Original Author: BitMEX

After the Federal Reserve announced a 50 basis point rate cut last Wednesday, the market saw an unexpected rise. For example, the weekly increase of $ETH exceeded 12%, $BTC exceeded 6%, and altcoins like $SUI and $AAVE saw even more significant gains.

It seems that traders' risk appetite is growing… creating conditions for a short-term rebound for $ETH in the coming weeks. This week, we will take another look at our old friend $ETH and explore its potential to outperform the market in the coming weeks.

Why we might be bullish on ETH, and how you can practice your market views by using options trading.

Let's delve into it.

Potential Rebound of ETH: 3 Catalysts

1. The $EIGEN token of EigenLayer is about to start trading

On September 30, the highly anticipated project EigenLayer in the crypto space will start trading its $EIGEN token. Considering the attention the project has attracted since its launch, this is expected to have a significant impact on the Ethereum ecosystem. The introduction of $EIGEN may become a factor in revitalizing interest in Ethereum, especially in driving network activity and value appreciation through $ETH re-staking.

Historical trends show that the issuance of tokens for major projects in the ecosystem is usually related to the price appreciation of their underlying blockchain native tokens. Therefore, we have reason to believe that the start of trading for $EIGEN will bring buying pressure to Ethereum and become an important catalyst for its short-term performance.

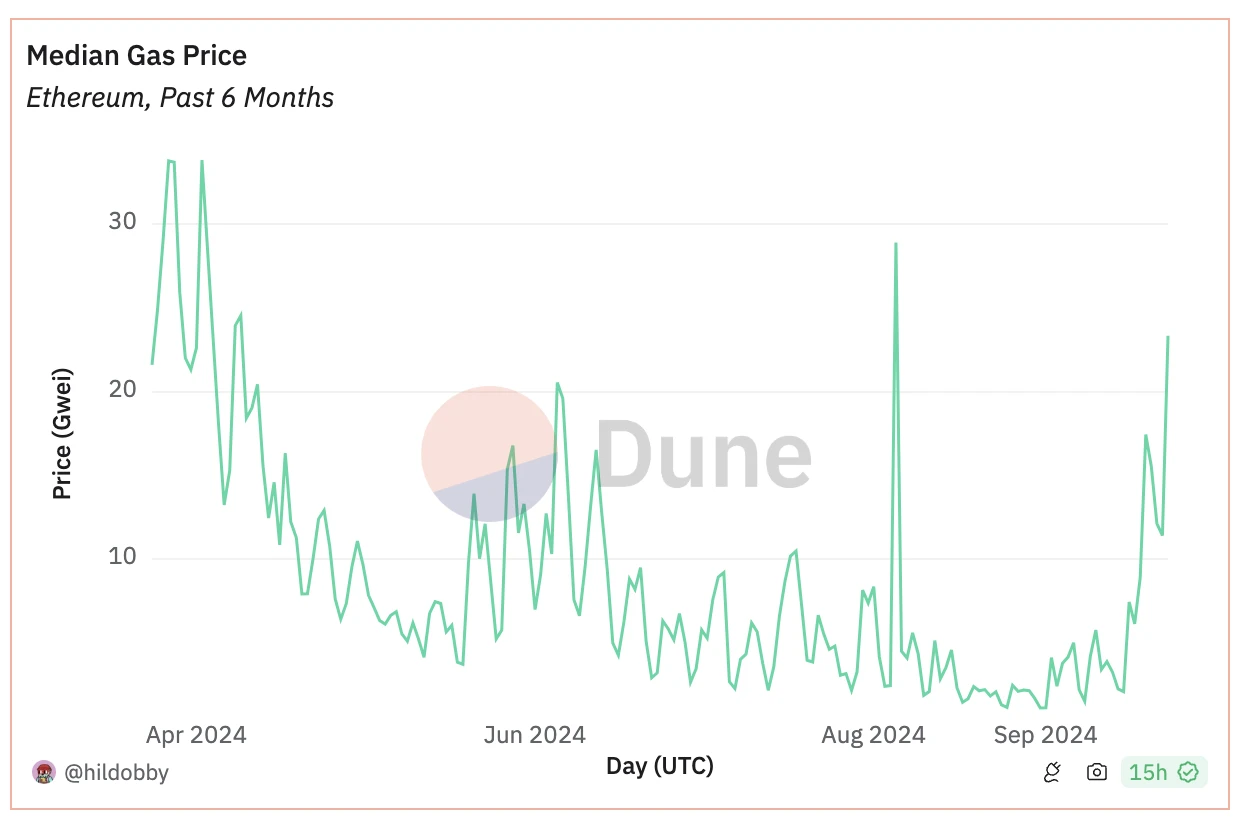

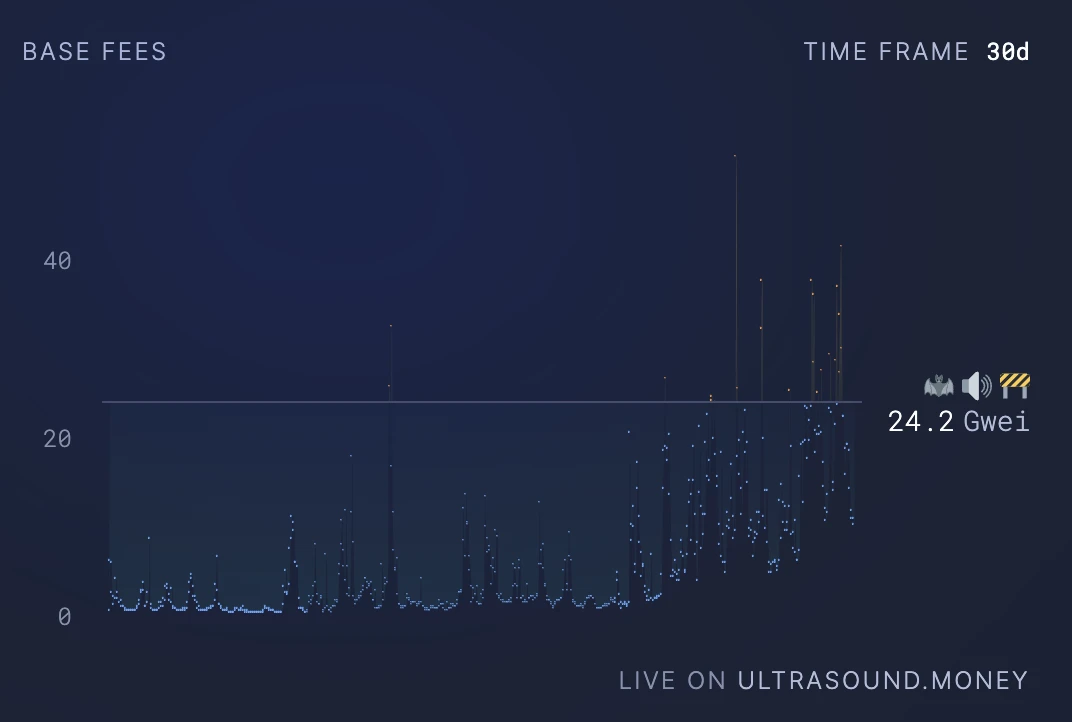

2. Ethereum gas fees reach the highest level in 6 months

Since September 16, Ethereum gas fees have been on a continuous upward trend. This surge is an important indicator of increased network activity and potential deflationary pressure on ETH supply. Higher gas fees indicate increased user activity and interaction with smart contracts on the Ethereum network, reflecting the growing demand for blockchain services.

Higher gas fees imply more ETH being burned, which could lead to deflation in ETH supply. This combination of increased network usage and potential supply reduction may have a positive impact on Ethereum's short-term value proposition.

3. Vitalik becomes active again

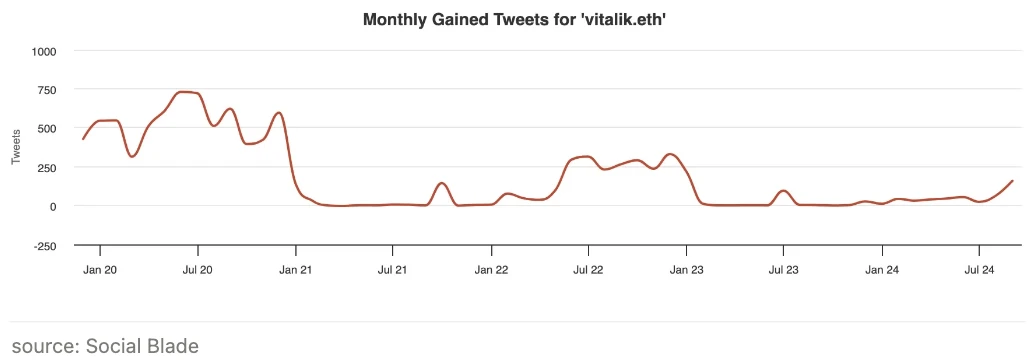

Our research shows that "V God" Vitalik has shown unprecedented activity on X since January 2023, indicating his refocus and commitment to $ETH. His presence is not limited to social media alone—this signifies his active involvement in the crypto community.

Vitalik was found interacting with DeFi founders at TOKEN2049 and recently met with one of Asia's most popular singers, JJ Lin.

In particular, the interaction with the latter suggests that Ethereum may expand to new audiences and markets. Vitalik's increased involvement not only revitalizes the Ethereum community but also foreshadows potential catalysts for increased interest and development within the ecosystem.

Putting it into practice: Utilizing options trading

Do you think these catalysts are important enough for $ETH to change the current bearish consensus?

Consider a bullish options spread strategy

A bullish options spread is a strategy that involves buying one call option and simultaneously selling another call option with a higher strike price, both with the same expiration date. This strategy is suitable for traders who believe that the underlying asset (in this case, Ethereum) will experience moderate growth or remain relatively stable.

Trading strategy

Buy 1 unit of $ETH call option, strike price $2,600, expiration date October 4

Sell 1 unit of $ETH call option, strike price $2,900, expiration date October 4

Potential returns

Breakeven point: $2,689.1

Maximum loss: $91.4 if $ETH falls below $2,600 on the expiration date

Maximum gain: $210.8 if $ETH reaches or exceeds $2,900 on the expiration date

Risk/reward ratio: 228%

Advantages

Limited risk: Maximum loss is limited to the net option premium paid for the spread, providing a clear risk profile.

Lower cost: Selling the higher strike call option helps offset the cost of buying the lower strike call option, making it cheaper than purchasing a call option alone.

Profit potential: If the underlying asset price moderately rises, you can profit, and when the price reaches or exceeds the higher strike price at expiration, you can realize the maximum profit.

Risks

Limited profit: Unlike simply buying a call option, the profit potential is capped, which may limit gains in a strong bull market.

Breakeven point challenge: The underlying asset price needs to exceed the breakeven point for the strategy to be profitable.

Time decay: Both options are subject to time decay, which may work against the strategy if price movements are slower than expected.

This strategy is typically used when you expect the underlying asset price to moderately rise but want to limit risk exposure. It is a more conservative approach compared to simply buying a call option, suitable for traders who want to participate in potential upward trends while managing downside risk.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。