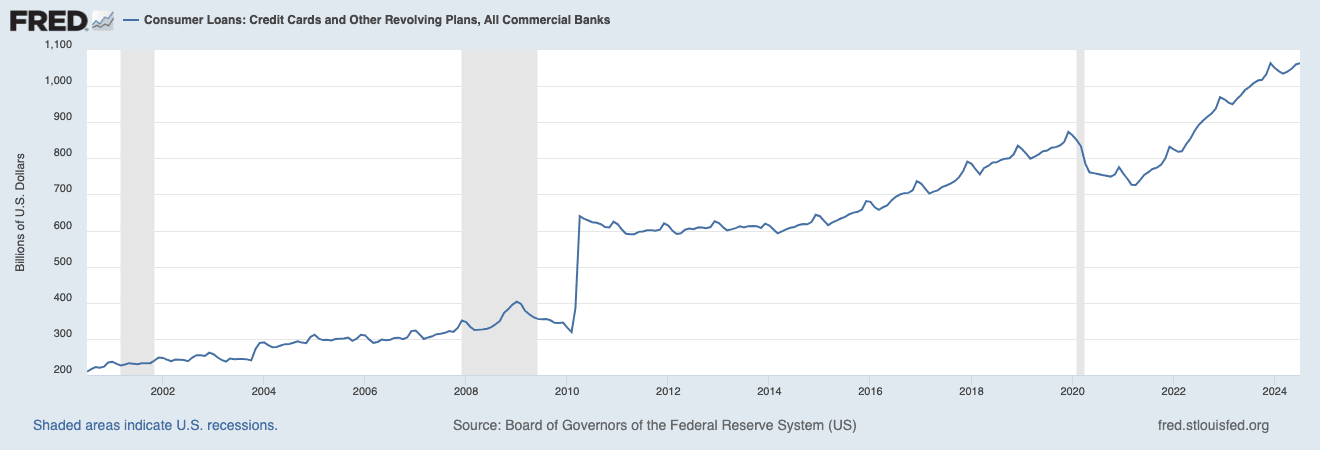

Although Vitalik may argue that decentralized finance (DeFi) is an ouroboros, a snake eating its own tail, we believe the situation is quite the opposite. DeFi may be the only positive category in cryptocurrency! It creates new capital markets and enables people to obtain credit and consume. Credit expansion is the fundamental force for creating consumption and investment. This is why the United States abandoned the gold standard, and the U.S. market did not collapse, but instead rose significantly over decades. The key to the economy is to maintain a cycle for growth. Why can't DeFi be the cycle?

Since the market bottom in November 2022, which projects have most successfully utilized the unique properties of cryptocurrency? Without a doubt, they have focused on decentralized finance (DeFi) or capital formation:

- Solana's price has risen 15 times, and it has always prioritized DeFi. In fact, it was envisioned as a "decentralized Nasdaq" from the beginning.

- Pump.fun has earned over $100 million for itself and created nearly $1 billion in profits for the ecosystem because it achieved permissionless capital formation for speculative assets;

- Ethena has expanded its basic trading volume to billions of dollars;

- In addition, we have many centralized finance (CeFi) companies, such as Tether and Coinbase, which provide financial services and have significantly increased market share.

One of the most notable narratives this year is the shift towards consumer-oriented cryptocurrency. We can roughly divide it into hyper-speculative games (such as yield curves, casinos, and memes) and products oriented towards digital ownership (such as Farcaster, Zora, etc.).

At the end of 2022, we first mentioned the necessity of consumer applications in the Fappening, when we felt that the market's focus had become too skewed towards infrastructure. Now, it seems that all attention is focused on building consumer applications for cryptocurrency, but many times without questioning the unique functions that the application can achieve.

Is mini-gaming on TON more enabling and enduring than the mundane borderless encrypted payments? Probably not. This is not to say that mini-games are not useful, but rather that they do not fully leverage the unique properties of cryptocurrency, as high data integrity for financial data is not necessary for these games. The token distribution, which is the fundamental principle of cryptocurrency capital formation, is what initially made them interesting.

Cryptocurrency Creates New Markets

Now that we have confirmed the excellent performance of cryptocurrency in capital formation and facilitating financial transactions, where does this take us? New markets.

Although Florence did not have maritime channels like Genoa and Venice, it became a trading superpower in medieval Europe, mainly due to its innovations in banking and financial instruments. The gold florin minted in Florence quickly became the dominant trade currency in the Western world.

The cryptocurrency superpower has always been in finding prices for assets that were previously unpriced. In other words, it is creating markets where there were none before, or at least significantly improving the trading experience by providing abundant liquidity in areas lacking liquidity. Cryptocurrency is a coordination tool that allows trading in opaque and emerging areas that require high specialization and are plagued by bureaucracy and multiple intermediaries.

Here are a few examples: Kettle is building a market for tokenized watches, with the team busy in New York's Diamond District handling watch certification, custody, and logistics. Baxus is solving similar issues for collectible wines, with their team handling authentication and operating a central storage facility controlling humidity, temperature, and more. Eventually, they both may be able to replace Sotheby's. In the physical world, many highly specialized work is being done, and the cryptocurrency element (coordination of payments) makes it possible to solve the cold start problem earlier. We will see the physical world and the cryptocurrency field mutually advancing each other.

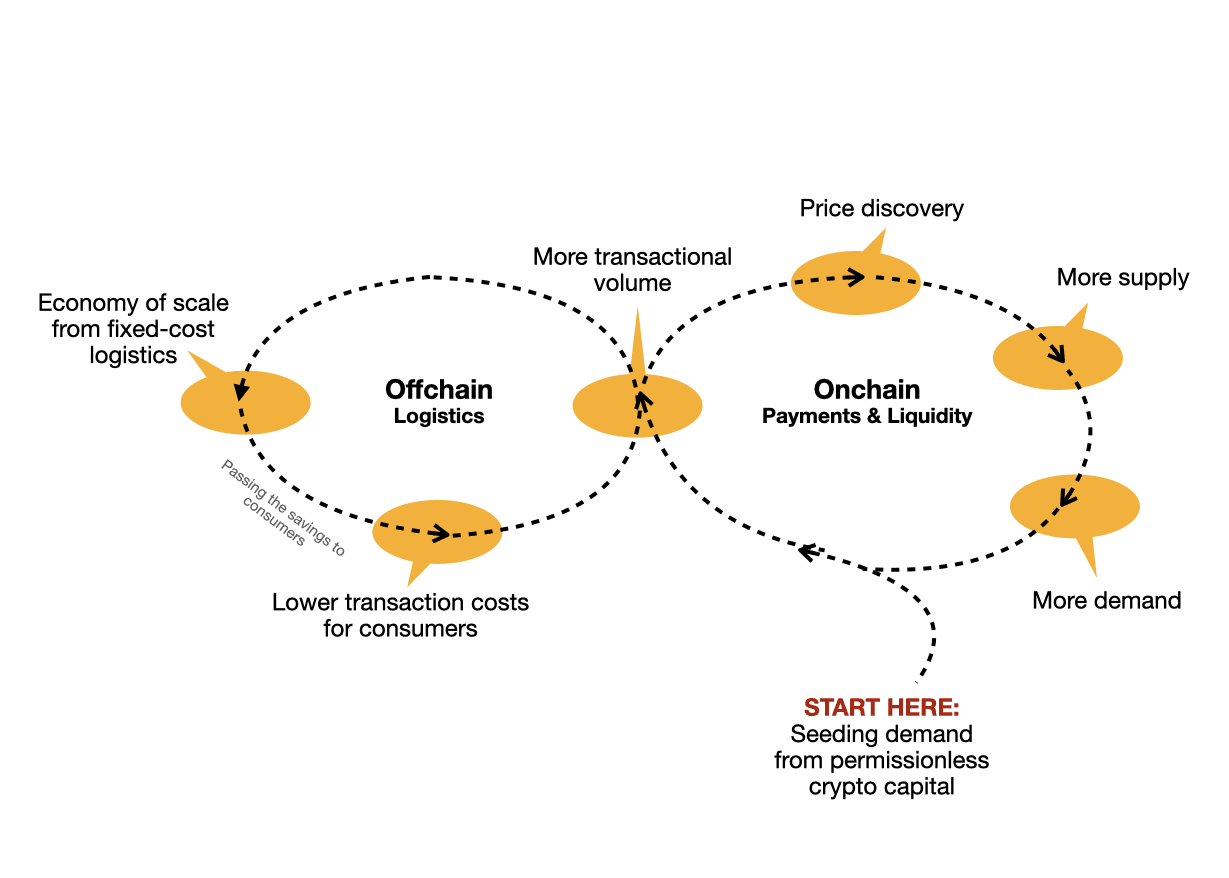

On-chain and off-chain components complement each other, as they both benefit from higher trading volume.

Cryptocurrency allows people to focus on things they didn't know existed before. Uniswap made people focus on ERC20 tokens, while Opensea made people focus on NFTs.

One new case we like is SkyTrade, which allows landowners to sell or lease the airspace rights above their property. These airspace rights are tokenized as NFTs and then auctioned to real estate developers and drone delivery companies like Walmart, Amazon, or future specialized air transport companies. Most property owners are not aware a) that they own airspace, and b) that this airspace is valuable to certain people. As the hottest form of capital, cryptocurrency can quickly prove this.

DePIN Market

Another market area with strong trading characteristics is DePIN, or decentralized physical infrastructure. Suppliers typically utilize potential or idle physical hardware, making it a relatively easier part of the bilateral market to launch. The existence of demand has not been validated—we can only speculate its existence based on demand for similar centralized services.

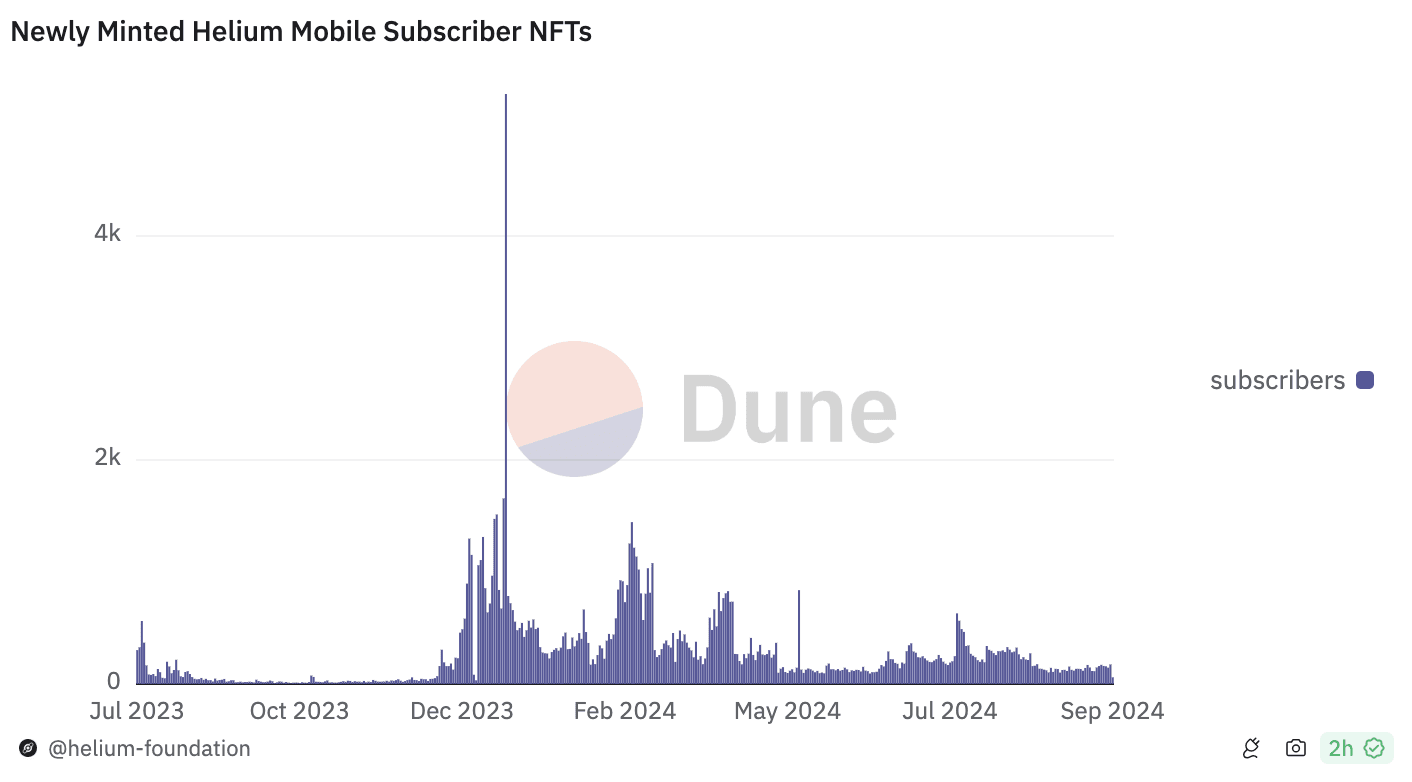

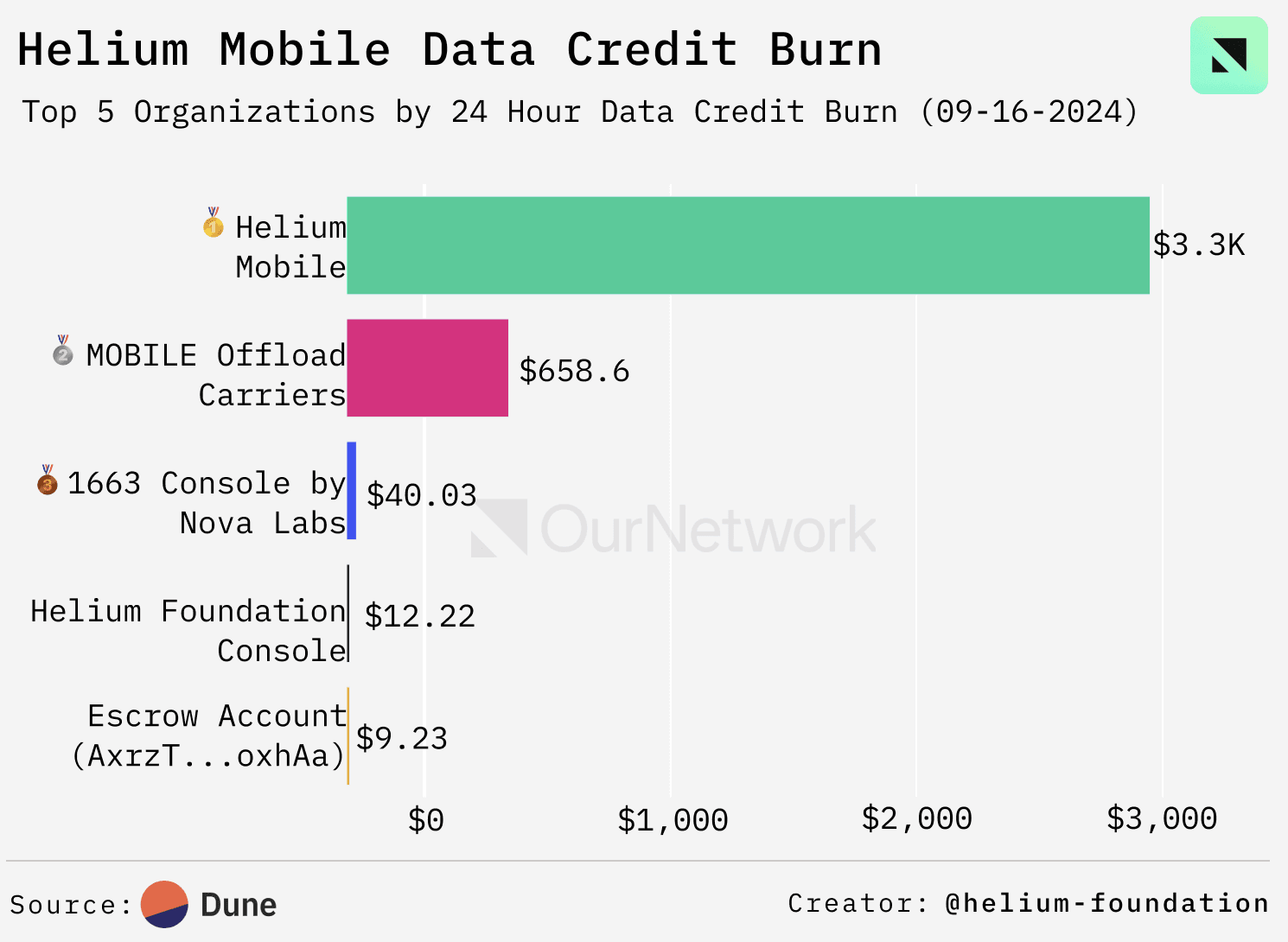

Essentially, DePIN is a market for service transactions. Unfortunately, we do not yet have enough demand and transaction value to indicate that it has found product-market fit (PMF).

Source: Dune and Helium Foundation

Source: Our Network 271

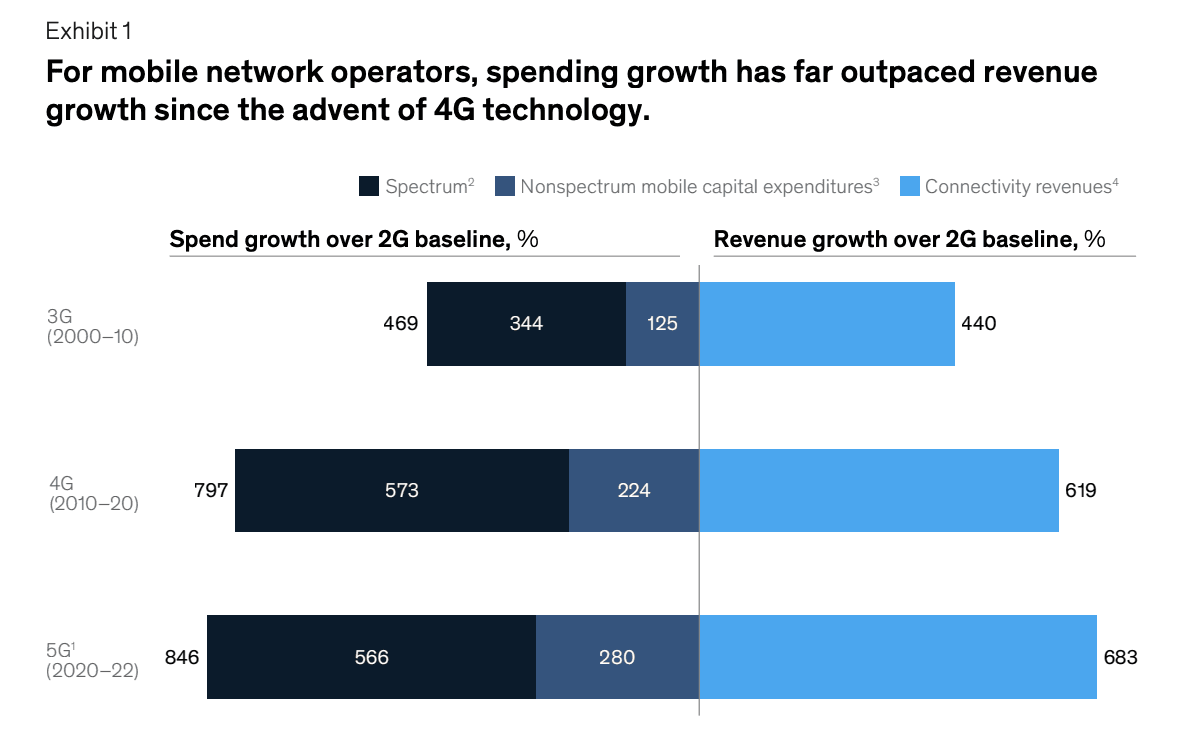

One of the main value propositions of DePIN is to shift the investment and maintenance of infrastructure to decentralized networks. The costs for centralized entities in doing this are rising, with the growth rate of capital expenditure (capex) exceeding the growth rate of income. Higher expenses mean consumers need to pay higher service fees. Additionally, the better the network coverage, the more expenses are required, as the cost of the last mile increases exponentially in rural areas. Without price discrimination, someone will eventually subsidize this service.

Source: "The Imperfect Present and the Bright Future of DePIN: A Deep Analysis of Compound"

Another factor is the resilience of the network, as seen in the U.S. power grid. Even though the grid is not a single, cohesive network, no single company is responsible for its maintenance. Instead, it is composed of many different utility companies (including privately and municipally owned companies) and is supervised by federal and state regulatory agencies. The grid is already fragmented, precisely for resilience. And as long as it can achieve the goals of affordability and resilience while earning the required cost of capital for the companies investing in and operating the infrastructure, it can further fragment.

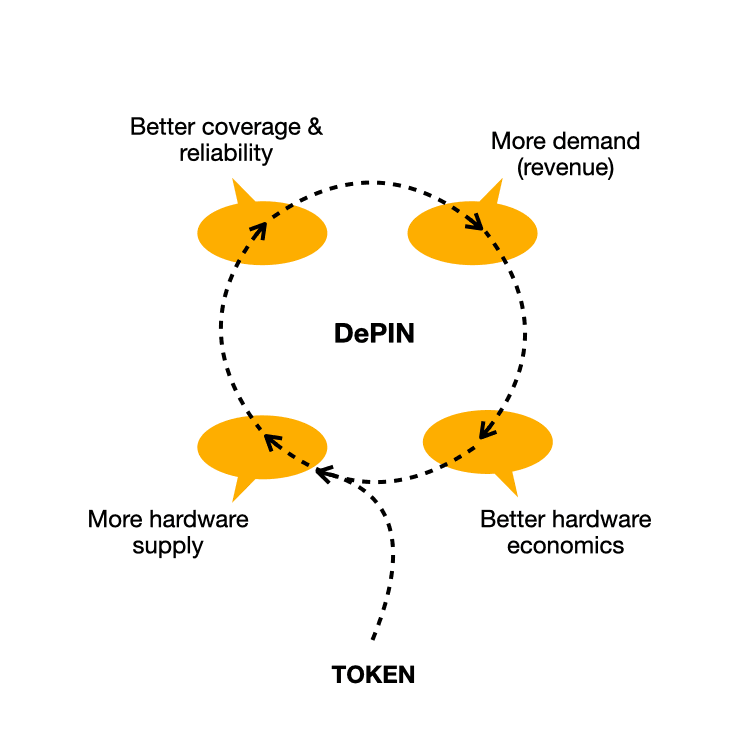

Why can DePIN effectively overcome the upfront investment costs of hardware? Because capital formation allows projects to quickly deploy tokens and distribute them to hardware operators.

Certainly, relying solely on tokens is not enough. But it is enough to get 100 truly interested users on the supply side to use it, to observe if there is demand and income. If there is, as demand and network coverage increase, unit economics will improve, and the degree of reliance on token incentives will decrease. Ultimately, all sustainable cryptocurrency markets will compete on a) price, and b) reliability and/or customer service, with income being the most important single metric.

Once again, the role of cryptocurrency is to help markets, and the DePIN that extends from it, reach the critical point of rapid development early on, through the coordination of resources and payments.

Creating Markets People Want to Trade In

After experiencing multiple cycles of cryptocurrency investment, we gradually realize that the creativity in the cryptocurrency field is limited by the unique properties it bestows. We discussed these properties earlier.

The permissionless nature of cryptocurrency is both a blessing and a curse. The design space for cryptocurrency startups seems infinite until you realize that these ideas must include strong and explicit financial elements.

We believe the answer is very clear—find assets and markets that people want to trade in before they realize it themselves. These ideas always sound controversial—whether it's the previous cycle's Helium (and earlier Uniswap), or today's SkyTrade. But this is a sign that you are exploring something worth paying attention to.

Unfortunately, not all types of assets will be traded. Time and time again, we see that users do not value their data, privacy, or swords in games. Markets related to "ownership" and equal compensation schemes for content creators have not succeeded. In the cryptocurrency field, enough time has passed to prove that some areas are ineffective, while great businesses have been built in others. In every cycle, explicit financial elements have been proven to be stronger than ever before.

Cryptocurrency cannot solve economically unreasonable ideas; instead, it further reinforces the capitalist features we are already familiar with. More money, more transactions, higher returns, and faster speed. Cryptocurrency is pushing us to continuously advance along the path that has been known and traversed since the formation of late medieval capitalism.

Creating new markets, seeking new assets, your application will thrive long-term on a blockchain network that ensures economic security. This is the most optimistic future for cryptocurrency.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。