Author: Nan Zhi, Odaily

Since August, Binance has frequently launched "old coins" contracts that are only available for spot trading, with an interval of about two days between each launch. Each time a contract is launched, there is usually a surge in the token's spot price. However, this "track" has now been targeted by various news arbitrage robots, and the surge often occurs before ordinary users receive the news.

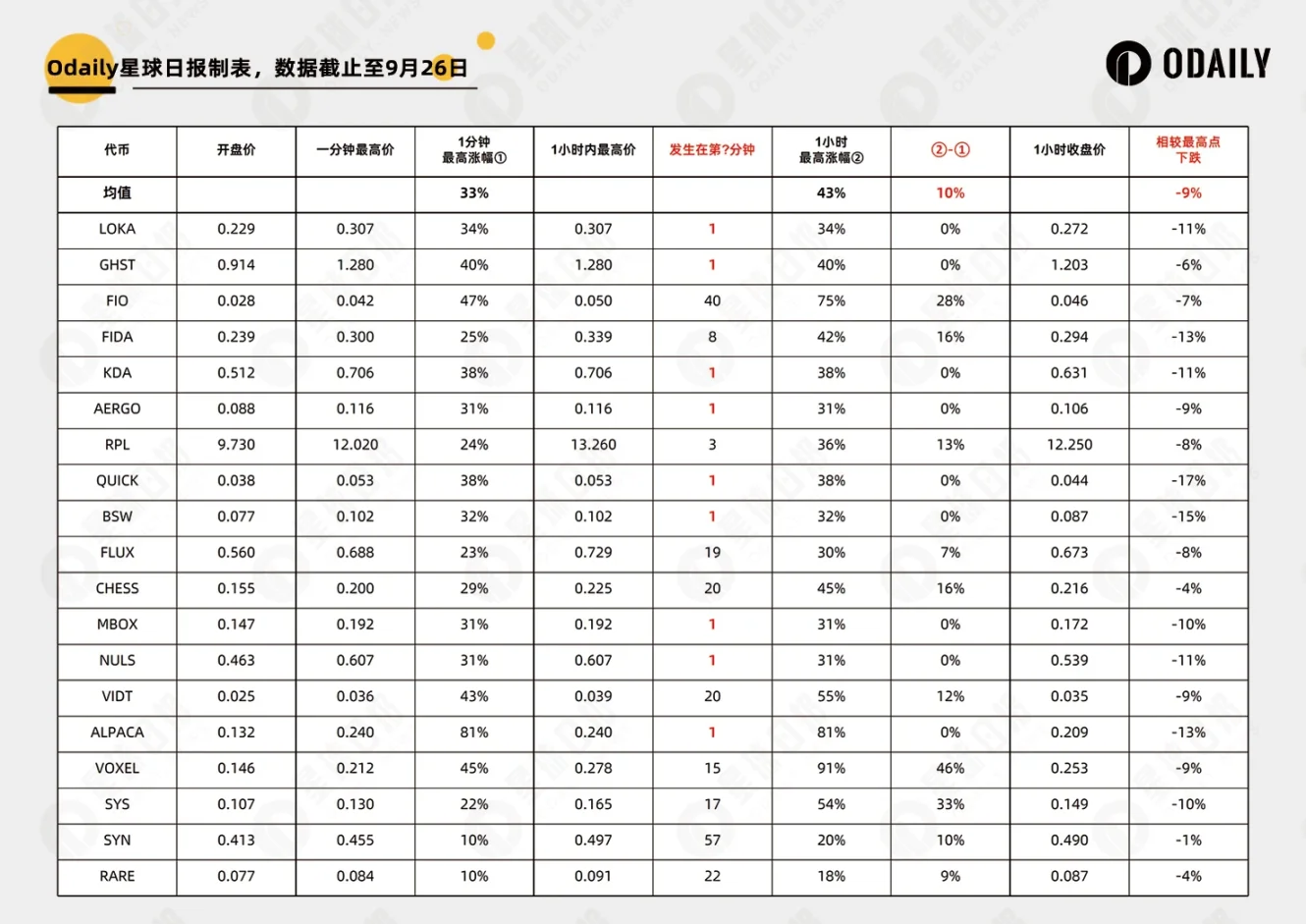

In response to this, Odaily has reviewed the market trends of 19 "old coins" since the launch on August 15, aiming to explore whether there are patterns for short-term and medium-term trading, and whether there are strategies suitable for ordinary users to participate in.

Let's start with the conclusions

After the announcement of the "old coins" contracts, the first minute is usually the highest point within 24 hours;

- Regardless of short-term or long-term trading, the profit-loss ratio for manual trading users is not ideal;

- After the contract is launched, holding long positions yields higher returns compared to short-term speculation.

How to trade in the ultra-short term?

In this section, Odaily has compiled the price data for each token for every minute, totaling 60 minutes (1 hour) for each token. The complete data is shown in the table below:

Data summary: The launch of contract announcements has a significant price-promoting effect, with an average surge of 33% in 1 minute; the average surge from the lowest to the highest point within 1 hour is 43%; the closing price after 1 hour drops back to the highest point within 1 minute.

Is it suitable for ordinary users to manually buy after seeing the news? The answer is currently no longer suitable. In the sixth column of the table, we have compiled data on which minute the highest point occurred within 1 hour after the contract was launched. Except for a few early tokens, it can be seen that the "highest point immediately after launch" situation is becoming more prominent, and various news arbitrage robots end the battle within 1 minute.

What about the profit-loss ratio in the short term? Naively calculated, the eighth column in the table, "②-①," can be considered as the average increase for retail investors after seeing the news, while the last column is the expected value of losses, resulting in a profit-loss ratio of only 1.11 (10 ÷ 9).

In conclusion, it is not recommended for manual trading users to immediately chase after long positions. Currently, it is more inclined to short after the surge in 1 minute (confirmation from other small exchanges with contracts is required).

Continuation of the upward trend in the medium term or shorting after the contract is launched?

Furthermore, we have compiled the price data for each token every 15 minutes, totaling 96 intervals of 15 minutes (1 day) for each token. The complete data is shown in the table below:

Data summary: The highest surge within 1 hour is consistent with the previous section, with an average of 43%; the 24-hour highest surge further increases, with an average rise to 55%, but mainly contributed by early tokens such as ALPACA, SYS, SYNC; the decline from the highest point has also expanded, with an average drop of 15%.

Is there a continuation of the upward trend in the medium term? The answer is that this effect is no longer present. Early tokens like ALPACA, after a short-term FOMO, can still continue to rise, but this effect is becoming less obvious for recent tokens. In this table, we also calculated which hour the highest point occurred within 24 hours. For recent tokens, the "highest point immediately after launch" situation is also prominent, with the surge occurring in the first minute of the first hour.

What about the profit-loss ratio in the medium term? Following the algorithm from the previous section, the profit-loss ratio for the medium term further decreases to 0.73 (11 ÷ 15), and it is clearly not suitable for long positions.

So, is shorting viable? We have listed the performance after the contract is launched in the last two columns of this table. It can be seen that the profit potential for short-term contracts is weak, but when extended to 24 hours, the decline significantly increases, making it more suitable for medium-term shorting.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。