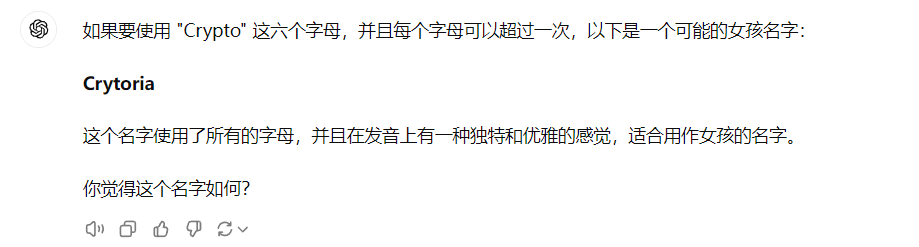

I used ChatGPT to bring in two more characters, and then see if it matches what you imagined.

If the term "会所" in the article refers to a cryptocurrency exchange, and "Crytoria" refers to a KOL (Key Opinion Leader) in the cryptocurrency market, then the story can be interpreted as how KOLs survive, grow, and seek power and wealth in the cryptocurrency market through influencing market and investor decisions within the ecosystem of the exchange. Here is a specific analysis:

Symbolic Meaning of "会所" (Cryptocurrency Exchange)

In this context, "会所" represents cryptocurrency exchanges, which are the main venues for interaction among project parties, investors, and KOLs in the market. Exchanges are not only trading platforms for cryptocurrency assets, but also the core venues that influence market liquidity, price fluctuations, and market sentiment.

Exchanges ("会所") have the following characteristics:

Central hub for high exposure and liquidity: Cryptocurrency projects and assets gain market exposure, trading liquidity, and investor attention by being listed on exchanges. Like a "会所," exchanges are the main venues for interaction among various projects, investors, and influencers (such as KOLs), and every action of market participants can affect prices and market sentiment.

Platform for centralized information and resources: Exchanges are the core of information and capital flow in the cryptocurrency market. Whether it's listing projects, token trading, or large-scale market fluctuations, exchanges are crucial for information dissemination and capital transfer. The messages, market analysis, and trading recommendations published by KOLs here can quickly influence market sentiment.

Coexistence of speculation and long-term value: Just as there are people pursuing short-term sensory enjoyment in a "会所" and others seeking long-term partners, exchanges accommodate both short-term speculators and long-term investors. Exchanges are breeding grounds for speculative activities in the cryptocurrency market, with sharp price fluctuations. KOLs can manipulate market sentiment, spread news or analysis, drive short-term price movements, attract speculators, or trigger market panic.

Symbolic Meaning of "Crytoria" (KOL in the Cryptocurrency Market)

In this story framework, "Crytoria" symbolizes KOLs in the cryptocurrency market. KOLs are core figures who influence investor decisions through social media, content creation, market analysis, and other means, especially within the exchange ecosystem, where their voices and opinions can sway market trends. In this system, Crytoria enhances herself through knowledge, skills, and social influence to gain more market influence and wealth.

Roles of KOLs (Crytoria):

Information disseminator and influencer: In the "会所," Crytoria wins favor by interacting with guests and providing emotional value. In the cryptocurrency market, KOLs play the role of information disseminators and market influencers in exchanges by publishing market analysis, trading recommendations, project reviews, and other content. Their statements can influence token prices, project exposure, and investor confidence in exchanges.

Controller of market sentiment: KOLs manipulate market sentiment. They can influence investor judgments by exaggerating, amplifying, or suppressing certain market information. For example, KOLs may create market panic or greed through Twitter, YouTube, or live streaming platforms, triggering short-term market fluctuations in exchanges. Crytoria gains favor with guests through careful emotional manipulation in the "会所," while KOLs in the cryptocurrency market drive market fluctuations through emotional management.

Acquirer of power and capital: In the cryptocurrency market, KOLs receive returns on their influence. Projects and exchanges are willing to pay them tokens or commissions in exchange for their promotion and publicity. At the same time, KOLs also profit directly from market fluctuations through their market judgments and participation in trading or investment. Crytoria gains benefits by establishing long-term relationships with guests, while KOLs obtain substantial economic returns by influencing market sentiment and guiding investor behavior.

Entanglement of interests with projects and exchanges: KOLs often have complex interests with cryptocurrency projects and exchanges. Projects hope KOLs will promote their tokens, while exchanges hope KOLs will increase market activity and attract more traders and liquidity. This multi-party relationship is similar to the complex interactions between Crytoria, the management of the "会所," and guests. KOLs not only need to maintain independence from the market and preserve their credibility, but also need to obtain economic benefits through various forms of cooperation.

Dependence on market fluctuations and hotspots: Crytoria's income depends on guest flow and market competition in the "会所," and similarly, the influence and income of KOLs depend on cryptocurrency market fluctuations. KOLs often seize market hotspots, participate in short-term speculation, and create public opinion to gain more exposure and opportunities. The greater the price fluctuations and trading volume of cryptocurrencies, the more valuable KOLs' voices become, and their influence grows accordingly.

Crytoria's Strategies: Operating as a KOL

As a KOL in the exchange ecosystem, Crytoria has adopted various strategies to enhance influence, gain wealth, and survive in the complex market environment.

Learning knowledge and market analysis, in-depth content creator: Crytoria enhances herself through learning about wine tasting and traditional Chinese medicine. Similarly, KOLs in the cryptocurrency market must continuously improve their market analysis and technical knowledge. Excellent KOLs create valuable content by conducting in-depth market analysis, technical evaluations, and trend predictions, attracting a larger following. Such KOLs' content not only serves as a "gimmick" but also helps investors make wiser investment decisions.

Influencing the market through social media, master of emotional management: In the "会所," Crytoria relies on emotional interaction and social relationships. Similarly, KOLs in the cryptocurrency market rely on social media to stay connected with investors. Through platforms like Twitter, YouTube, and Telegram, KOLs can quickly release market analysis or opinions, triggering market sentiment fluctuations. KOLs' social media strategies determine the scope of their influence and their position within the exchange ecosystem.

Market manipulation and trend guidance, mastering market sentiment: Crytoria's success comes from her precise grasp of guests' emotions, and similarly, the success of KOLs in the cryptocurrency market stems from their control of market sentiment. By capturing market hotspots and amplifying positive or negative news about projects, KOLs can create short-term market fluctuations and guide investors' buying and selling behavior to profit from them.

Cooperation with exchanges and projects, mutual benefit: Crytoria maintains her position through cooperation with the "会所" and guests. Similarly, KOLs need to collaborate with projects and exchanges. Projects want KOLs to promote their tokens, while exchanges hope KOLs will bring more trading volume. Through such cooperation, KOLs not only receive rewards but also enhance their influence in the industry.

Branding and self-marketing, building long-term trust: Crytoria strives to build her brand image in the "会所," and similarly, KOLs must establish their own brand through content creation, event participation, and personal image building. An influential KOL not only needs sharp market analysis skills but also requires a unique style and brand value to stand out in the market competition.

Symbiotic Relationship Between Exchanges and KOLs

Mutual dependence: The relationship between KOLs and exchanges is one of mutual dependence. Exchanges need KOLs' influence to drive trading volume and attract new users, while KOLs need exchanges to provide liquidity and market hotspots to increase the value of their content. Cooperation between the two is usually achieved through commissions, token sharing, or event promotion for mutual benefit.

Driver of market fluctuations: KOLs drive short-term market fluctuations by influencing investor market sentiment. These fluctuations, in turn, attract more speculators to enter the market, increasing exchange liquidity. Therefore, KOLs are not only observers and commentators of the market but also drivers of market fluctuations.

Summary:

"会所" (Exchanges) are the core venues for capital and information flow in the cryptocurrency market, and KOLs influence market sentiment, disseminate project information, and drive market fluctuations through the platform of exchanges.

Crytoria (KOL) represents key opinion leaders in the cryptocurrency market, who, through their market analysis, social media influence, and cooperation with projects, seek economic returns and social recognition within the complex ecosystem of exchanges.

This post is sponsored by @ApeXProtocolCN | Dex With ApeX

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。