The regulatory crisis of TUSD is still pending approval of the settlement agreement, but its market confidence has been challenged.

By Nancy, PANews

On September 25th, the U.S. SEC announced on its official website that it had filed charges against TrueCoin LLC and TrustToken Inc., alleging that TrueUSD (TUSD) was involved in fraudulent and unregistered investment contract sales.

Faced with the regulatory crackdown by the SEC, the former stablecoin TUSD operator TrustToken and TrueCoin did not respond directly, but quickly agreed to pay fines to resolve the crisis. At the same time, SEC documents revealed the existence of redemption difficulties for TUSD, and on-chain data indicated that TUSD was highly controlled. Whether the regulatory crisis of TUSD can be safely resolved still awaits the approval of the settlement agreement, but its market confidence has been challenged.

More than 99% of the assets are held by First Digital, and Sun Yuchen's team holds more than 80%

According to the complaint filed by the SEC with the U.S. Northern District Court of California, TrueCoin is the issuer of TUSD, and TrustToken is the developer and operator of TrueFi. TrueCoin and TrustToken conducted unregistered investment contract sales from November 2020 to April 2023, and promoted the profit opportunities of TUSD and its operated lending protocol TrueFi to guide investors' expectations. For example, according to an article released by TrueFi in 2021, the annualized lending yield (APY) of TUSD at that time was approximately 21.37%. By the end of 2021, over 78 million TUSD (about 6% of the circulating supply at that time) had been borrowed on the TrueFi protocol.

The documents also pointed out that TrueCoin and TrustToken made false statements about the asset reserves. Despite these companies claiming that TUSD was pegged 1:1 to the U.S. dollar, a "considerable portion" of TUSD's supporting assets were invested in a speculative and high-risk offshore investment fund to obtain additional returns. For example, by March 2022, TUSD reserves worth $565 million were invested in the fund, accounting for approximately 37% of the circulating supply of TUSD.

The documents revealed that this transfer activity was particularly evident from the end of 2020 to the middle of 2023. During this period, TrueCoin sold TUSD operations to an unrelated offshore entity in December 2020, but remained deeply involved in TUSD operations until at least July 2023. It was not until the fall of 2022 that TrueCoin and TrustToken realized the liquidity issues of the offshore investment fund and requested a delay in redemption. After July 2023, several large-scale TUSD redemptions occurred after TrueCoin and TrustToken no longer participated in TUSD operations. However, as of September 2024, over 99% of the assets supporting TUSD were still invested in the offshore investment fund.

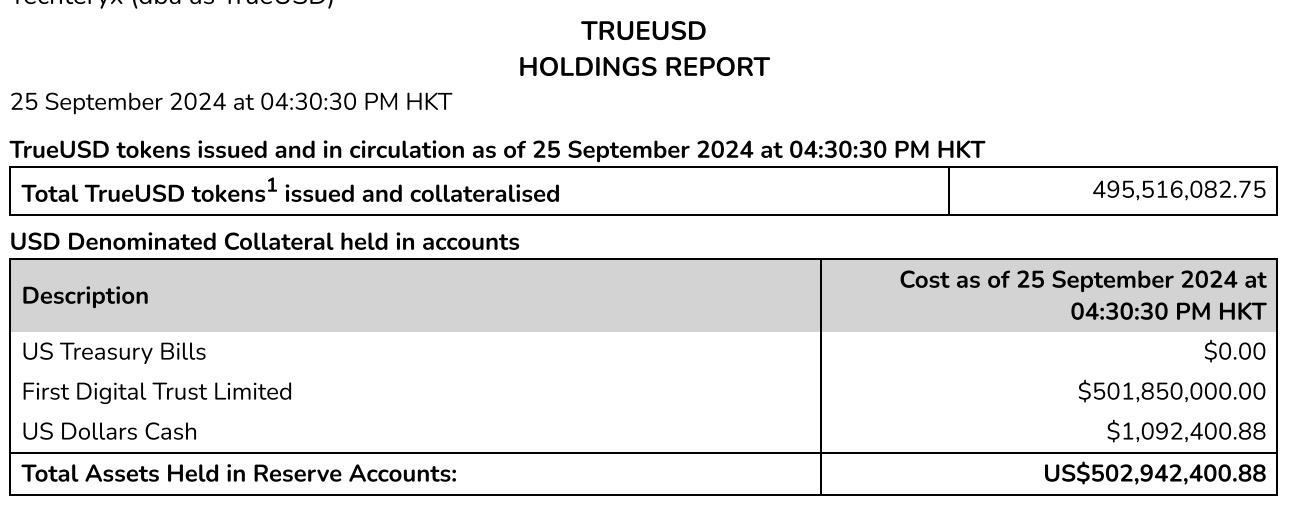

TUSD asset reserves Source: Moore Hong Kong

According to the reserve transparency report released by Moore Hong Kong on September 25th, the total amount of TUSD is 495 million, with collateral valued at nearly $503 million. The collateral includes $0 in U.S. Treasury bonds, $1.092 million in cash, and nearly $502 million held by First Digital Trust Limited, accounting for approximately 99.8%. From this data, the offshore investment fund mentioned by the SEC may be First Digital, and the fact that the fund's reserves originally accounted for 37% of the circulating supply and now account for 101.4%, as well as the small proportion of other collateral, also implies that during this period, TUSD redemptions were completed through U.S. Treasury bonds and cash reserves.

"Five hundred million dollars in reserves correspond to the funds held in First Digital as reported in the Moore report. Some news reports have indicated that there have been some issues with the channels of First Digital, and it may not be possible to retrieve them. The $500 million held in First Digital has not changed in the transparency report from Moore, which seems to support this. If the funds in First Digital are difficult to redeem, then TUSD is essentially worthless." Wu, a blockchain analyst @defioasis, pointed out in a post that based on on-chain data, over 80% of TUSD is now controlled by Justin Sun's team, with an address suspected to be Justin Sun's: 0x9F…19Fe, holding 50% of the total; JustLend has 146 million TUSD, accounting for 30%; the SUN io pool has 6.5 million TUSD, accounting for 1.3%; the remaining amount is distributed among exchanges such as Binance and unmarked addresses.

@defioasis further pointed out that the largest use case for TUSD in JustLend is to pledge TUSD for other assets such as USDT, with the largest loan amount currently being $63.44 million in USDT. In addition, the stablecoin stUSDT used by Justin Sun's team for RWA can be minted into stUSDT using USDT and TUSD on the Tron network. The total supply of stUSDT is 225 million, with 72% of the total held in HTX and 8.24% held by Justin Sun: 0x17…a132. He believes that TUSD may already be a shell, and the total supply has been greatly reduced, with Justin Sun's team essentially in control, and the problem of idleness seems insignificant.

"TrueCoin and TrustToken sought their own profits through false statements about the security of investments, exposing investors to a significant amount of undisclosed risks. This case is a typical demonstration of the importance of registration, where investors are deprived of the critical information needed to make fully informed decisions in such products," said Jorge G. Tenreiro, Acting Head of the SEC's Division of Enforcement.

Approval of the settlement agreement is still pending, and significant movements have occurred after the charges

In the past, most crypto projects sued by the SEC have often chosen to pay a settlement amount to resolve the charges.

According to the SEC, TrueCoin and TrustToken, without admitting or denying the charges, agreed to accept a final judgment prohibiting them from violating relevant provisions of federal securities laws and to each pay a civil penalty of nearly $164,000. TrueCoin also agreed to return approximately $656,000 in profits and interest.

However, it should be noted that the settlement agreement still requires court approval, and the SEC's investigation is still ongoing. According to the SEC's litigation procedures and the steps for settlement, after law enforcement officers and the parties reach an agreement on the settlement conditions, the settlement documents still need to be submitted to the judge for approval.

After TUSD was charged, significant movement of TUSD occurred in Justin Sun's on-chain address. According to Arkham's data monitoring, the address marked as suspected Justin Sun, 0x9FCc, transferred 72 million TUSD to HTX within the past 12 hours, and the address currently holds nearly 170 million TUSD. In addition, on-chain analyst Yu Jin also pointed out that related addresses of Sun Yuchen's team transferred a total of 216.6 million TUSD to HTX on the Tron and Ethereum chains yesterday evening. The total supply of TUSD is only 495.5 million, and addresses related to Sun Yuchen's team hold 390 million.

Additionally, affected by the SEC's charges, DEX Curve is considering removing TUSD from its collateral list for the stablecoin crvUSD. The proposal states, "crvUSD relies excessively on small stablecoins, especially TUSD, which has had suspicious performance in the past and has recently been charged by the SEC for defrauding investors. LlamaRisk (Curve's lending platform) has always been skeptical of TUSD and recommends stakeholders to review the public evidence provided by TUSD. This evidence shows that almost 100% of the reserves are related to a Hong Kong custodian: the Hong Kong custodian also invests in other financial instruments to generate returns, which may not be quickly converted into cash, subject to market conditions or fund performance. Based on publicly available information, we cannot determine whether the asset reserves supporting TUSD have liquidity or whether the stablecoin has the ability to pay. What we do know is that TUSD experienced a long period of decoupling after being delisted from Binance in February, with the supply decreasing from $3.3 billion in November 2023 to $500 million in April 2024, and the supply has remained significantly stable since then, indicating little public interest in the stablecoin and possibly mainly held by insiders. In fact, 78% of the Ethereum supply (about 50% of the total supply) is held by EOAs (Externally Owned Accounts) related to Justin Sun. Therefore, completely removing the exposure of crvUSD to TUSD may be a wise move."

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。