Original: "Understanding Minimum Blob Base Fees"

Original Author: Data Always - Flashbots Research

Compiled by: Odaily Planet Daily

Flashbots Researcher Data Always published an article, demonstrating whether raising the minimum base fee of Blob would affect the cost of existing L2 or related transactions in the ecosystem. The article summary is as follows:

The setting of the Blobspace base price has sparked community controversy, partly due to misunderstandings of how Blob finds its path on-chain. Although it is currently believed that Blob contributes nothing to the protocol, this view is only valid when analyzing Blobspace fees.

Transactions carried by Blob still need to pay the mainnet Gas fee, and during periods of high demand, the impact of Gas priority auctions makes L2 transaction pricing more complex.

This article demonstrates whether raising the minimum base fee of Blob can alleviate the mismatch between price and demand.

Overall, this adjustment has a limited impact on transaction costs, especially for efficient Blob submitters, the fee increase is minimal.

The following is the original article compiled by Odaily Planet Daily

The proposal to set the minimum blobspace base price has sparked controversy in the community, but this may be due to a misunderstanding of how Blob finds its path on-chain. It is generally believed that Blob currently contributes nothing to the protocol, but this is only valid when we limit our analysis to blobspace fees.

Although the blobspace fee market has made slow progress in reaching the target demand level, it has encountered the cold start problem predicted by Davide Crapis a year before Deneb. However, transactions carried by Blob still pay the mainnet Gas fee, whether for execution or priority execution. The current concern raised by Max Resnick is that the hard limit of six blocks per blob, combined with the slow response of the blobspace fee market, may lead to long-term priority gas auctions during periods of high network demand. During these PGA periods, L2 transaction pricing becomes more difficult, and strict blob memory pool rules also make blob inclusion unpredictable.

EIP-77628 aims to minimize the mismatch between future blobspace prices and Blob demand until L2 adoption overcomes the cold start problem. The current configuration sets the minimum Blobspace base fee at 1 wei, requiring at least 30 minutes of fully saturated blocks for the blobspace fee to reach $0.01 per Blob and begin to affect Blob pricing dynamics. Under the current system, when demand surges, the network reverts to unpredictable PGA as L2 competes for timely inclusion.

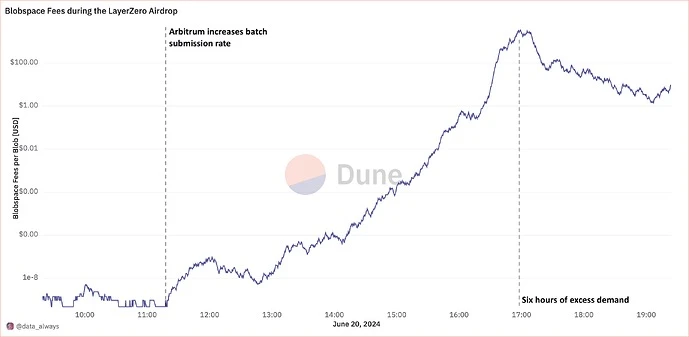

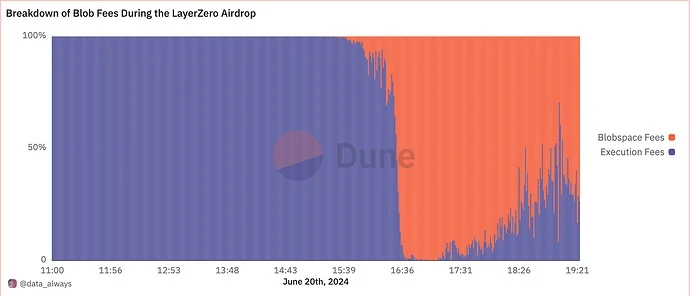

For example, on June 20th, the network experienced the second blob contention event, stemming from the LayerZero airdrop. During this period, the excess demand for blobs lasted for six hours until the network reached equilibrium.

Current Status of Blob Transaction Fees

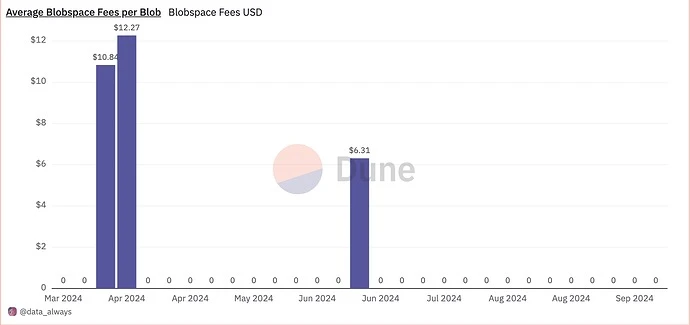

Six months after Deneb went live, the utilization of blobspace remains below target. Therefore, the blobspace base fee remains low, and most of the blobspace gas fees generated by Blobs can be ignored. To date, the average cost of blobspace has only risen to over $0.01 per blob for three weeks, during the "blobscription" frenzy on March 25th and April 1st, and during the LayerZero airdrop on June 17th.

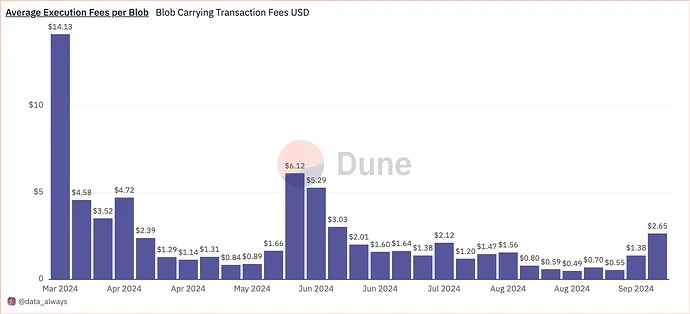

The cost of carrying out Blob-hosted transactions (also known as Type-3) still requires payment of gas fees to execute on the mainnet, compared to the fees in blobspace. Despite gas prices dropping to their lowest in years, the average execution cost per blob ranges from $0.50 to $3.00. These costs are negligible compared to the historical call data pricing of L2 releases, and blobs are essentially fully subsidized by the network. However, these small fees are still important when setting the minimum base fee for blobs.

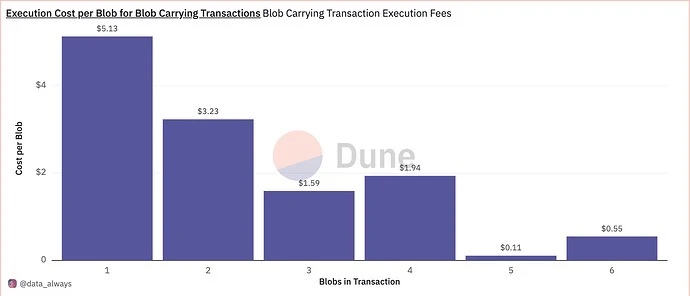

Further analysis of the execution costs of transactions carrying blobs, based on their blob content, reveals a highly heterogeneous market. Transactions carrying only one blob pay the highest fees, while transactions carrying 5 or 6 blobs pay very little or no fees per blob. In fact, the total fees paid by these five or six transactions are much lower.

Differences in blob submission strategies by different entities are one of the important reasons for this situation. Base, OP Mainnet, Blast, and many smaller L2s are highly efficient financially by publishing data to EOA, requiring only 21,000 mainnet gas for the transaction, regardless of the number of blobs, but these transactions are not suitable for fraud proofs. These chains account for the vast majority of transactions carrying five or more blobs, reducing the perceived price of submitting multiple blobs in a single transaction. In contrast, L2s that publish more complex data to better support fraud proofs, such as Arbitrum, StarkNet, Scroll, ZkSync Era, Taiko, and Linea, use significantly more mainnet gas, usually submitting only one blob per transaction.

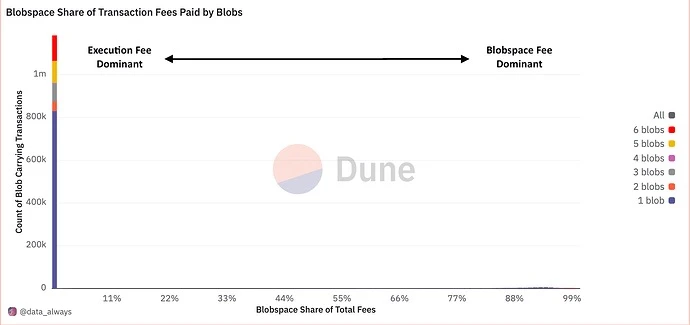

Based on the above statistical data, when we combine the blobspace and execution fees for each transaction, we find that, except for the short-term surge in Blob demand (which would not be affected by an increase in the minimum base fee), the current distribution of blobspace payments is almost entirely concentrated in execution fees. This indicates that the blobspace fee market is currently not functioning properly, and there is significant room to increase the minimum blob gas fee without significantly increasing the total cost paid by Blobs.

In contrast, if we focus on the period when the blobspace fee market enters the price discovery phase, the fee density quickly shifts towards blobspace fees. It seems to work well when the market is in operation. Therefore, the most important issue is the recurring cold start problem—the dilemma the market currently faces.

When the blobspace fee market is dominated by execution fees, blob submitters who publish less execution data (mainly on OP Stack chains) benefit. It also complicates the block building process: historically, many algorithms have determined Blob inclusion based on the priority fee for each gas, but due to the significant differences in mainnet gas usage for these transactions, it forces L2s that submit higher quality proofs to pay higher rates for all or most of the gas. Larger transactions further amplify the advantage of submitting less execution data. By approaching an environment dominated by blobspace fees, we weaken this advantage.

Impact of the Minimum Fee

Based on the current price of ETH, Max's original proposal sets the minimum fee for each blob at $0.05. By supplementing the execution cost with this new minimum fee, the proposal would increase the average cost per blob by 2%.

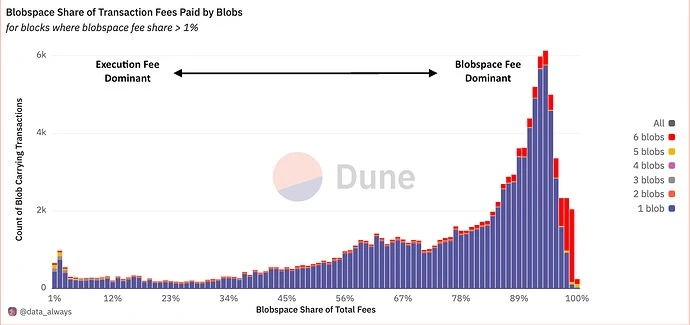

The revised proposal lowers the minimum blob base fee to 2^25, about one-fifth of the original proposal, i.e., $0.01 per blob. Starting from early July, this means an average cost increase of 0.7% per blob, but due to the financial efficiency differences among blob submitters, the percentage change is not uniform across different entities.

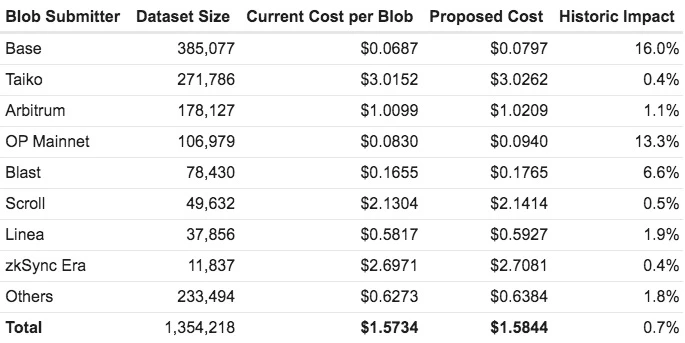

Analyzing the previous transaction breakdown to consider the minimum blobspace base fee of 2^25 wei, and only considering transactions where the original blobspace base fee is lower than the proposed new minimum fee, we see that while the fee structure is significantly changing, the blob base fee still remains a small component of all affected Blob-hosted transactions. Efficient transactions submitted by Base and OP Mainnet (carrying five blobs) will see a 10% to 30% fee increase based on L1 gas prices, which should be easily absorbed. Less efficient transactions, especially those carrying one to three blobs, will see a fee increase of less than 10%.

Table: Blob submission statistics divided by entity from July 1, 2024, to September 17, 2024, assuming an ETH price of $2,500.

Analyzing the previous transaction breakdown to consider the minimum blobspace base fee of 2^25 wei, and only considering transactions where the original blobspace base fee is lower than the proposed new minimum fee, we see that while the fee structure is significantly changing, the blob base fee still remains a small component of all affected Blob-hosted transactions. Efficient transactions submitted by Base and OP Mainnet (carrying five blobs) will see a 10% to 30% fee increase based on L1 gas prices, which should be easily absorbed. Less efficient transactions, especially those carrying one to three blobs, will see a fee increase of less than 10%.

So far, the 2^25 minimum blob base fee has not accounted for the majority of the costs paid in Blob-hosted transactions.

Blobspace Response Time

Under EIP-4844, the maximum inter-block update of blobspace base fee is set at 12.5%. Starting from 1 wei, it would take 148 maximum capacity blocks, over 29 minutes (12-second block time), for the base fee to rise above 2^25 wei. This update cycle has been defined as the protocol's response time, but it still only represents the shortest amount of time. Due to market inefficiency, blocks are not fully loaded with blobs, significantly extending the time for price discovery.

Before the LayerZero airdrop on June 20th, the blob base fee was at its minimum of 1 wei. During peak times, the blob base fee reached 7471 gwei (equivalent to $3,450 per blob). Although theoretically it could reach this height in 51 minutes, the actual increase took nearly six hours. Under Max's proposal, this theoretical peak could be reached in 21 minutes, but clearly these theoretical values are not accurate.

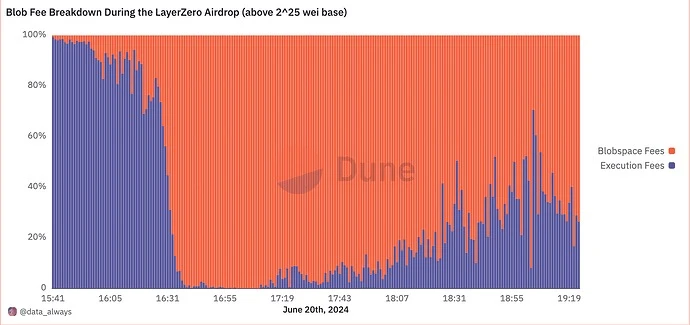

The goal of the proposal is to set the minimum blob base fee close to the inflection point where blobspace fees begin to occupy a measurable share of the total fees, rather than focusing solely on time. On June 20th, despite the surge in Blob count after 11:00 UTC, it wasn't until 15:17 UTC that blobspace fees began to account for 0.1% of the total fees paid by Blobs, and it wasn't until 15:41 UTC that it exceeded the base fee of 2^25 wei (0.0335 gwei).

In contrast, if the minimum base fee during the LayerZero airdrop period were 2^25 wei, the network might skip the cold start problem and minimize the misalignment between price and demand. As shown in the following figure, we can predict that the blob market will still need an hour or longer to normalize.

In conclusion, raising the minimum blobspace base fee is not a panacea, but it should be seen as a welcome change to the protocol. The market impact of the proposal should be minimal, with only the cheapest and lowest quality blob prices exceeding a 1% increase, and still significantly lower than their competitors' prices.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。