Arbitrum's DAO has passed a vote to implement a new sequencing feature named "Timeboost™️". However, it may have a disastrous impact on users in the Arbitrum ecosystem.

By: joshuabaker.eth

Translated by: Shanoubah, Golden Finance

Recently, Arbitrum's DAO passed a vote to implement a new sequencing feature named "Timeboost™️". At the end of this article, my task is to appeal to the Arbitrum DAO and team to reconsider their implementation of Timeboost™️, but I am aware that this may be futile. I have identified some major issues, not only in the greed and short-sightedness displayed in promoting this feature, but also in the potentially disastrous impact it may have on users in the Arbitrum ecosystem.

When talking to people in the CeFi (centralized finance) field, I often refer to Arbitrum as a beacon of hope in the increasingly deteriorating MEV (maximum extractable value) environment. Unfortunately, this is no longer the case. The first-come, first-served mechanism used to be a very special ordering structure, making Arbitrum a safe haven for users who do not want their trades to be exploited in various ways. However, this "upgrade" (if you can call it that) fundamentally undermines this.

Why are they building this monster?

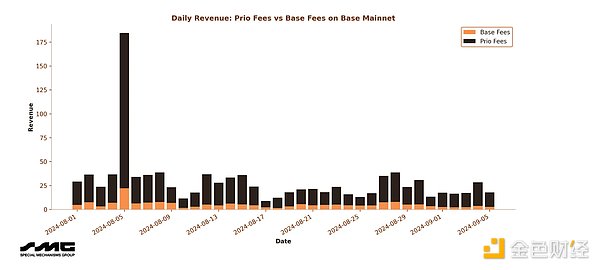

First, let's look at some data on other L2 (layer 2 network) revenue sources:

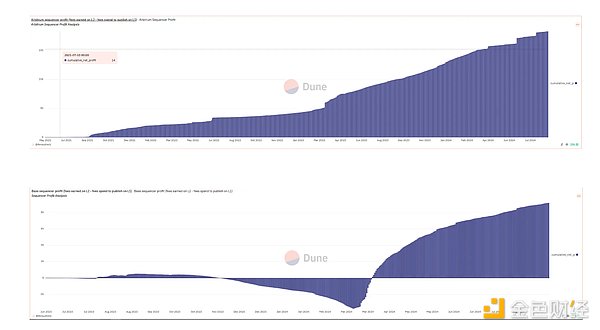

Also, let's take a look at the revenue and profit data for Arbitrum and Base over the past year:

In particular, let's focus on two data points, as these are the most alarming data points for Arbitrum as a top player, as Base has surpassed them in profit benchmarks over the past 9 and 6 months. As you can clearly see in the SMG data you posted above, most of Base's profits come from priority fees, which are fees paid by searchers and market makers (MM) to prioritize their arbitrage and MEV. So far, Arbitrum has not had a priority gas fee mechanism, but is still making a lot of money.

This is why the foundation and DAO want to establish a priority gas fee mechanism, but I want to make it clear: I have no objections to this! What I detest is this over-engineered mechanism, which could crush Arbitrum's retail users and result in more MEV extracted per dollar of trading volume than any other chain in the Ethereum ecosystem. At the end of the article, I will detail some alternative solutions that I suggest the foundation and DAO explore, but first, let's carefully analyze the design of this "mechanism".

The mechanism itself

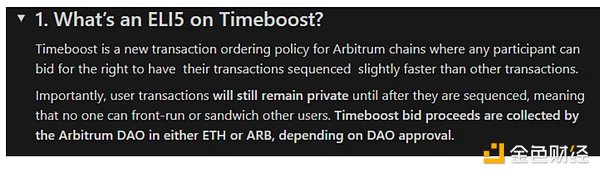

This is a snippet from the Arbitrum official FAQ document:

Two data points caught my attention: Timeboost™️ sells the right to place trades at the beginning of a block, continuously for a full minute. Given that this will extend the block time on Arbitrum from 200 milliseconds to 450 milliseconds (as mentioned in the document), this means that the auction winner will on average gain exclusive first trade control rights for about 133 blocks. A few days ago, I raised this point on Twitter, and now I want to delve into some serious ways that savvy searchers could thoroughly disrupt the system:

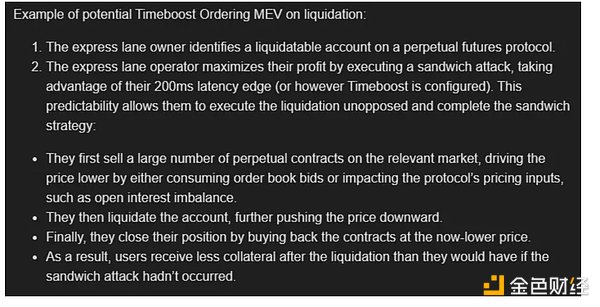

First, let's look at an example detailed by the Chaos Labs team in their risk assessment of Timeboost™️, but I believe they severely underestimate the following risks:

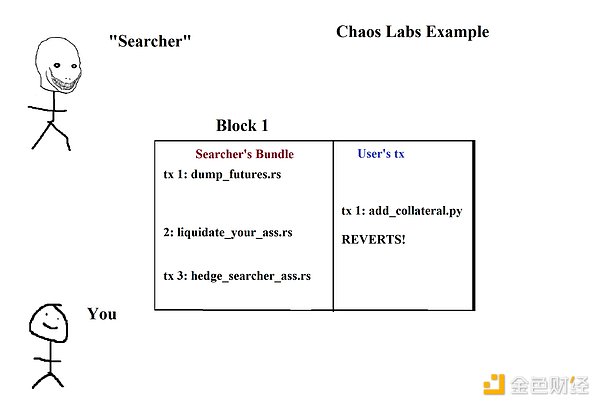

This is what I drew for you clear-minded folks:

If you read the content in the Arbitrum documentation/FAQ about Timeboost™️, you will find that they are actually advocating for this mechanism. They believe that simple front-running and back-running operations within each block are a good thing, as theoretically the auction will capture a large portion of MEV. But this only holds true if the auction is only for one block. The current auction is actually for 133 blocks. This means that they are essentially selling the right to "sandwich" 132 consecutive blocks (the first block doesn't count because it's free). This fact will lead to massive multi-block MEV, potentially reaching unprecedented levels. I also want to point out another potential scenario of malicious game theory that I expect to occur at least once.

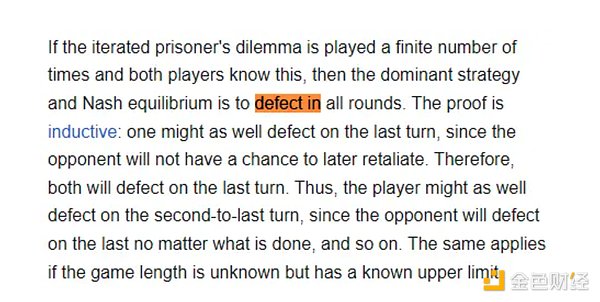

Here's a quote from the Wikipedia page on the prisoner's dilemma. Very basic stuff. In any infinite game, cooperation is the optimal strategy! But in any finite game, the outcome is often that you screw over your opponent. This is the reason events like Celsius or FTX occur, but it also explains why platforms like eBay have very low fraud rates. What does this mean for Arbitrum's Timeboost™️ mechanism? Quite simply, if I were an anonymous auction bidder with the ability to generate 2^256 different public keys for bidding, I could do whatever I want, because I'm not playing an infinite game, but countless finite games. In my view, a potential attack vector is similar to the price manipulation example from Chaos Labs, but it will span multiple blocks.

Assuming this searcher is savvy enough to have a model based on market liquidity that can predict the price changes of a token on a centralized exchange (CEX) with over 50% probability. In fact, this is what market makers do—collect data, make predictions based on this data, and adjust spreads and orders accordingly. Also, assuming Chaos Labs' judgment is correct, because of the existence of Timeboost, no one will attempt CEX-DEX (decentralized exchange) arbitrage during the 200-millisecond delayed trading period in each block:

If you've heard of the prisoner's dilemma, you'll know that the solution is always to be the last one to drop the soap… wait, that's not right. Hold on a second…

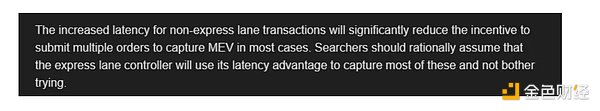

It's also worth noting that shorter block times reduce the MEV (supported by papers) extractable from on-chain "LVR" (lagged price arbitrage): In this scenario, searchers are fully aware that all order flow within a block comes from retail users or low complexity users. Therefore, they can effectively treat the entire 1-minute period as one giant block running for a full minute. In other words, they can strategically delay arbitrage operations, allow price fluctuations, and then execute large-scale arbitrage at T+n blocks instead of arbitraging every block. This situation cannot be modeled without real-time operation of Timeboost™️, but it should be noted that some searchers may be paying attention to this. This could become a way of extracting value, initially tested sporadically on certain blocks, and then gradually deployed on a large scale. We are likely to see some kind of arms race between successful bidders and unsuccessful bidders.

For example, the winning bidder "A" chooses not to arbitrage the n-2 blocks in their first minute, but instead combines the n-2 and n-1 blocks into one block and operates using the method I just described. They then place back-running trades in the last block, treating the first two blocks as a larger, more profitable block.

Suppose searcher "B" notices this. They realize they can include a trade during the delay period of the n-1 block, arbitraging that block before "A". So in the next minute, "A" places a back-running trade in the n-2 block, arbitraging before "B" and turning "B" into the victim of the first trade arbitrage in the next block.

If this is a bit confusing, I apologize, but it all turns into a prisoner's dilemma. If "A" knows that "B" won't betray them in the next block, they will betray "B" before the opportunity arises. If "A" discovers this, they will be smarter next time.

Summary

Please do not implement this mechanism. If you insist on implementing it, at least give me some popcorn to watch the show. But seriously, I think there are some interesting ideas worth exploring in the Timeboost mechanism, but the potential for multi-block MEV is too serious to be ignored. Arbitrum has always been my favorite chain, as I mentioned earlier, I tell every traditional finance professional that this is an excellent MEV ecosystem chain, where users can get good pricing, liquidity, and protection from front-running exploitation.

However, this proposal will ruin everything.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。