Master Chen Discusses Hot Topics:

Today, let's first discuss an issue, which is the distinction between noise and the main theme. We can take the trend after the approval of the Bitcoin ETF in January as an example. The segment in the blue box is the noise.

At that time, Grayscale was continuously selling, while the main theme was the segment in the yellow box. Various ETFs were competing to buy Bitcoin and driving the price up to 73K. At that time, Master Chen was also bullish on the positive impact brought by the approval of the ETF.

Of course, during the noise phase, there were setbacks. So, what is the main theme now, and what is noise?

Master Chen believes that Powell's clear shift at Jackson Hole is the main theme, and everything else at this stage is noise. Some people say that the market has already priced in the positive impact of the rate cut, but if we look at the high point of Bitcoin, it was in March, and the CPI in the first three months of the United States this year exceeded expectations.

At that time, the market was still concerned about the resurgence of inflation and whether the Fed would continue to raise interest rates. Later, inflation fell in the second quarter, and expectations for a rate cut resumed. However, Bitcoin did not reach a new high and fell from 73K in March to a low of 49K in August.

In contrast, the US stock market has been hitting new highs since March, so I can't see that Bitcoin has already priced in any potential rate cut positives. Perhaps with the recent rate cut, the substantial decrease in capital market borrowing costs, the upward trend of Bitcoin will gradually return!

Master Chen's Trend Analysis:

Before the release of multiple indicators today, the price of Bitcoin has dropped to the lower range and is in the rebound stage.

To achieve a rebound, 62.6k can be observed as the short-term low point. It needs to return to the upward channel mentioned by Master Chen yesterday and rise above 63.5K to change the viewpoint to a rebound. The currently set 62.6k is the short-term low point.

Resistance Reference:

First Resistance: 63500

Second Resistance: 63800

To achieve a short-term rebound, 63.5k has become a key resistance. Since the price has moved away from the downward channel, the resistance zone will become stronger.

Therefore, 63.5k can be set as an important resistance level. Due to the continuous decrease in the low point, the coin price may consolidate near the first resistance level.

If it breaks through and stabilizes again, wait for buying pressure and judge the retracement range.

Support Reference:

First Support: 62900

Second Support: 62600

The first support is currently the current low point, and this support level can be used as an entry point for a short-term rebound. The current price is close to 62.9k, near the lower limit of the range, and this is also a good risk-reward ratio area.

In today's trading, it is recommended to pay attention to the fluctuation in the range of 62.9k to 63.5k. Wait for confirmation of the direction after the release of the indicators, and then trade according to the trend.

If it returns to the channel, the rebound expectation can be maintained. However, in the case of uncertainty about whether the resistance breakthrough is successful, it is recommended to observe fully before deciding to enter.

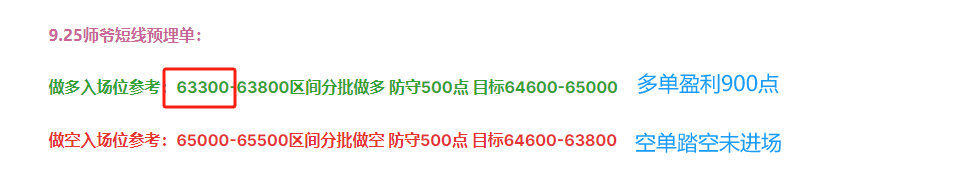

Master Chen's Short-term Pre-set Orders on 9.26:

Long Entry Reference: 62100-62600 range, gradually enter long positions, defend 500 points, target 62900-63500

Short Entry Reference: 63800-64300 range, gradually enter short positions, defend 500 points, target 62900-62600

This article is exclusively planned and published by Master Chen (WeChat public account: Coin God Master Chen). If you need to learn more about real-time investment strategies, how to get out of a predicament, spot contract trading techniques, operational skills, and candlestick knowledge, you can add Master Chen for learning and communication. I hope to help you find what you want in the currency circle. Focusing on BTC, ETH, and altcoin spot contracts for many years, there is no 100% method, only 100% going with the trend; daily updates on macro analysis articles across the web, technical analysis of mainstream coins and altcoins, and spot mid- to long-term replay price prediction videos.

Friendly reminder: Only the column public account (as shown in the picture above) is written by Master Chen. The end of the article and other advertisements in the comment section are not related to the author. Please be cautious in distinguishing between true and false. Thank you for reading.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。