Master Chatting about Hot Topics:

As the recent market gradually warms up, many old fans have been asking Master about many altcoins. For example, whether the altcoin season is coming, or whether the current altcoins will have better development prospects.

First of all, Master wants to say that even if all the new money is only buying Bitcoin or Bitcoin ETF, who is selling to them? Isn't it the people in the crypto circle?

And are these people leaving the crypto circle after selling? How can altcoins and Bitcoin be isolated? This simple logic has been eloquently explained by many experts.

Looking back, every bull market has started with Bitcoin. This is the rhythm of the influx of water, and the altcoin has not yet exploded because the water is not large enough.

Master's Trend Analysis:

After breaking through the pressure level following a short-term consolidation yesterday, it stabilized at 64K and returned to the upward channel.

The entire market currently believes that the reason for the rise in Bitcoin is the rate cut by the Federal Reserve and the large-scale economic stimulus plan announced by China.

But Master believes that the probability of breaking through the psychological resistance level of 65K based solely on simple technical indicators is small. Therefore, if it is to break through 65K, new market momentum is needed.

In the short term, Master suggests trading based on the breakthrough pressure level as support.

Reference Resistance Levels:

First Resistance Level: 64600

Second Resistance Level: 65000

The first resistance level is the current high point. If there are no new bullish factors, the probability of breaking through is low, and it is expected to consolidate and then decide the direction.

65K is the psychological resistance level for most retail investors, so it is difficult to break through based solely on technical indicators. Therefore, it is necessary to observe whether a successful retest can be conducted.

Reference Support Levels:

First Support Level: 63800

Second Support Level: 63300

In the short term, we can set the first support level as an important support and consider it as a suitable adjustment range.

Due to the strong pressure at 65K, the probability of a short-term adjustment is high. Master suggests gradually focusing on the upward channel and 63.8K as support before making trading decisions.

In today's trading, although the short-term bullish view can be maintained, it is advisable to adopt an adjustment strategy near the 65K psychological resistance level.

It has already returned to the upward channel and can maintain the rebound view. However, due to the strong resistance near 65K, the risk-reward ratio for short positions will be more favorable.

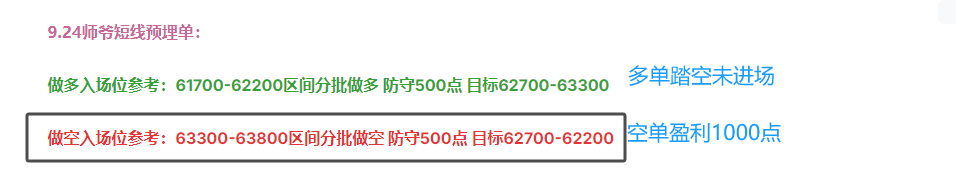

Master's Short-term Pre-set Orders on 9.25:

Long Entry Reference: 63300-63800 range, gradually enter long positions, defend 500 points, target 64600-65000

Short Entry Reference: 65000-65500 range, gradually enter short positions, defend 500 points, target 64600-63800

This article is exclusively planned and published by Master Chen (WeChat Official Account: 币神师爷陈). If you need to learn more about real-time investment strategies, how to get out of a predicament, spot contract trading techniques, operational skills, and candlestick knowledge, you can add Master Chen for learning and communication. I hope to help you find what you want in the crypto circle. Focusing on BTC, ETH, and altcoin spot contracts for many years, there is no 100% method, only 100% going with the trend; daily macro analysis articles updated across the web, technical analysis of mainstream coins and altcoins, and long-term and medium-term replay price prediction videos.

Friendly reminder: Only the official WeChat account (shown in the image above) is written by Master Chen. The end of the article and other advertisements in the comments section are not related to the author. Please discern carefully between true and false. Thank you for reading.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。