"Weekly Editor's Picks" is a "functional" section of Odaily Planet Daily. In addition to covering a large amount of real-time information every week, Planet Daily also publishes many high-quality in-depth analysis contents, which may be hidden in the information flow and hot news, passing by you.

Therefore, our editorial department will select some high-quality articles worth reading and collecting from the content published in the past 7 days every Saturday, bringing new inspiration to you in the encrypted world from the perspectives of data analysis, industry judgment, and opinion output.

Now, let's read together:

Investment

Arbitrage Trading, the Invisible Driving Force of the Prosperous Cryptocurrency Market

In the field of cryptocurrency, arbitrage trading usually involves borrowing stablecoins to invest in DeFi. Although the returns are high, significant risks accompany the volatility. Arbitrage trading can enhance market liquidity, but during a crisis, it may lead to drastic fluctuations, exacerbating market instability. In the cryptocurrency market, this may trigger a speculative bubble. Therefore, risk management is crucial for investors and enterprises using this strategy.

Innovations such as tokenization of returns and decentralized liquidity are shaping the future of arbitrage trading in cryptocurrencies. However, the potential emergence of anti-arbitrage mechanisms presents challenges, requiring the development of more resilient financial products to cope with it.

Meme, Ton Games Devouring the Market, Not Just a "Industry Clearance" Limited to CEX?

From the user's perspective, the endless Meme and Ton game projects have almost devoured the market. This is not just a problem for any CEX, but the entire market is going through an adjustment period. These Meme and Ton games are like igniting a box of dazzling fireworks, instantly attracting user flow, incremental funds, and attention, which looks good on the surface, but also accelerates the depletion of market liquidity and overdraws users' trust in exchanges and crypto.

Exchanges are not judges; they look at the emotional value of the community and retail investors.

Market Rebound, Which Sectors Have Become Bright New Stars?

Sui ecosystem, CZ's release, AI sector, modularization.

When Binance Intensively Launches "Old Coin" Contracts, How Can Ordinary Users Maximize Profits?

The highest point within 24 hours was in the first minute after the announcement. The most stable strategy is to hold short positions for a longer time after the contract is launched.

Entrepreneurship

The Way of DeFi Evolution: Why Humanization is More Crucial than Digital Growth?

The community can be divided into three levels:

1% are developers, builders, and teams, they are creators.

9% are users, authors, funds, researchers, and angel investors, they are keen on observing this field and making some comments, although they are not part of the team, they are not just newcomers passing by.

90% are random traders and speculators, they usually do not read documents. They pay attention to headlines, buy and sell cryptocurrencies, but do not care about in-depth research. They are not stupid, just not attached to any investment. For them, fundamentals are usually irrelevant, they only care about price trends.

A few high-level contributors are often more valuable than thousands of fans or critics. These core members closely connected due to shared intrinsic values (preferably on-chain) often have a more lasting impact, despite requiring a higher initial investment.

Interacting directly and personally with the community—20 carefully crafted private messages often produce results more quickly than tweets sent to 20,000 followers. Although this approach is not easy to scale, it is indispensable in the early stages of building a vibrant and healthy community.

A strong community is not only a rich source of recruitment, especially suitable for attracting non-engineering talents. If your project has not attracted talent from the community, you may need to rethink how to better integrate community building with recruitment.

Opinion: Cryptocurrency Applications, Less Talk about Technology, More about Demand

Most consumer applications can be divided into three categories: wealth, social and entertainment, and their intersection. User guidance and retention are two critical moments for good applications, especially retention. Therefore, it is important to design for the right community from the beginning. Innovation should be reflected in user experience, not just the technology itself. Make good use of existing modules.

Meme

Characteristics of top players: super diamond hands, 40%-45% win rate, profit-loss ratio of 1:5 or higher.

PEPE Loses Key Support, Where is the Bottom Fishing Opportunity?

The price may further decline in the short term, but with the arrival of the fourth quarter, PEPE is expected to have a rebound opportunity.

For investors who are optimistic about the token in the long term, the current price trend may be a good opportunity to increase holdings, and emerging Pepe products such as Pepe Unchained will also become market focus. Short-term investors should remain cautious and avoid high-risk operations under bearish pressure.

Bitcoin Ecosystem

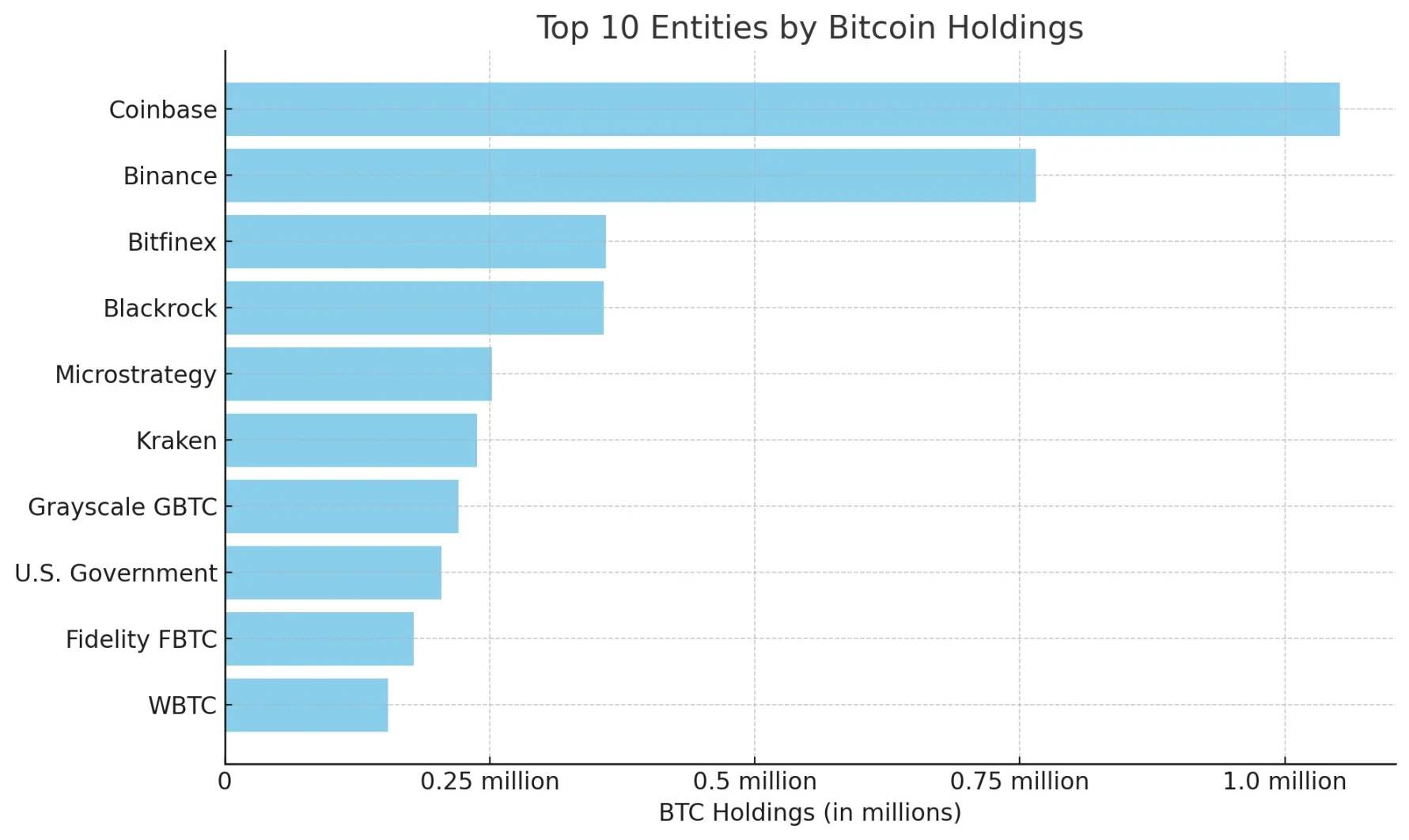

Overview of the Top Ten Bitcoin Holders

Currently, there are numerous Bitcoin Layer 2 projects, and even a "currency inflation" phenomenon has emerged. Each project adopts different technological routes. Well-known Bitcoin Layer 2 projects such as Stacks and Rootstock were established relatively early and have explored the relevant technologies for a long time, but the projects currently lack more highlights.

With the maturity of the Bitcoin base protocol, projects such as Merlin, RGB++, and Babylon are making the Bitcoin ecosystem more diverse, which also brings more possibilities for the development of Layer 2.

Narrowing of technical standards for Layer 2 may be a trend in future development.

Also recommended: "BTC (Re)staking Supply-Side Competition Intensifies, Wrapped BTC Competes for Market".

Ethereum and Scalability

Power Shift in Ethereum's 10-Year History: 3 Reshuffles, "Midlife Crisis," and De-Vitalikization

Introduction of former high-weight holders in Ethereum.

BitMEX Alpha: Reassessing Ethereum

ETH's potential rebound has 3 catalysts: EigenLayer's $EIGEN token is about to start trading; gas at the highest level in 6 months; Vitalik's reactivation.

Understanding Puffer UniFi AVS: From Preconfs to Ethereum's Next Decade?

Puffer UniFi AVS, as an innovative mechanism design for pre-confirmation technology, is currently the most critical step for "Based Rollup+Preconfs":

For users, Puffer UniFi AVS brings almost instant transaction confirmation experience, greatly improving user experience and laying a solid foundation for the widespread adoption of Based Rollup;

For pre-confirmation service providers, it strengthens the reward and punishment mechanism through on-chain registration and forfeiture, improving efficiency and credibility within the ecosystem;

For L1 verification nodes, it opens up additional income channels, enhancing the attractiveness of participating node verification, further strengthening the economic incentives and legitimacy of the Ethereum mainnet.

Multi-Ecosystem and Cross-Chain

Recommended: "Singapore Breakpoint Overview: 43 Key Solana Project Dynamics".

Rising Star, Will Sui Become the Next Solana?

On-chain data: Sui outperforms Solana in 2021; social media influence: Sui lacks a "star endorser"; seizing the opportunity: Solana still dominates the MEME market capital boost: the two are cut from the same cloth; market performance: similar market experiences in price trends.

Also recommended: "Sui Sparks Meme Trend, A Quick Guide to Trading Tools and Popular Tokens".

TON Asia Development Relations Manager: What Should Developers Build on TON?

The core of TON and Telegram should always revolve around three pillars: social, payment, and finance (large user base + seamless cross-platform functionality + strong value transfer).

Promising areas to watch include credit card cashback and gift card businesses, RWAs, Earn products, Launchpool-type programs, or companies focusing on offline QR code payment solutions.

DeFi

DeFi Renaissance in Progress: What are the Fundamental Changes in the Race?

Several factors are pointing towards the revival of DeFi.

On the one hand, we are witnessing the emergence of several new DeFi primitives that are safer, more scalable, and more mature than a few years ago. DeFi has proven its resilience and established itself as one of the few industries in the crypto space with practical use cases and real adoption.

On the other hand, the current monetary environment is also supporting the revival of DeFi. This is similar to the background of the last DeFi summer, and the current DeFi metrics indicate that we may be at the starting point of a larger upward trend.

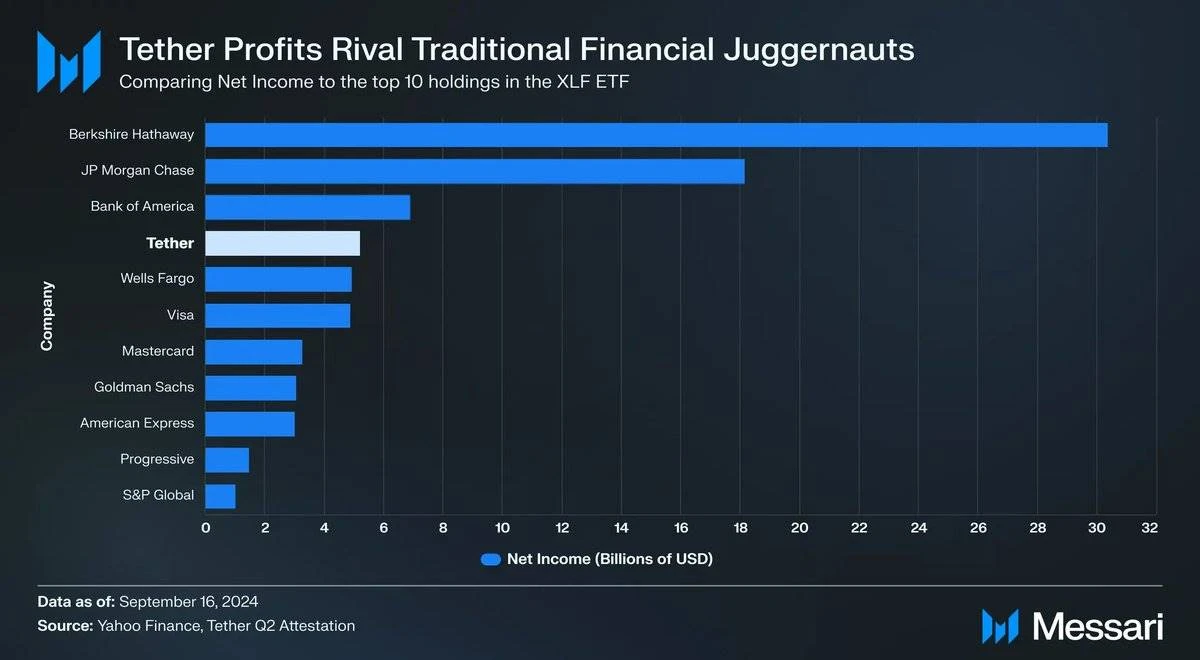

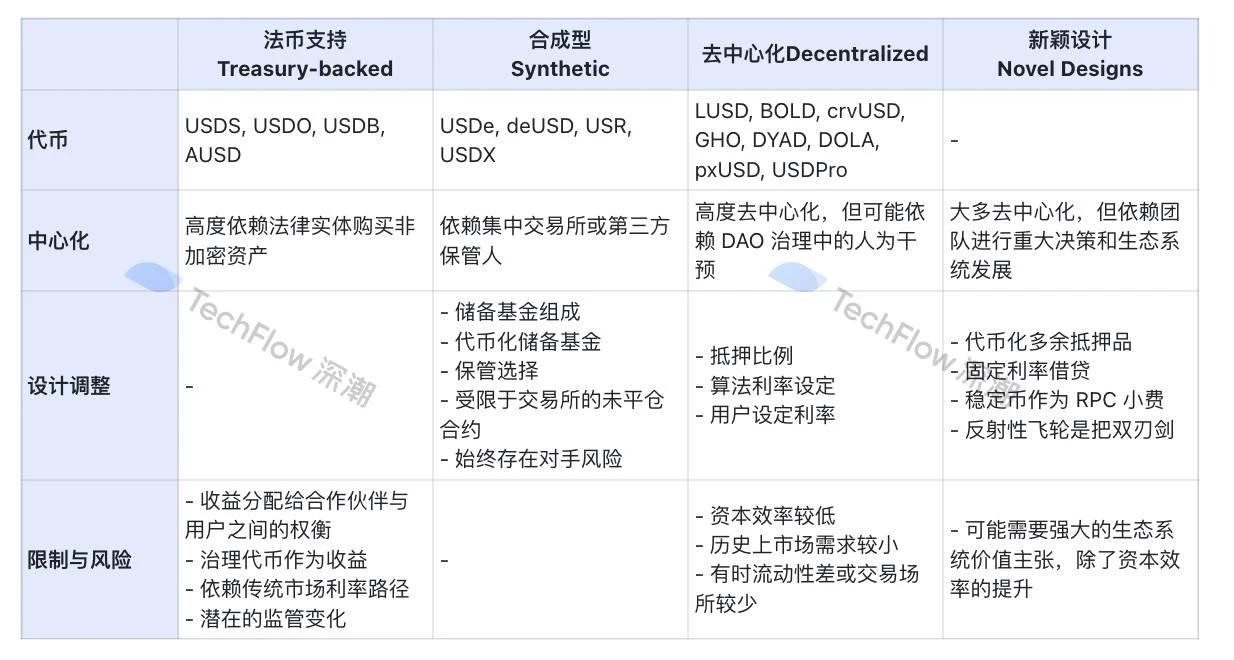

Messari Researcher: Overview of Stablecoin Market Products and Their Features

Price Doubles, TVL Returns, Reanalyzing Aave, the Leading Old Dragon Head that First Revived

Key catalysts that set AAVE apart from other altcoins include stakers sharing protocol revenue, collaboration with BlackRock, entry into Solana, leading position, and brand reputation.

Although AAVE has recently surged, its price is still undervalued.

GameFi, SocialFi

Delphi Digital Report: Overall Financing of Web3 Games Declines, but Activity Remains Strong

Over 50 games were launched in 2024, including significant profit-making projects such as Xai, Pixels, and Notcoin.

Shooting games remain the mainstream type in Web3.

In MMORPGs, the most anticipated game is MapleStory Universe.

Mobile games like King of Destiny and Matr1x Fire are growing rapidly, attracting hundreds of thousands of users. Matr1x Fire has exceeded 3.5 million downloads.

Ronin and TON ecosystems are leading in Web3 games.

Inventory of Farcaster's Top 100 Celebrities: Building High-Quality Feed Streams

Initially, Warpcast was invitation-only, and Dan Romero personally invited users through Twitter DMs, onboarding the initial ten thousand users, roughly divided into three categories: Coinbase-related, a16z and other VCs, and the Ethereum ecosystem. The wool party came and went, but the underlying color of Warpcast remains.

In contrast, Twitter is like public media, and Farcaster is like a friend circle—Twitter's big Vs are generally encouraged to output alpha information, project research, and industry insights, while Farcaster's big Vs prefer to discuss new products or ideas, life insights, and existential thoughts.

In the past week, Fortune reported that CZ was released early, and his lawyer stated that he was not willing to immediately accept interviews; Ethereum Meme once again saw a "hundred dogs barking," "hippos" single-handedly saving Solana, and the return of the "zoo market" after three years;

In addition, in terms of policy and macro markets, Biden: expects the Fed to continue cutting interest rates; Harris promises to make the United States a leader in the blockchain field and reiterates support for digital assets; the US SEC approves BlackRock's Bitcoin spot ETF options trading; on September 21, the RMB exchange rate against the US dollar approached the 7.0 mark, and the USDT off-exchange rate dropped to 6.94; Bank of Japan Governor: if trend inflation rises as predicted, it is suitable to raise interest rates; Japan's Financial Services Agency is considering reforming regulations on encrypted games, making it easier for companies to "deal with" in-game encrypted assets; foreign media: former Apple design director confirms collaboration with OpenAI to develop new devices, an iPhone veteran joins;

In terms of opinions and voices, VanEck analyst: Harris becoming president may be more favorable for Bitcoin; Bank of America: the current market's reaction to a 50bp Fed rate cut seems to be following the script of "soft rate cuts" or "panic rate cuts"; US lawmakers criticize Gary Gensler as the most "destructive" and "lawless" chairman in SEC history; Arthur Hayes: the accuracy of macroeconomic forecasts in recent years is only 25%, but crypto investments are still profitable; Vitalik: "Reducing L1 slot time" is worth discussing, but should be approached with caution to avoid harming independent stakers; Vitalik: achieving the concepts of "popup city" and "network states" still needs to address governance and membership issues; Aave co-founder: there is no proposal to detach wBTC, Sky's forced detachment may result in legal liability;

Institutional, major company, and top project news, Circle CEO: pushing for an IPO, plans to relocate headquarters to Wall Street next year; Binance launches spot pre-trading service; Blast launches global deposit layer GDL, supporting deposits to any Blast address or DApp through multiple CEX and fiat channels; Ethena plans to collaborate with Securitize to launch a new stablecoin UStb, supported by BlackRock BUIDL; Jupiter is advancing the second major vote on the disposal of its token JUP (J4J#2), deciding the outcome of disposing approximately 215 million JUP (approximately $190 million); ether.fi Foundation: open application for the 3rd quarter ETHFI airdrop; Pencils Protocol opens application for airdrop; LayerZero: ZRO airdrop claim period has ended, unclaimed tokens will be redistributed; Magic Eden will launch the ME token on Solana; Stacks Foundation: Nakamoto activation is expected to take place on October 9; Hamster Kombat: on the first day, 88.75% of HMSTR can be claimed, 2.3 million users were banned for cheating, and the token distribution sparked controversy; TERMINUS leads the "Mars Tide" Meme coin outbreak;

In terms of data, IntoTheBlock: USDT market value approaches $120 billion, reaching a historical high; Three Arrows Capital and Alameda Research need 3 years to sell all their unlocked WLD… Well, it's been another eventful week.

Attached is the link to the "Weekly Editor's Picks" series portal.

Until next time~

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。