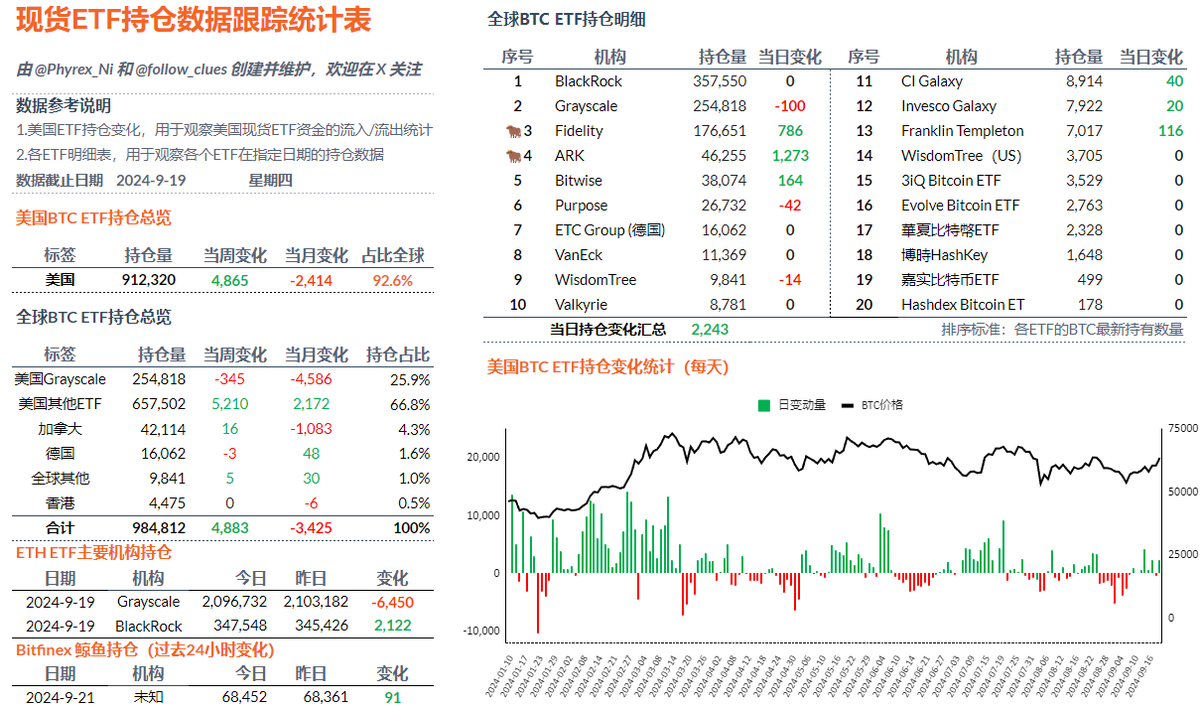

After reviewing the data for ETH, I returned to BTC. As mentioned earlier, although BlackRock only increased its BTC holdings on one of the past 17 working days, the overall data for BTC spot ETFs is very positive. In the previous trading day, only Grayscale reduced its holdings by 100 BTC, while five out of the remaining ten ETF institutions increased their holdings by 2,359 BTC. The other five institutions remained unchanged, with Fidelity and ARK increasing their holdings by 787 BTC and 1,273 BTC, respectively.

In the United States, apart from Hashdex, all eleven ETF institutions showed net increases in their holdings this week. Although the increases were not significant, they do indicate some signs of investor sentiment recovery.

Especially in terms of selling, it is evident that investor selling, including Grayscale, is decreasing, while signs of buying are increasing and signs of selling are decreasing. More BTC is shifting towards long-term and high net worth investors.

The data has been updated, and the link is: https://docs.google.com/spreadsheets/d/1N8YIm1ZzDN197hMAlkuvH3BgFb8es0x1y4AJLCbDPbc/edit?usp=sharing

This tweet is sponsored by @ApeXProtocolCN | Dex With ApeX

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。