This article has compiled the recent listing information of the three major exchanges (Binance, OKX, Bybit), and referenced the exchange listing information provided by "杀破狼". If a project aims to list on CEX as the ultimate goal and positive factor, which token categories have the most advantages?

Author: FMGResearch

1. Infra category favored by major exchanges

Recently, since $nerio was listed on Binance, it has gained over 20 times in value. Meanwhile, Binance has continuously listed multiple TON-related project tokens, attracting widespread attention in the market. The enthusiasm of other exchanges for the TON ecosystem contrasts sharply with their indifference to other tracks.

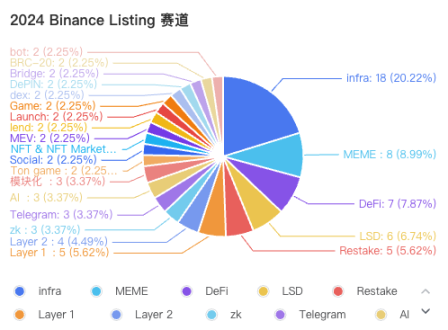

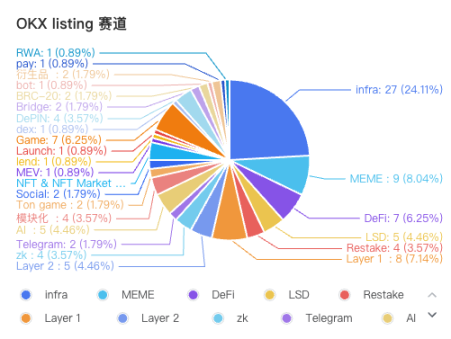

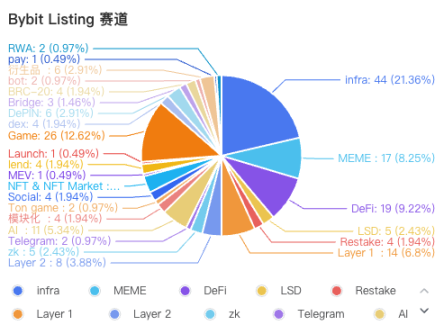

On Binance, Infra accounts for 20.22%, followed by MEME and DeFi.

On OKX, the proportion of Infra further expanded to 24.11%, followed by MEME, DeFi, and Layer 1;

Among the 119 projects listed on Bybit, 44 projects are marked as Infra, followed by MEME, DeFi, and Layer 1.

Summary

The once popular Game track has generally cooled off this year.

In addition, the reason why major exchanges are willing to choose Infra, MEME, and DeFi tracks as the main listing targets is that Infra, DeFi, and Layer 1 generally serve as the terminal faucets for different secondary tracks and popular projects. For example, the popularity of projects like BOME will transfer value to SOL; the surging of NOT and CATI will also drive up the price of TON. However, these types of products generally have a longer cycle, and most products take 1-2 years from obtaining investment to listing on exchanges.

In contrast, the trend of MEME captures more hotspots and users, becoming the main reason for exchanges to timely list tokens.

2. Different scales represented by the three major exchanges for delisting

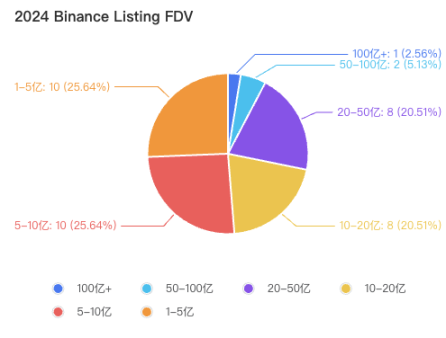

Binance has statistics for 40 projects, with an average FDV of around 24 billion US dollars; the median is 8.7 billion US dollars;

Among them, the proportion of projects with FDV of 1-5 billion and 5-10 billion US dollars is the highest, at 25.64% each;

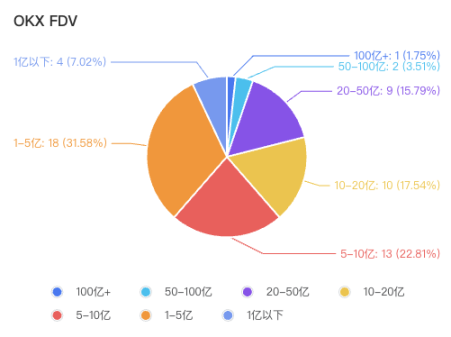

OKX has statistics for 57 projects, with an average FDV of around 18 billion US dollars, and a median of 7.3 billion US dollars;

Among them, the proportion of projects with FDV of 1-5 billion US dollars is the highest at 31.58%, followed by 5-10 billion at 22.81%;

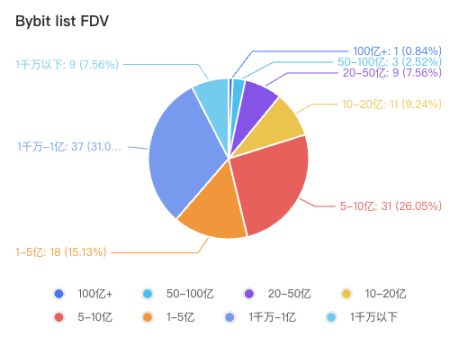

Bybit has statistics for 119 projects, with an average FDV of around 10 billion US dollars, and a median of 72 million US dollars;

Among them, the proportion of projects with FDV of 10 million - 1 billion is the highest at 31%, followed by 5-10 billion at 26.05%;

Summary

From the performance of the listed projects, Binance and OKX have similar performance and are in the first tier of exchanges. Projects that can be listed on Binance and OKX also imply a high probability of achieving an FDV of over 10 billion US dollars. While Bybit's listing criteria are showing a narrowing trend, it is still relatively relaxed compared to Binance and OKX. It is the main target for various project parties at present.

3. Influence of institutions on listing

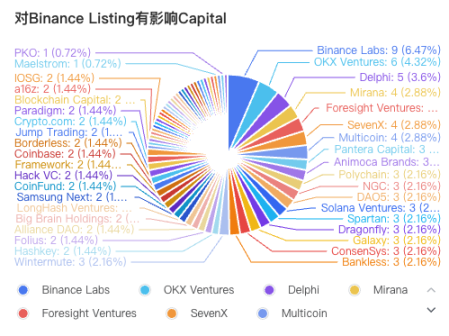

Among the projects listed on Binance, the institution that appeared the most frequently is Binance Labs, appearing 9 times in 40 projects; followed by OKX Ventures, appearing 6 times; in addition, Delphi appeared 5 times; Mirana, Forsight Ventures, SevenX, Multicoin appeared 4 times.

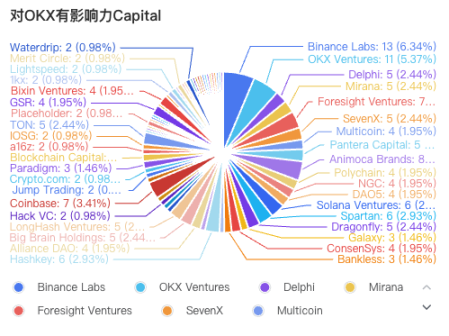

Among the projects listed on OKX, Binance Labs appeared the most, appearing 13 times, OKX Ventures appeared 11 times, Animoca appeared 8 times, Forsight Ventures and Coinbase appeared 7 times, and Solana Ventures and Spartan appeared 6 times.

Summary

Exchanges generally favor Infra, but as the founder of IOSG pointed out, projects with valuations around 100 million and have not completed TGE have abandoned their plans to list on Binance due to the difficulty. Infra projects with valuations between 300 million and 500 million are still struggling to raise funds. In the context of high valuation and difficult financing in the large infrastructure, a series of small games in the TON ecosystem are increasingly favored by exchanges.

Starting from Notion, Doge, Catizen, and Hamster have successively listed on first-tier exchanges. Their initial FDV performance is impressive, with NOT reaching nearly 30 billion US dollars at its peak, and CATI also rising to over 10 billion US dollars upon listing. These data all demonstrate the high potential of the TON ecosystem. Starting from games, completing the initial Web3 transformation of users, and then projects like DuckChain as Ton L2; UTONIC Protocol as a re-staking platform in the Ton ecosystem; RedStone as an oracle; DeDust as a Dex… the TON ecosystem is gradually becoming complete.

Expectations for the future of TON

Here, we can boldly speculate and focus on two ideas for the TON ecosystem:

- A traffic distribution and reuse platform based on Telegram;

Due to Telegram's natural aggregation of 9 billion traffic, and the further infusion of the idea of interactive profit through Notcoin into the minds of TG users, in the future, advertising investment and task distribution for B-end will become a trend. A representative project is PEPE Miner Bot, which is a task distribution and reward acquisition platform based on Telegram. Users can earn PEPE tokens by joining the Bot, and earn more PEPE tokens after completing other tasks. Currently, the project has over 700,000 subscribers, with massive traffic.

- CeDeFi business built on Telegram's native software.

Due to Telegram's inherent elements of Web2 and Web3, it is logical and feasible to build a combination of CeFi and DeFi in this ecosystem. A representative case is Blum, which is a hybrid exchange combining CeFi and DeFi, providing access to universal tokens through gamification in the Telegram mini-application. Blum can access CEX and DEX tokens on one platform, support over 30 chains, and provide additional features including AI navigation, P2P trading, derivative trading, etc. The project has already received investment from Binance Labs.

Data sources for this article: Rootdata, "杀破狼", Coinmarketmap

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。