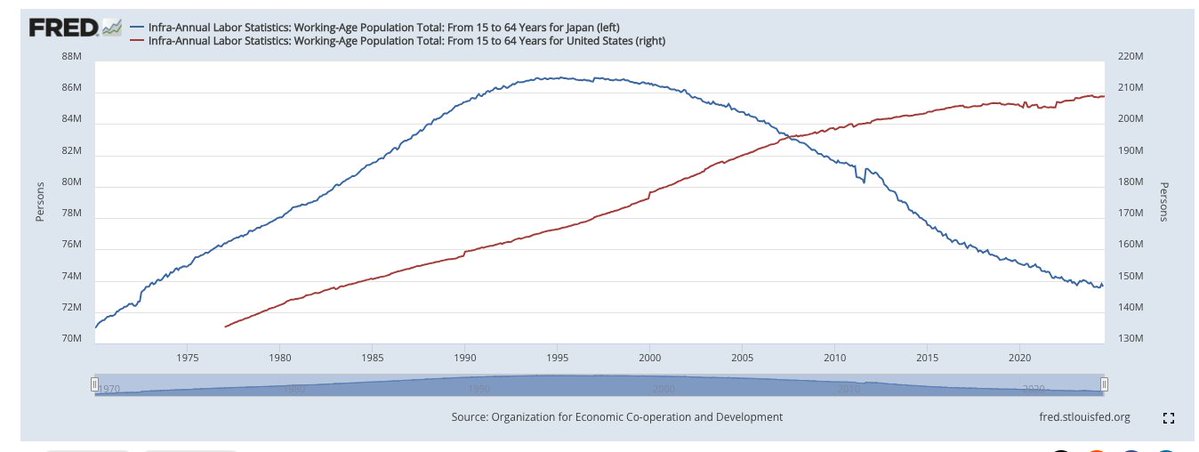

Another version of Japan's lost three decades is the decline in population - the decrease in the working-age population. As shown in (Figure 1), around 1995, Japan's working-age population peaked and then gradually declined. This can be further divided into two steps: from the 1990s to 2011, the economic slowdown in Japan was mainly due to the decline in population, with per capita income basically on par with the United States. However, since 2012, Japan's per capita income (calculated based on the working population) has also started to decline, creating a gap with the United States.

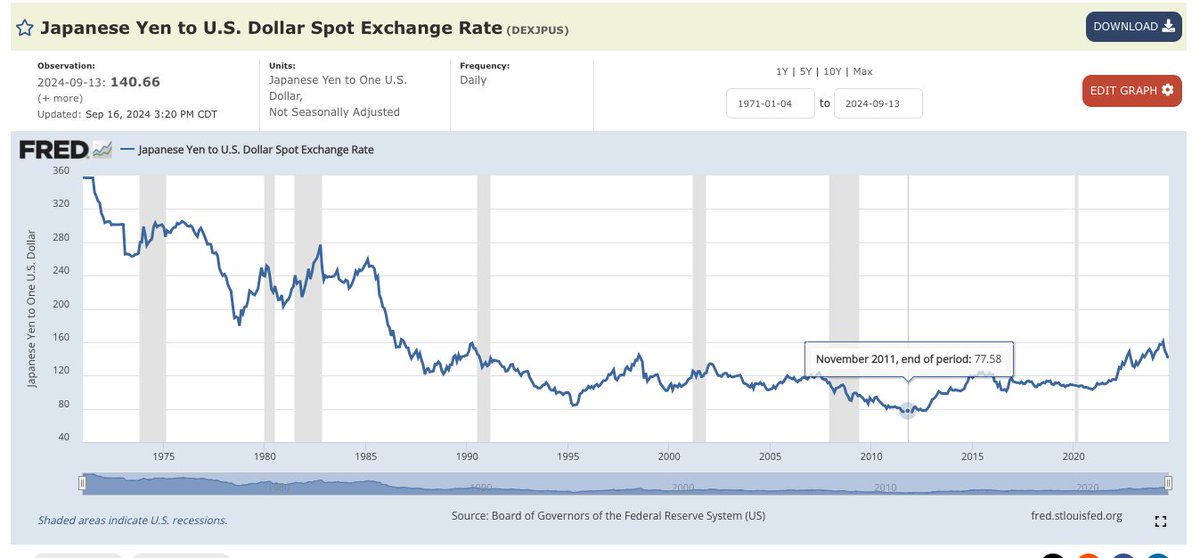

What happened in 2012? Shinzo Abe came to power and promoted "Abenomics," which essentially involved loose monetary policy and initiated the depreciation of the yen (Figure 3, with the exchange rate at 77 at the end of 2011). Therefore, from the results, it can be seen that loose monetary policy did not rescue Japan from the earlier population-led economic slowdown; instead, it suppressed the wages of young people and reduced Japan's per capita output.

The logic here is that young people have no assets, while the elderly have assets and can exchange them for US dollars, so the elderly can preserve their wealth, while young people are increasingly becoming corporate slaves. Consumption in society relies on young people, as the elderly, with no future, are unwilling to consume and have no desire to consume - most of them are impotent 😂.

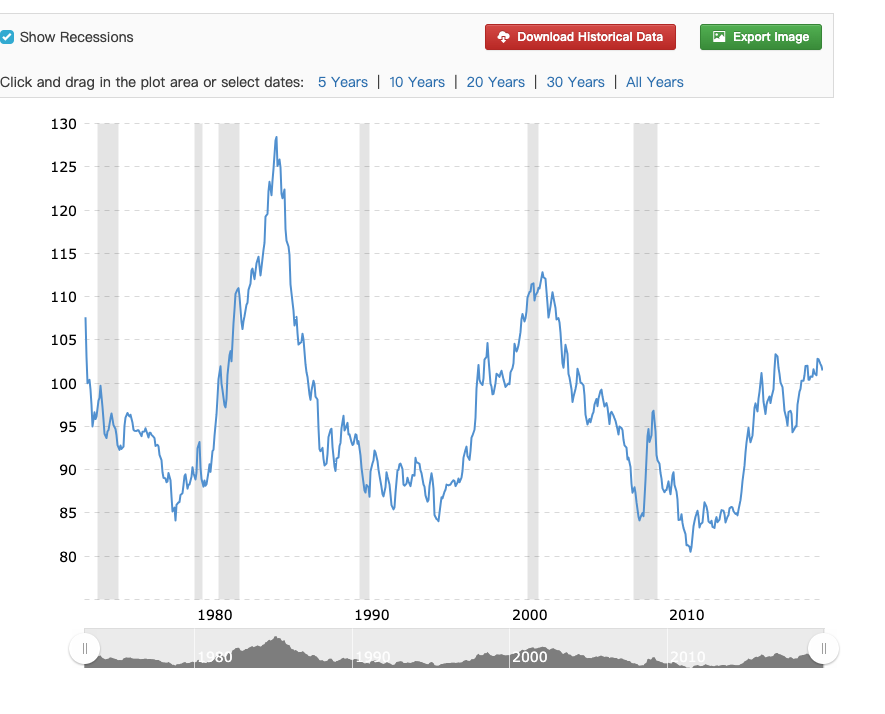

In contrast, the United States saw its currency rise from the bottom in 2011. Under this model, young people earning wages have a larger income distribution, which also supports the entire economy. Of course, exchange rates and the economy are two sides of the same coin. Ultimately, the United States follows a positive cycle of population => economy => strong currency => strong economy, while Japan is the opposite.

China's peak labor force population appeared around 2016 and has gradually declined since then. However, China has an advantage in that its urbanization rate is only 66%, compared to Japan's urbanization rate of 78% in 1995. This 12% gap should provide some impetus for China's development.

Furthermore, it is important to learn from Japan's lessons. Not to mention strengthening the currency, at the very least, China should not have a weak currency like the yen. The essence of a weak currency is to exploit young people, support the elderly, and support big capital.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。