On the afternoon of September 2nd, AICoin researchers conducted a graphic and text sharing on "The Tricks of Retail Investors' Counterattack (with Membership and OKX peripherals)" in the AICoin PC-end-Group Chat-Live. Here is a summary of the live content.

Today, we are sharing a very practical tool - the main force large order tool.

The main force large order tool is used to track the hanging orders and transaction situations of large holders, and can even know whether the main force is opening or closing a position. Once the main force places an order on the market, our main force large order tool can immediately capture it and display it on the K-line. It can specifically track the position, amount, and whether it is a spot order or a contract order of the main force's hanging order.

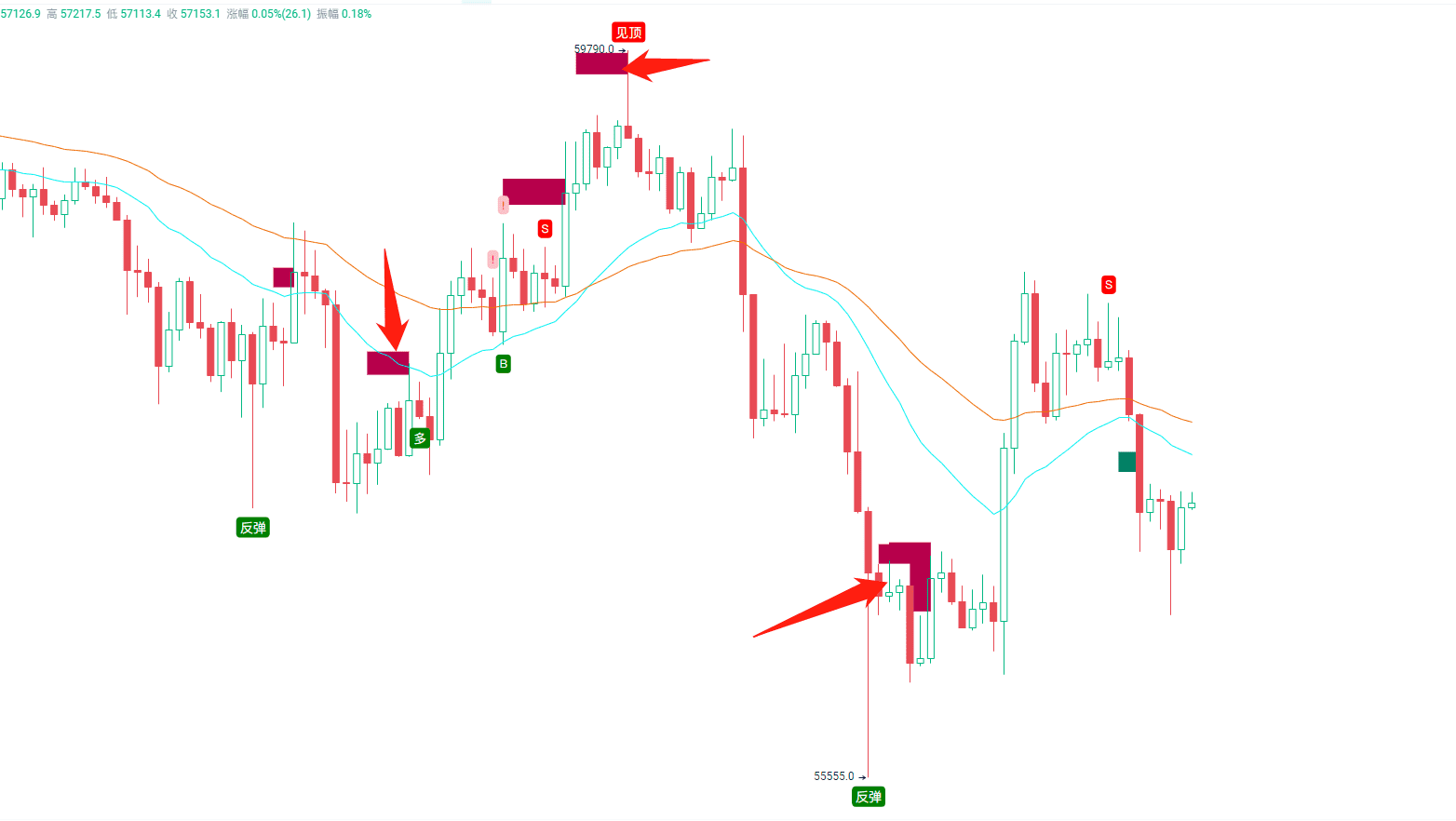

These are large orders:

I. Three techniques for using the main force large order tool

- Viewing hanging orders

Based on the performance of large orders in the past, the location of the main force's hanging orders will generally be reached, which is the gravitational force of large orders, especially when the hanging order time is long, the amount is large, and it is not at a special position.

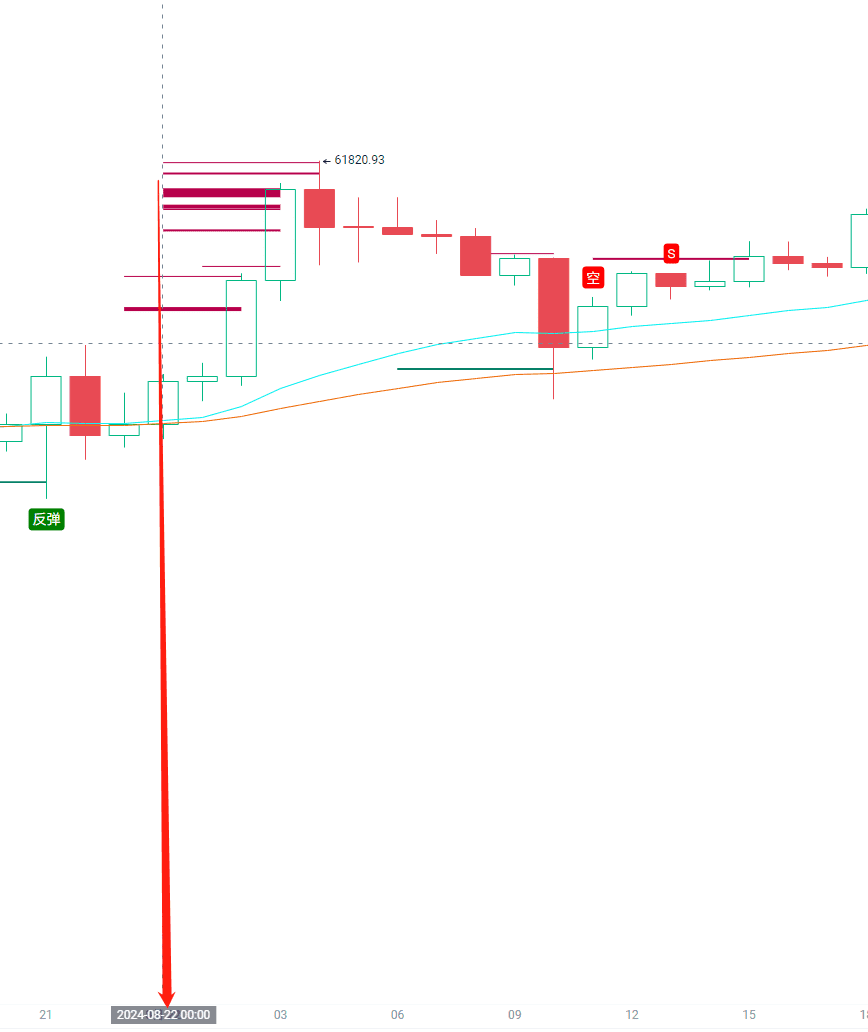

These lighter colors are hanging orders:

When hanging orders appear, we can use the large order statistics tool for confirmation. We can layout orders opposite to the direction of the main force's hanging orders in a short period of time based on which direction has more and denser hanging orders and is closer to the current price. Why operate in the opposite direction of the main force's hanging orders? Because these are hanging orders. For example, if the main force of Binance hangs a large sell order, it is placed above the current price. In order to be executed, the price must first rise to the order price to be executed. For a hanging sell order, before it is executed, it is bullish; after it is executed, it is bearish. The same applies to hanging buy orders.

For example, currently, large holders on Binance have placed many sell orders above the current price:

For example, these are sell orders placed by the main force at midnight, the price rose before they were executed. After the execution, the price fell back:

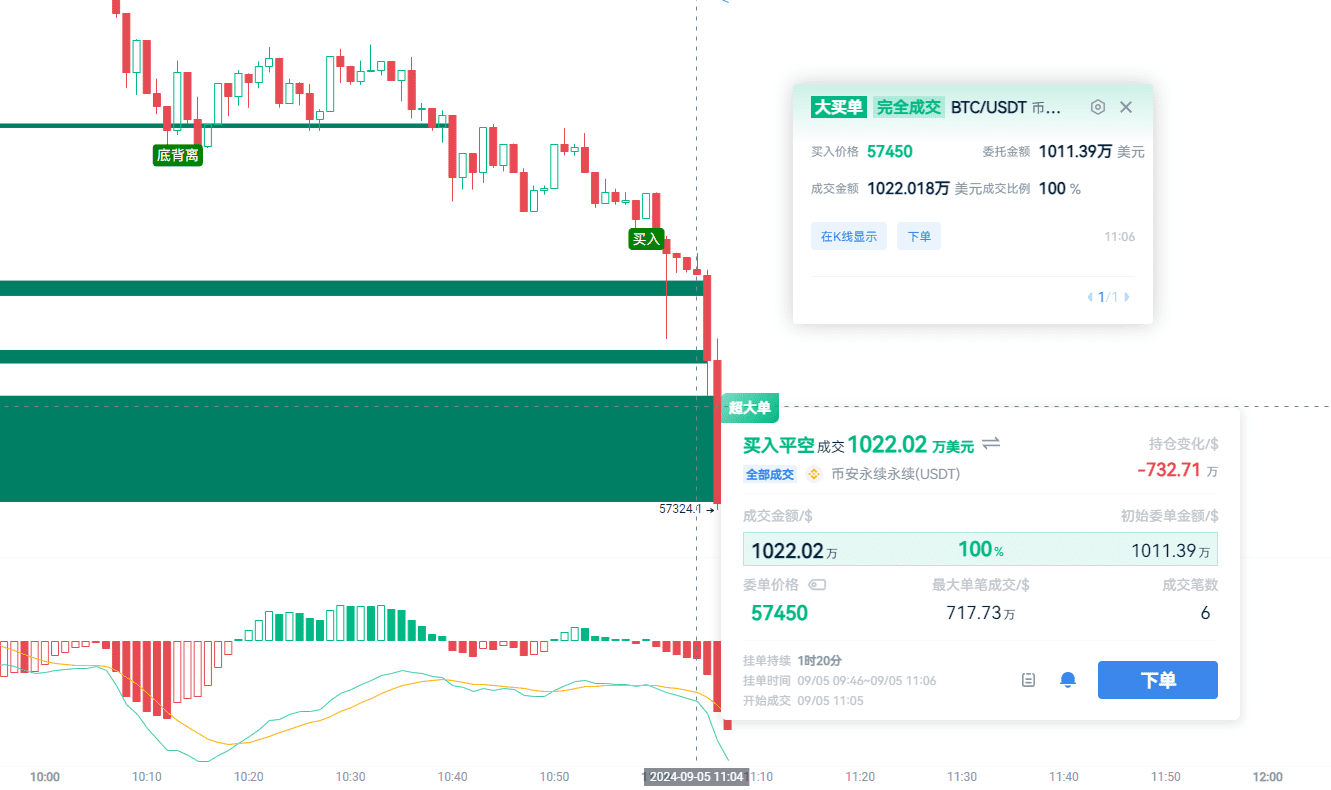

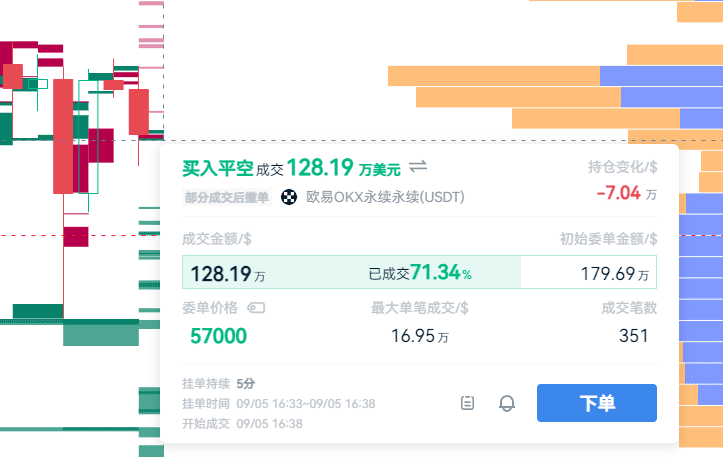

- Viewing transaction orders

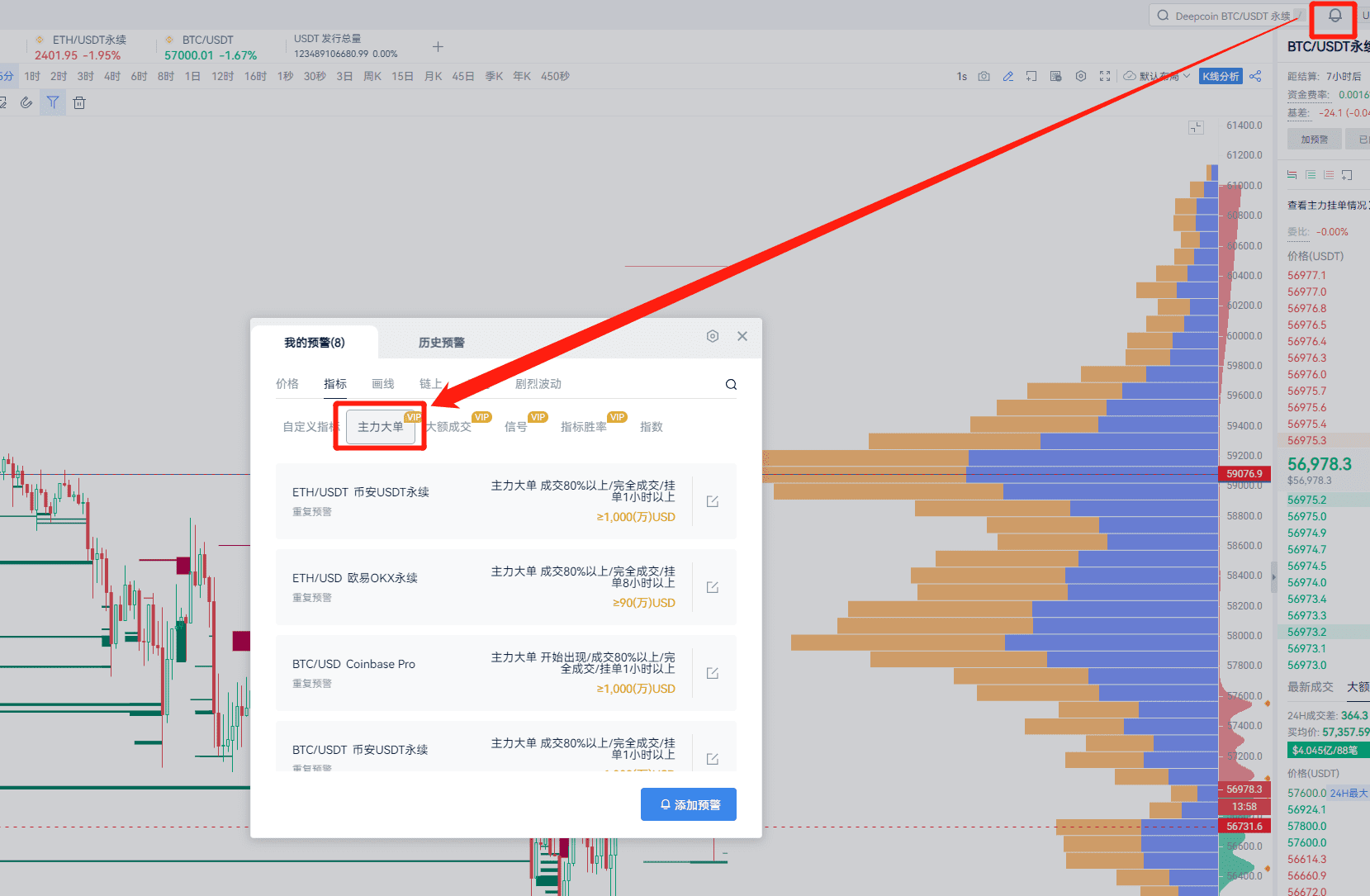

AICoin's editor mainly focuses on the large orders of the three major platforms: Binance, OKX, and Coinbase. Recently, the success rate of Binance's BTC/USDT perpetual million-level large orders is very good. Binance BTC/USDT perpetual currency pair: hanging orders last ≥1 hour + transaction amount ≥10 million US dollars.

Pay special attention to hanging orders lasting over 4 hours or 8 hours, as well as consecutive transactions and over 2 transactions of million-dollar large orders:

These currency pairs' large orders are also worth paying attention to:

OKX ETH/USD perpetual: duration ≥12 hours + transaction amount ≥900,000 US dollars

OKX BTC/USD perpetual: duration ≥1 hour + transaction amount ≥10 million US dollars

Coinbase BTC/USDT spot: duration ≥1 hour + transaction amount ≥10 million US dollars (rare)

Coinbase ETH/USDT spot: duration ≥1 hour + transaction amount ≥10 million US dollars (very rare)

These large orders can also be tracked with the main force large order alert:

It is recommended to focus on these two uses:

(1) Spot large orders: ① sell transaction, main force unloading, bearish; ② buy transaction, main force building/adding positions, bullish.

(2) Contract large orders: ① open long: bullish; ② open short: bearish; ③ close long/short or no specific opening direction: take profit or hold position for observation.

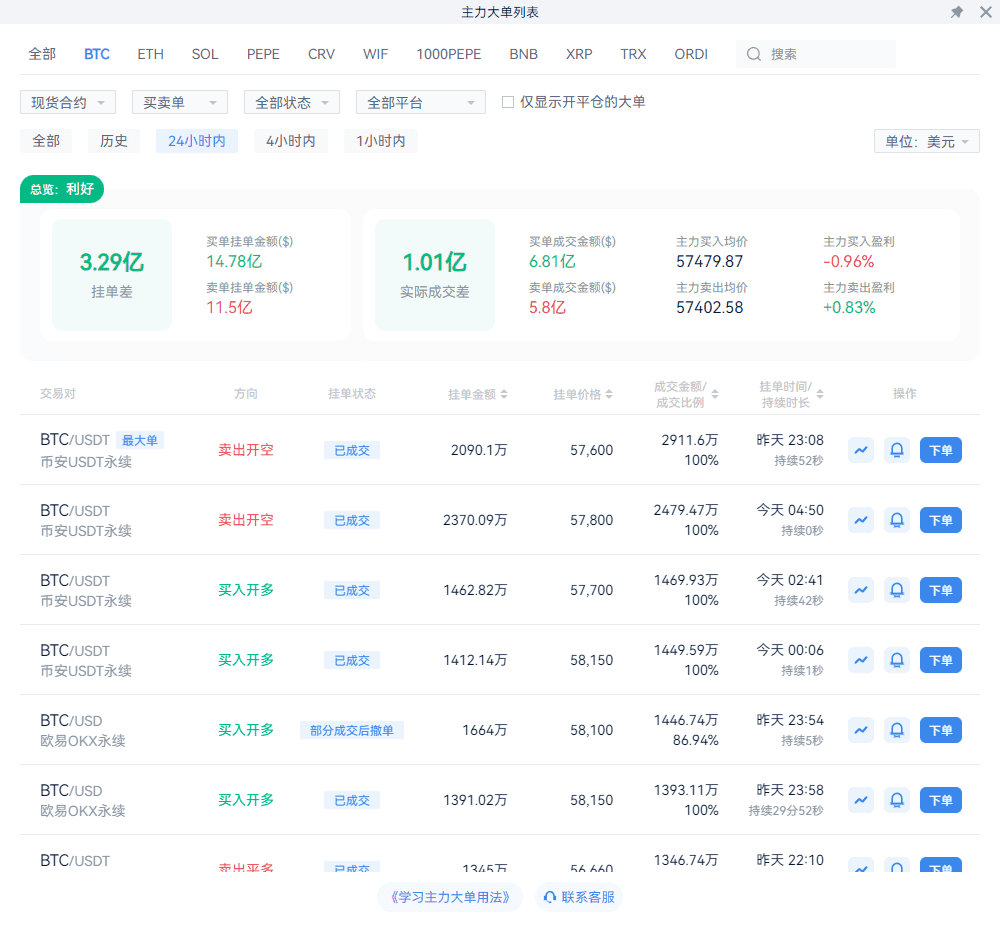

The previous discussion was about the transaction situation of individual currency pairs, and we can also look at the large orders across platforms.

Pay special attention to the period of oscillation, where more buy transactions indicate bullishness, and more sell transactions indicate bearishness:

AICoin's editor often uses cross-platform large order statistics for main force signals, and has recently achieved four consecutive wins:

When conducting cross-platform statistics, there is no need to filter by hanging order duration, amount, etc.

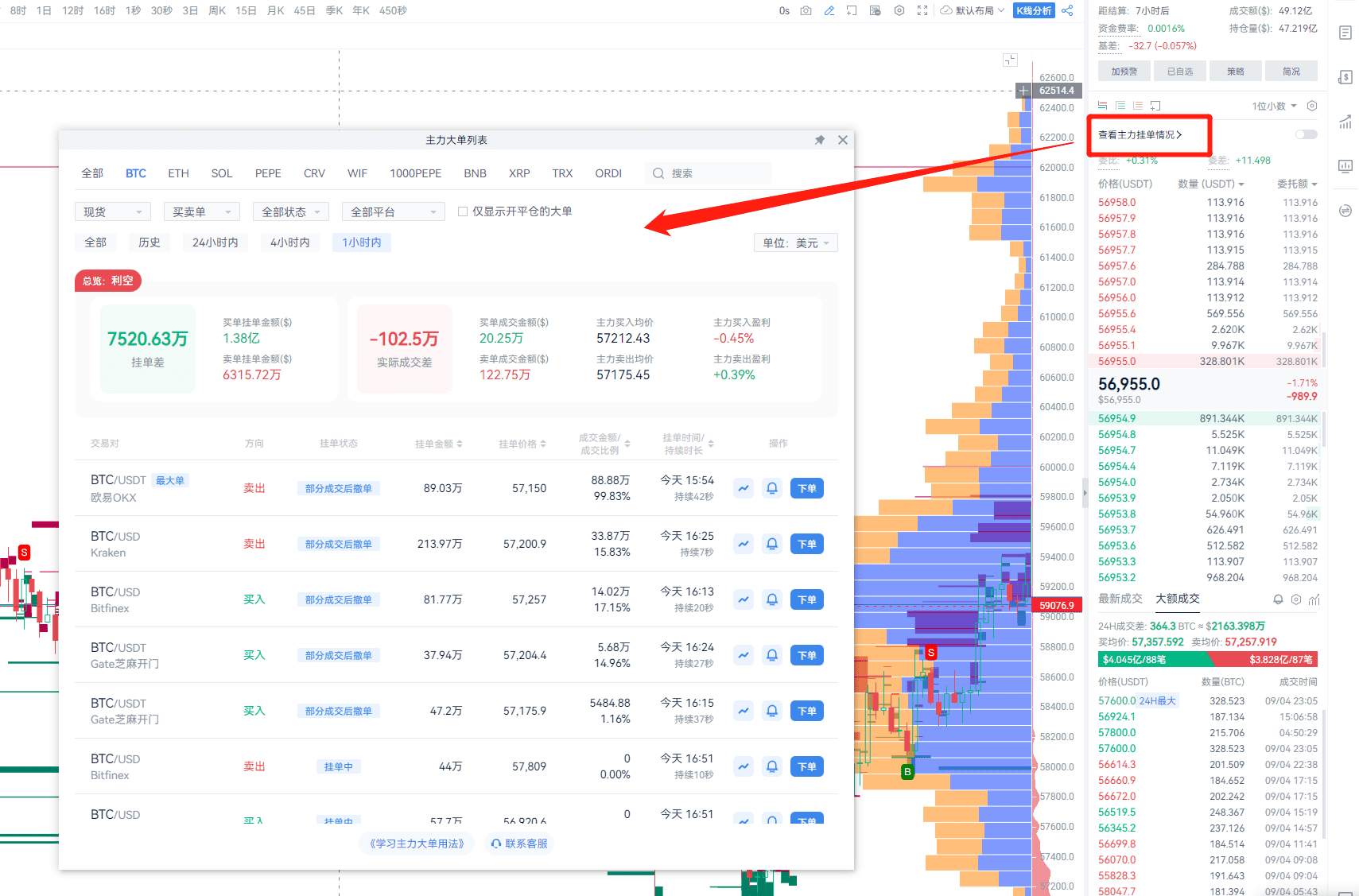

- Viewing the main force large order list

First, take an overview of the buying and selling transaction situations of spot and contract large orders on all platforms and in all conditions for each time period:

Look at the actual transaction differences within 24 hours, 4 hours, and 1 hour.

That is, this data:

If the sell transactions are gradually increasing, it means the price is rising, and the hanging sell orders are being executed. When the net sell amount within 1 hour gradually decreases, it means the price is starting to decline as the hanging buy orders are being executed, indicating bearishness. Conversely, the same applies.

For example, currently, within 24 hours, there is a net purchase of 101 million US dollars, within 4 hours, a net sell of 20.81 million US dollars, but in the most recent 1 hour, the net sell amount has decreased to 1.9 million US dollars, indicating that buy transactions are increasing, and the main force is entering the market again:

Or closing short positions:

Summary:

(1) Viewing hanging orders:

① Hanging buy orders: bearish before execution, bullish after execution; ② Hanging sell orders: bullish before execution, bearish after execution

(2) Viewing transactions:

Spot large orders: ① Sell transaction, main force unloading, bearish; ② Buy transaction, main force building/adding positions, bullish

Contract large orders: ① Buy to open long: bullish; ② Sell to open short: bearish; ③ Close long/short or no specific opening direction: take profit or hold position for observation

(3) Viewing the main force large order list

If sell transactions are gradually increasing, it means the price is rising, and the hanging sell orders are being executed. When the net sell amount within 1 hour gradually decreases, it means the price is starting to decline as the hanging buy orders are being executed, indicating bearishness. Conversely, the same applies.

The above is all the content shared this time.

Thank you for watching. We hope that every AICoin user can find a suitable indicator strategy and have a rolling source of wealth!

Recommended reading:

For more live content, please follow the "AICoin - Leading Data Market, Intelligent Tools Platform" section on AICoin, and feel free to download AICoin - Leading Data Market, Intelligent Tools Platform

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。