9.21 Zhang Lihui: Bitcoin Market Analysis and Operation Suggestions:

In the 1-hour chart of Bitcoin, the Bollinger Bands channel has started to run parallel, and after reaching a high above 64100 yesterday, a retracement has formed. The light long position in the 62100-62500 range has been triggered, and it can be seen that the candlestick has provided a good opportunity for long positions. From the MACD, it can be observed that the volume continues to shrink below the 0 axis, and the DIF is approaching the 0 axis, forming a convergence. This indicates a short position, so there is no need to panic. Let's continue to see if the candlestick can touch the middle band and upper band positions.

In the 4-hour Bollinger Bands channel, the trend continues upward without convergence. As mentioned yesterday, pay attention to not breaking the middle band and EMA15 line for the long position. The strategy is completely confirmed. Despite the fact that the fast and slow lines are forming a death cross, Zhang Lihui believes that it can be reversed. If the position is broken, everyone should consider the appropriate replenishment position based on the extent of the market decline, still referring to the middle band and EMA30 range.

The short-term indicators at the daily level are bullish, so everyone should not panic due to a small retracement. After all, there have been many whales recently, and it is easy to get trapped by chasing long positions at low levels.

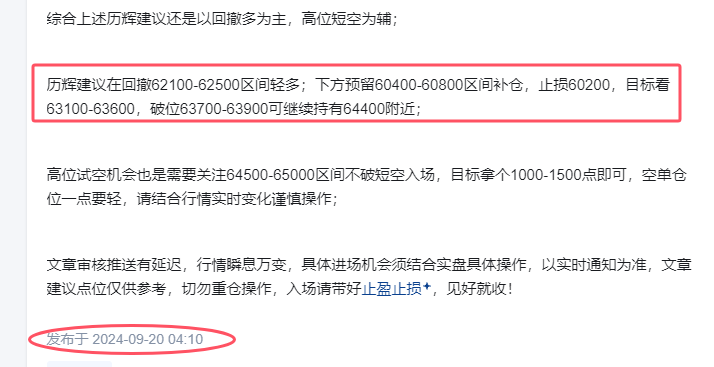

In summary, Zhang Lihui's suggested operational strategy remains unchanged, focusing mainly on long positions during retracements and short positions at high levels. For those who have not entered the market yet, they can consider the following:

Zhang Lihui suggests going long in the 62400-62800 retracement range; reserve a replenishment range of 61500-61000 below, stop loss at 60500, and target at 62900-62800-63900; if the position is broken at 64000-64300, it can be held until around 65000.

For shorting opportunities, also pay attention to the entry point at 64000-64300 without breaking, with a target of 1000-1500 points; do not be greedy!

Article reviews may be delayed, and the market changes rapidly. Specific entry opportunities need to be combined with actual trading operations, and real-time notifications should be followed. The suggested entry points in the article are for reference only. Do not over-leverage, and set stop-loss and take-profit levels when entering the market. Take profits when the opportunity arises!

Zhang Lihui interprets world economic news, analyzes the global trend of the currency circle, and has conducted in-depth research on BTC, ETH, LTC, DOT, EOS, BNB, SOL, and other currencies while studying and furthering education in the United States. For those who are not familiar with trading operations, you are welcome to comment and leave a message!

Scan the QR code below to follow the author in person!

This article is exclusively published by (WeChat Official Account: Zhang Lihui) for reference only, and all risks are assumed by the reader. May we remain humble and brave in the complex currency circle, unafraid of challenges, and eager to explore. Just as "The road ahead is long, I will seek with my will, and strive to explore," I hope that we will keep pace with the times, draw wisdom, travel thousands of miles, experience storms, and comprehend life.

Under Zhang Lihui's guidance, may you seize opportunities, create value, remember the market's baptism, and stay true to your original aspirations. In the wave of digital currency, may we hold onto our beliefs, forge ahead, and jointly compose the future, sharing the joy of success. Let us work together to create brilliance in this investment journey full of challenges and opportunities!

Friendly reminder: Only the official account at the end of the article is created by the author. Advertisements at the end of the article and in the comments section are not related to the author. Please discern carefully, and thank you for reading.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。