The token economics of Cati are quite different from those of not and dogs. If you want to invest in Cati, you must pay attention. The latter is more like a community token, with the majority of chips allocated to the community. Cati, on the other hand, is more like a traditional institutional token, with chip allocation including investors, teams, treasury, advisors, and liquidity shares.

The total supply of Cati is 1 billion, with a nominal initial circulation of 305 million. However, according to on-chain data, the current external circulation is 19%, which is 190 million. It is speculated that 15% of the Cati allocated for airdrops has been unlocked but has not entered the market.

Cati's seed and strategic rounds of financing raised $2.8 million, selling 100 million CATI tokens at an average price of $0.028. Based on the price of $1 as mentioned above, investors have an average profit of 35 times. If we differentiate between the seed and strategic rounds, institutional profits from the seed round are at least 50 times.

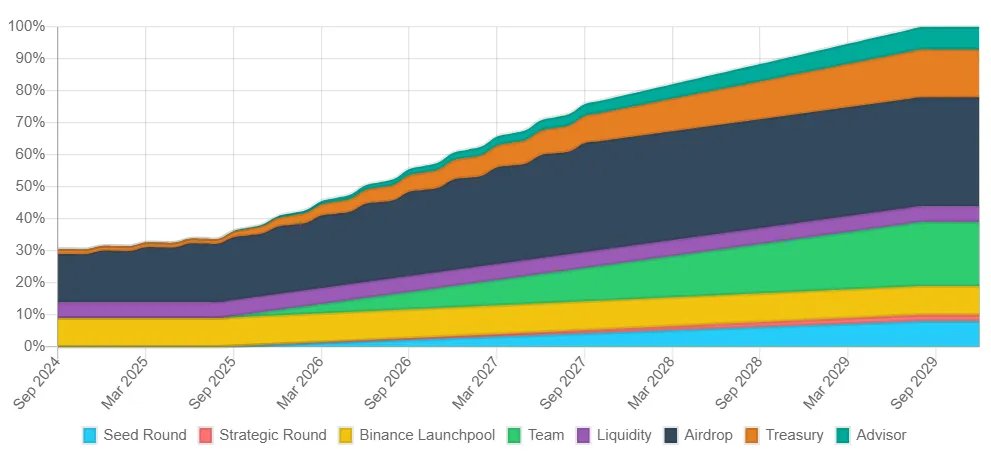

From the unlocking rules, the team and institutions will unlock after one year.

Overall, in the short term, the circulating market value is not high, leaving significant speculative space. In the long term, it is just another VC token.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。