Against the backdrop of global monetary easing, the daily net inflow of BTC ETF exceeded 100 million US dollars for the second consecutive day.

Authors: Shaurya Malwa, Sam Reynolds

Translation: Koala, Mars Finance

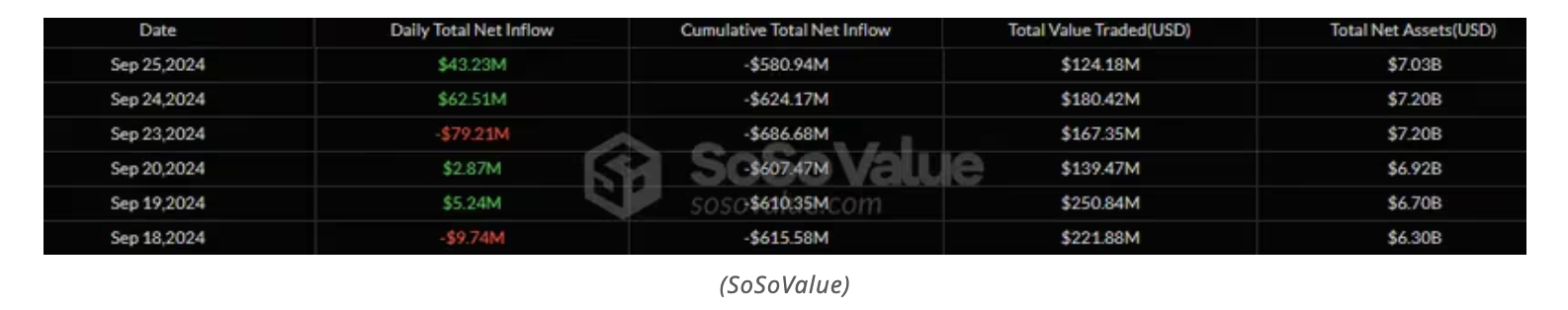

Data from SoSoValue shows that against the backdrop of global monetary easing, the daily net inflow of BTC ETF exceeded 100 million US dollars for the second consecutive day. In addition, as World ID expands to more countries, Worldcoin has seen a double-digit increase.

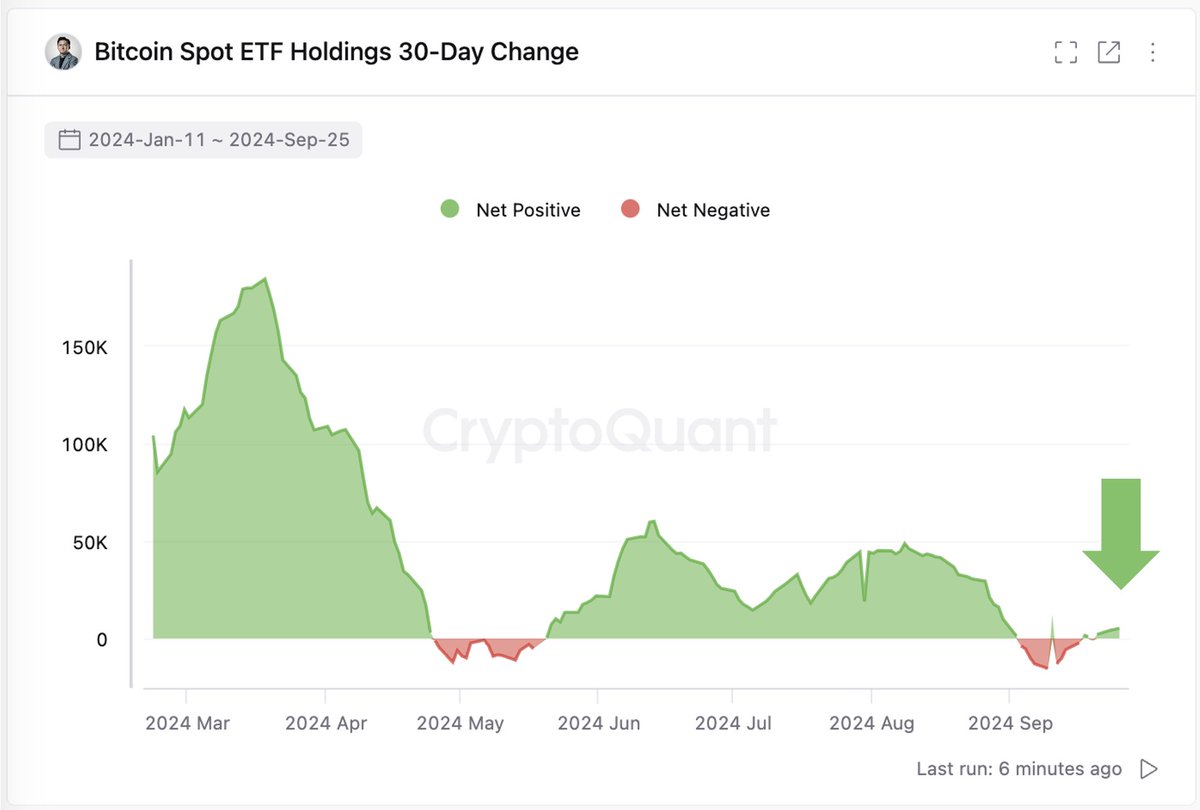

The Bitcoin trading price broke through $63,000, experiencing a slight intraday decline but an overall increase for the week. The significant positive net inflow of BTC ETF indicates an accumulation trend.

It is reported that following the decision by the People's Bank of China to lower the reserve requirement ratio for deposits and reduce the repurchase rate, China is considering injecting a massive capital of 1 trillion yuan into its major state-owned banks to boost the economy.

The Ethereum trading price broke through $2,500, with an increase for the week despite a slight intraday decline, and its ETF also experienced net inflows. Meanwhile, following the expansion announcement and developments by OpenAI, the WLD token of WorldCoin surged by 14%.

During the first half of the Asian trading session on Thursday, the Bitcoin (BTC) trading price surpassed $63,000, dropping by 1.4% but rising by 2% on a weekly basis, as the inflow of Bitcoin exchange-traded funds (ETFs) remained positive.

Reports suggest that China is considering injecting up to 1 trillion yuan (142 billion US dollars) of capital into its largest state-owned banks to enhance their ability to support the struggling economy, leading to a surge in Asian stock markets.

Earlier this week, the People's Bank of China (PBOC) made a loosening decision, reducing the reserve requirement ratio for mainland banks by 50 basis points (bps) and lowering the seven-day reverse repurchase rate (the rate at which the central bank borrows funds from commercial banks) by 20 basis points to 1.5%.

Data from SoSoValue shows that the daily net inflow of BTC ETF exceeded 100 million US dollars for the second consecutive day. This marks the fifth consecutive day of net inflows for the fund.

CryptoQuant's data shows that the indicator tracking the 30-day net position of ETFs in September turned positive for the first time, indicating an increasing trend of accumulation rather than selling.

Meanwhile, the Ethereum (ETH) trading price surpassed $2,500, dropping by 1.3% on the day but rising by 8% for the week. Data shows that the spot ETH ETF achieved a daily net inflow of 43 million US dollars for the second consecutive day.

In a recent report, Presto Research wrote that driven by the increase in network transaction volume, Ethereum gas fees have risen. Meanwhile, following the 50 basis point rate cut by the Federal Reserve, ETH has outperformed BTC.

Presto Write stated that although on-chain yields are still lower than three-month Treasury bills, some investors are preparing for a potential recovery in total locked value (TVL). However, a more widespread capital migration may not occur until 2025.

WorldCoin's WLD, supported by Sam Altman, rose by 14% in the past 24 hours, becoming one of the few winners in the broader cryptocurrency market. The company announced on Wednesday that it has begun offering verification services in Poland, Malaysia, and Guatemala over the past week, attracting more users and improving the fundamentals of the project.

This increase comes at a time when there have been executive changes at another company under Altman, OpenAI, and the company's transition from a non-profit organization to a for-profit benefit corporation. The WLD token has historically tended to develop on OpenAI, as cryptocurrency traders may perceive a close relationship between the two.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。