The Transformation Journey of Morpho

Author: Deep Tide TechFlow

Despite the recent popularity of MEME in the past few months, the market's interest in DeFi has been lackluster. However, with the interest rate cut in place, the community has reignited confidence in the "resurgence of DeFi." As one of the three driving forces of DeFi development, the future development of decentralized lending is highly anticipated. Even the Trump team has intervened and announced the launch of the lending project WorldLibertyFinancial (WLF).

In the discussion of who will lead the revival of DeFi, Morpho, which was announced to have received a $50 million financing in early August and has a total financing amount of over $80 million, has been frequently mentioned.

With such a staggering financing scale, more people have become curious:

In the fiercely competitive lending track, why did Morpho stand out? What is Morpho brewing under the new round of massive financing?

The name of the Morpho project can be directly translated as "flash butterfly," and its project logo also resembles a butterfly spreading its wings. In fact, Morpho is also staging a stunning "metamorphosis": from the earliest Morpho Optimizer in 2021, a lending product based on Aave and Compound, to its current dedication to integrating decentralized finance with internet infrastructure protocols, promoting the transformation of private financial infrastructure into public goods.

How is this "metamorphosis" carried out? How does Morpho empower lending, DeFi, and the entire financial industry as a financial infrastructure?

This article aims to delve into the transformation journey of Morpho.

Metamorphosis: Morpho Promotes the Transformation of Private Financial Infrastructure into Public Goods

Why Become Financial Infrastructure?

Morpho believes that the current decentralized lending track suffers from mainstream asset concentration, inefficient capital utilization, less-than-ideal interest rates, and inadequate user experience. Morpho aims to bring optimization, and financial infrastructure is the basic system where multiple market participants gather to solve financial business problems. However, the current financial infrastructure stack has problems in terms of accessibility, fragmentation, interoperability, efficiency, and flexibility.

To systematically improve the current lending track, it is necessary to completely rebuild the lending market from scratch. Therefore, Morpho aims to build a universal infrastructure that anyone can participate in and build upon, thereby further breaking through the boundaries of DeFi and unleashing innovation.

From a project perspective, it is speculated that in the crypto world, compared to a single product, becoming "infrastructure" not only reflects the strength of the project itself but also has a higher development ceiling. The TVL of decentralized lending has surpassed that of DEX, becoming the track with the largest capital capacity in the DeFi field. Becoming the foundational layer of lending also makes Morpho's future growth potential more convincing.

Why Must the Financial Infrastructure Morpho Aims to Build Have the Attributes of Public Goods?

The answer is obvious. If the infrastructure is private, it will tend to serve a particular entity, which is not purely aimed at driving industry development.

Morpho defines financial infrastructure as "public resources" that everyone can use, reducing its availability and making all code and rules open and transparent. The only thing users need to trust is the verifiable technology itself.

So, What Kind of Public Product-Type Financial Infrastructure Is Morpho Committed to Building?

Morpho aims to build decentralized infrastructure with an internet-style approach. It not only leverages the advantages of blockchain but also, through characteristics such as permissionless and high flexibility, can not only innovate the crypto world but also expand its service range to the global financial system.

Therefore, the public product-type financial infrastructure that Morpho is committed to building has the following characteristics.

First, this foundational layer follows the basic principles of decentralization. It possesses verifiable security, providing participants with a secure foundation without the need for trust. Its accessibility and functionality operate stably and are not affected by single points of failure, allowing participants to integrate with confidence.

Second, this foundational layer is permissionless. It is open to anyone and provides high flexibility and freedom, allowing any developer to join and serve any user, thereby further expanding the service range and innovation vitality.

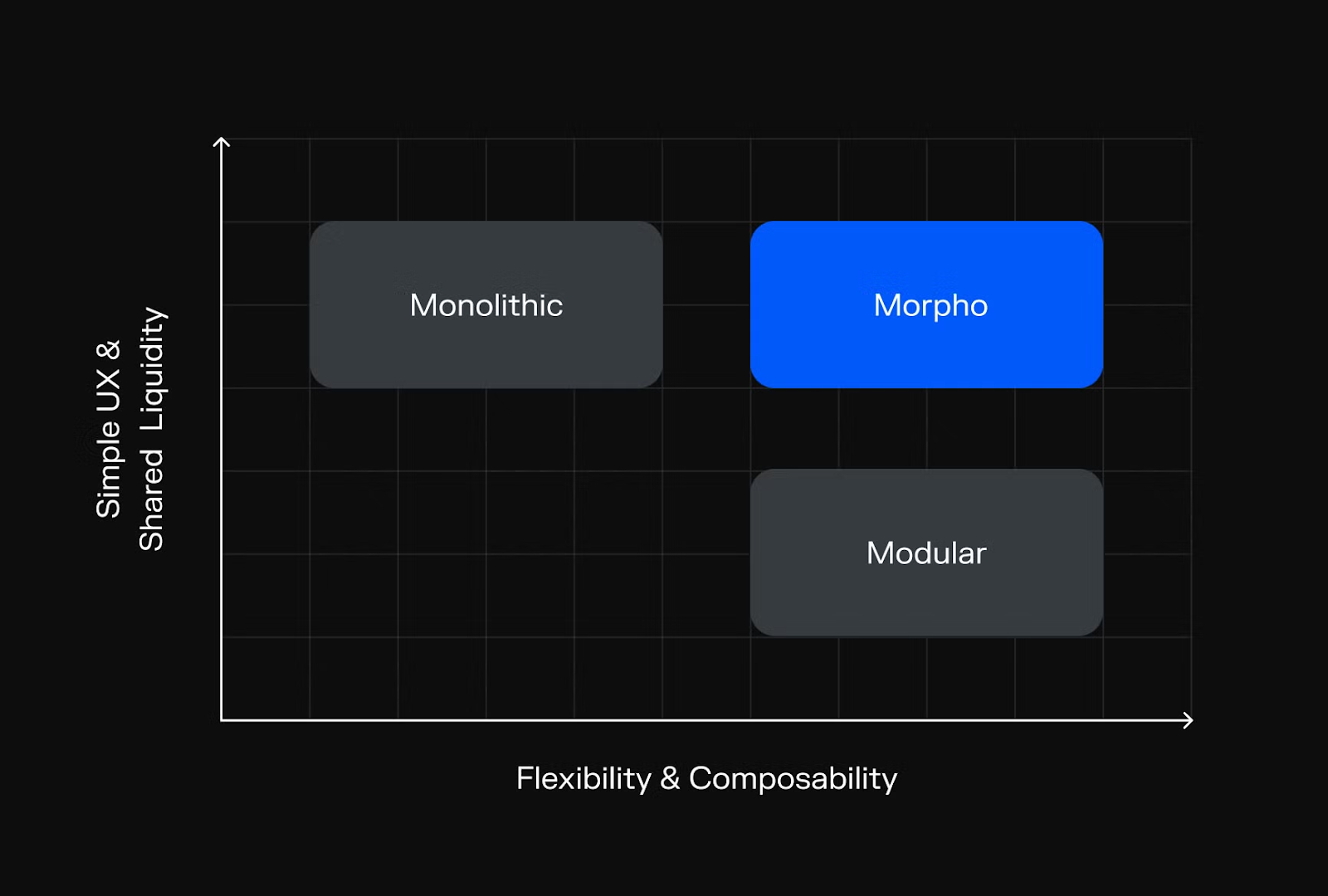

Most importantly, this foundational layer is original and aggregated. Many people view Morpho as a modular solution, but this is actually a misconception. In reality, Morpho is an aggregated solution that combines the advantages of integrated lending and modular lending. The overall architecture is divided into two levels:

Original market layer: Designed with minimal, immutable, and flexible features, it not only provides strong security advantages but also excels at connecting various financial applications and supports the reuse of the same instance in different use cases.

Modular layer based on the original market layer: It is dedicated to providing personalized support in user experience, liquidity, and risk management.

In this way, Morpho's lending solution achieves multiple advantages:

In terms of security, benefiting from rigorous auditing, formal verification, and immutable codebase, various types of lending schemes will be built on a strong security foundation. Upgrading or changing individual modules will not affect other templates.

In terms of flexibility, Morpho not only operates permissionlessly but also avoids the series of problems brought about by a single liquidity pool and risk management in an integrated lending scheme. It supports easy participation and the construction of various asset, risk, and return lending.

In terms of liquidity, in traditional modular lending solutions, each pool has different logic and assets, leading to fragmented liquidity and complex user experience. In Morpho's layered design, the original market can be reused, and different modules can aggregate liquidity.

Morpho believes that if financial businesses can operate on a truly decentralized, permissionless, and flexible and efficient public financial infrastructure, finance will usher in a new round of explosive development.

Such a public product-type financial infrastructure, although extremely attractive, sounds more like a "want it all" concept. How does Morpho achieve this transformation?

Implementation: How Do Morpho Markets and Morpho Vaults Innovate the Lending Experience?

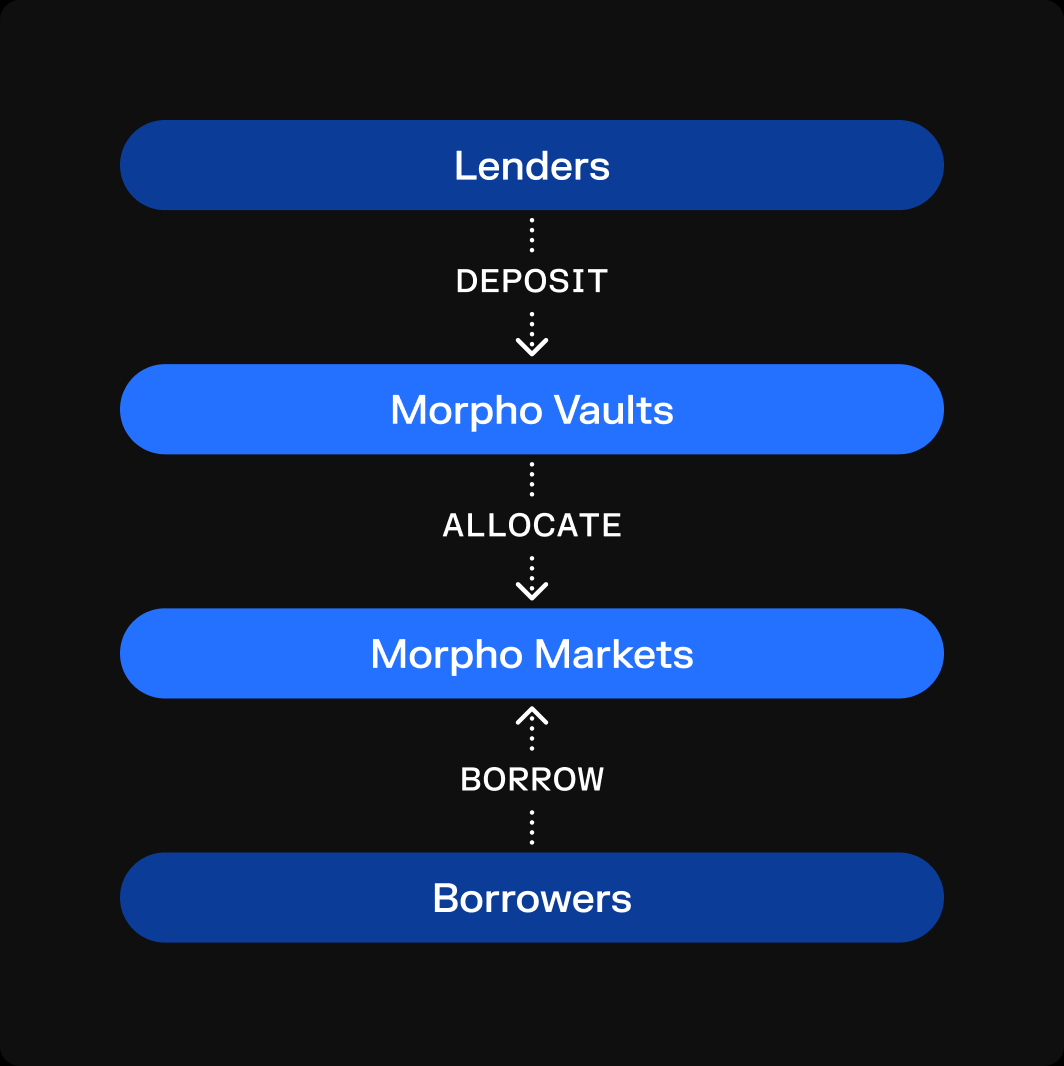

The lending market is essentially the matching of demand between "borrowers" and "lenders." Morpho aims to build an open, efficient, and flexible platform where anyone can earn income and borrow any asset.

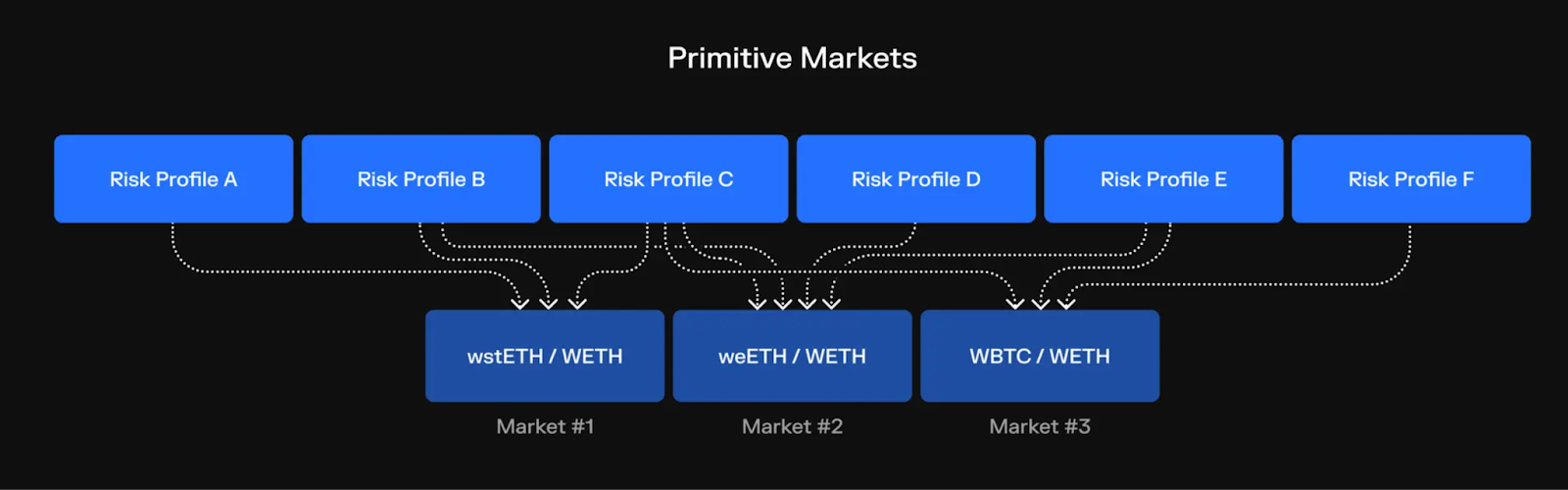

Morpho Markets is a simple, immutable single loan and collateral asset market (corresponding to the original market layer mentioned above), giving creators of the lending market a high degree of autonomy. Anyone can deploy an independent lending market by specifying a collateral asset, a loan asset, an interest rate model (IRM), the loan-to-liquidation value (LLTV), and the oracle to be accessed.

In addition, since the lending markets of Morpho Markets are isolated, when losses occur, the losses will be immediately shared among the users who provide funds to that lending pool, without automatically spreading any risk among all users.

Morpho Vaults is a professional lending treasury planned by external risk experts and built based on Morpho Markets (corresponding to the modular layer based on the original market layer mentioned above). Each vault contains a loan asset, and different vaults have different risks/returns.

Users can deposit corresponding loan assets into the vaults to earn income based on their risk preferences, and the vaults aggregate liquidity to Morpho Markets to better match the demand between "borrowers" and "lenders."

For ordinary users:

When choosing to deposit assets, users will receive stronger security guarantees, more diverse funding participation choices, and higher interest income.

On the one hand, the non-custodial nature of Morpho Vaults gives users greater control over their assets.

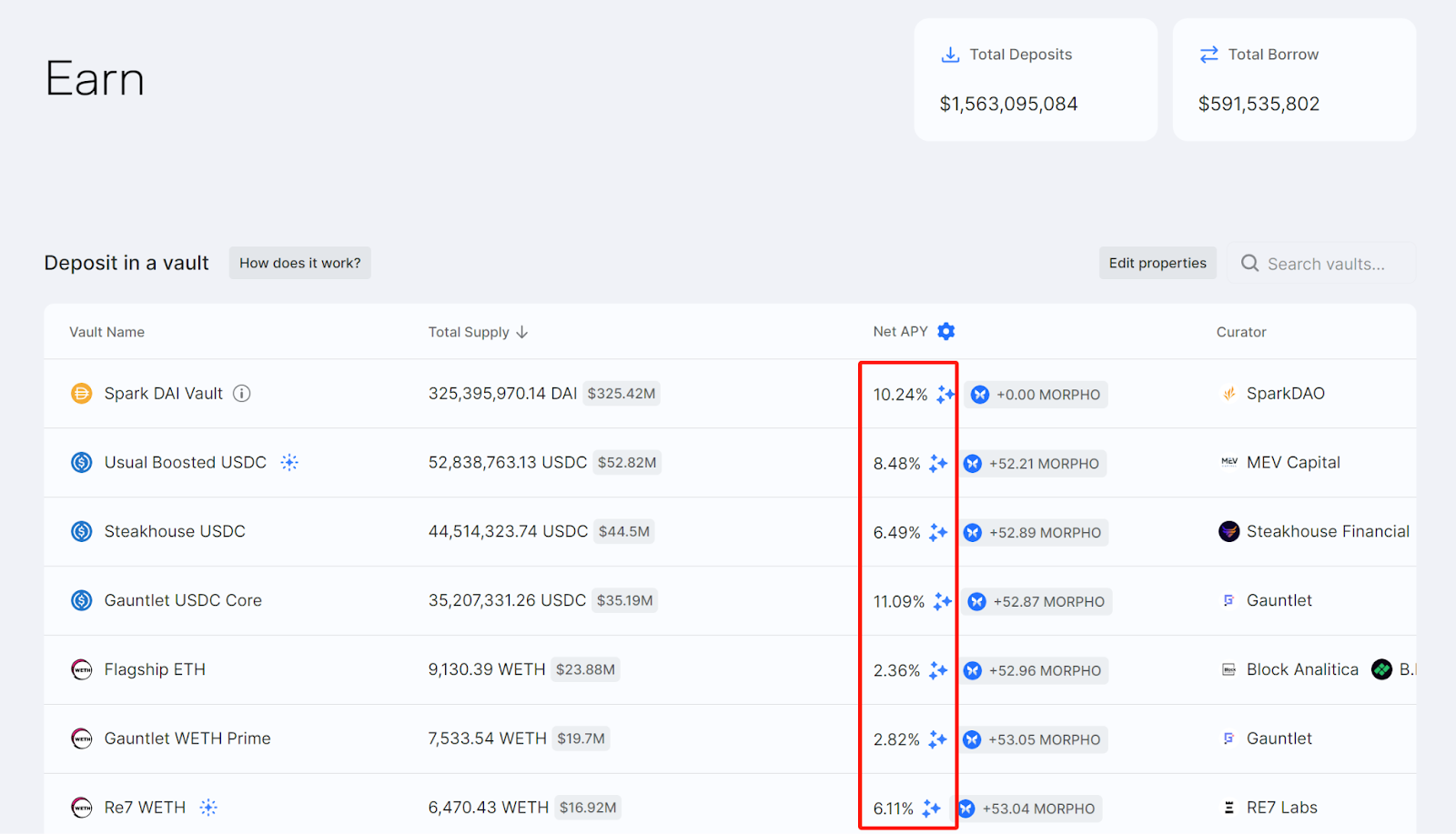

On the other hand, users can choose different vaults based on their income needs. To attract more users to deposit assets, vault managers will not only strive to develop more scientific risk/reward strategies for the vaults but also actively benefit users. According to the rules, vault managers can receive up to 50% of the vault interest as income, but currently, some vaults even distribute all interest income to users.

Currently, the annualized yield of multiple Morpho vaults is at 4%, with the highest reaching 11.4%, generally higher than other lending protocols.

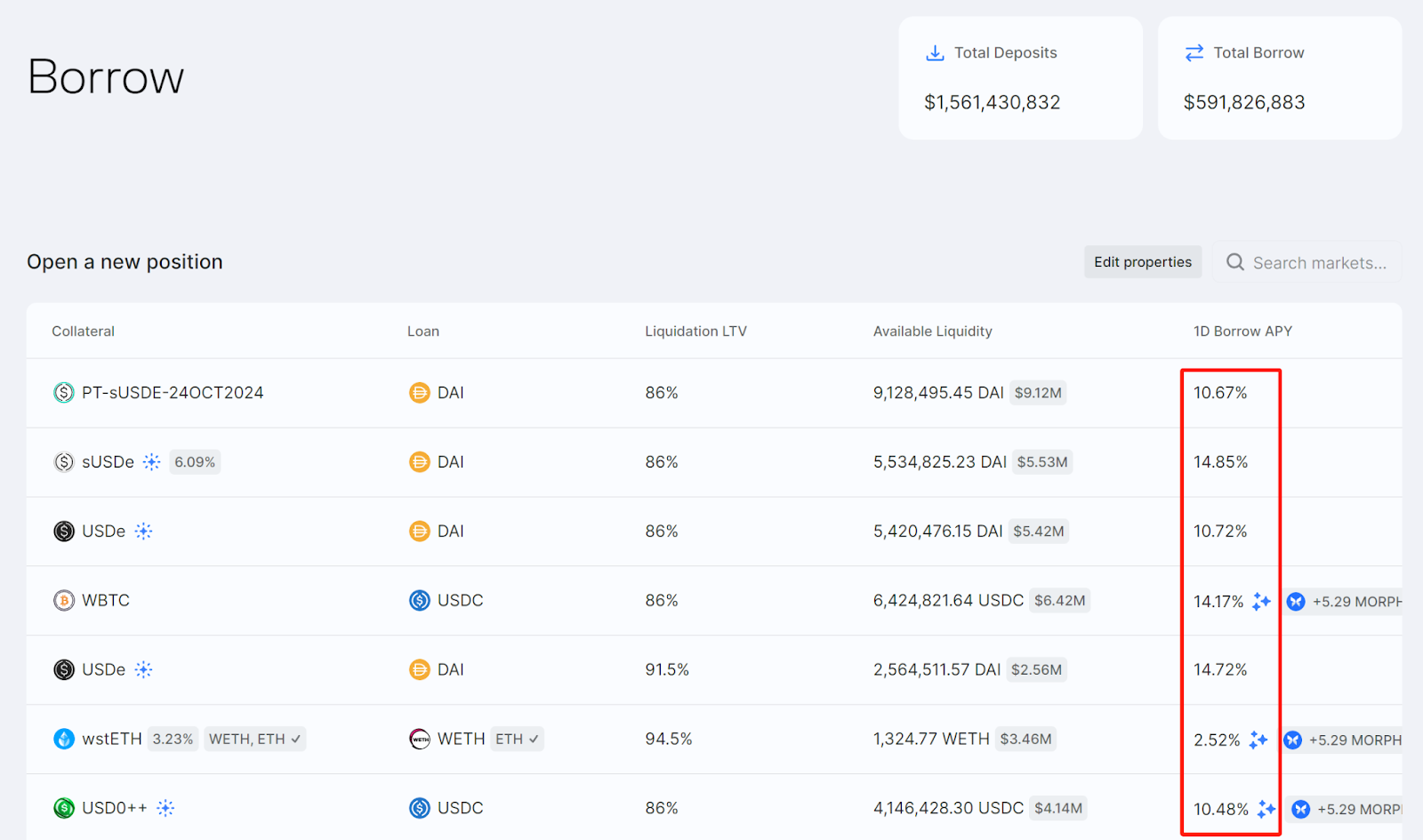

When choosing to lend assets, users will receive a higher loan-to-value ratio, allowing them to borrow more funds and maximize capital utilization. Although Morpho's borrowing interest rates are only slightly higher than Aave's at the moment, Morpho currently does not charge platform fees, making borrowing costs lower and interest rate differentials smaller.

For enterprises and developers:

Based on Morpho, it is not only faster and easier to deploy vaults and markets that better meet actual needs (different assets, different risks, different returns), but also enables complete control over the vaults and markets. More importantly, as a public financial infrastructure, Morpho greatly reduces the development time and cost required for construction through shared infrastructure, while also achieving better liquidity aggregation.

Implementation: From Web3 to Web2, Morpho Welcomes a New Round of Ecosystem Expansion

Transformation is a careful decision, but fortunately, feedback from the market further validates the correctness of Morpho's choice.

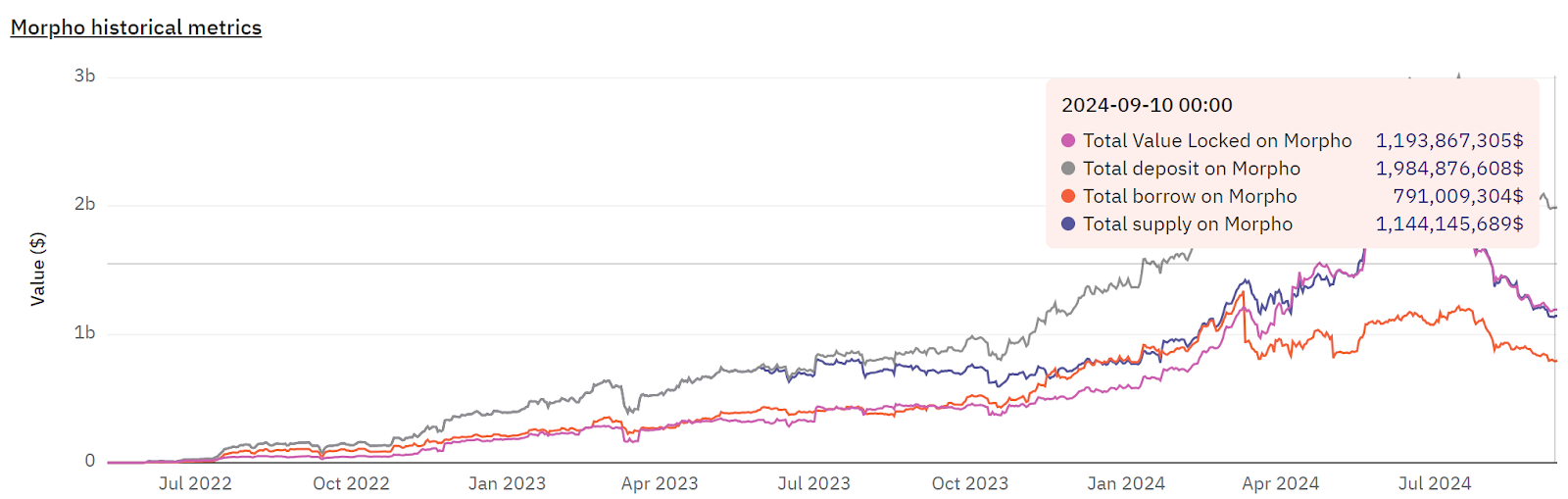

In the past few months, we have seen counter-trend growth in both on-chain data and ecosystem cooperation for Morpho.

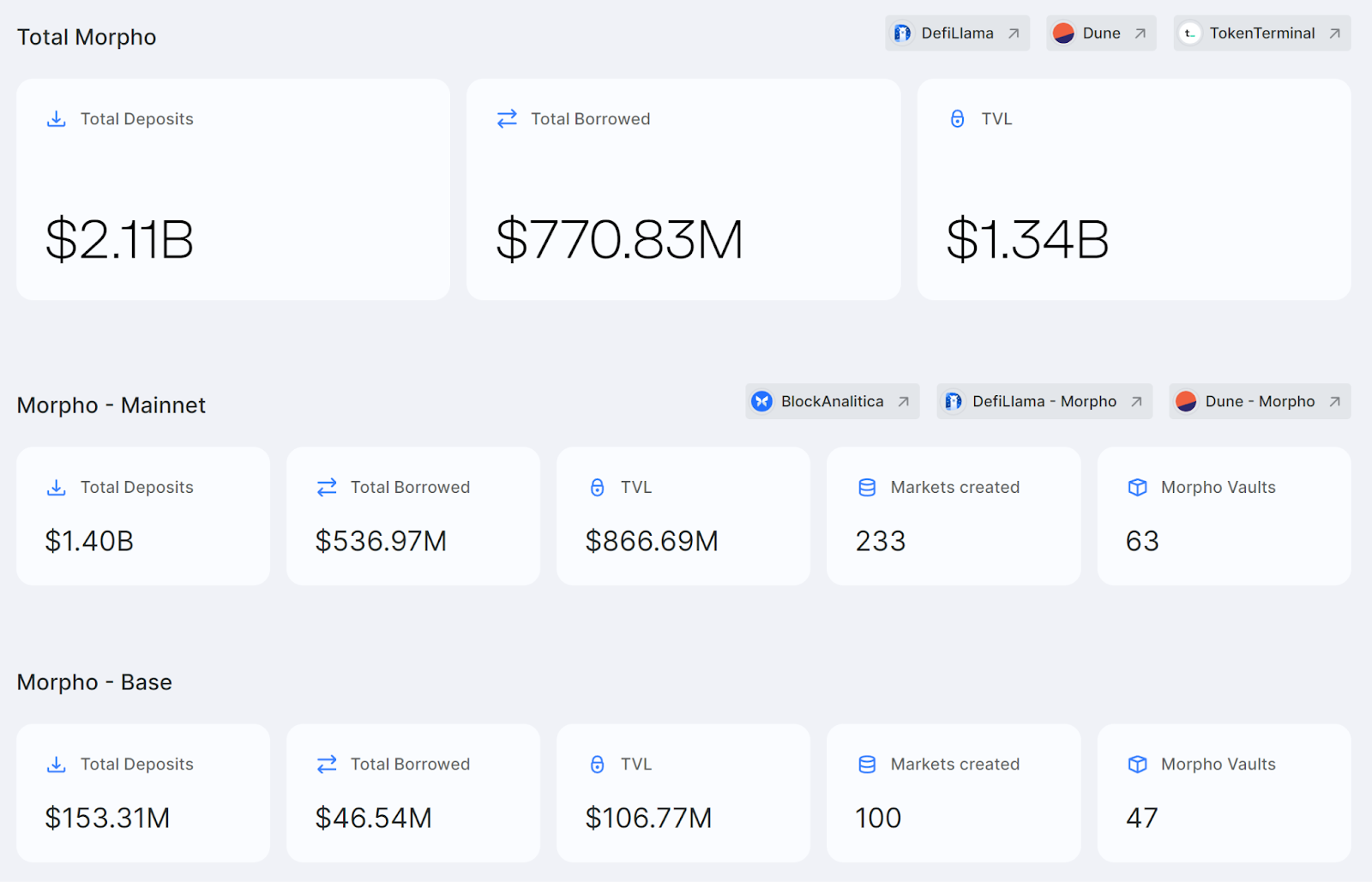

According to data from the Morpho Analytics page, the total deposits in Morpho currently exceed $21 billion, total borrowings exceed $770 million, and on-chain TVL exceeds $13.4 billion, an increase of over 220% compared to the $6 billion at the beginning of the year. According to DefiLlama rankings, Morpho ranks sixth in the lending track.

In terms of deployed Markets and Vaults, there are currently over 333 Morpho Markets created on Ethereum and Base networks, and the created Morpho Vaults have reached 110.

It is worth noting that since announcing its entry into the BASE ecosystem in June this year, Morpho has become the fastest-growing DeFi protocol on BASE.

Currently, the total deposits in Morpho on the BASE network exceed $153 million, with total borrowings of $46.54 million and TVL exceeding $100 million. Additionally, the number of Morpho Markets created on the Base network is 100, and Morpho Vaults have also reached 47, fully demonstrating the activity of Morpho in the BASE ecosystem.

The growth of on-chain data is inseparable from the thriving ecosystem of Morpho. As a public financial infrastructure, Morpho is committed to integrating with fintech and enterprises, using decentralized power to revolutionize traditional finance and introducing more incremental users to the crypto world through a good user experience.

As Morpho says: Fintech in the frontend, Morpho in the backend.

We can indeed see the practice of this concept in Morpho's ecosystem.

According to the official website, the current Morpho ecosystem includes 200+ projects, including major DeFi projects such as Elixir, Aragon, Contango, Safe, SummerFi, and Stream, all of which have chosen to build on Morpho.

As a public financial infrastructure, Morpho not only empowers DeFi projects in the crypto world but also extends its achievements to traditional finance areas such as RWA.

In the DeFi field, the most representative collaboration is with MakerDAO (now known as Sky). In March of this year, MakerDAO's lending protocol Spark deployed $100 million of new DAI liquidity through Morpho. The funds were allocated to the sUSDe/DAI and USDe/DAI markets, allowing users to borrow Ethena's stablecoin USDe and sUSDe with efficient leverage positions supported by Maker's liquidity. Many KOLs analyzed that MakerDAO's move was aimed at countering Aave's launch of its stablecoin GHO and consolidating its competitiveness in the DeFi field.

As a hot narrative in this cycle, Morpho has not missed out on BTCFi. Recently, the cbBTC launched by Coinbase and LBTC launched by Lombard will also be deployed on Morpho.

In innovating the traditional finance sector, Morpho has been very active recently:

In August, Morpho announced a partnership with blockchain technology company Centrifuge and top exchange Coinbase to launch an institutional real-world asset (RWA) lending market. The market uses Coinbase's Layer 2 network Base and Morpho Vaults system as technical support and uses three tokenized US bonds, including Centrifuge's Anemoy fund, Midas's short-term US Treasury bills (mTBILL), and Hashnote's US yield coin (USYC), as collateral to provide instant liquidity without the need to redeem the US bonds.

In early September, the fintech platform SwissBorg, which focuses on cryptocurrencies and serves the European market, announced the launch of a USDC yield product using the Morpho protocol. The product is currently available to SwissBorg app users, who can access the WBTC/USDC and wstETH/USDC markets on Morpho.

This cooperation not only helps SwissBorg users to enjoy higher security and risk-adjusted returns without touching high-risk assets, but also enables crypto newcomers to easily access on-chain income opportunities. It also promotes Morpho's access to a wider range of Web2 users, demonstrating its enormous potential for revolutionizing traditional finance and driving explosive growth.

As praised by SwissBorg for this collaboration: Morpho Vaults provide customizable infrastructure that allows traditional financial platforms to develop exclusive products, thereby reducing risks associated with traditional Web3 lending protocols.

It is worth mentioning that the Asian market has always been an important sector in the crypto industry. At this year's TOKEN2049 event in Singapore, many industry leaders mentioned that Asia is leading the development of the crypto market, with countries in Asia ranking in the top 40% in terms of user adoption.

As a result, Morpho is actively seeking cooperation with the Asian market and expanding its business in Asia, especially in China and South Korea. In the future, we will see more of Morpho's movements in the Asian market, aiming to promote its public financial infrastructure services to a wider range of Asian crypto users, providing them with a more efficient and flexible lending experience.

Future Growth: Token Conversion Sparks Discussion, Participate to Earn More Income

Actions speak louder than words, and true experience comes from real participation.

Enterprises and developers can participate in Morpho through the Curate/Build page: Through Curate, participants can easily create custom vaults with customized strategies, permissions, and governance in seconds using public code, and earn income by managing lending vaults. For more DAOs, fintech, applications, and CEX, they can use Morpho Stack to build any custom product, greatly reducing development time and cost, and enjoying the advantages of increased security, flexibility, and better liquidity brought by Morpho Stack.

Ordinary users can participate in Morpho through the Earn/Borrow page:

The Earn page lists various Morpho Vaults, allowing users to choose vaults based on their risk preferences and deposit assets to earn income. The earnings from each vault vary and fluctuate with the market, consisting of native earnings (interest paid by borrowers), reward APY (provided by third parties), and MORPHO token rewards.

The Borrow page supports users in providing collateral and borrowing assets, with simpler operations, higher capital utilization efficiency, and lower costs.

Participating in Earn or Borrow is currently the only way to earn MORPHO tokens.

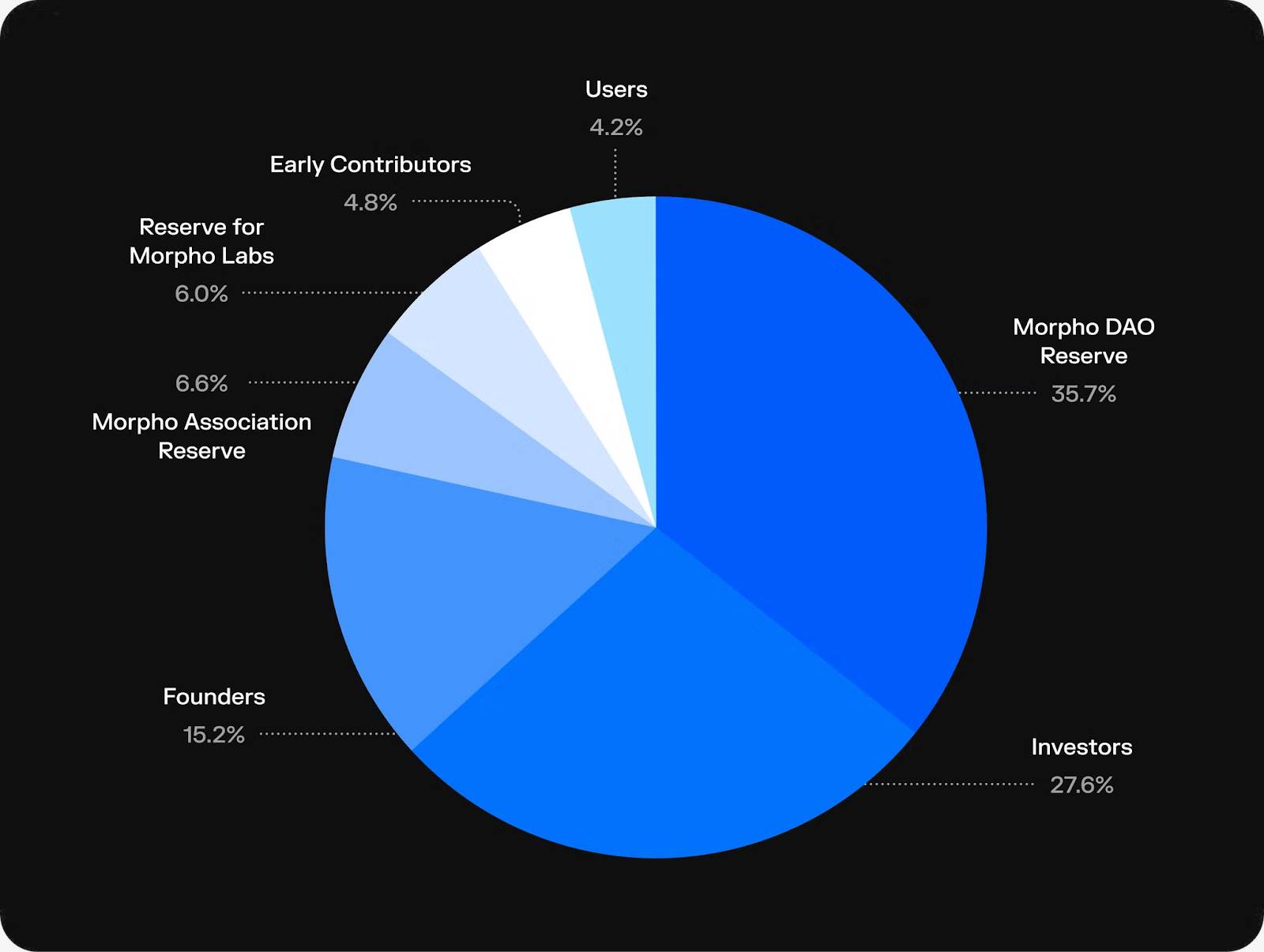

As a governance token, the total supply of MORPHO is 1 billion. Morpho DAO is responsible for managing the Morpho protocol, composed of MORPHO token holders and delegates, and is responsible for governing the Morpho protocol. MORPHO token holders can participate in ecosystem governance and vote on protocol changes.

As of August, the overall distribution of MORPHO tokens is as follows:

It is important to note that currently, MORPHO tokens are not transferable, meaning they cannot be traded or listed on CEX/DEX. In late August, Morpho DAO initiated a discussion on unlocking the transferability of MORPHO tokens and received widespread community support. This means that MORPHO tokens are likely to be officially launched before the end of the year, and at that time, Morpho may introduce user incentive activities such as airdrops. This important milestone has raised high expectations for Morpho's future growth and greatly encouraged users to actively participate in Earn/Borrow to accumulate more income chips.

On the ecosystem side, Morpho's ecosystem has the huge advantage of being permissionless, supporting anyone to create innovative applications based on it. This gives Morpho itself a strong innovative drive. In the future, while continuously improving and optimizing Morpho Stack, Morpho will continue to focus on ecosystem cooperation, maintaining growth momentum in the BASE ecosystem, and promoting cooperation with leading fintech companies to expand the public decentralized financial infrastructure services to a wider range of Web2/Web3 users.

In the crypto world, the ability to navigate complete bull and bear cycles is largely a measure of success, and long-term competitiveness requires continuous innovation based on market needs.

As a veteran player in DeFi, Morpho has unleashed its innovative potential for Web3 from a single lending optimization product to becoming a truly decentralized, permissionless, flexible, and efficient public financial system, breaking the boundaries of Web3 to bring innovation to the broader global financial system.

In the foreseeable future, with the continued expansion of its ecosystem and the official launch of its token, Morpho will enter a rapid growth phase, becoming an important force leading the revival of DeFi in this cycle.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。