Original | Odaily Planet Daily ( @OdailyChina )_

Author | Nan Zhi ( @Assassin_Malvo )_

On September 24th, the AI-driven DID project Aspecta launched the Launch platform Build Key. The platform introduces the Bonding Curve model in the issuance of various assets, essentially a relatively novel pre-market. Odaily will interpret this Launch platform.

(Odaily note: Bonding Curve is often translated as "联合曲线," more accurately it can be translated as a price change function, referring to the change in the price of assets during the sales process.)

Build Key Analysis

In the current market, the most familiar platform for the public to issue assets using the Bonding Curve is Pump.fun and its imitations. The trading process and model of Build Key are similar to those of Pump.fun, but it restricts the issuance of assets to "project parties" only.

The project party first needs to undergo whitelist verification through Aspecta's DID system before issuing Key assets, and attach various future redeemable project resources to the Key, including airdrops, tokens, points, NFTs, and other forms.

It is worth noting that the redeemable resources of Key are not only related to quantity, but can also include a time factor, aiming to further encourage early supporters to participate.

For traders, buying Key is a quick way to obtain project resources early, and the Bonding Curve model further incentivizes early participation. Compared to the order book model of the pre-market, AMM models like Bonding Curve can more quickly achieve market pricing and self-balancing for airdrop resources.

Taking GAIB, the first batch of projects officially cooperating with the platform, as an example, its Key started at 0.000175 BNB, quickly rose after opening, and eventually stabilized at around 0.014 - 0.016 BNB, with a maximum increase of 85 times. As for the airdrop rules, users holding GAIB's Key will be allocated 0.01% of the total token amount, with the fraction calculated based on the quantity of Key and the holding time.

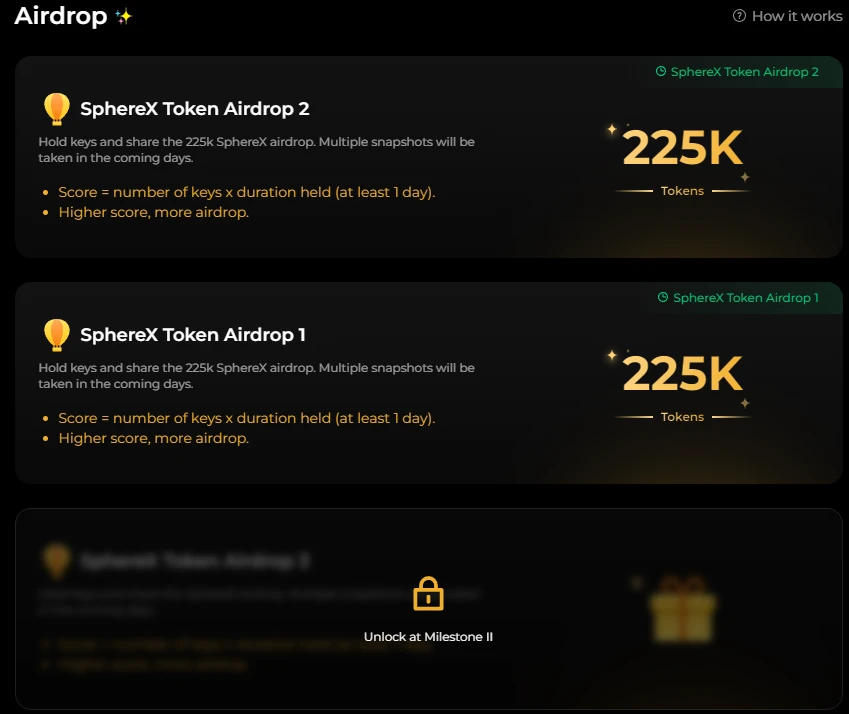

Another project, SphereX, also adopted the same scoring algorithm, but changed the corresponding assets to two rounds of 225,000 tokens. Users can make a relatively objective evaluation based on this price, token market value, and the value of the project itself.

Fees and Discounts

For traders, the cost of each Key transaction is relatively high, at 5% of the transaction amount, with 2% for the project party, 2% for Aspecta, and 1% for the incentive plan. Therefore, it is recommended that traders calculate and confirm the reasonable value before making a purchase and hold it for the long term.

According to the official documentation, the incentive plan takes various forms, including:

Referral rewards: Users can promote using referral links, and the promoter will receive 10% of the transaction fee of the referred party, paid in BNB, while the referred party's transaction fee will be reduced by 10% in the first 7 days.

Points: Holding and trading Key, as well as referring friends, will earn points, and the official statement indicates that points will be related to "future earnings" or may be airdropped with project tokens.

Pre-Launch participants will receive a 20% fee discount within 7 days of the official launch (ended).

Funding Situation

In March 2024, Aspecta became one of the 13 early projects selected for the MVB VII accelerator program.

In March 2023, AI-driven, developer-focused digital identity ecosystem Aspecta announced the completion of a $3.5 million seed round of financing.

Aspecta's seed round of financing consisted of two phases, A and B. Phase A was completed in April 2022, with participation from institutions such as ZhenFund, YC China, UpHonest Capital, and Yale Alumni Fund. Phase B was completed in November 2022, with participation from institutions such as HashKey Capital, Foresight Ventures, SNZ Holding, and Infinity Ventures Crypto, raising a total of $3.5 million.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。