Coinbase, Binance, and Bitfinex are the top three.

Author: Jamie Redman

Translator: Luffy, Foresight News

Over the past decade, a large amount of Bitcoin has flowed into centralized exchanges, listed and private companies, governments, exchange-traded funds (ETFs), and derivative token projects such as WBTC. This article will analyze in depth the top ten entities holding the most Bitcoin.

Investigating the top ten Bitcoin holders

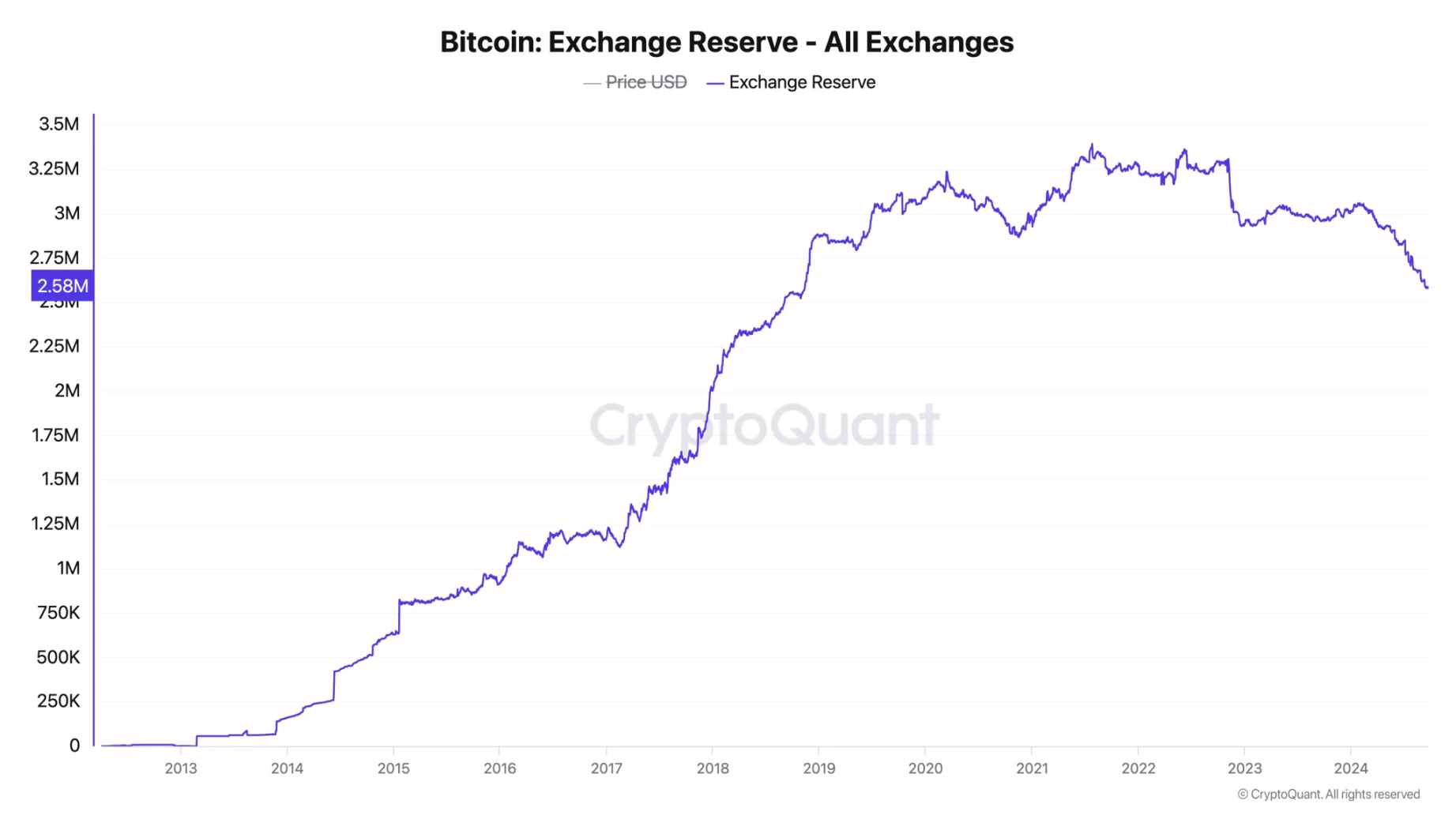

According to data from Cryptoquant, centralized cryptocurrency exchanges currently hold approximately 2,581,607.09 BTC. From a trend perspective, the amount of Bitcoin held by exchanges has been declining since 2022, but it still exceeds the amount held by exchanges during the period of 2015-2017. On January 1, 2017, the Bitcoin stored on these platforms, as recorded by Cryptoquant, was only 1.17 million BTC. In addition to exchanges, the amount of Bitcoin held by ETFs, DeFi projects, governments, private and listed companies has been increasing since 2020.

The amount of Bitcoin held by centralized exchanges

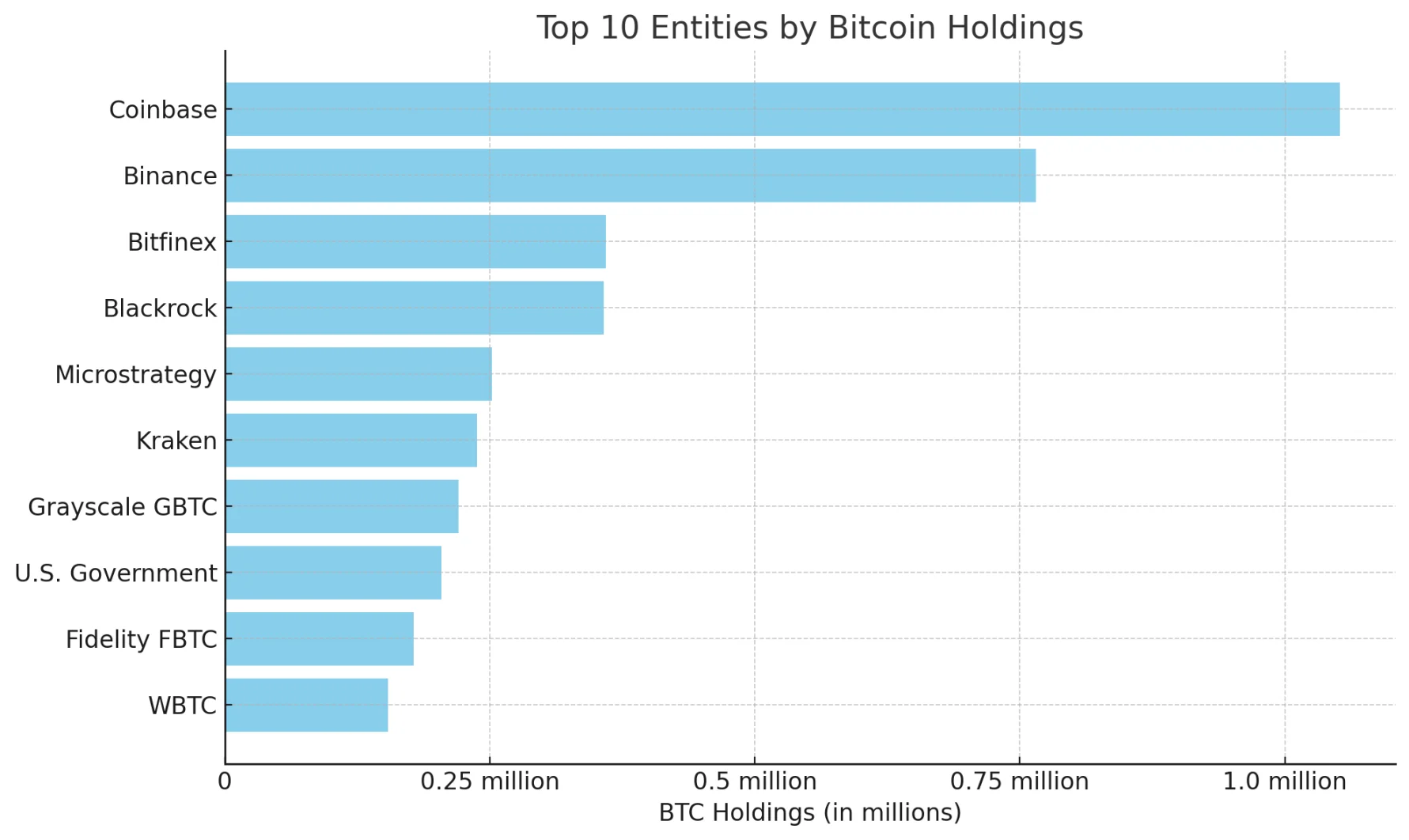

After researching the untapped Coinbase block rewards from 2009 to 2012, as reported by Bitcoin.com, we decided to conduct an in-depth analysis of the top ten Bitcoin holding entities. Similar to previous research, this study used data from timechainindex.com, but our research does not include untapped block rewards and unknown individuals referred to as "X". The entities studied include centralized exchanges, governments, companies, and ETPs. The data shows that as of September 22, 2024, Coinbase is the largest entity holding Bitcoin.

Coinbase holds a total of 1,051,650.41 BTC across 145,491 addresses, valued at 66.4 billion USD. Binance is the second largest Bitcoin holder, with 765,072.92 BTC held across 120,528 addresses. Bitfinex is the third largest holder, with the exchange holding 359,687.52 BTC across 2,161 wallets. Ranking fourth is BlackRock, which holds 357,550.21 BTC across 760 addresses. It is worth noting that BlackRock's Bitcoin is held by Coinbase Custody.

Data source: timechainindex.com and Microstrategy

According to Microstrategy, the company holds 252,220 BTC, ranking it fifth in terms of holdings, behind BlackRock. However, our research data only counts the 213,996.14 BTC held by Microstrategy in 501 wallets. Kraken ranks sixth, holding 237,900.9 BTC, stored across 78,023 wallets. The seventh largest Bitcoin holder is Grayscale's GBTC, holding 220,439.82 BTC, also custodied by Coinbase Custody.

The US government ranks eighth, holding 204,302.34 BTC across 125 different wallets. Fidelity's FBTC fund uses its own custody solution to store Bitcoin, holding 178,191.25 BTC across 562 wallets. The last and tenth largest Bitcoin holder is the WBTC project, which reserves Bitcoin in a 1:1 ratio and then mints derivative ERC20 tokens, with its Bitcoin stored across 948 wallets.

The distribution of Bitcoin among the top ten holding entities highlights the growing institutional interest in this asset. It also indicates that many users are still using CEX platforms to trade and store their Bitcoin. As Bitcoin gradually integrates into various fields from governments to listed companies, it highlights the current shift from individual ownership to larger, more centralized holdings. This trend may impact the future liquidity and accessibility of Bitcoin, especially as the trend of ETFs and institutional custody solutions continues to expand.

CEX holdings dominate the top three, users should be aware of the risks

It is important to emphasize that although Coinbase custodies two-thirds of the Bitcoin held by US ETFs and the top three exchanges manage the largest Bitcoin reserves, most of these assets belong to retail investors and high-net-worth individuals. These funds are customer assets, but exchanges still have 100% complete control over them. If there is misconduct and their cold wallets are stolen, the exchanges either compensate the customers or go bankrupt, leaving users to bear the consequences of their mismanagement.

This is why it has been recommended for over a decade to use non-custodial wallet solutions, which allow users to have complete control over their funds. While exchanges are suitable for trading, many exchanges have been hacked since the emergence of cryptocurrency exchanges, and misconduct continues to occur. For safety reasons, it is advisable for users to only keep funds they can afford to lose on exchanges for trading, while storing the rest of their digital assets in non-custodial wallets.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。