Interpreting Binance's Pre-market, another declaration of war against high market value

Binance has announced Pre-market, and at first glance, I thought it was just the common pre-market. But after carefully reading the rules, I realized I was wrong. Its purpose is not to earn more fees, but to make another important attempt to eliminate high market value projects.

It seems to have become a consensus that a project listed on Binance will have a high market value. After the initial token generation event (TGE), the retail investors are harvested, Binance is criticized, and only the project team and their yacht models are happy. What's even more frustrating is that the project team makes a lot of money and then takes it easy.

So, what's different about Pre-market? Why is it possible to break this phenomenon? The core is that the chips in Pre-market are only distributed through Launchpool, which means there are no project teams, market makers, or chips from airdrops in the name of insider trading. Letting the community determine the pricing to eliminate high market value.

Let's first talk about the current tactics of the project teams. Before listing, they gather a strong and hardworking team, top VC investments, a grand narrative, and data contributed by the community. Then they wait to be favored by the "God's" lucky hand. And then everything starts to change. At the opening, the project team has strong control, they have sufficient chips, the market makers working for them have rich trading experience, first-hand fund data, and a deep understanding of the psychology of the retail investors. In addition, for the airdropped chips, the project team can use methods such as server crashes to control the pace of chips entering the exchange. They are like all-seeing gods, with overwhelming advantages over the retail investors. And on the opening day, the project team can make a lot of profit.

If you often read my tweets, you will know that I have disclosed multiple times how many project teams cash out a large amount on Binance at the opening. The proportion is quite exaggerated. If Launchpool accounts for 5% of the total, the project team can cash out 5% on their own, or even more. Cash out at least $50 million at a time, and in projects with good liquidity, it can exceed $100 million. The root of all this is that at the opening, the project team and their market maker friends use their financial and chip advantages, as well as rich experience, to control the pricing on Binance and achieve a high market value at the opening.

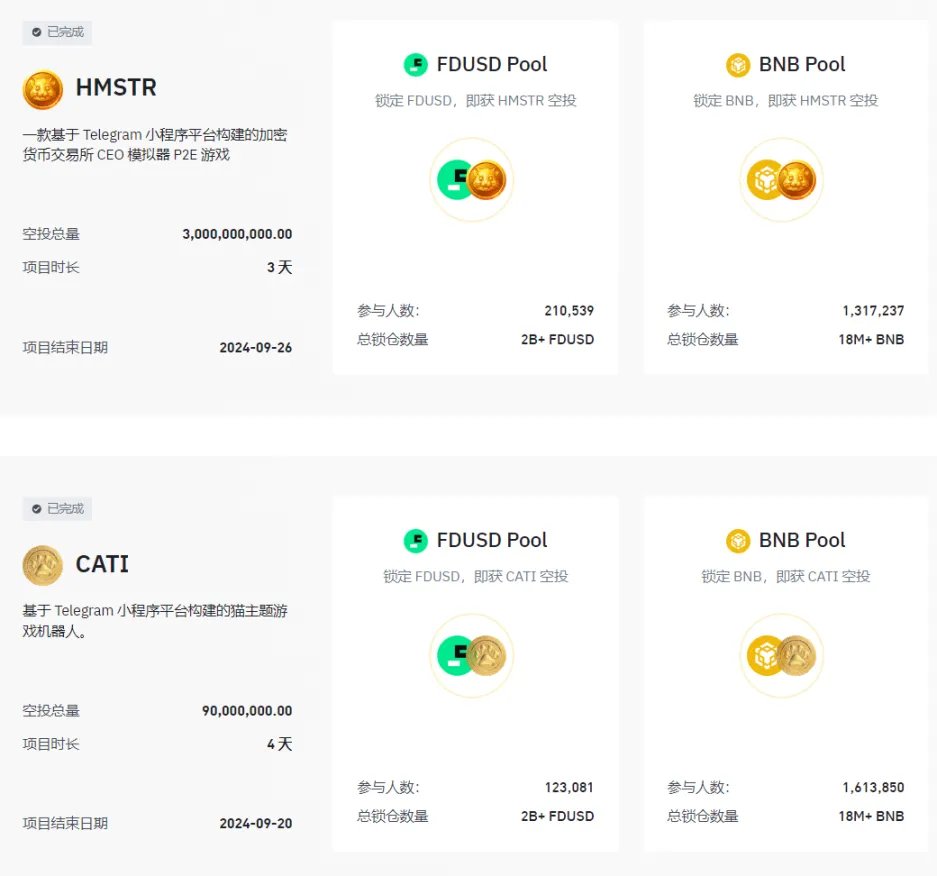

Once Pre-market is launched, this tactic will be broken. Pre-market elsewhere is a means of trading the listing fee in advance and does not involve actual tokens. But in Binance's Pre-market, the chips being traded are from Launchpool. So these chips are in the hands of users participating in Launchpool. Based on the participation in previous periods, there are 1 to 2 million participants in Launchpool. So these chips are relatively dispersed and not easily controlled in a centralized manner. And based on my own speculation, Launchpool tokens are essentially free, it's just a matter of whether the feast is luxurious or not, so the sensitivity to price is not high. This makes it easier for the market value at the opening not to be very high.

In Pre-market, only Launchpool chips are traded, and the project team and market makers cannot participate. We know that at the beginning, we and the project team are one family, traveling together, building together, and envisioning the universe together. But once listed on Binance, the project team becomes a complete scumbag. They only want to sell us tokens at a high price, so they can go to yacht parties with their girlfriends. We still want to build, we still want to reach for the stars, and now with Pre-market, this scumbag cannot manipulate the price through financial and chip advantages. So, we are genuinely buying and selling, with no deception. And Binance sets a limit on holdings to prevent the price from being influenced by large holders or malicious individuals. In other words, Pre-market is a market for the community to fully determine the price, not the project team. Therefore, it can be inferred that since the project team previously wanted a high market value at the opening to cash out, now that the project team no longer has an influence on the price, the market value of the project in Pre-market will definitely decrease.

Once Pre-market has a price, it has a very significant guiding effect on the opening of the spot market, especially forming a large expectation psychologically, or what is called the anchoring effect. Previously, at the direct opening, market makers could first raise the price significantly, sell a portion, and then with airdrops, etc., the price would naturally fall. But when the price drops to a certain extent, retail investors will think: "Wow, it's dropped by 50%, it's already very cheap, after all, this is a project with a future, with the support of the 'God of W', and the girlfriend of 'God of M', I can buy, buy, buy, and go all in." But with a low price in Pre-market, even if the project team raises the price, retail investors may consider selling, rather than buying.

People are a mysterious species. When something drops from $100 to $80, you think it's really cheap, a big discount, a good opportunity that only comes once a year. But when it rises from $60 to $80, you think it's too expensive, and you'd rather wait. You'd be surprised, but that's human nature.

In summary, the launch of Pre-market is another bold attempt by Binance to oppose high market value, aiming to have the community determine the price before the opening, thereby eliminating the project team's control over the price. And through psychology, it influences the actual opening price of the spot market. It allows retail investors who want to participate to do so in advance, rather than being harvested by the project team at the opening.

The actual situation needs to be verified through practice. But Binance's intentions are good, and I hope it can achieve the expected results. After all, the market value of projects listed now is too high, and the secondary market is almost out of steam. In the future, good quality projects can also be listed with peace of mind. Because click, click, click, click, my mouse has already broken twice.

@binancezh @binance @sisibinance @heyibinance

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。