Author: Frank, PANews

The public chain Sui on Facebook has recently attracted much attention, and the most discussed topic on social media is "SUI tokens seem to be replicating the trend of SOL in 2021." Many opinions believe that the recent rise of SUI is very similar to the start of the previous surge of SOL, thus inferring that Sui may become the next Solana.

Sui's mainnet went live in May 2023, while Solana's mainnet went live in March 2020, and there is currently a significant difference in their data. However, from the perspective of growth potential, it is necessary to compare the performance of both at the same time. PANews compared the performance of Sui and Solana in July 2021, more than a year after their launch, which, although somewhat "seeking swords on a boat," can provide an objective reference and comparison.

On-chain Data: Sui Outperforms Solana in 2021

To make a clearer comparison of the data, we took Solana's data from around July 12, 2021, and Sui's data from September 24.

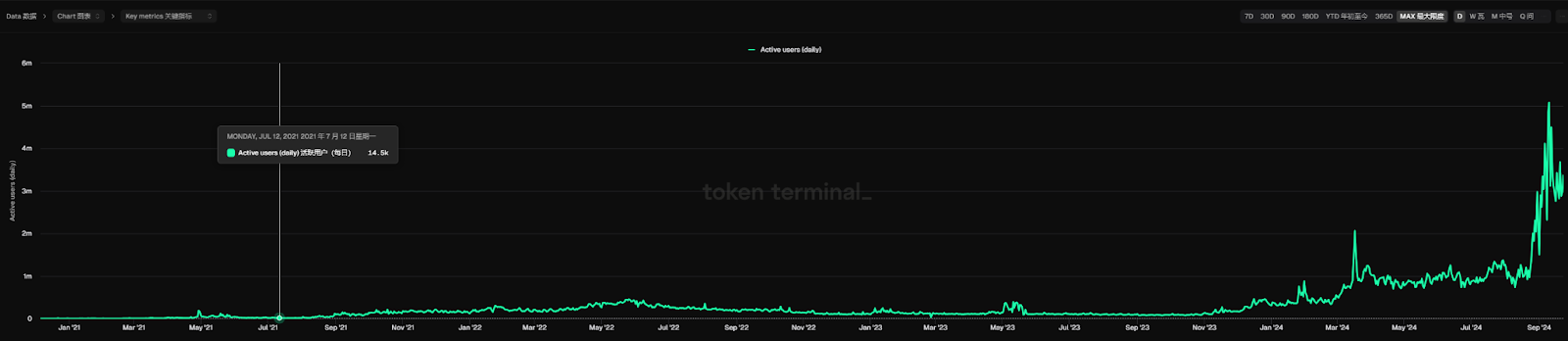

From the on-chain data perspective, Sui's current data overall outperforms Solana's performance in 2021. In fact, in 2021, although the SOL token on Solana saw a huge increase, the ecological data was evidently not impressive enough. Especially in terms of on-chain daily activity, Solana's daily activity in 2021 was basically in the range of tens of thousands of addresses, only breaking through to over 100,000 in 2022. However, Sui's data has seen significant changes recently. Before April this year, the number of daily active addresses on the Sui chain was similar to Solana's in 2021, averaging in the tens of thousands. After experiencing "boosting" from SPAM junk emails in April, the number of daily active addresses on Sui's chain surged to over a million, maintaining over 400,000 even during the quiet market phase in August, and has recently experienced another significant increase, surpassing a million daily active addresses once again.

Sui daily active address data

Solana daily active address data

In the bullish sentiment towards Sui, one indicator that has been mentioned multiple times is that Sui's peak TPS can reach 297,000 transactions, while Solana's peak is 65,000 transactions. However, from the current daily TPS perspective, Sui's TPS data still does not match Solana's level in July 2021.

Overall, from an on-chain perspective, Sui's activity is significantly better than Solana's in July 2021, which indeed provides evidence for Sui to become the next Solana.

Social Media Influence: Sui Lacks a "Celebrity Endorser"

Ecological development is one aspect, but sometimes the hype on social media in the crypto field seems to have a greater impact on a token's price. One important reason for Solana's significant increase in 2021 was the public support from FTX founder SBF. Dylan and Ian Macalinao, co-founders of Saber (the fastest-growing DeFi project on Solana in 2021), mentioned why they chose Solana, saying, "We have been following SBF for a while, and we were using FTX at the time. From there, we saw that Solana is a very good public chain."

In addition to SBF's influence, the bullish view of Solana in the crypto field was also driven by significant investments from prominent venture capital firm A16z. However, this is attributed to the perspective of capital. More details to follow. In addition, in 2021, Solana also received cooperation and endorsements from several celebrities such as Mike Tyson, Michael Jordan, and Melania Trump. Therefore, in 2021, Solana became a veritable internet celebrity public chain, hyped on social media as the "Ethereum killer," which is similar to the current hype of Sui becoming the next Solana. Andrew Kang, co-founder and partner of Mechanism Capital, commented in response, "I don't think SUI's market value will reach the level of SOL. Its current market value is only 3.5% of SOL's, which sounds similar to the arguments made by the .eth community before or during SOL's outperformance."

In comparison, there are also many KOLs supporting Sui on social media today. In September, K33 Research analyst David Zimmerman stated that the Sui network, with its technical advantages and the upcoming native game console, may become a strong competitor to Solana.

However, Sui seems to lack a "celebrity endorser" like SBF, but there are numerous industry KOLs expressing bullish views on Sui on social media.

Seizing the Opportunity: Solana Still Dominates the MEME Market

Seizing the opportunity is also a key to a project's success. The trend in 2021 was NFTs and DeFi, and Solana gained much attention in the NFT trend. However, in the current cycle, MEME is the biggest trend, contributing significantly to on-chain data performance, and it seems that this trend has been dominated by Solana. However, from recent data, it appears that the MEME market on Sui has finally made progress. The number of new tokens added daily on Sui recently surpassed 300, showing a breakthrough growth, while before September 10, this number was only between 30 and 50. However, this level still lags significantly behind Solana (which still maintains the generation of 10,000 new tokens daily on-chain). As the new token generation data for Solana in 2021 cannot be found, it cannot be compared with Solana at that time.

In terms of trading volume, on September 24, the on-chain 24-hour token trading volume for Sui was $95 million, while Solana's was $1.1 billion on that day. Solana still dominates the important MEME trend. Sui also faces multiple competitors such as Base, Ethereum L2, and TON.

Capital Boost: Both Have the Same Origin

Ultimately, capital boost is also an important factor in the market value growth of tokens. Recently, capital support for Sui mainly comes from Grayscale, with the Grayscale SUI Trust fund management scale surpassing $1 million on September 13. In addition, on September 17, Circle co-founder and CEO Jeremy Allaire announced the launch of USDC&CCTP on the Sui Network.

Looking back at Solana in 2021, in addition to providing influence on social media, FTX also provided strong financial support to Solana. It is estimated that FTX and its related investment department Alameda Research invested over $100 million in various companies and projects in the Solana ecosystem. In June 2021, a16z injected $314 million in financing into Solana. The strong connection with FTX enabled Solana to receive significant funding for promotion and price increase.

Sui has not received any recent financing (there are reports of OTC financing, but it has not been confirmed). The last significant financing was a $300 million round in 2022, led by FTX Ventures, with participation from a16z Crypto, Jump Crypto, Apollo, Binance Labs, Franklin Templeton, Coinbase Ventures, Circle Ventures, Lightspeed Venture Partners, Bixin Ventures, and A&T Capital. Many of these investors were also backers of Solana in the past. However, in 2023, Sui's development company, Mysten Labs, paid $96 million to repurchase shares from FTX.

Market Performance: Similar Market Trends

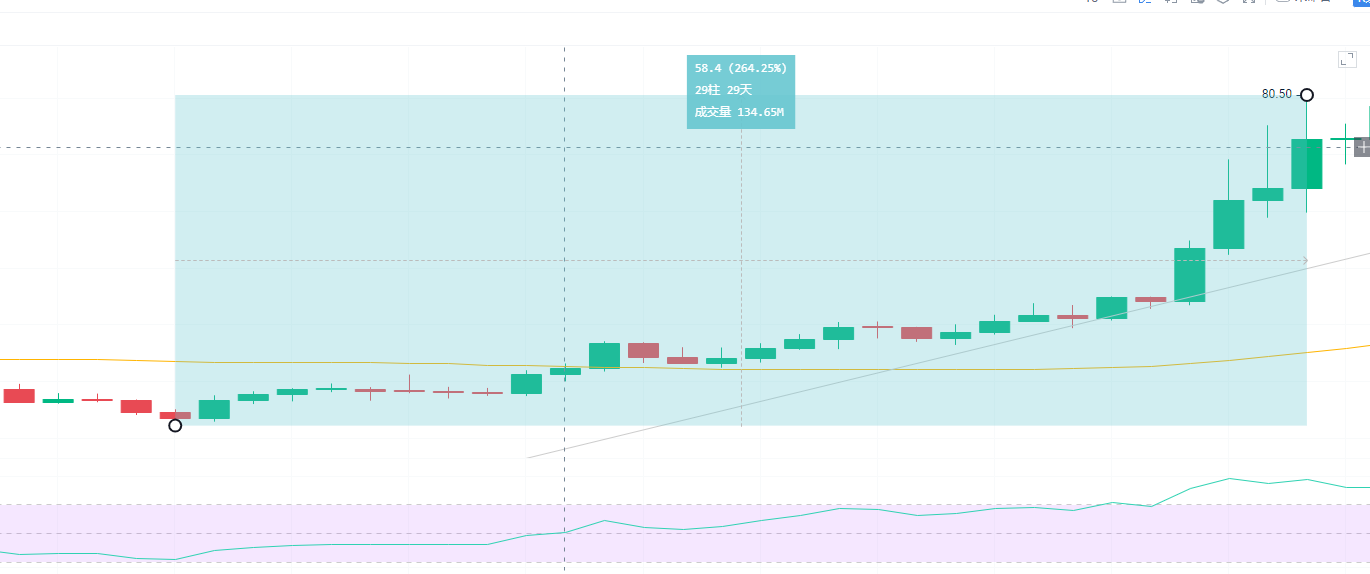

Returning to the core area of current bullish sentiment, the token market. Sui's token has seen a significant increase recently, rising by 256% from August 5 to September 23, within 49 days, which far outperforms other public chains.

Solana market trend chart in July 2021

Looking back at SOL in 2021, from July 20 to August 18, within 29 days, it rose by 264%. There indeed seems to be many similarities in the concentrated surge of both at a certain stage.

SUI market trend chart in August-September 2024

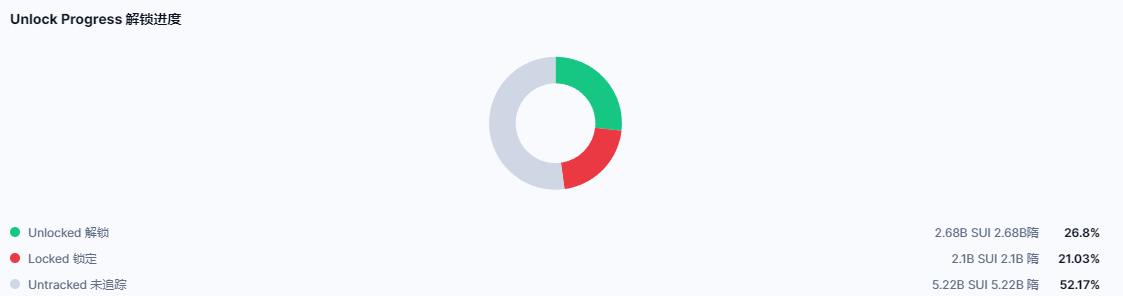

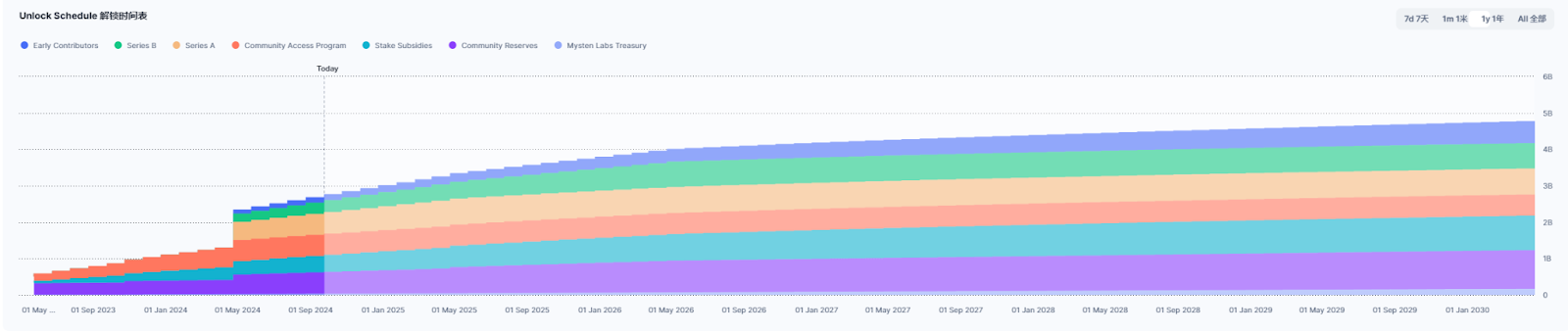

Currently, SUI's circulating market value is about $4.1 billion, while SOL reached a market value of $18.7 billion after the first round of increase. However, SUI's current supply is at 26.8%, and SUI tokens will continue to unlock every month. Currently, 21% of SUI tokens remain unlocked. Even if the market value of these tokens is added, it still does not match the $18.7 billion market value of SOL after the first round of increase in 2021.

In terms of trading activity, SUI's recent surge may be attributed to the enthusiasm in the Korean market. The largest Korean exchange, Upbit, currently accounts for approximately 7.21% of the trading volume share of SUI, making it the largest exchange for SUI trading volume outside of Binance, Coinbase, and OKX.

Overall, Sui indeed shares many similarities with Solana in 2021. Similar social media sentiments, similar performance advantages, and similar investment institutions, among others. Perhaps Sui may become the next performance public chain favored by the market, but there are still several questions that everyone needs to consider. Firstly, Sui has not achieved the same outstanding effect as Solana did in 2021. Currently, it faces strong competitors in the L1 and L2 race. Can performance really be a killer advantage? Secondly, Sui's data growth often shows explosive growth, followed by significant declines. Can this kind of volatile on-chain data really represent the activity of the ecosystem? Thirdly, there have been no ecosystem DApps with wealth effects and breaking effects like Raydium and MagicEden in the previous bull market for Solana. Fourth, the unlocking of tokens cannot be ignored. Of course, no one can predict the market, and the above analysis should not be taken as investment advice. Please proceed with caution.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。