Author: Keyrock, Crypto Market Maker

Translation: Felix, PANews

Retaining and acquiring cryptocurrency users is not an easy task. The distribution of free airdropped tokens is intended to attract long-term user participation, but often leads to rapid sell-offs. Although some airdrop cases have successfully promoted project adoption, the majority have failed. This article will explore the performance of airdrops in 2024 and their influencing factors.

Key Points:

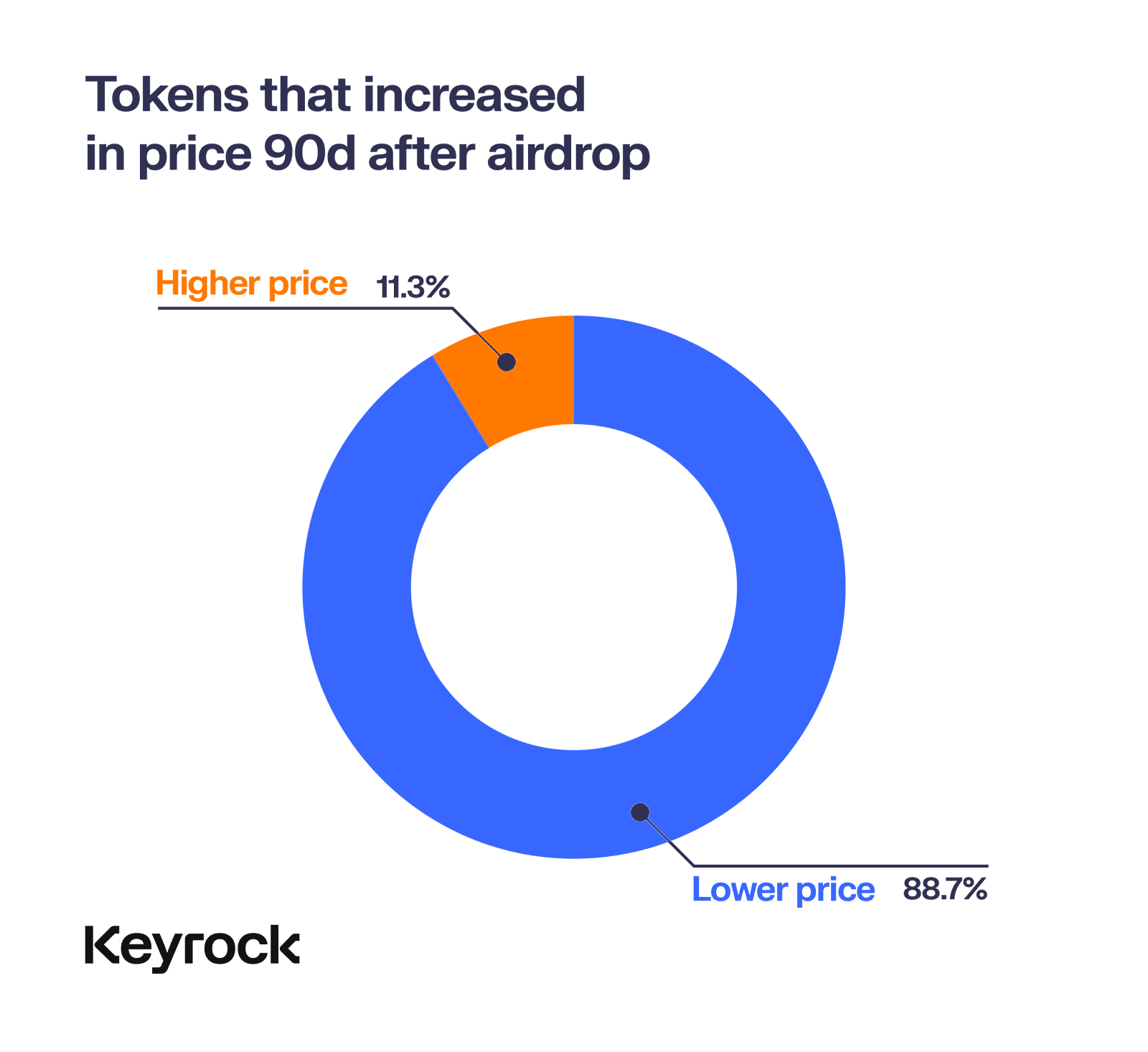

Sustaining prices is difficult, with most airdropped tokens collapsing within 15 days. In 2024, 88% of airdropped tokens experienced significant declines within a few months, despite the initial price surge.

More airdrops lead to better performance. Tokens with airdrop allocations exceeding 10% of the total supply exhibit better community retention rates and price performance, while tokens with airdrop allocations below 5% are typically quickly sold off after listing.

Overinflated fully diluted valuations (FDV) inflict the most damage on projects. High FDV suppresses growth and liquidity, leading to significant post-airdrop price declines.

Liquidity is crucial. Many tokens collapsed under selling pressure due to insufficient liquidity to support high FDV. Deep liquidity is key to price stability post-airdrop.

A challenging year. Cryptocurrencies faced significant challenges in 2024, with most airdrops being severely impacted. The strategies for a few successful cases included strategic allocation, strong liquidity, and genuine FDV.

Airdrops: A Double-Edged Sword for Token Distribution

Since 2017, airdrops have been a popular strategy for distributing tokens and generating early speculation. However, by 2024, many projects struggled to "take off" due to oversaturation. While airdrops still generate initial excitement, most result in short-term selling pressure, low community retention, and high protocol "death rates." Nonetheless, some outstanding projects have successfully reversed this trend, demonstrating that when executed properly, airdrops can still lead to meaningful long-term success.

This report aims to reveal the 2024 airdrop phenomenon by analyzing 62 airdrops on six chains, comparing their performance in terms of price, user acceptance, and long-term sustainability. While each protocol has its unique variables, the overall data clearly depicts the effectiveness of these airdrops in achieving their intended goals.

Overall Performance

When examining the overall performance of 2024 airdrops, most did not perform well post-launch. While a few tokens achieved impressive early returns, the majority faced downward pressure as the market reevaluated their value. This pattern highlights a broader issue within the airdrop model: many users may only be seeking rewards rather than long-term participation in the protocol.

All airdrops face a critical question: does the protocol have staying power? After the initial reward distribution, will users continue to see value in the platform, or is their participation purely transactional? This analysis, based on data from multiple time periods, reveals a key insight: for most airdropped tokens, the hype typically diminishes rapidly within the first two weeks.

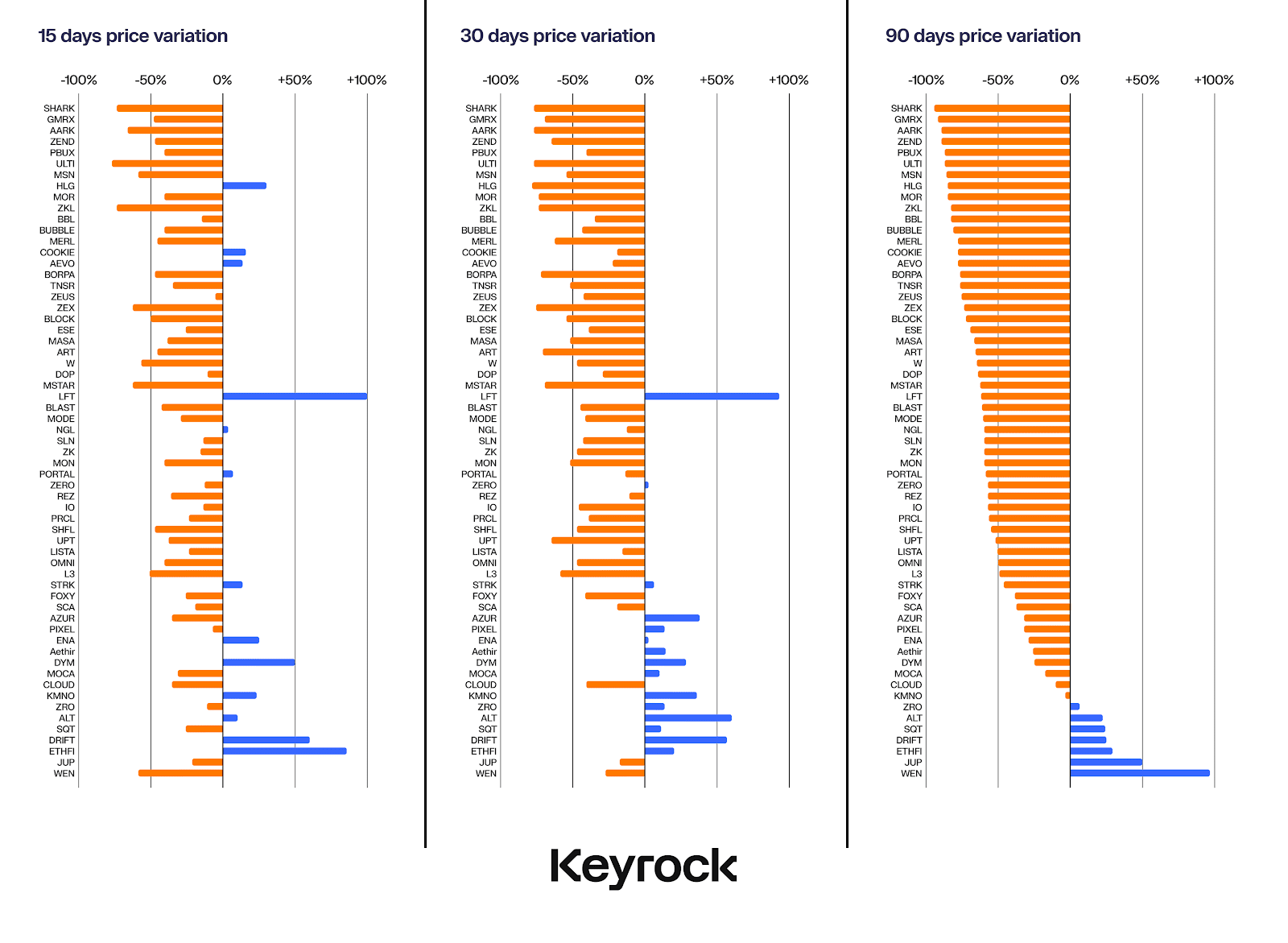

Observing price trends at 15, 30, and 90 days, it is evident that most price movements occur in the initial days following the airdrop. Three months later, few tokens were able to achieve positive results, with only a handful able to reverse this trend. Nevertheless, it is important to consider the broader context: the entire crypto market performed poorly during this period, further complicating the situation.

Chain-Specific Situations

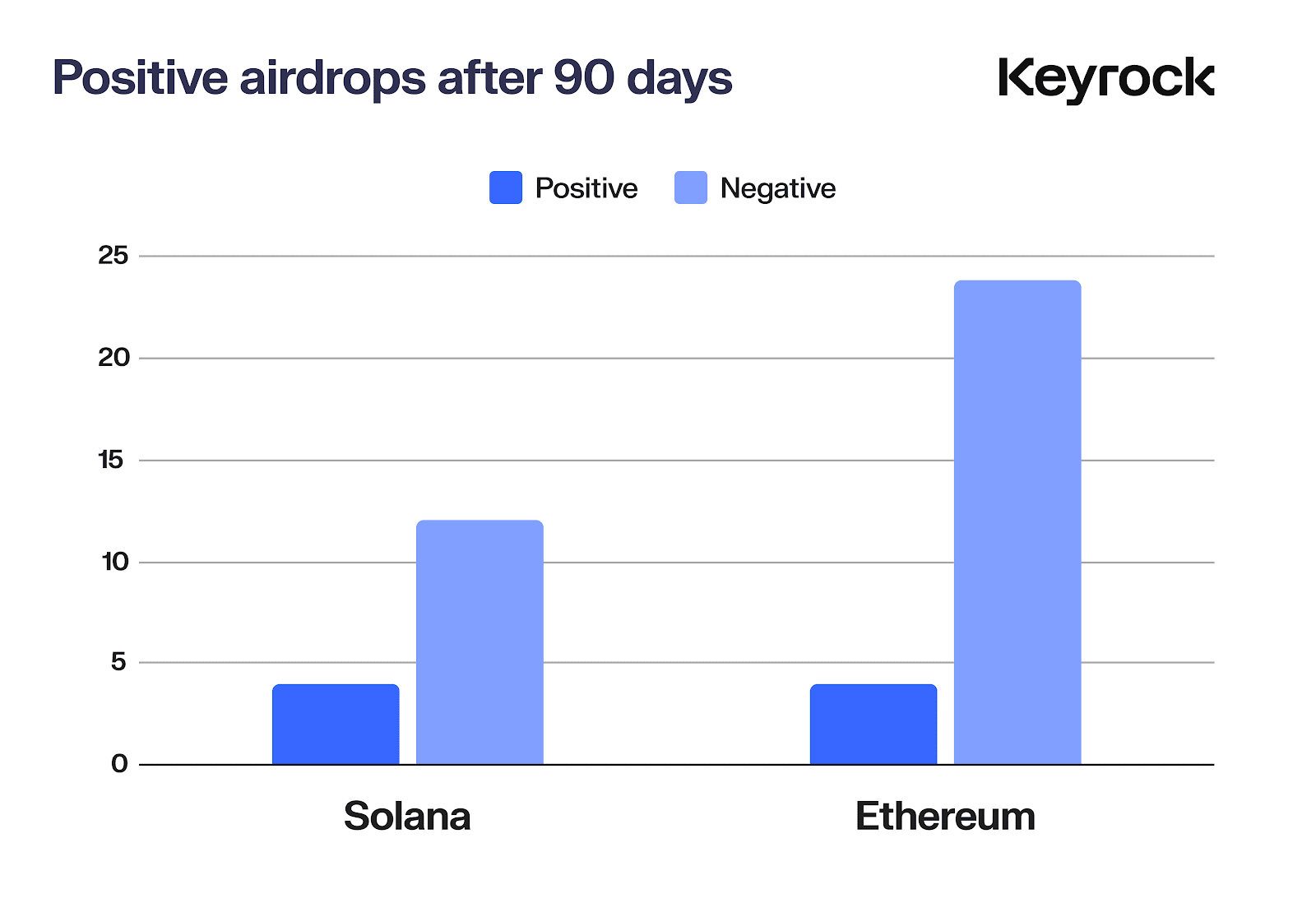

While the overall performance was poor, not all chains fared the same. Among the analyzed 62 airdrops, only 8 achieved positive returns after 90 days: 4 on Ethereum and 4 on Solana, with none on BNB, Starknet, Arbitrum, Merlin, Blast, Mode, and ZkSync. Solana had a positive return rate of 25%, while Ethereum had a positive return rate of 14.8%.

The positive performance of airdrops on the Solana chain is not surprising, as the chain has become a gathering place for retail investors over the past two years and is a true challenger to Ethereum's dominance. Additionally, given that many other chains studied are L2 and directly compete with each other, it is not surprising that only the mother chain maintains some winners.

Although the report does not include Telegram's Ton network, it is worth noting that there have been quite a few successful airdrops as user enthusiasm and adoption of the network have expanded.

Normal Performance

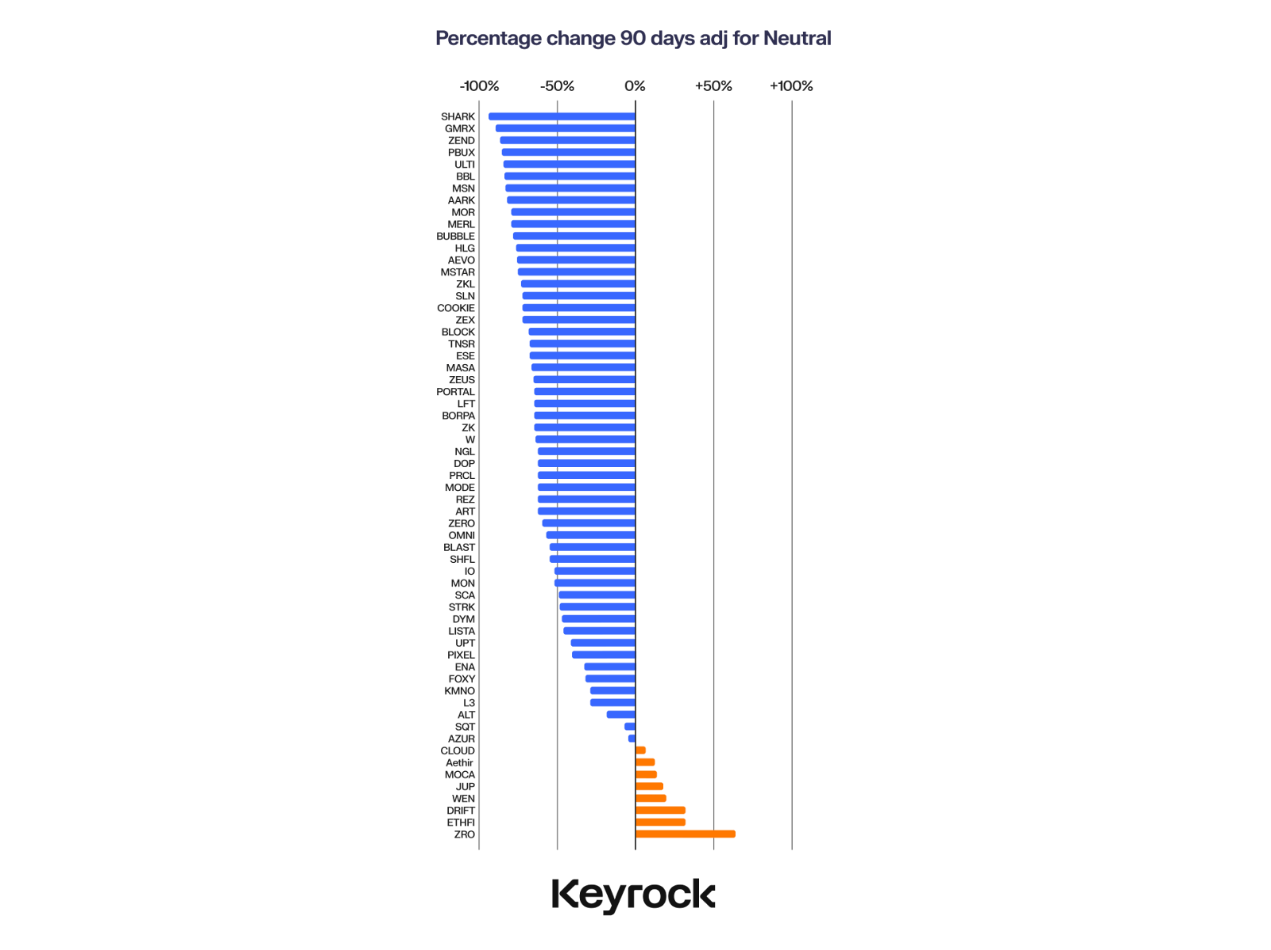

However, what if larger chains were separated from airdrops? Would the data change when considering the fluctuations of the parent tokens? Even when comparing the price movements of these airdrops with the performance of their respective ecosystems, such as comparing airdrops on Polygon with the price movements of MATIC, or airdrops on Solana with the price movements of SOL, the results are still not optimistic.

Despite the market's decline after reaching its peak in 2023, it is still not enough to compensate for the lackluster performance of airdropped tokens compared to native tokens or altcoins. While these sell-offs are associated with a larger narrative, they reflect the market's widespread concerns about short-term prosperity. When assets considered "mature" are declining, the last thing people want is something untested or "new."

Overall, even in the worst-case scenario within 90 days, Solana and ETH only experienced declines of about 15-20%, but this still indicates much greater volatility for these airdrops, which is related to the overall narrative rather than price behavior.

Performance Segmented by Distribution Method

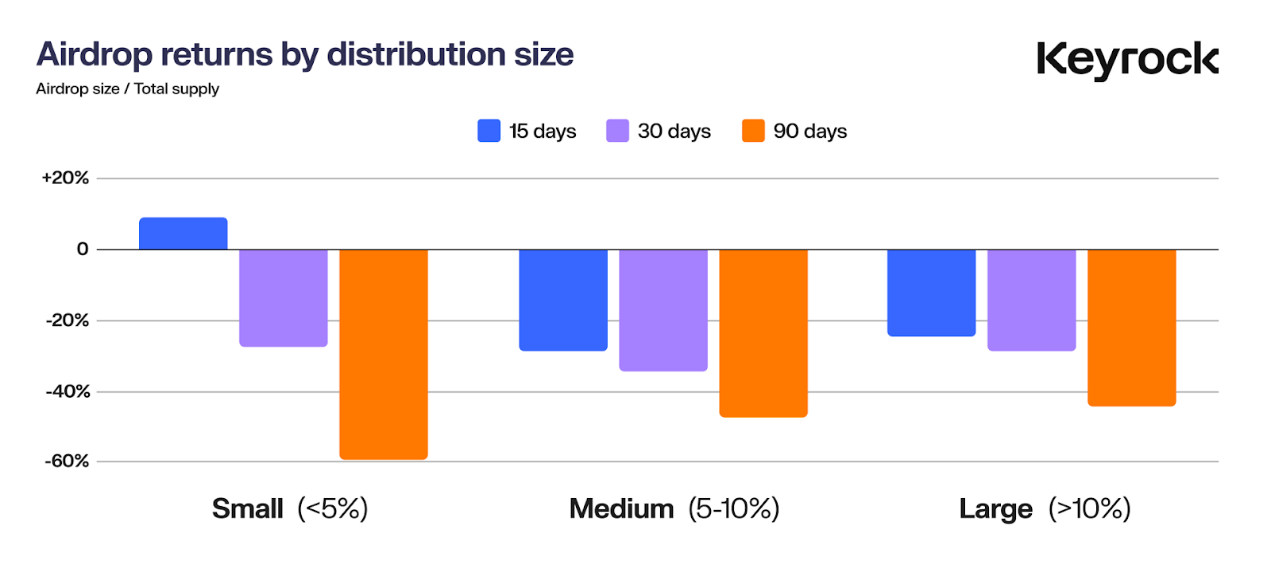

Another key factor influencing airdrop performance is the distribution of the total token supply. The protocol's decision on how many tokens to distribute significantly affects price performance. This raises some key questions: does being generous bring returns? Is being more conservative safer? Does providing more tokens to users lead to better prices, or does it pose risks due to excessive token distribution?

To further analyze this, the airdrops were divided into three categories:

- Small-scale airdrops: 5% of the total supply

- Medium-scale airdrops: > 5% and ≤10%

- Large-scale airdrops: > 10%

Their performance was then observed over three time periods (15 days, 30 days, and 90 days).

In the short term (15 days), small-scale airdrops (5%) often perform well, possibly due to the limited supply resulting in minimal immediate selling pressure. However, this initial success is often short-lived, as tokens from small-scale airdrops experience significant declines within three months. This may be due to various factors: the low supply initially suppresses selling, but over time, shifts in the narrative or insiders starting to sell can lead to imitation by the broader community.

Allocation Dynamics

Effect of Token Allocation

The scale of airdrops directly impacts price performance. Smaller-scale airdrops reduce initial selling pressure but often result in significant sell-offs within a few months. On the other hand, larger allocations do generate more early volatility but lead to stronger long-term performance, indicating that generous allocations increase investor loyalty and inspire support for the token.

Association of Allocation with Market Sentiment

While community sentiment is intangible, it is a key factor for airdrop success. Larger token allocations are often perceived as fairer, fostering a stronger sense of ownership and participation among users. This creates a positive feedback loop: users feel more invested and are less likely to sell, contributing to long-term stability. In contrast, smaller allocations may initially feel safer but often lead to short-lived enthusiasm followed by rapid sell-offs.

While it is challenging to quantify the sentiment or "atmosphere" of all 62 airdrops, it remains a strong indicator of a project's enduring appeal. Signs of strong sentiment include active and engaged communities on platforms like Discord, meaningful discussions on social media, and genuine interest in the product. Additionally, the novelty and innovation of a product often help maintain positive momentum, as they attract more loyal users rather than speculative airdrop hunters.

FDV Effect

An important area of focus is whether the fully diluted valuation (FDV) of tokens at issuance significantly impacts their post-airdrop performance. The calculation of FDV involves multiplying the current token price by the total token supply, including circulating tokens and any locked, vested, or future tokens.

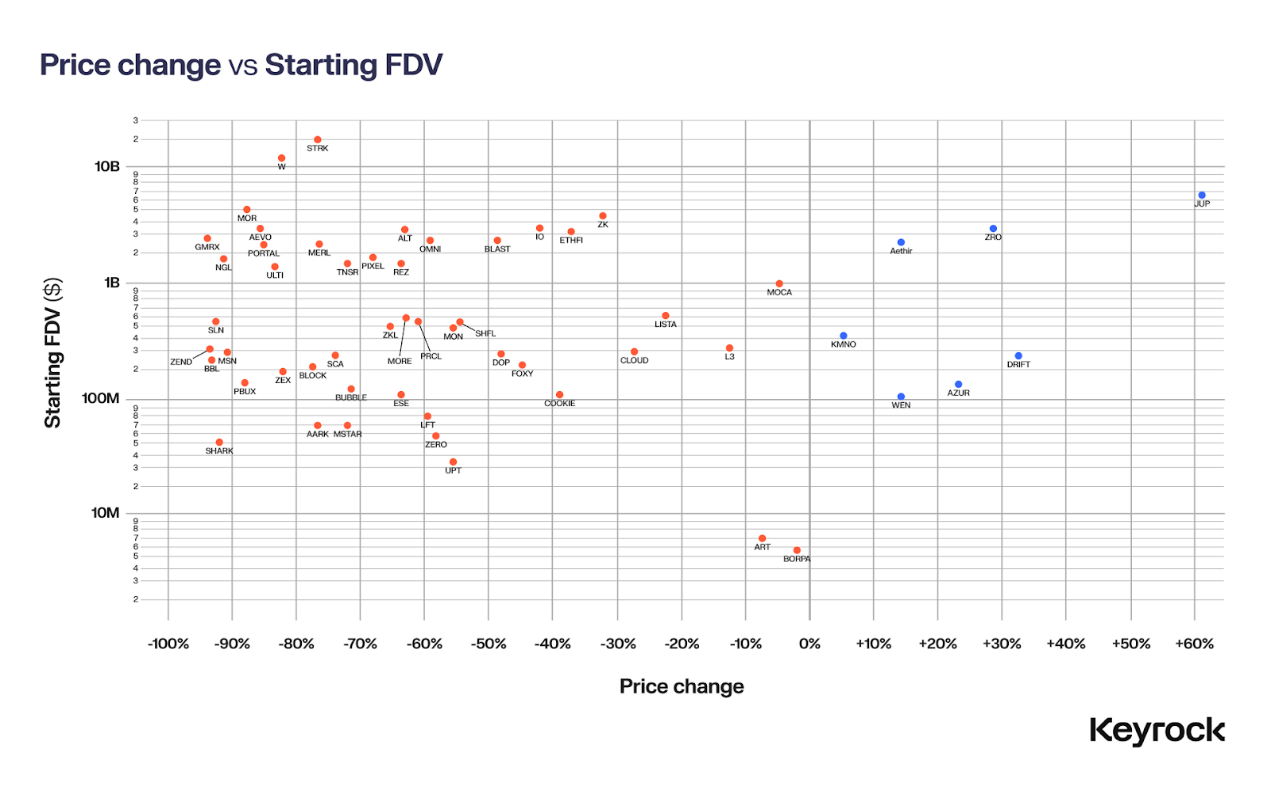

In the crypto space, it is often observed that a project's FDV seems disproportionately high compared to its actual utility or impact at issuance. This raises a key question: are tokens penalized for having an excessively high FDV at issuance, or does the impact of FDV vary by project?

The data in this article covers a wide range of projects, with a 3,000-fold difference between the 62 airdrop samples, from projects with an FDV of only $5.9 million at launch to those with an FDV as high as $19 billion.

When plotting this data, a clear trend emerges: the larger the FDV at launch, the greater the likelihood of significant price declines, regardless of project type, hype level, or community sentiment.

Two main factors are at play. The first is a fundamental market principle: investors are attracted by the perception of upward liquidity. Tokens with lower FDV offer growth potential and the psychological comfort of "early participation," attracting investors with the promise of future returns. On the other hand, projects with excessively high FDV often struggle to maintain momentum, as the expected upside potential is limited.

Economists have long debated the concept of "room to grow" in the market. As Robert Shiller pointed out, when investors feel that returns are limited, the "irrational exuberance" quickly fades. In the crypto space, when a token's FDV indicates limited growth potential, this exuberance also rapidly dissipates.

The second factor is more technical: liquidity. Tokens with larger FDV often lack the liquidity to support these valuations. When a large number of tokens are distributed to the community, even a small percentage of users looking to cash out can create significant selling pressure with no buyers on the other side.

Taking JUP as an example, it was launched with an FDV of $6.9 billion, supported by a series of liquidity pools and market makers, estimated at $22 million on the day of issuance. This makes JUP's liquidity-to-cash flow ratio only 0.03%. While this is lower compared to WEN (2%), it is relatively higher compared to other tokens in the same category.

When compared to Wormhole, which had an FDV of $13 billion, to achieve the same 0.03% liquidity ratio, Wormhole would need liquidity of $39 million. However, even including all available liquidity pools (official, unofficial, and Cex Liquidity), the best estimate is only close to $6 million. With 17% of tokens allocated to users, the unsustainable market value seems to have been set. Since its launch, token W has declined by 83%.

If there is not enough liquidity, prices are highly sensitive to selling pressure. The psychological demand for growth potential and the actual liquidity required to support large FDV explain why tokens with higher FDV struggle to maintain their value.

The data confirms this. Tokens with lower FDV experience far fewer price hits than those launched with excessively high valuations, with the latter suffering the most significant losses in the months following the airdrop.

Case Studies

DRIFT

The decentralized futures trading platform Drift has been operating on Solana for nearly three years. Drift's journey has been filled with victories and challenges, including surviving multiple hacks and exploits. However, every setback has forged a stronger protocol, evolving into a platform that has proven its value far beyond airdrop farming.

When Drift's airdrop finally arrived, it was warmly welcomed, especially by its long-term user base. The team strategically allocated 12% of the total token supply for the airdrop, a relatively high proportion, and introduced a clever reward system that initiated every six hours after the initial distribution.

Drift's market value was only $56 million, which surprised many, especially when compared to other vAMMs (virtual automated market makers) with fewer users and a shorter history but higher valuations. The true potential of Drift quickly became evident, with a market value reaching $163 million, a 2.9x increase post-launch.

The key to Drift's success lies in fair and thoughtful distribution. By rewarding long-term loyal users, Drift effectively filtered out Sybil attacks, cultivated a more genuine community, and avoided the detrimental factors that sometimes plague such events.

What Sets Drift Apart?

Long history and solid foundation

- Drift's long history allows it to reward its existing loyal user base.

- With a high-quality, verified product, the team can easily identify and reward genuine power users.

Generous phased allocation

- Allocating 12% of the total supply (a significant proportion for an airdrop) demonstrates Drift's commitment to the community.

- The phased release structure helps minimize selling pressure and maintain value stability post-launch.

- Most importantly, the airdrop is designed to reward actual usage, not just inflate metrics for yield farmers.

Realistic valuation

- Drift's conservative launch valuation avoids the trap of excessive speculation, maintaining expected rationality.

- Sufficient liquidity was embedded in the initial liquidity pool, ensuring smooth market operations.

- The lower FDV not only sets Drift apart but also triggers broader discussions around overvalued competitors.

ZEND

ZkLend (ZEND) is currently facing a severe downturn, with its value plummeting by 95%, and daily trading volume struggling to exceed $400,000. This is a stark contrast for a project that once had a market value of $300 million. In addition to this unusual situation, ZkLend's TVL is now more than twice its FDV. This is uncommon in the crypto world and not a positive sign.

So, how did a project that shone brightly under the hype of Starknet (aimed at expanding Ethereum's zk-rollup solution) end up in such a precarious situation?

Riding the Wave of Starknet, but Missing the Boat

ZkLend's concept was not particularly groundbreaking, aiming to be a lending platform for various assets, benefiting from the Starknet narrative. The protocol leveraged the momentum of Starknet to position itself as a key participant in the cross-chain liquidity ecosystem.

- Creating farming networks where users could earn rewards across different protocols

- Attracting liquidity and users through rewards and cross-chain activities

However, in execution, the platform attracted "profit-driven" users who were only focused on short-term rewards and made no commitment to the protocol's long-term health. ZkLend failed to cultivate a sustainable ecosystem and found itself at the mercy of reward hunters, resulting in brief participation and low retention rates.

Backfiring Airdrop

ZkLend's airdrop strategy exacerbated its issues. Due to a lack of significant product or brand awareness before the airdrop, the token allocation attracted speculators rather than genuine users. This critical mistake led to:

- A large number of airdrop hunters eager to quickly cash out.

- Participants lacking loyalty or genuine engagement, with no long-term commitment.

- Token value rapidly declining as speculators immediately sold off the tokens.

The airdrop not only failed to garner attention and foster loyalty but instead created a brief speculative frenzy that quickly dissipated.

ZkLend's case serves as a warning: while hype and airdrops can attract users, they alone cannot create value, utility, or a sustainable community.

Key Lessons:

- Hype alone is not enough: building real value requires more than just hype around popular narratives.

- Airdrops without vetted users can trigger speculation and disrupt value.

- Overvaluing a new product carries significant risks, especially in the absence of validated use cases.

Conclusion

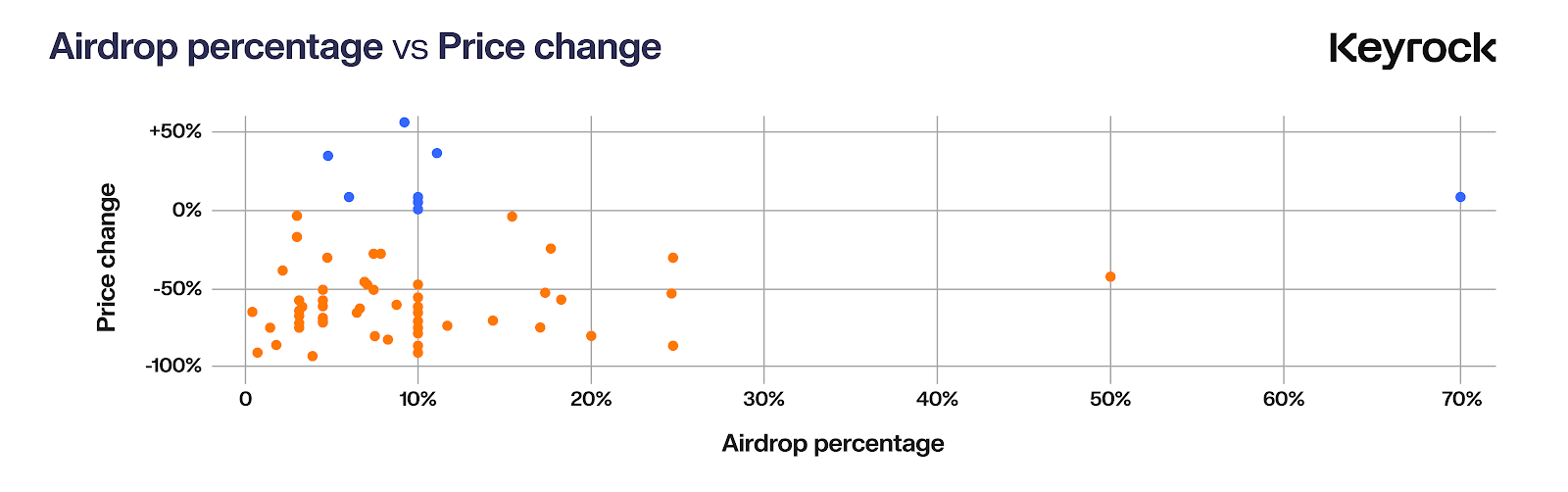

If the goal is to maximize returns, selling on the first day is often the best choice, as 85% of airdropped tokens experience significant price declines within a few months. Solana's performance in airdrops in 2024 was outstanding, but overall performance was not as bad when adjusted based on market conditions. Projects like WEN and JUP became successful airdrop cases, demonstrating that strategic approaches can still yield substantial returns.

Contrary to popular belief, larger-scale airdrops do not always lead to sell-offs. 70% of tokens with a 70% airdrop allocation achieved positive returns, highlighting the greater importance of FDV management. High FDV is a serious mistake that limits growth potential. More importantly, it creates liquidity issues: inflated FDV requires significant liquidity to sustain, which is often unattainable. Without sufficient liquidity, airdropped tokens are prone to significant price declines, as there is not enough capital to absorb the selling pressure. Projects launched with realistic FDV and a reliable liquidity provision plan can better handle post-airdrop fluctuations.

Liquidity is crucial. High FDV puts immense pressure on liquidity. Inadequate liquidity leads to large-scale sell-offs that depress prices, especially in airdrops, as recipients quickly sell off. By maintaining controlled FDV and focusing on liquidity, projects can create better stability and long-term growth potential.

Ultimately, the success of an airdrop depends not only on the allocation size but also on FDV, liquidity, community engagement, and narrative. Projects like WEN and JUP struck the right balance, establishing enduring value, while other projects with excessively high FDV and shallow liquidity failed to sustain their momentum.

In a rapidly changing market, many investors make quick decisions. Selling on the first day is often the safest choice, but for those focused on long-term fundamentals, there are always some "gems" worth holding.

Related Read: Airdrop Projects Not to Miss in Q4 2024

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。