Original Title: "The Evolution of Prediction Markets - Castle Research Report on Understanding Polymarket and Azuro"

Authors: Atomist, Mooms, and Francesco, castlecapital

Compiled by: Arain, ChainCatcher

Original Link: https://chronicle.castlecapital.vc/p/evolution-of-prediction-markets

The future is essentially unpredictable. Throughout history, humans have been trying to predict it through bets or strategic actions involving money.

Will it rain tomorrow?

Will my enemy launch an attack today?

For a long time, making these predictions has been a matter of life and death.

Historically, most of these markets have been "closed," either centralized or managed by third parties. This means that participants had to adhere to predefined rules without the ability to create their own markets or set their own conditions.

The emergence of cryptocurrencies provided an opportunity to move these markets onto the chain, making them truly decentralized and resistant to manipulation.

Unlike centralized markets where users trade with "bookmakers," decentralized prediction markets allow users to trade with other users betting in the opposite direction.

Since the launch of Augur in 2015, prediction markets have become a significant use case for cryptocurrencies, even mentioned in the Ethereum whitepaper.

However, they only recently gained mainstream attention.

Prediction markets have experienced unprecedented growth in all indicators, finding product-market fit (PMF) in speculation around events such as the launch of Ethereum ETF and the results of the US elections.

This report aims to provide a comprehensive overview of the prediction market landscape, introducing the concept, highlighting historical use cases, examining the current technological level, and delving into two leading platforms, Azuro and Polymarket, to explore the future potential of this field.

We believe this will be a winner - are you willing to bet on it?

Between Gambling and Cryptocurrencies: The Importance of Prediction Markets

Prediction markets are one of the most fascinating applications of cryptocurrencies, allowing users to bet on various events on-chain.

Gambling has been rooted in human culture since the Stone Age.

By 3000 BC, the Sumerians had already started using six-sided dice for gambling.

For thousands of years, humans have gambled on almost anything.

With the proliferation of technology and the rise of digital natives, gambling has gradually shifted to online platforms, making online gambling a thriving industry.

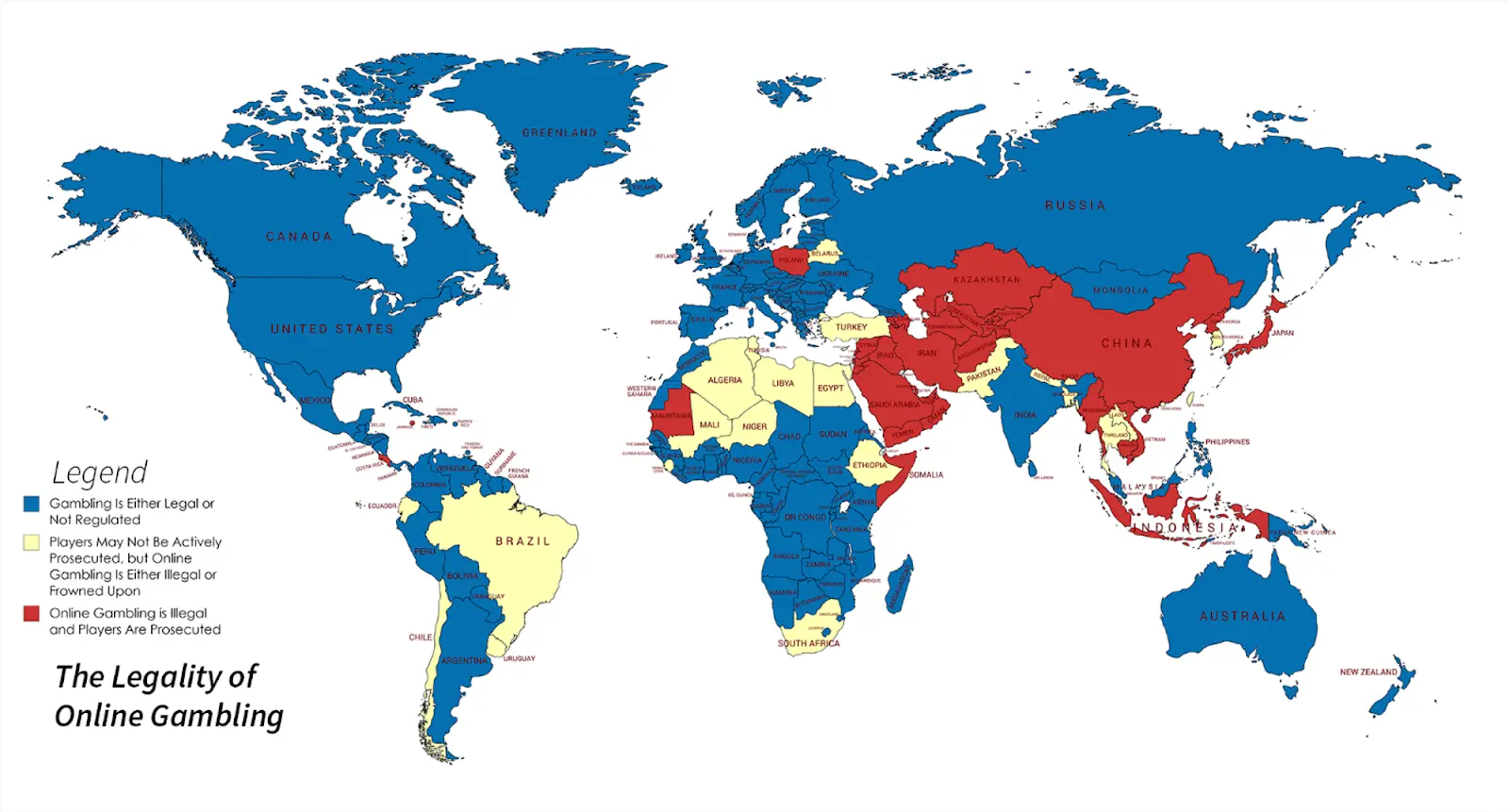

Source: Casinosenligne

The global gambling market is estimated to reach $773.7 billion in 2023 and is expected to reach $1 trillion by 2030, with a compound annual growth rate (CAGR) of 3.7% (2023-2030).

Within this broader field, the global online gambling market is projected to reach $100.9 billion in 2024, expected to grow at a CAGR of 6.20% to reach 281.3 million users by 2029, driven by several significant trends:

- Deteriorating global economic conditions

- Increase in digital native users

- Convenience and accessibility of online gambling

- Improved regulatory clarity

The Argument for Decentralized Casinos

Nearly one-third of the global population resides in countries where gambling is in a legal gray area or outright prohibited. Officially, these restrictions are intended to protect citizens from the risks of gambling. However, these restrictions have not solved the problem; instead, they drive individuals to unlicensed operators.

As a result, users face worse odds, higher fees, and significantly increased risks of being subjected to fraudulent or deceptive practices by unscrupulous operators.

To fill this gap, global online platform giants such as Rollbit and Stake have risen to become some of the most popular online gambling platforms within a few years, sponsoring influential celebrities, sports events, and teams - and did you know? They all accept cryptocurrencies.

In this context, prediction markets have found their place at the intersection of cryptocurrencies and gambling, aligning with the "decentralized casino argument" proposed by GCR.

Compared to other use cases of cryptocurrencies, prediction markets have less friction as they do not require users to understand all the nuances of how the system operates internally.

Users are already familiar with online betting, so transitioning to prediction markets is seamless, requiring minimal guidance and habitual changes.

About Prediction Markets

Before delving into the importance of prediction markets, it is crucial to introduce the concept. Prediction markets refer to platforms where users can bet on the outcomes of future events.

Their functionality is similar to futures markets, but they cover a wider range of topics, including assets prices, sports, politics, weather, and even the likelihood of your favorite cryptocurrency influencer being sentenced to prison.

Behind the scenes, prediction markets operate through smart contracts that encode the rules of each market, ensuring a fair and transparent system.

Users participate in the market by purchasing shares based on the outcome, valued at 0 (for incorrect predictions) or 100 (for correct predictions).

How do prediction markets work?

Users interact with decentralized applications (dApps) using stablecoins.

They place bets on the outcomes of events they believe may occur.

Based on the event's outcome, they either receive a return or lose the bet.

Prediction markets can be designed using order books (Polymarket) or automated market makers (AMM).

Prediction markets using order books (Polymarket) allow users to trade directly with other users, similar to traditional stock or futures markets.

Prediction markets designed using automated market makers (AMM) (Azuro) automatically match buy and sell orders through smart contracts without human intervention.

In order book-based prediction markets:

Users can choose market orders or limit orders.

Market liquidity is directly related to user activity and interest.

The order book provides transparency on the current bid and ask prices in each market.

In automated market maker (AMM) design:

Users are incentivized to provide liquidity to the pool, creating a "unified betting platform" covering all markets, and in exchange, they can earn a portion of the trading fees.

AMM adjusts the odds and defines prices and other conditions within the prediction engine.

The prediction engine determines all the logic for accepting bets, including payment allocation.

Based on their outcomes, markets can be categorized into various types:

Binary markets: Yes/No (e.g., Will Bitcoin reach $100,000 next month?)

Categorical markets: Multiple options (e.g., Who will be the next US president?)

Scalar markets: Range-based options (e.g., What will be the price of Bitcoin next month?)

History and Early Use Cases of Prediction Markets

Augur Protocol

Prediction markets are not a new concept in the cryptocurrency world.

They are one of the early use cases, and the Augur protocol and its token $REP are among the earliest examples.

Augur is a decentralized prediction market oracle network. Its initial token offering (ICO) took place in 2015, and its V1 version was launched three years later in 2018.

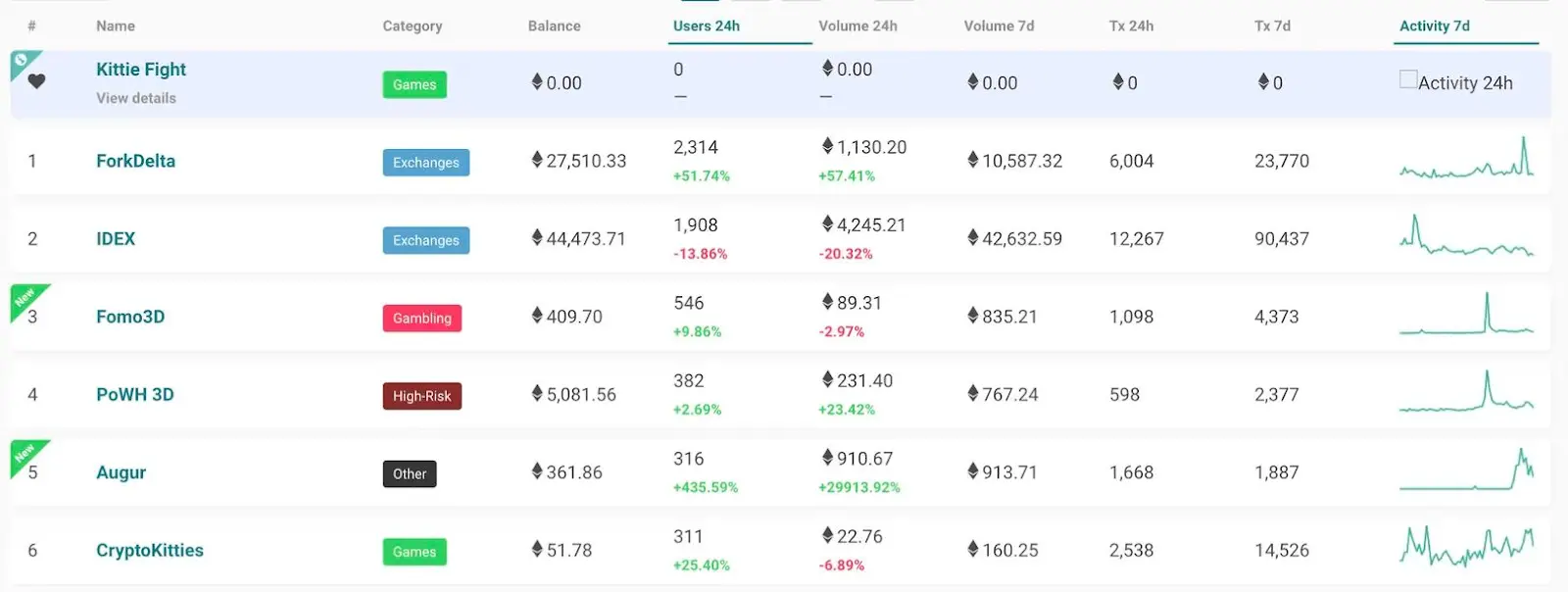

This anticipation led to a surge in users, making Augur V1 one of the most popular decentralized applications (dApps), surpassing even Cryptokitties in popularity.

Source: dappradar

Augur's goal is to solve a key problem in blockchain: how to transfer real-world data to the blockchain without relying on third parties, known as the "oracle problem." This solution allows users to bet on controversial markets, including murder.

In 2020, Augur V2 was launched, bringing several improvements:

- Peer-to-peer order book design

- Use of DAI as the base currency for trading

These improvements aim to enhance the transparency, efficiency, and user experience of the system. The peer-to-peer order book design allows users to trade directly with each other, while using DAI as the base currency provides more stability and predictability, as DAI is a stablecoin pegged to the US dollar.

Reasons for Augur's Failure

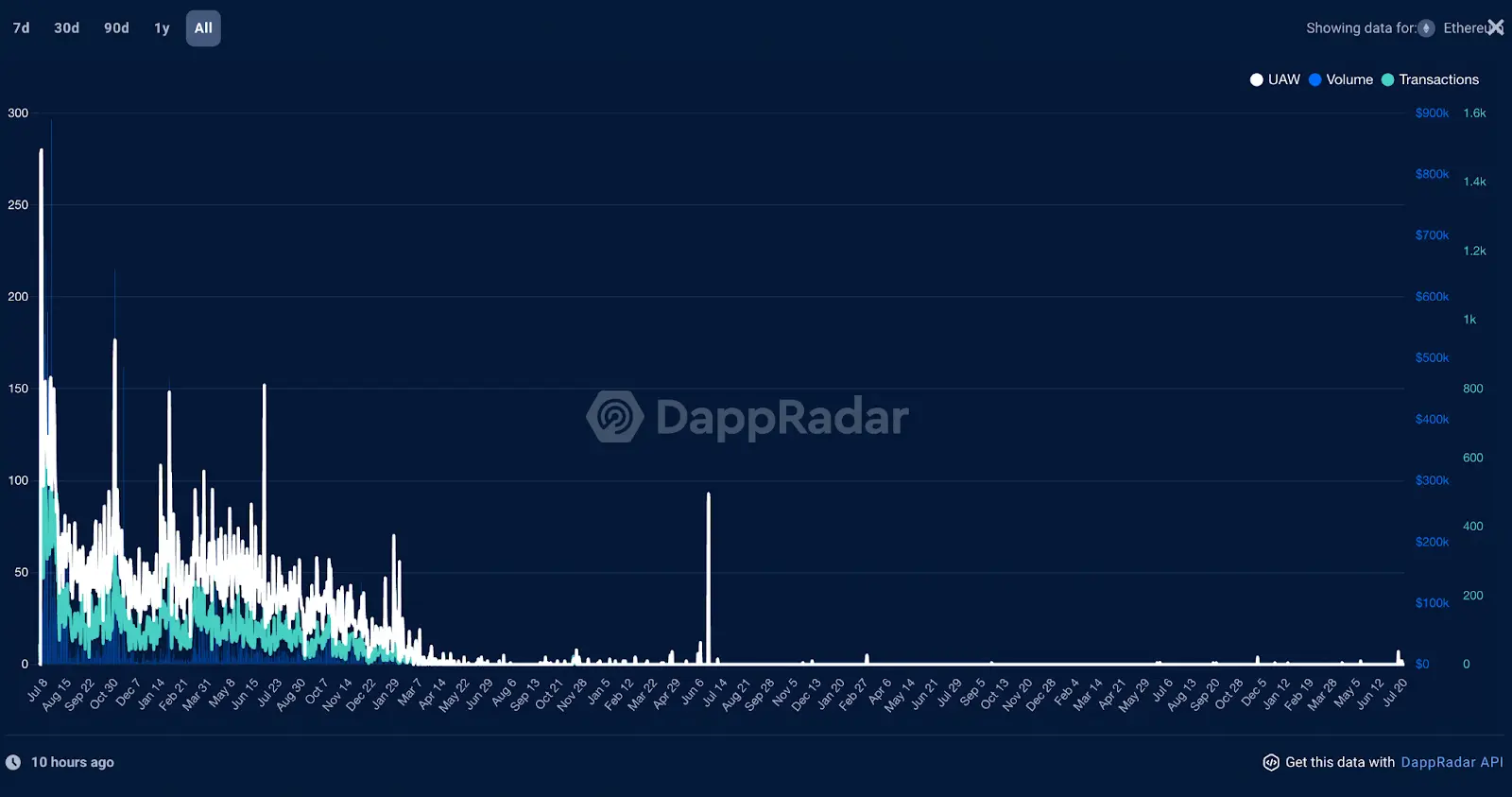

Despite these improvements, Augur still struggled to gain market acceptance, as reflected in the following data.

Historical trading volume:

Annual transaction volume:

Factors contributing to this outcome include:

Early entry: When Augur was launched, Uniswap V1 had not yet been deployed, and many of the current mechanisms providing liquidity did not exist. It was the era of Etherdelta. The platform's prediction markets also struggled to find a solid product-market fit (PMF) and often experienced a decline in usage after the initial excitement.

Accessibility: There was no easy way to access the platform. Users had to download the Augur app client and have a well-functioning Metamask wallet with an ETH balance.

Complexity: The platform's mechanisms and user interface were quite complex, leading to network issues and long connection times.

Limited market quantity: The limited number of available markets restricted user participation.

High GAS fees: Built on Ethereum, Augur's transactions were constrained by ETH GAS fees.

Prediction Market Industry

Industry Frontiers

Fast forward to 2024, the prediction market industry is experiencing unprecedented interest and growth.

The US election has become a significant catalyst for the prediction market industry, reflecting the increasingly close connection between cryptocurrencies and real-world events (such as ETF approvals and US candidates' political stances on Bitcoin).

Notably, a US presidential candidate mentioned decentralized prediction markets as a source of election data, highlighting the industry's growing relevance.

Prediction markets are now considered one of the most accurate ways to measure public sentiment on various topics. This increased attention has translated into increased trading volume and growing user interest.

Next, let's explore the current state of prediction markets through on-chain data and leading platforms, using Azuro and Polymarket as case studies.

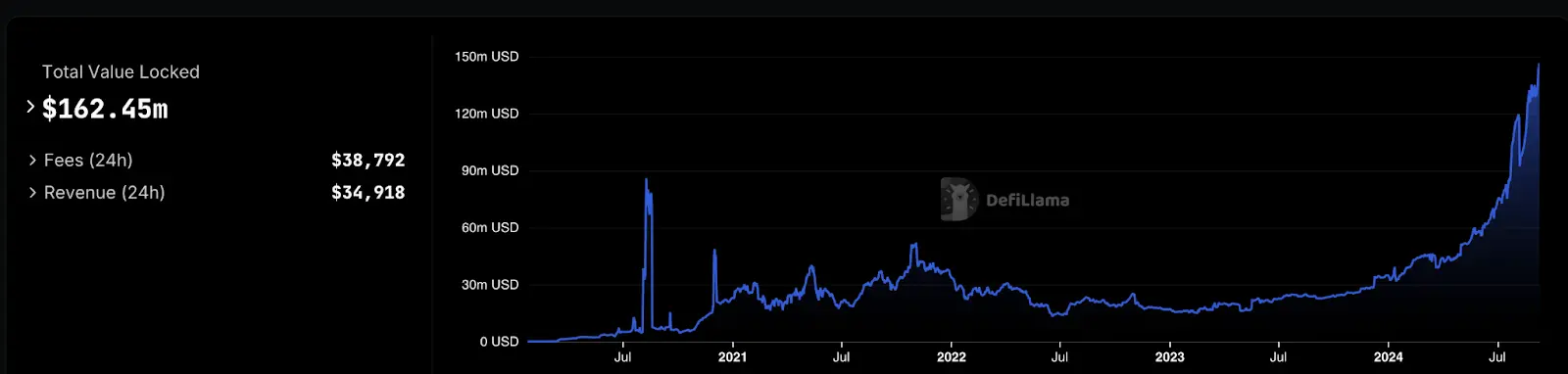

Understanding Prediction Markets Through Data

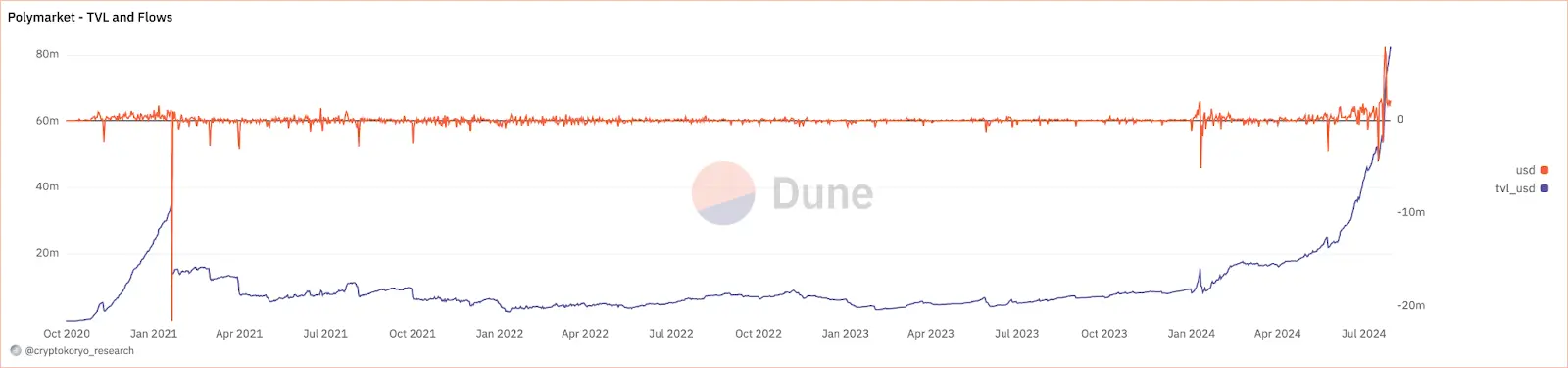

The prediction market industry holds a total value locked (TVL) of $162 million.

While the Defillama chart shows the industry's situation since its inception, most of the TVL accumulation occurred in 2024.

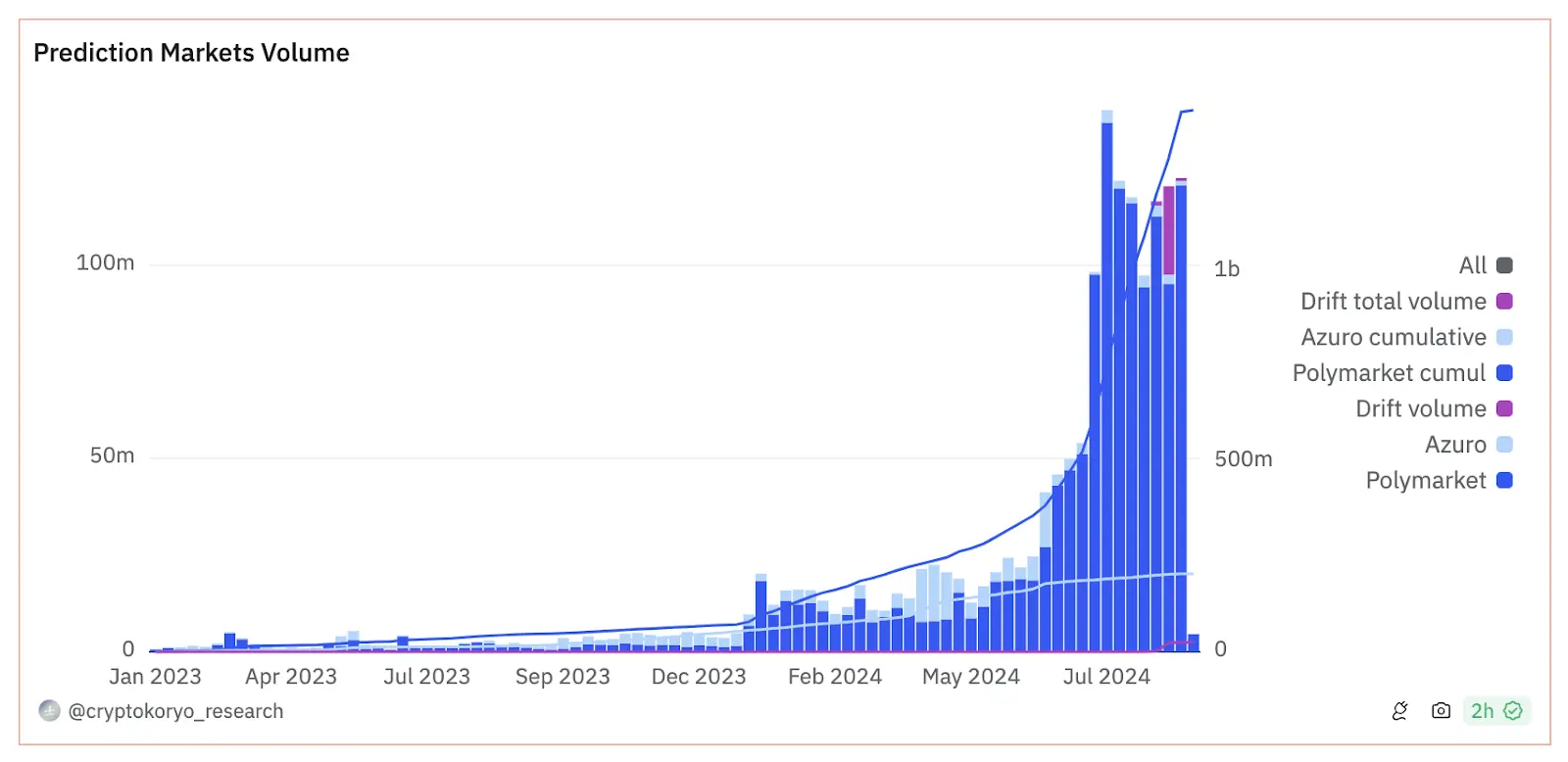

Similarly, the trading volume surged from a weekly high of $25 million before June 2024 to a weekly $183 million in August 2024, growing by over 7 times.

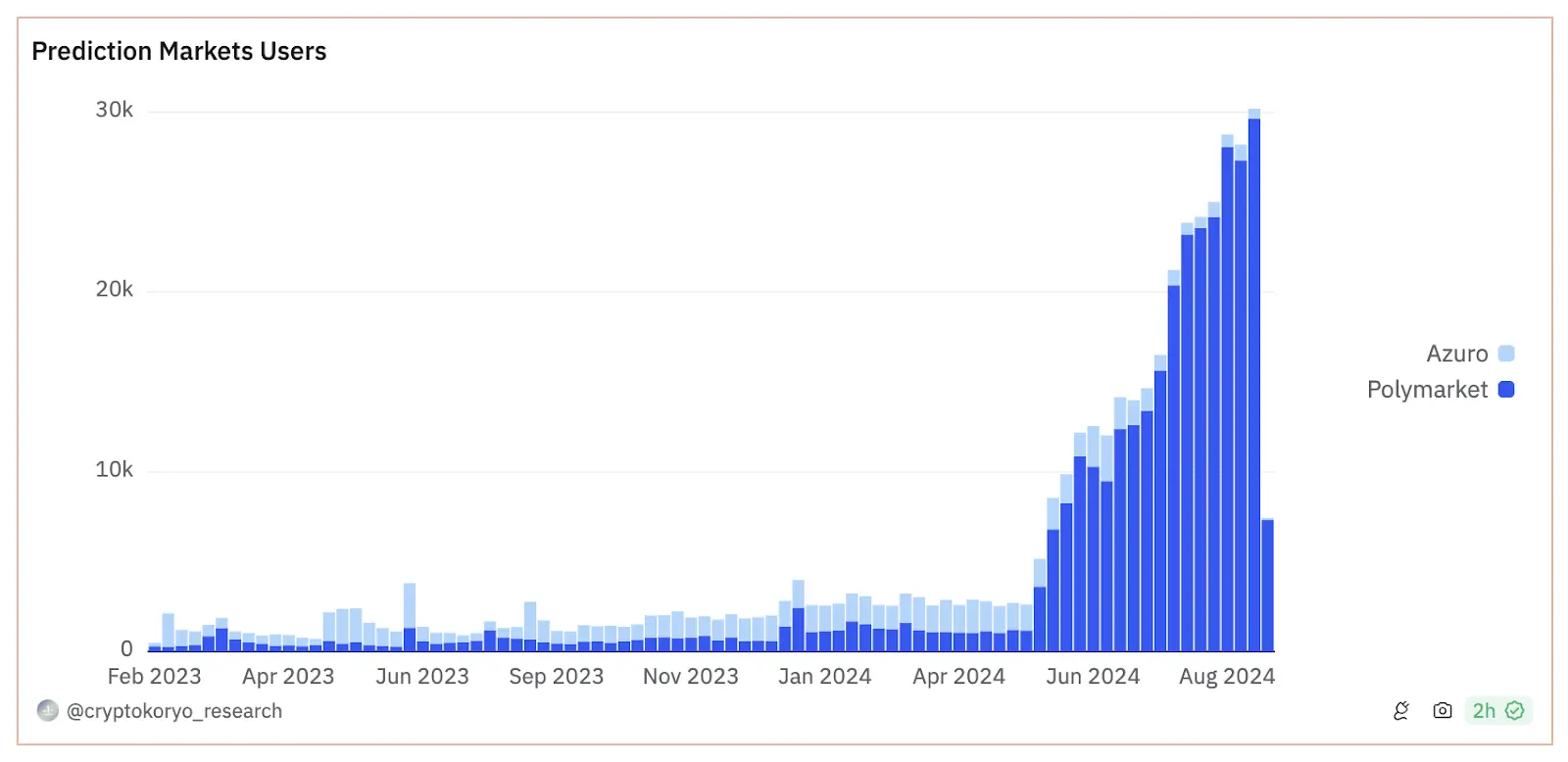

Due to their recent growth, approximately 30,000 users are participating in prediction markets daily, a significant increase from the average of 3,000 users before May 2024.

This growth aligns with the increase in daily trading volume, as most of the new trading volume comes from users joining Polymarket to bet on major events such as the US election.

Case Studies of Azuro and Polymarket

This section analyzes two leading players in the industry, Azuro and Polymarket.

It delves into the underlying workings of these platforms, their differences and similarities, and considers these platforms not as competing but complementary, each with its unique characteristics.

Polymarket

Since its launch in 2020, Polymarket has become a well-known brand in the prediction market industry. Many believe that Polymarket is the Trojan horse that will ultimately bring cryptocurrencies into the mainstream.

Based on Polygon, Polymarket's TVL reached $87.5 million, accounting for over 60% of the industry's total TVL.

Polymarket has undergone some evolution in its development. Initially, markets were deployed in the form of "constant product" automated market makers (AMM), similar to Uniswap V2 pools, where the stock price of each market reflected the likelihood of the outcome. However, over the past year, markets have gradually shifted to an order book model.

Currently, each market takes the form of an order book, where users can place their bids and asks.

Polymarket uses UMA's decentralized optimistic oracle for dispute resolution, with UMA token holders serving as unbiased judges for relevant market outcomes. In cases of disagreement about event outcomes, "disputers" can challenge the answer.

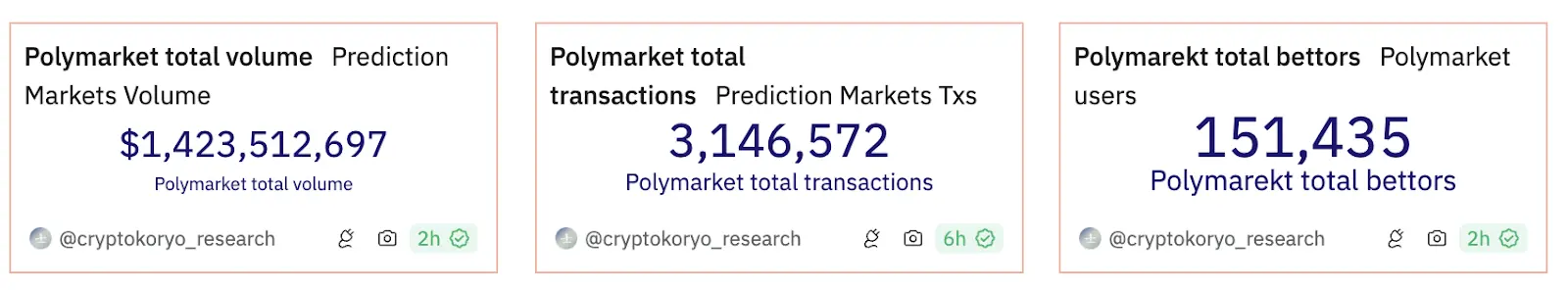

Since its inception, Polymarket has achieved the following milestones:

- Trading volume exceeding $1.4 billion

- Over 3.1 million trades

- Over 150,000 total bettors on the platform

As of August 2024, the most popular categories on Polymarket by betting volume are primarily political, with one sports category related to the 2024 European Championship.

Polymarket seems to cater to large-scale, occasional bettors on major events rather than catering to small, frequent bettors.

The two most popular categories on Polymarket, "Winner of the 2024 Presidential Election" and "Democratic Party Candidate for 2024," contributed over $660 million, accounting for 84.23% of the total trading volume.

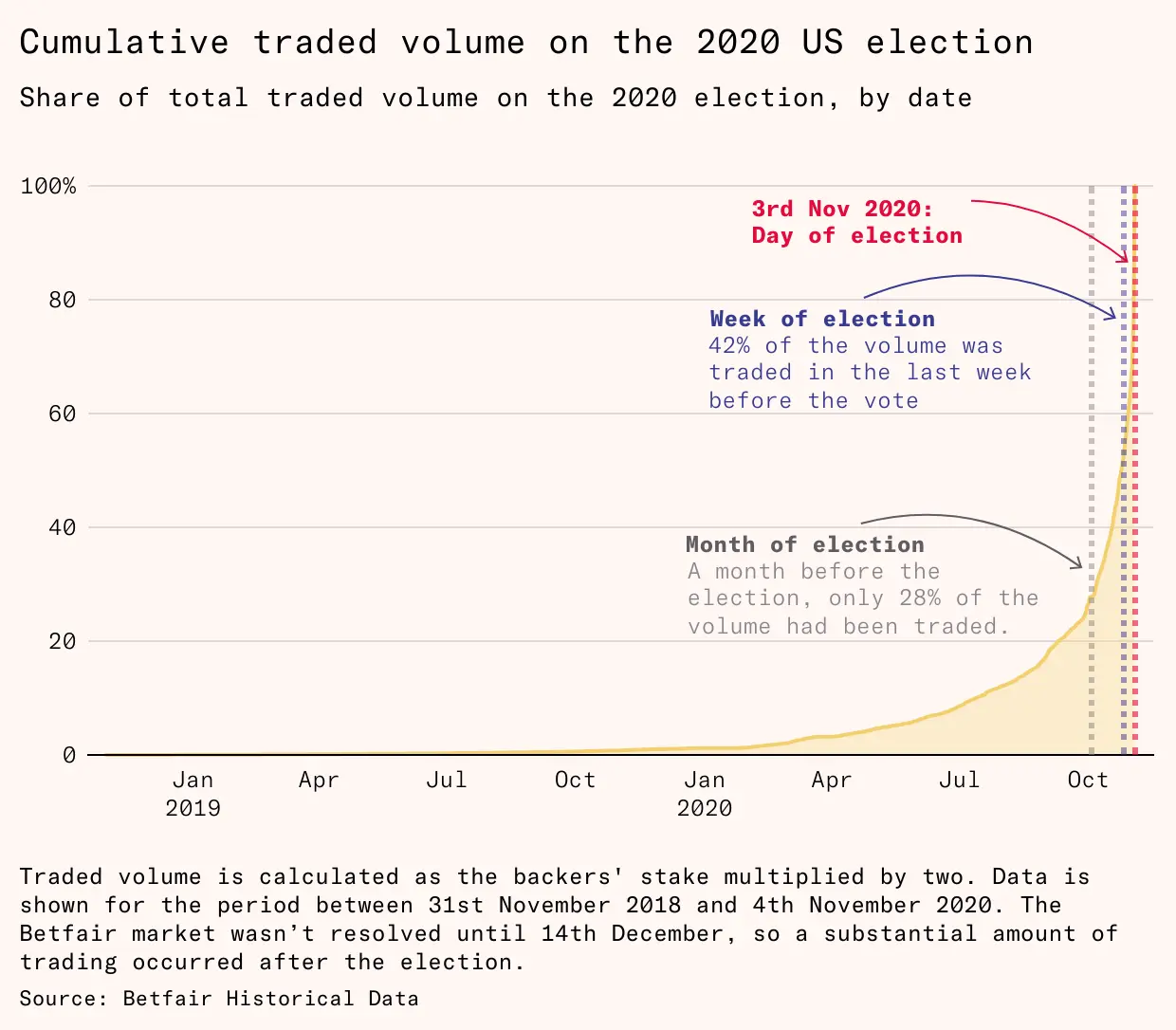

As we approach the 2024 US presidential election, it will be interesting to observe whether the trend in accumulated trading volume will be similar to that of 2020.

Although the surge in Polymarket's trading volume can be attributed to the US election, all of the platform's on-chain metrics have shown positive trends since the launch of the Bitcoin ETF in early 2024, indicating a widespread increase in the adoption of prediction markets.

As part of its roadmap, Polymarket has committed to increasing the number of supported markets and reducing its reliance on political events.

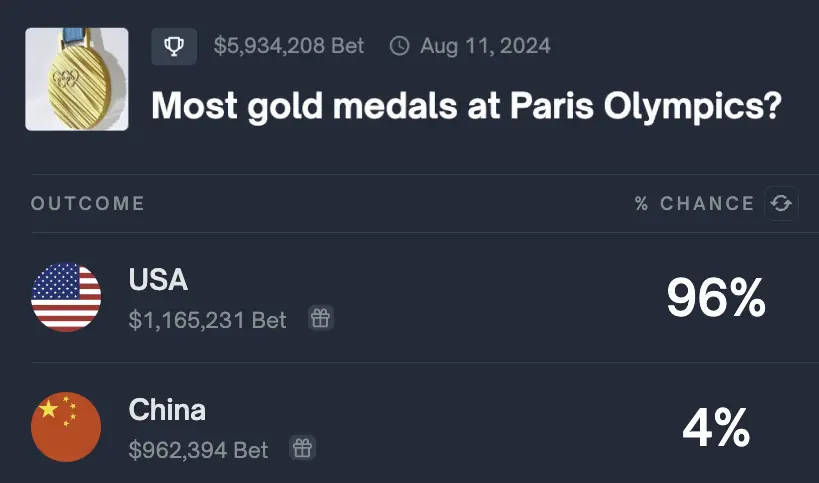

Recent events, such as the Olympics, have sparked activity in these markets, with the market predicting the country to win the most gold medals at the Paris Olympics becoming the third-largest market, with a trading volume exceeding $6 million.

Additionally, they have just open-sourced PolyLend, their peer-to-peer (p2p) lending protocol, which allows users to "use their locked conditional token positions in existing markets as collateral to borrow USDC."

PolyLend offers the following features:

- Leveraging conditional token positions by borrowing USDC.

- Providing fixed-rate loans in USDC, collateralized by conditional token positions.

- Transferring loans to new lenders using a Dutch auction mechanism.

Interestingly, Polymarket states that this development will not be used in production but is open-sourced to the community for building on top of it.

Azuro

Azuro is an infrastructure and liquidity layer built for gaming dApps and protocols, currently operating on Polygon, Gnosis Chain, and Chiliz.

Azuro introduces a peer pool design that addresses inefficiencies in the peer-to-peer model, including:

- Dependence on active liquidity

- Need for multiple markets to ensure user participation

- Activity concentrated on major events

In this new model, market makers and users interact by providing liquidity in a pool that serves multiple markets. This allows anyone to act as a bookmaker and provide liquidity to bettors, creating "passive liquidity" and real returns, with liquidity providers acting as counterparties to bettors on Azuro.

Adding more markets to a single pool also helps diversify the risk for liquidity providers and improves the platform's capital efficiency, enabling it to:

- Support more trading volume

- Enhance user experience

- Increase returns for liquidity providers

This design utilizes a novel data structure called the Liquidity Tree to track provided liquidity.

Azuro's liquidity pools act as counterparties on the platform, allowing users to provide liquidity and effectively act as bookmakers, generating real returns from fees collected by the protocol.

In this way, users providing liquidity to the pool have immediate exposure to all markets supported by the pool and earn fees based on the price difference and trading volume, embedded in the market odds.

Dispute resolution in Azuro is managed through an "optimistic oracle approach," with plans to decentralize it in the near future. As Azuro primarily supports sports events, they have clear outcomes and rarely involve ambiguous situations such as political or news-related events. AzuroDAO will serve as the final truth arbiter in case of disputes over oracle resolution results (to be implemented).

In addition to supporting sports markets and more games, Azuro allows anyone to launch prediction apps or websites faster without incurring any upfront costs, such as bookmaker.xyz, a prediction app.

These frontends can abstract all core technology, avoid launching liquidity, and directly tap into Azuro's liquidity, while also earning a certain percentage of profits from pools associated with their user activity, similar to an affiliate marketing model.

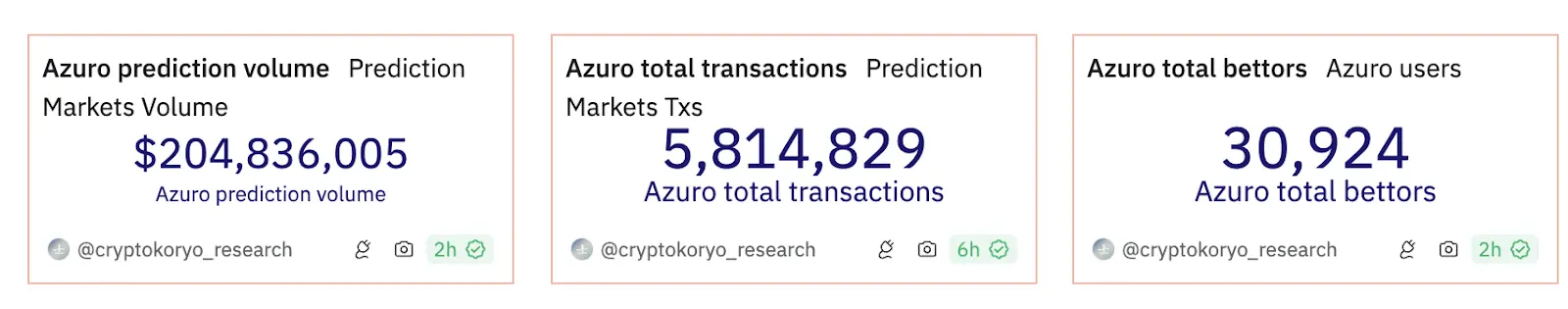

Since its launch, Azuro has facilitated:

- Over $200 million in prediction trading volume

- Over 5.8 million trades related to predictions

- A total of over 30,000 bettors

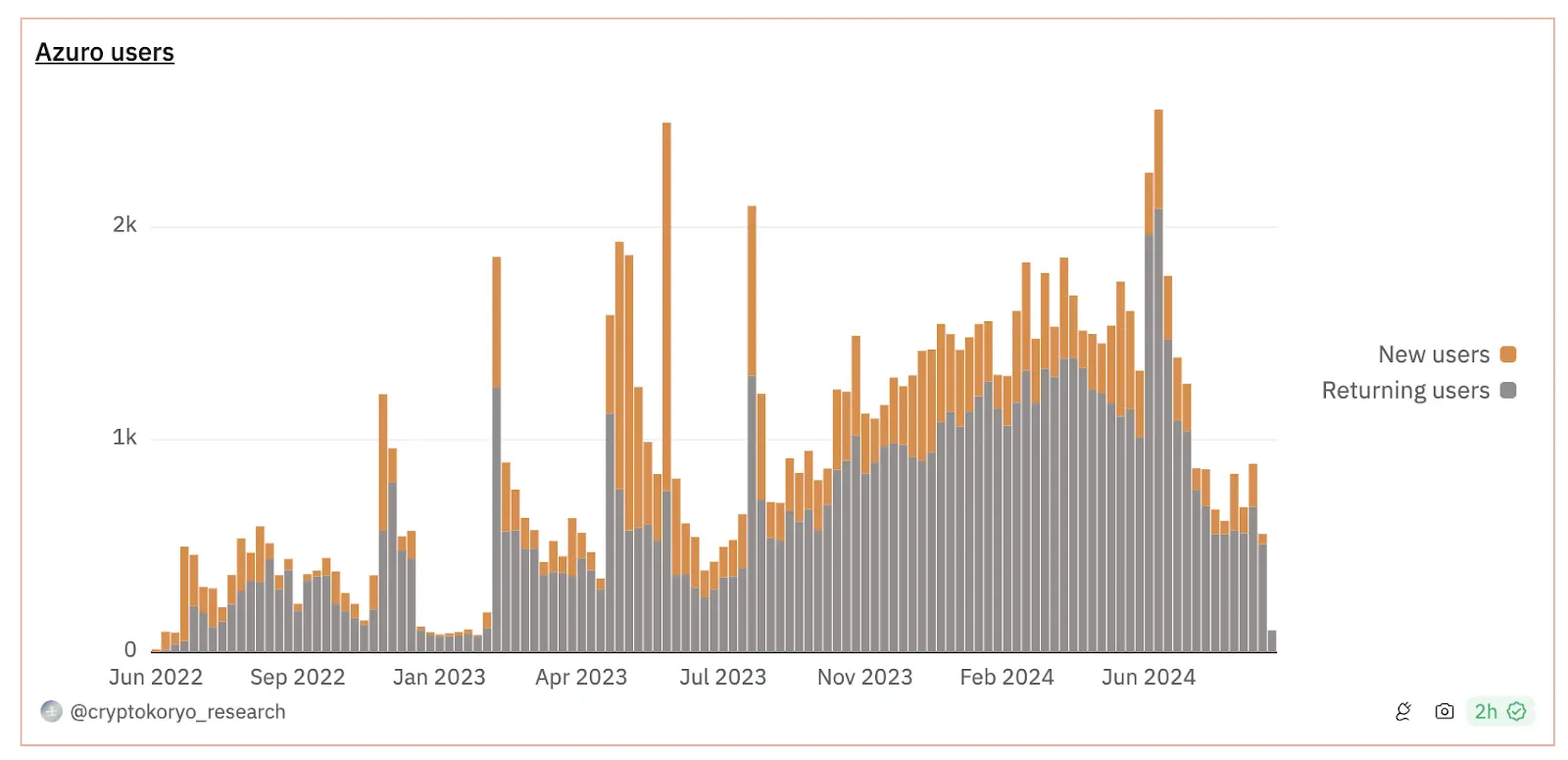

Azuro's user base has been actively growing, reaching a record high of over 2,500 new users. An interesting observation is that the majority of Azuro users are repeat customers. This indicates that the platform not only attracts new users but also maintains user loyalty and repeat usage.

Why is this the case?

The largest event on Azuro accounts for only 0.7% of its total volume, indicating a broad distribution of betting volume. Additionally, they offer a range of events and games to maintain user engagement.

Therefore, Azuro primarily attracts users who enjoy making repeated bets across various markets, with a focus on sports events.

Let's delve into which categories have been driving the majority of the trading volume on Azuro as of August 2024:

- 58.4% Soccer events

- 11.9% Basketball

- 11.2% Tennis

- 9.6% Baseball

The only non-sports event in Azuro's top events is an esports game: Counter-Strike (ranked 6th), along with League of Legends, Dota 2, and CS:GO.

Which markets within these categories have been driving the most trading volume?

The top 10 successful events on Azuro are all soccer matches. Matches from the English Premier League lead in single-match betting volume, with the betting volume for the Arsenal vs. Chelsea match in April 2024 nearing $15 million.

In terms of the number of bettors, international soccer matches are the most popular.

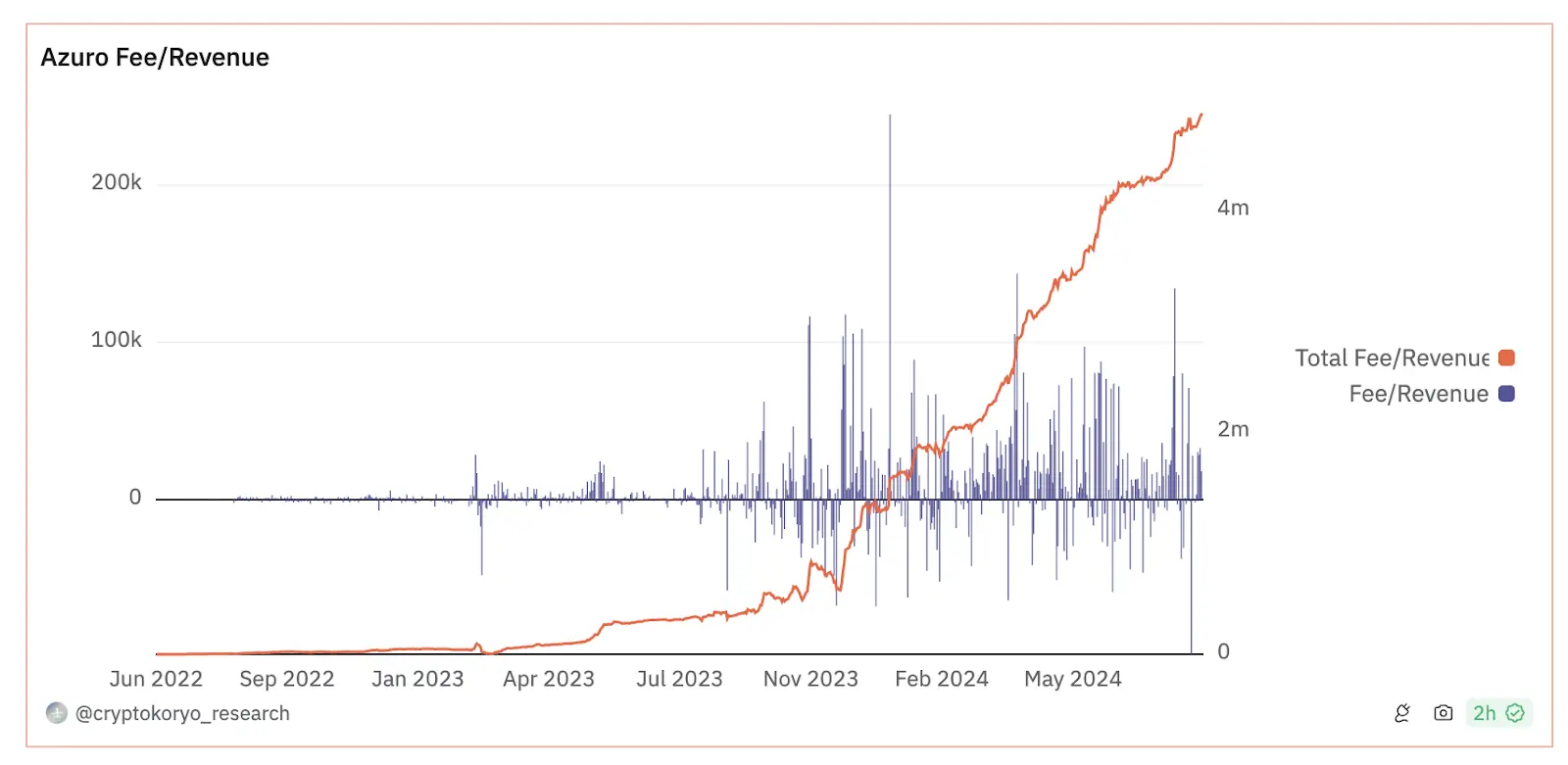

Since its inception, Azuro has generated over $4 million in income for liquidity providers, with an average annualized return rate (APY) exceeding 20% (currently at 12%).

In Azuro's case, liquidity providers face counterparty risk, as the liquidity pool acts as the counterparty to all trades on the platform and its affiliated platforms.

$AZUR Token

Azuro's native token $AZUR is used as a governance token and adds gamification and incentive alignment layers between users and the protocol.

Owning the native token is one of the main differentiating factors between Azuro and Polymarket.

As part of its roadmap, Azuro is committed to supporting a wider range of events, including social and political events: they recently announced the market for the winner of the US presidential election, the protocol's first non-sports market.

In addition to expanding markets, Azuro is also investing efforts in:

- Decentralizing governance and dispute resolution mechanisms

- Supporting more networks for cross-chain liquidity

- Launching codeless frontends

- Providing further value-added mechanisms for $AZUR and DAO

Comparative Analysis

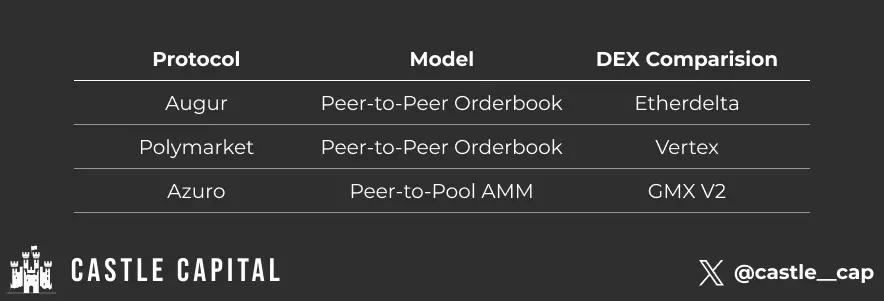

First, we can see the technical design differences of each prediction market protocol, as shown below.

Augur seems to be ahead of its time, much like Etherdelta, building a traditional order book product on-chain before it has been scaled or reached sufficient performance. Polymarket initially leveraged the success of Uniswap in constant product formulas for a better user experience, then transitioned to order books, similar to Verterx. Finally, Azuro implemented a peer pool model similar to GMX, allowing Azuro to evenly scale liquidity for all markets, with deep pools serving multiple markets, abstracting complexity from users.

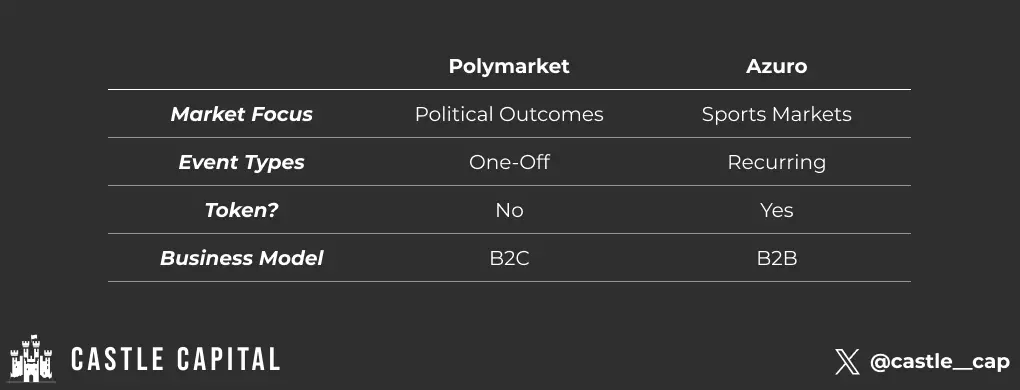

In addition to the technical aspects, we can also make a business comparison:

Political Markets vs. Sports Markets:

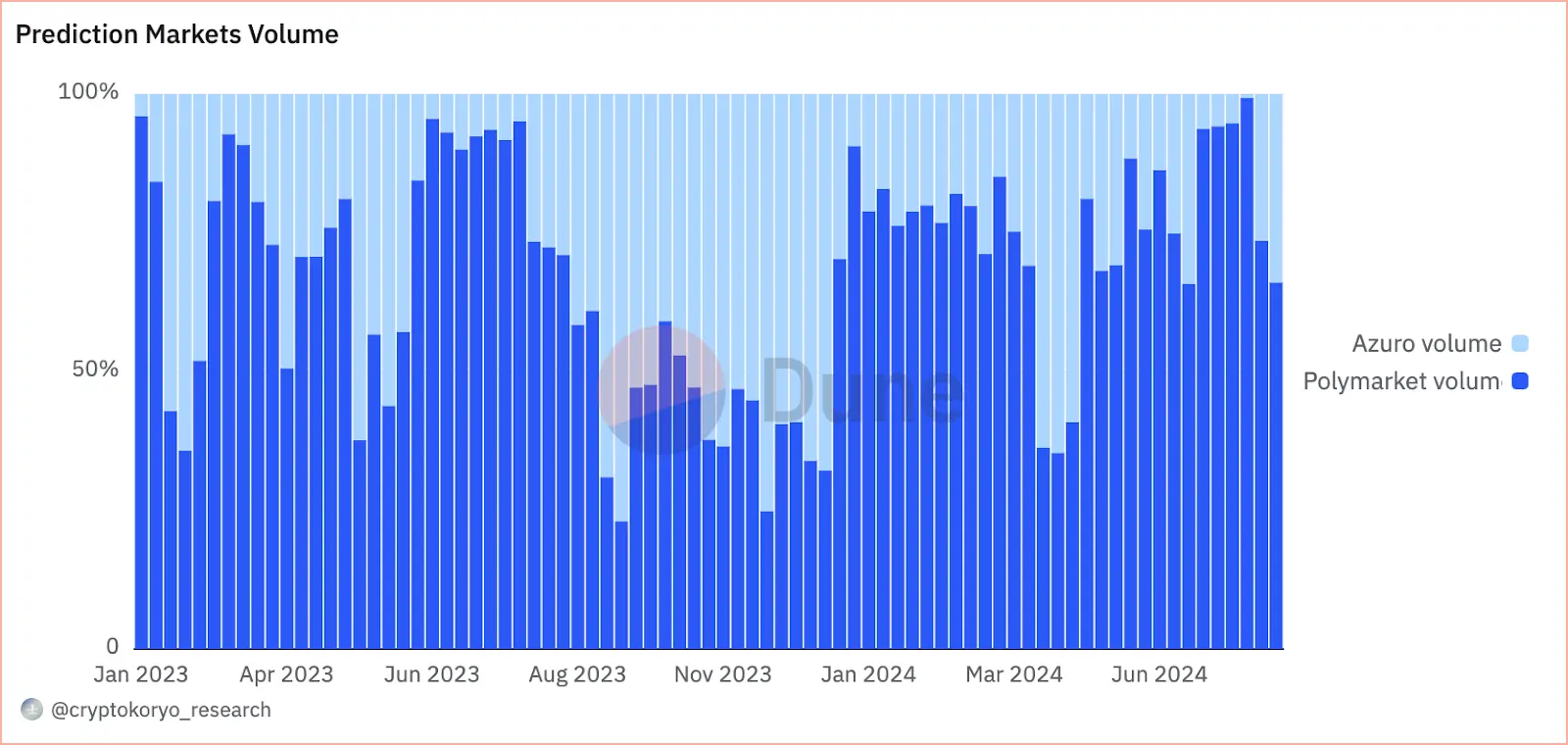

Before the narrative of the US election, Azuro led the field due to its offerings of sports-related markets. However, the US election became the main driver of recent success in prediction markets, primarily dominated by Polymarket. Meanwhile, as Azuro relies on sports events, its trading volume slows down during the summer due to the rest period for these events.

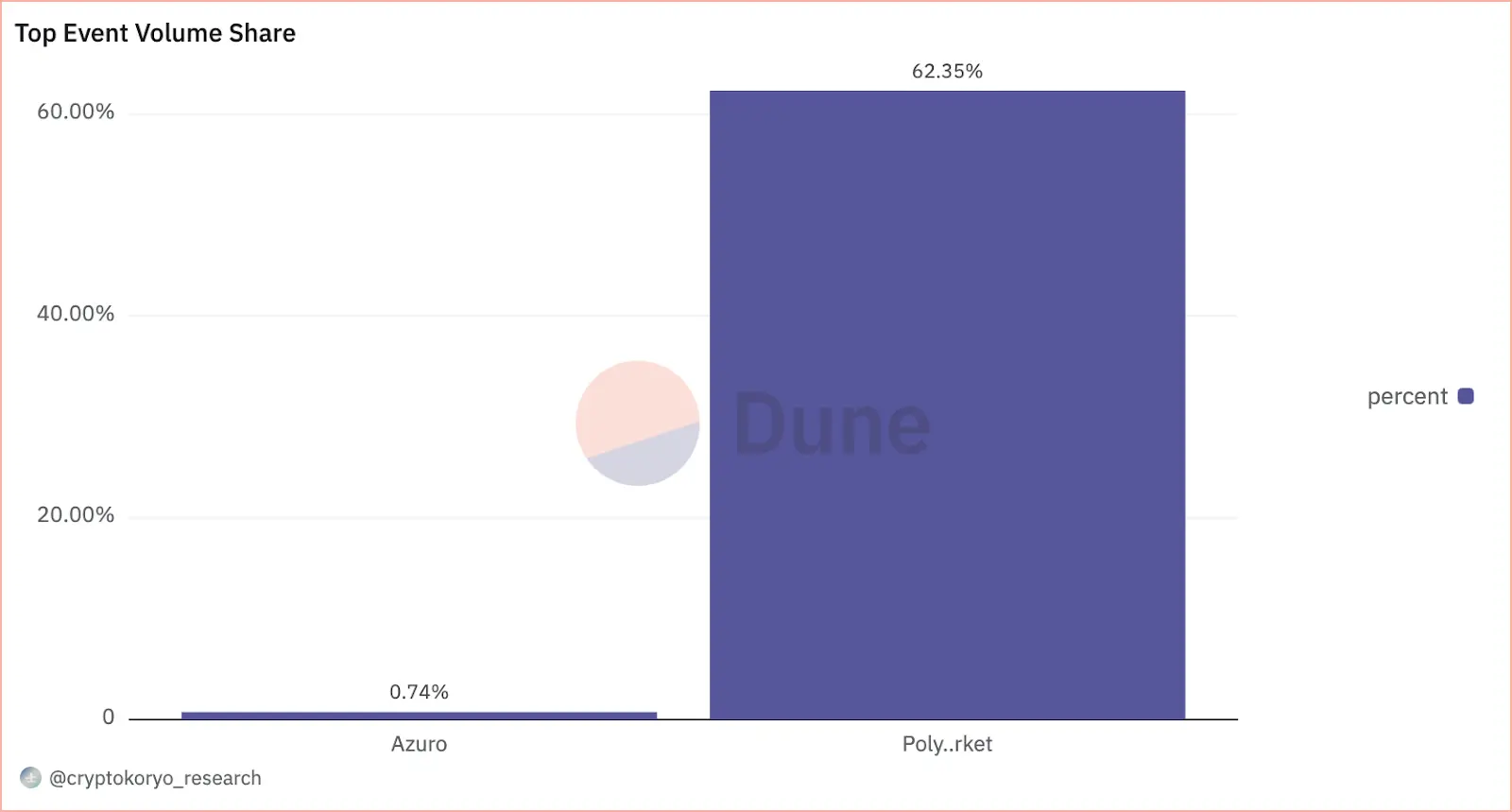

One-time Events vs. Repeat Events:

While Polymarket thrives on large but limited markets, attracting strategic narrative speculators who are likely to use Polymarket as a one-time use, Azuro, on the other hand, offers many smaller markets, attracting users back and converting them into repeat customers. On Polymarket, top events account for 62% of total trading volume, while on Azuro, this proportion is only 0.74%. This highlights how Polymarket positions itself to capture the largest "news" events, while Azuro's offerings include multiple smaller events, more suitable for repeat betting.

Token or No Token:

Whether Azuro's token has a significant impact on its trading volume and user growth, having a token provides broader strategic alignment between the protocol and the community.

B2B vs. B2C:

These platforms are complementary rather than competing. Azuro focuses more on B2B and repeat sports events, while Polymarket focuses more on B2C and news, political, and economic events.

Seeking Growth:

Both platforms are seeking to expand their supported market lists and expand to more networks.

Key Challenges

As a novel tool, prediction markets face several challenges before being adopted beyond the cryptocurrency space:

Liquidity: Low participation often leads to insufficient market depth, widening bid-ask spreads, and reducing prediction accuracy. This low liquidity may also make markets more susceptible to price manipulation by a few participants.

Regulatory Uncertainty: The legal status of prediction markets varies by jurisdiction, and the lack of clear regulations creates significant legal risks. Compliance with laws such as anti-money laundering (AML) and know your customer (KYC) is particularly complex for decentralized platforms, as these platforms emphasize anonymity.

Market Manipulation: The open nature and pseudo-anonymous nature of these platforms, along with relatively small markets, make them susceptible to manipulation.

User Experience: The complexity of decentralized platforms, including managing wallets and understanding gas fees, may be a barrier for non-technical users, limiting broader adoption.

Oracle and Data Accuracy: Prediction markets rely on oracles to bring external data onto the blockchain. Ensuring the reliability and security of these oracles is crucial, as inaccurate data can lead to incorrect outcomes and loss of trust.

Scalability: High transaction costs and slow processing speeds on some blockchains make participation expensive and less appealing, especially during network congestion.

Incentives and Governance: Properly aligning incentives for participants, market makers, and data providers is a challenge. Decentralized governance may be slow and contentious, leading to inefficiencies in managing the platform.

Trust and Adoption: Establishing trust in a decentralized environment without central authority is difficult. Overcoming these trust issues and convincing users to transition from traditional platforms is key to broader adoption.

Addressing these challenges will require ongoing innovation, regulatory engagement, and community development to ensure the long-term success of decentralized prediction markets.

Future of the Prediction Market Industry

In prediction markets, people vote with money.

Therefore, they are increasingly recognized as a means to provide accurate public sentiment on various topics.

Platforms like Azuro and Polymarket lead in this field, each with its unique strengths and market demands. Azuro excels in sports markets and repeat events, while Polymarket dominates in major political and news-related events.

As a short-term goal, both platforms aim to expand their market offerings.

Polymarket aims to reduce its reliance on the US election, while Azuro hopes to support more political and news markets and drive more trading volume beyond sports betting.

The future of prediction markets looks promising, with significant potential for enhancements in utility and attractiveness, such as integration with artificial intelligence and market product expansion.

One speculation involves artificial intelligence agents, where prediction markets will transition from manual market creation to being led by artificial intelligence. For example, Azuro will use Olas to develop intelligent AI agents that can perform specific tasks on its platform. In prediction markets, we can envision AI agents efficiently providing liquidity to markets and extracting API data from markets.

Additionally, they will take on the role of "guardians" of the system, resolving conflicts and preventing disputes, enhancing the resilience and smooth operation of prediction markets.

As the industry evolves, prediction markets are poised to become a key tool for measuring public sentiment and making informed decisions in a decentralized manner.

In this way, using prediction markets can lead to genuinely decentralized sentiment, which can be seamlessly integrated into news websites and mainstream publications, and even used by politicians.

Prediction markets like Azuro and Polymarket may further solidify their position in "real sentiment," thereby providing API services for news and data providers.

In fact, prediction markets are not limited to cryptocurrency users but are also an interesting avenue for traditional gamblers, political experts, news publications, and others.

This may also slightly change the platforms, expanding into decentralized surveys and other forms of public opinion polls to measure public opinion, build arguments, and test hypotheses and assumptions.

"With the increasing noise of news, prediction markets represent an 'economically supported source of truth' in a world of fake news, post-truth, and deep fakes."

Prediction markets ultimately break mainstream narratives.

Can they maintain their position beyond seasonal hype?

Do we expect more challengers to enter this market once it consolidates?

Food for thought.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。