Hello everyone, I am your friend Lao Cui Shuobi, focusing on the analysis of digital currency market trends, striving to deliver the most valuable market information to the majority of currency friends. Welcome the attention and likes of the majority of currency friends, and refuse any market smokescreen.

After a day of twists and turns, looking back, the market is still the same, but fortunately, there was a wave of growth after the article was published. I believe that everyone who follows Lao Cui can also see the recent trend, which is basically clear. It is mainly bullish and there should not be too much deviation. Let's directly enter today's technical analysis. In the four-hour chart, it can be seen that the seven-day moving average had a turning point at 8 am and reached a new high of 2702 at midnight, and then it has been under pressure for a pullback. At this stage, it is considered to have held the downside space and has temporarily started a new round of corrective market. The low point is also very clear and has not broken through the 2600 support level. The 30-day moving average shows a more stable trend, always in an upward phase, currently priced at 2572, and the buying intention is still higher than the selling side.

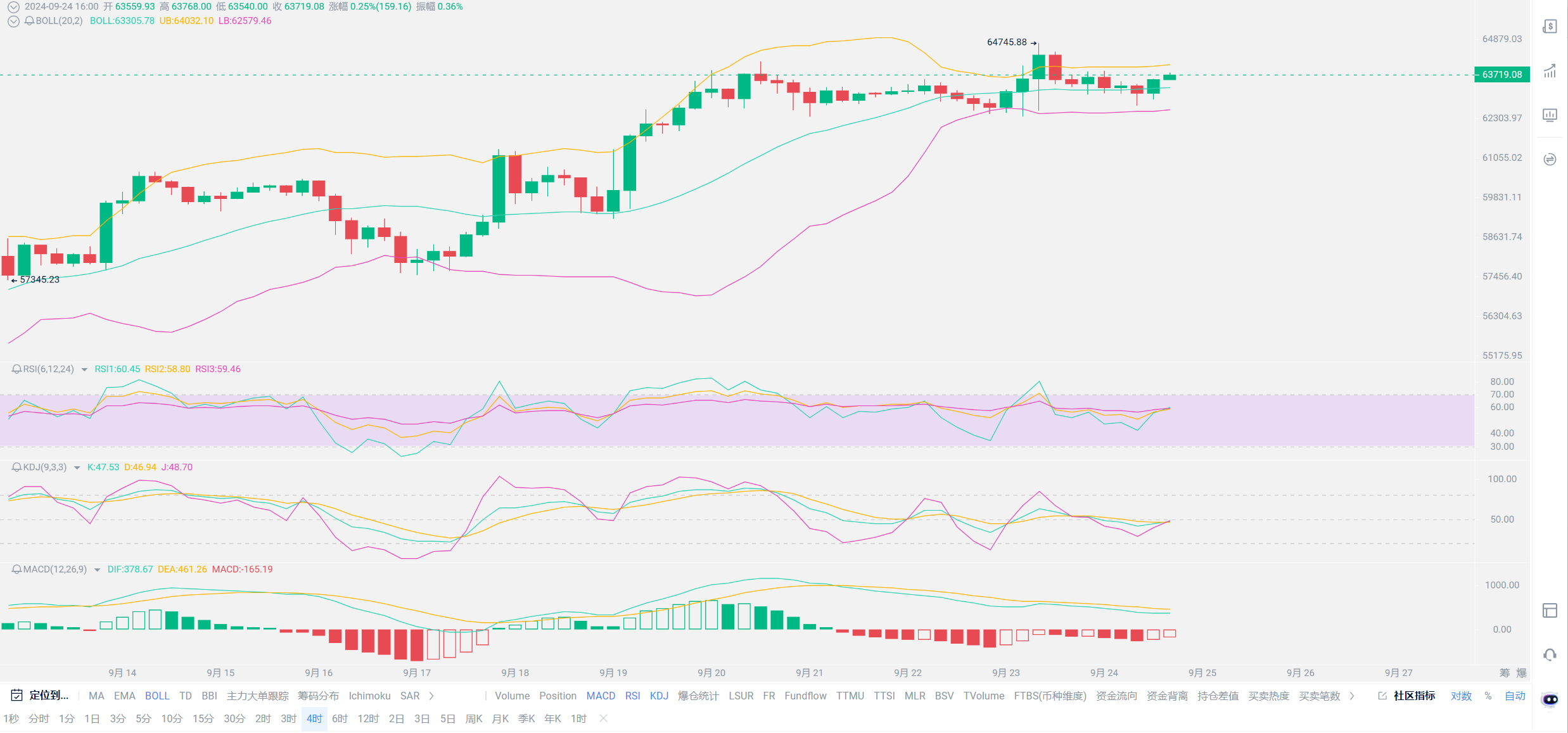

Today's Bollinger Bands show a completely different trend compared to the previous days, with the upper and lower bands showing a faintly outward opening trend. Once formed, it is feared that the bullish market will continue. The current market price is between the middle and upper bands, with a distance of nearly fifty points from the upper band, which further confirms the strong trend of the bullish market. The initial form of the moving average and Bollinger Bands basically confirms that the short-term bearish strength is not strong. The data of these two indicators further indicates that the stage of rebound after the high point has basically come to an end, and there may be another wave of growth next. So, for those who want to enter the market, seize the opportunity. The KDJ three lines are all within normal values, with no signs of overbought or oversold, and the RSI three lines are more stable, almost hovering between 50-70. From a technical perspective, the market trend is relatively clear, and the bulls have an absolute advantage.

Next, let's look at the news aspect. Today, the violent growth of AICoin was stimulated once the interest rate cut and reserve requirement cut were announced. Everyone should not look at the trend of the currency circle. This kind of growth trend tends to indicate that the domestic economic strength still exists, with transaction volumes reaching billions and the growth rate being considerable. The ultimate hero is still attributed to the interest rate cut strategy of the United States. This point proves Lao Cui's previous speculation that due to the 50 basis point interest rate cut by the United States, the outflow of funds will almost not have a time difference and can be directly injected into the financial market, indicating signs of improvement in the global economic situation compared to before. Everyone needs to pay attention to the price trend of gold. Although gold has surged once recently, after the interest rate cut, the overall outflow of funds is still very obvious, and a downturn has appeared in the past two days. So, for those who hold gold, remember to observe it more. The overall improvement in the economic situation is particularly evident in gold. As long as the financial situation improves, gold will definitely depreciate. Conversely, social unrest will cause gold to remain high. The point to be made here is that the outflow of funds from gold is a good thing for the currency circle, including the decline, which is good news for the entire financial environment. Be careful of major events if the growth continues.

Since we've come to this point, Lao Cui always reminds everyone during the big rise that the interest rate cut in September will indeed bring about a wave of growth, but one thing to be vigilant about is that there is no interest rate cut plan in October. Historically, usually when the interest rate is cut by fifty basis points, there will be no plan for an interest rate cut in the next month, which will create a one-month window period, and a lot of funds will wait for the low point of the interest rate cut before flowing out a certain amount of funds. This also creates a period of stagnation in the entire bull market process, and this period of stagnation will cause the market to move sideways. If the supply of funds cannot keep up, it may cause even worse effects, such as retaliatory decline. The nature of the entire financial market is particularly in line with public opinion, so from October to November before the interest rate cut, everyone needs to pay attention to a deep pullback. This is something that contract users need to worry about. For spot users, it can be completely ignored, and the depth of the pullback will not reach our entry point.

Lao Cui's summary: Every time the market has already made a move while I am still thinking about it. For the technical analysis, many values are still not matching up. I hope everyone can understand. This article was still being written in the morning, and a wave of growth has already occurred before it was finished. The bullish market has not changed, so I still want to share it with everyone. From a technical and news perspective, today has officially entered a bullish sentiment. The analysis from yesterday also rose to the 2700 level. The short-term target of 2700 is definitely stable. For the future market, the ideal position for spot users is still after 3000, so spot users do not need to rush to exit in the near future. The most concerned topic today is the interest rate cut and reserve requirement cut in China, which will not affect our currency market. Everyone just needs to pay attention to the assets of domestic entities. This round of opportunities for those who need to untie their positions has also been given. As for the real estate market, Lao Cui's judgment is basically the same as Goldman Sachs's. If you can sell, try to do so. Going too far, contract users have had a large fluctuation recently. If you need to enter the market, you can ask Lao Cui. Personally, I am mainly bullish. It is difficult for the current Ethereum market to have a pullback depth of 150 points. Everyone can use it as a stop-loss point.

Lao Cui's message: Investment is like playing chess. Masters can see five steps, seven steps, or even a dozen steps ahead, while those with lower skills can only see two or three steps. The high-level players consider the overall situation and plan for the general trend, not focusing on individual moves or territories, but aiming for the ultimate victory. The lower-level players fight for every inch, frequently switching between long and short positions, only fighting for short-term gains, and frequently end up in trouble.

This material is for learning and reference only and does not constitute investment advice. Buying and selling based on this material is at your own risk!

The article is time-sensitive. If there is any infringement, you can search for the public account "Lao Cui Shuobi" to contact the author!

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。