Just under two weeks after its launch, cbBTC, as an important substitute in the market, has surged to become the third largest wrapped Bitcoin. However, at the same time, concerns have been raised in the market due to its transparency issues.

By Nancy, PANews

After WBTC experienced a trust crisis, many competing products emerged in the market, among which the most notable is cbBTC, backed by the largest US crypto exchange, Coinbase. Just under two weeks after its launch, as an important substitute in the market, cbBTC has surged to become the third largest wrapped Bitcoin. However, at the same time, its transparency issues have raised concerns in the market.

Surging to become the third largest wrapped Bitcoin, market share is only 1.2%

On September 12, Coinbase announced the official launch of its wrapped Bitcoin version, Coinbase Wrapped BTC (cbBTC), backed by a 1:1 BTC endorsement, which will operate on the Ethereum mainnet and Base.

As the largest crypto exchange in the United States, known for its compliance advantages, Coinbase has led cbBTC to rapidly capture market share, especially as WBTC, which previously held a stable market position, is being "abandoned" by more whales and old DeFi projects such as SKY (MakerDAO) and AAVE.

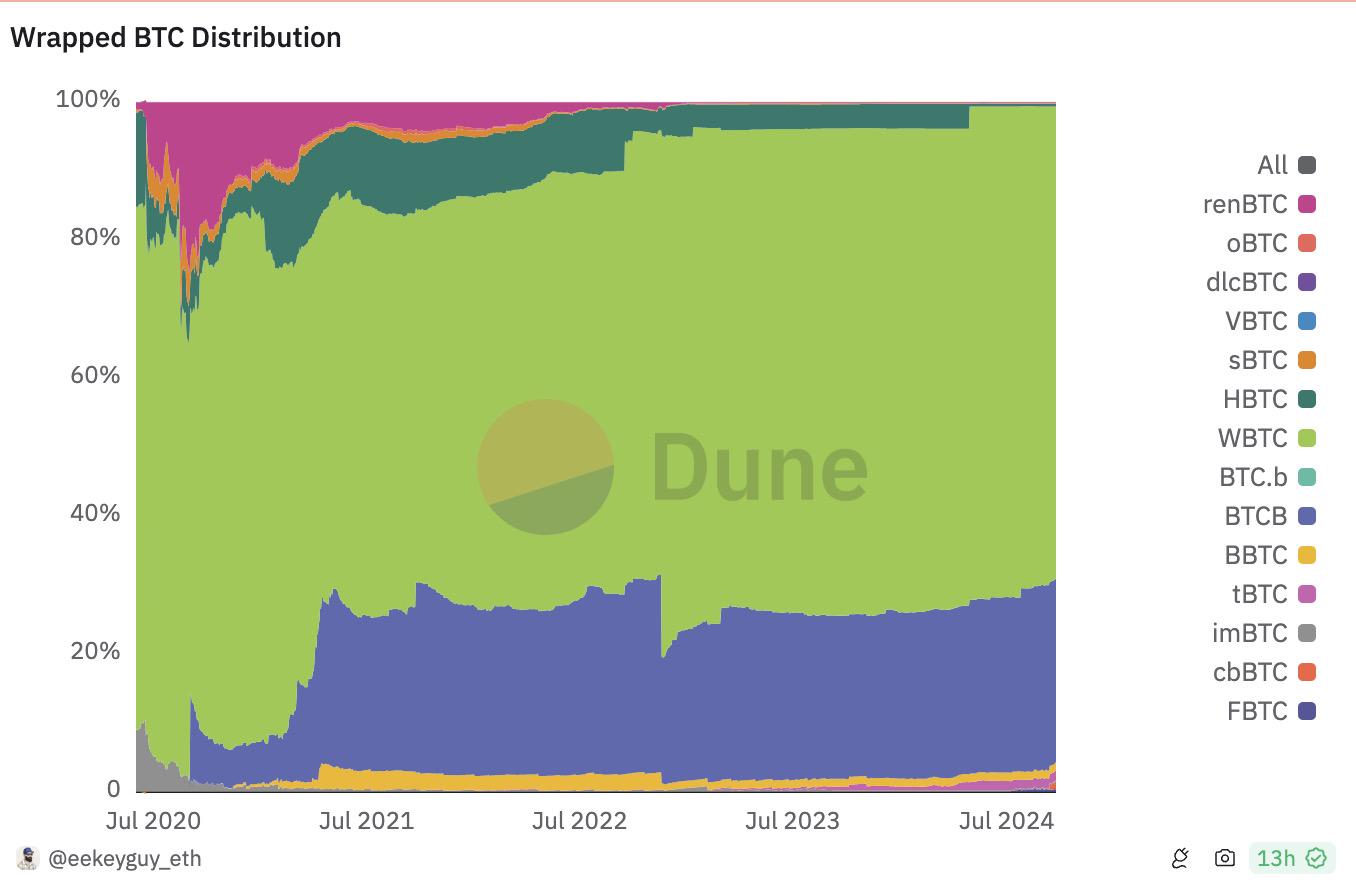

According to Dune data, as of September 24, the circulating supply of cbBTC reached 2944, with Ethereum chain accounting for 53.9% and Base chain accounting for 46.1%. The current market value of cbBTC exceeds $180 million, with a trading volume of nearly $1.31 billion in the past 24 hours, mainly concentrated on Aerodrome (93.3%) and Uniswap (4.4%).

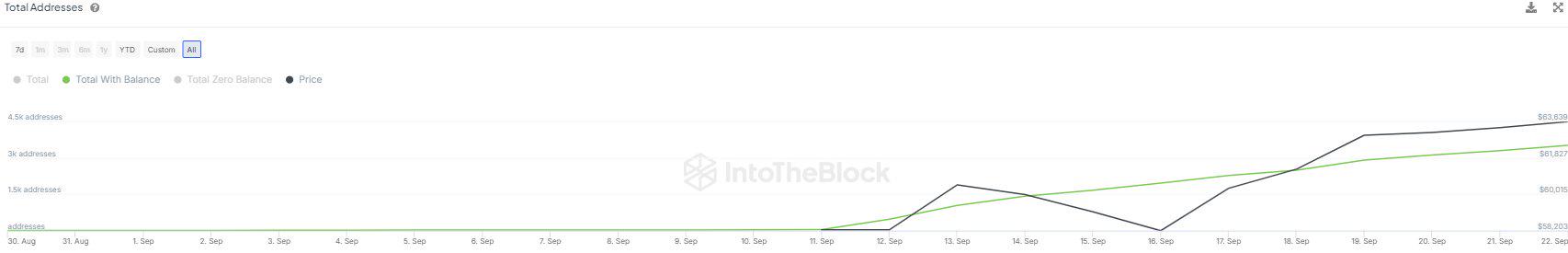

At the same time, the latest data from IntoTheBlock shows that the number of user addresses for cbBTC has exceeded 3,500, with these addresses settling an average value of $472 million worth of Bitcoin on the Base chain every day.

In terms of market share, Dune data shows that as of September 23, cbBTC is tied for third place with BBTC at a 1.2% share, still far behind WBTC (68.5%) and BTCB (26.6%). However, according to Hassan Ahmed, the head of Coinbase in Southeast Asia, revealed at the recent Solana Breakpoint event that cbBTC plans to introduce Solana, which may further drive its market expansion.

Due to concerns over service terms and transparency, the official response has long planned to implement PoR

Trust is the anchor of value for wrapped assets. Shortly after its launch, cbBTC faced concerns over the lack of transparency in asset reserves and service terms.

In mid-September, just a few days after its launch, cbBTC was questioned for the lack of transparency in its Bitcoin reserves. At the time, crypto analyst Tyler Durden hinted in a post that Coinbase allowed BlackRock to borrow Bitcoin without providing collateral, suggesting that these two companies might profit by controlling the price of Bitcoin. In response to claims that cbBTC was sold to BlackRock without maintaining a 1:1 backing, Coinbase CEO Brian Armstrong denied this, stating that BlackRock's Bitcoin ETF's minting and burning of Bitcoin are transparent and conducted on-chain. Due to privacy considerations, Coinbase cannot share the wallet addresses of its institutional clients. However, he also admitted that cbBTC is backed by a centralized custodian, in this case, Coinbase itself. At the same time, BlackRock runs blockchain nodes to verify the Bitcoin holdings of IBIT, ensuring the security of client assets. If institutional clients request it, BlackRock will display this data, but will not make it public to the world.

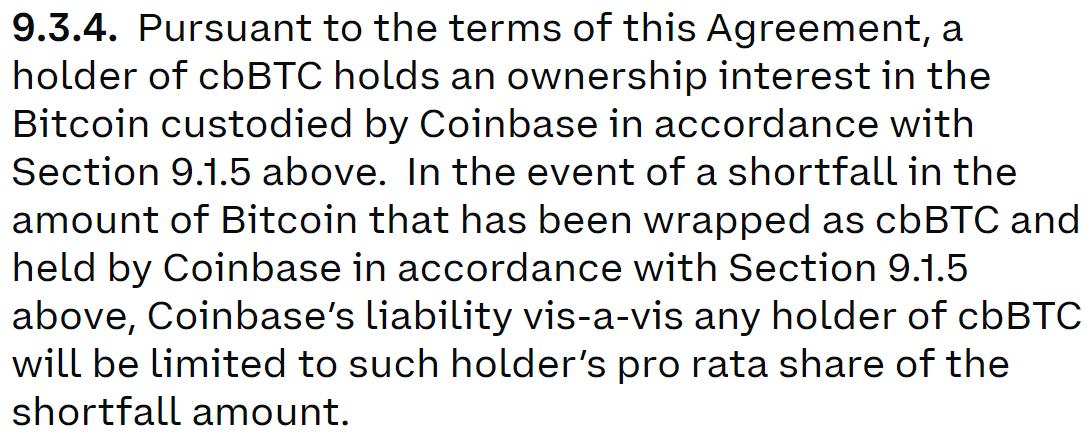

Shortly after, cbBTC faced controversy over its service terms, with some community users stating that the user terms of cbBTC state that if Bitcoin is lost due to malicious activity or unforeseen events, Coinbase will not fully compensate customers, but will distribute to customers in proportion to the remaining Bitcoin.

In response, Coinbase's Chief Legal Officer Paul Grewal stated that if the exchange loses the underlying Bitcoin, Coinbase will fully compensate customers. This policy limits the exchange's liability for external losses arising from complex trading and leverage positions that customers may enter. For example, if a trader uses cbBTC as collateral on a lending platform and is liquidated due to malicious activity resulting in the loss of underlying Bitcoin, Coinbase will fully compensate for the lost Bitcoin, but will not compensate for any fees or monetary losses arising from the liquidation itself.

However, Coinbase's explanation seems to have not dispelled external doubts, including TRON founder Justin Sun "stirring up trouble," stating that "cbBTC is not BTC." In terms of user asset protection, there are differences between WBTC and cbBTC. The former issuer, BitGo, provides up to $250 million in on-chain insurance funds, while cbBTC does not provide any financial guarantees, and the asset reserves are also not transparent.

0xngmi, founder of DeFiLlama, recently pointed out on social media, "To be honest, almost every cross-chain bridge (including WBTC) will provide proof of reserves (PoR) so that users can check if the issued tokens have sufficient backing. However, Coinbase has not done so, and cbBTC is far below the standard in terms of transparency. This is also why it has not been listed on DeFiLlama, because its TVL cannot be verified. If we don't list other cross-chain bridge projects that cannot verify TVL, we won't make an exception for Coinbase. We treat all projects equally."

Dragonfly data analyst Hildobby also wrote that seeing Coinbase issue cbBTC without any proof of reserves (similar to cbETH two years ago) disappoints him. When cbETH was launched, I raised complaints, but was told that I could only use their centralized terminal to obtain the conversion rate. In a survey last year, Coinbase held 12% of staked ETH (which was never formally confirmed in any way). In addition, Coinbase's quarterly reports have disclosed the amount of staked ETH, but they did not disclose it in the recent report.

In addition, some community members pointed out that the service agreement for cbBTC is signed with Coinbase Inc., a company that is not a regulated financial institution and was accused by the SEC last year of being an unregistered securities exchange, broker-dealer, and clearing agency, independent of Coinbase TrustCompany, a crypto custody business regulated by the New York Department of Financial Services (NYDFS).

In response, Lukas Staniszewski, the product manager of cbBTC, stated, "We understand the importance of proof of reserves. For cbBTC, we have long planned to implement proof of reserves, and the team is working hard to push this work forward. We did not publicly disclose this earlier because we wanted to complete the construction first."

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。