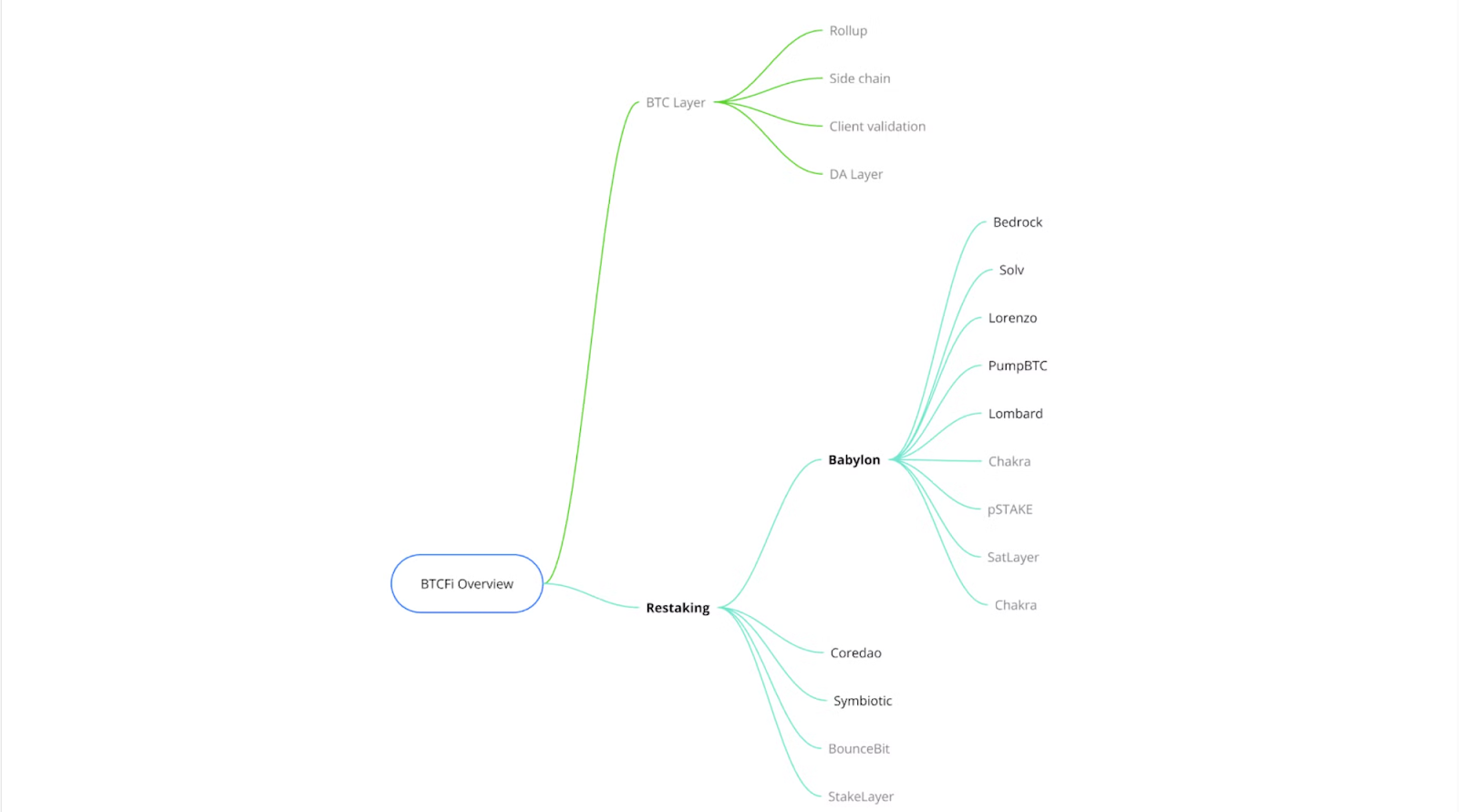

Bitcoin has been limited in its potential for applications in terms of earnings due to its proof of work (PoW) consensus. Unlike proof of stake (PoS), Bitcoin lacks a native staking mechanism. However, with the rise of BTCFi, new methods are gradually emerging, allowing Bitcoin to generate income without sacrificing security. The BTCFi ecosystem is roughly divided into two parts: the BTC layer and heavy staking, as well as asset protocols such as ARC20 and BRC20. This article will explore how emerging participants in the BTCFi field are reshaping the landscape of Bitcoin staking and compare their main advantages.

Current Landscape of Bitcoin Staking

Bitcoin staking is not a new topic in this cycle. There are well-known projects such as BounceBit, Coredao, Stakelayer, as well as Babylon and Symbiotic, which have recently received widespread attention.

First, let's analyze Babylon's solution. Babylon's Bitcoin staking scheme includes multiple innovations aimed at enhancing security and user experience, making it stand out among many protocols:

Remote Staking: Babylon uses Bitcoin's UTXO model and script system for staking, slashing, and reward distribution. A significant advantage is that users staking Bitcoin do not face the risk of slashing penalties, only node operators are affected. This means that users' Bitcoin is not at risk of loss, but they cannot unlock staked funds early, resulting in higher security.

Timestamp Server: Babylon's timestamp server records events from the PoS chain on the Bitcoin mainnet, providing tamper-resistant timestamp records. Although the Bitcoin mainnet ensures that these records cannot be changed once they are on-chain, the accuracy of the timestamps still depends on Babylon's PoS network.

Three-Layer Architecture: Babylon's architecture is divided into three layers—Bitcoin as the base layer, Babylon as the middle layer, and the PoS chain as the top layer. Babylon records checkpoint records from the PoS chain on the Bitcoin blockchain, ensuring the immutability of the data. By using Cosmos as the middle layer, it enhances its scalability and flexibility, attracting node operators and enabling native Bitcoin staking to support Babylon's PoS network.

Although Babylon is a leader in the native Bitcoin staking field, it is not the only protocol exploring heavy staking. Let's take a look at the Bitcoin staking schemes of two other star projects:

Symbiotic: Founded by Lido and Paradigm, Symbiotic is considered a direct competitor to EigenLayer. Symbiotic recently announced support for Bitcoin heavy staking, but currently only accepts WBTC staking. Unlike the native Bitcoin staking offered by Babylon, Symbiotic requires users to transfer Bitcoin to a third-party custody address. So far, Symbiotic has staked 1,630 WBTC and incentivized user participation through point rewards.

CoreDAO: CoreDAO offers two staking methods: one is native staking, allowing Bitcoin holders to delegate Bitcoin to Core validators without transferring funds; the other is custodial staking, where users send Bitcoin to a locking address and mint coreBTC on the CORE chain. Currently, CoreDAO only supports the custodial staking option.

All three aim to bring more use cases to the Bitcoin ecosystem, sparking cross-chain communication or data sharing between Bitcoin and other chains. The staking platforms themselves share the security of the underlying network through modular thinking and empower AVS upwards, providing infrastructure for a wide range of applications, significantly improving the efficiency and performance of the blockchain.

Advantages:

Babylon and CoreDAO shorten the staking process of the PoS chain through Bitcoin's timestamp mechanism.

Symbiotic has the support of Lido and Paradigm, giving it an advantage in protocol collaboration and ecosystem advancement.

Babylon is the first to achieve native staking, achieving trustless staking on Bitcoin.

Disadvantages:

CoreDAO and Symbiotic still rely on third-party custody to address trust assumptions.

Babylon's PoW+PoS architecture has security logic shortcomings and can only passively rely on the Bitcoin network to achieve accounting functions, unable to actively utilize the security of the Bitcoin network.

Unlike Ethereum's staking platforms, Bitcoin's staking platforms do not directly transfer the security of the Bitcoin network to their respective PoS networks, which is also a key direction for future development.

Bitcoin Staking Ecosystem

Several protocols have partnered with the Bitcoin staking ecosystem, aiming to enhance the liquidity and utility of staked Bitcoin assets:

Bedrock: As the lead project in the first round of pre-staking for Babylon, holding about 30% of the shares, Bedrock supports staking WBTC to mint uniBTC. After the launch of the Babylon mainnet, users will be able to earn rewards from uniBTC and Babylon staking, and may receive airdrops through Bedrock's Diamonds program.

Lombard: Lombard allows users to stake Bitcoin through Babylon, with Lombard managing the heavy staking process. When users stake Bitcoin, Lombard mints an equivalent amount of LBTC on Ethereum. Users can use LBTC to participate in DeFi activities, enjoying the flexibility of cross-chain earnings.

Lorenzo: Lorenzo provides liquid staking and heavy staking through a principal-revenue separation model, allowing users to stake Bitcoin or BTCB to obtain stBTC (liquid principal tokens) and YAT (revenue tokens). This dual-token system allows users to accumulate Lorenzo points while receiving Babylon's native staking rewards.

Pell Network: Pell is the first secure network built on Bitcoin heavy staking and operates on Babylon's AVS network. Pell's TVL has exceeded $200 million in three weeks, with over 410,000 unique addresses. Pell offers four heavy staking methods, covering native Bitcoin staking to staking LP tokens containing liquid BTC derivatives, and its AVS architecture allows it to capture significant income from middleware, oracles, modular chains, and other areas.

PumpBTC: Allows users to stake WBTC or BTCB and receive pumpBTC tokens at a 1:1 ratio. What sets PumpBTC apart is that the heavy staking process is handled by third-party custodians (such as Cobo and Coincover). Users can enjoy earnings without directly interacting with the protocol, simplifying the staking process.

Solv Protocol: Solv has developed a cross-chain Bitcoin asset liquidity layer, supporting cross-chain bridging of WBTC on Arbitrum, BTCB on the BNB chain, and BTC.b on Avalanche. Users can earn XP points by holding solvBTC, participating in lending protocols, or adding liquidity to pools. Additionally, even though the Babylon mainnet has not yet launched, users can bridge to Babylon through Solv's vault to earn more points.

Stakestone: Expected to adopt a model similar to ETH-STONE, users stake native Bitcoin to Babylon and mint revenue-based STONEBTC for cross-chain liquidity. Users can earn points from various ecosystems, such as 2x Scroll points.

Conclusion

Transforming Bitcoin into an income-generating asset is of great significance. Bitcoin heavy staking is an effective complement to the definition of Bitcoin as "digital gold," greatly enhancing its liquidity. Unlike the Ethereum ecosystem, BTCFi protocols such as Babylon, Symbiotic, and CoreDAO do not rely on pre-existing infrastructure, which brings both challenges and opportunities. Platforms like Solv, Lombard, and Lorenzo are gradually developing, focusing on multiple rewards, security flexibility, and dual incentive systems. BTCFi is still in its early stages, with rapid technological and ecosystem development, and we will continue to monitor the dynamics in this area.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。