Speaker: Kyle Samani, Co-founder of Multicoin Organizer: Shanoa, Golden Finance

With the rapid development of blockchain technology, Ethereum, as a leader in the industry, has achieved great success. However, after 9 years of development, it took Ethereum 5 years to determine its expansion plan and another 7 years to complete the transition from Proof of Work (PoW) to Proof of Stake (PoS). Ethereum has never been clear about what it wants to become. The expansion plan keeps changing without a clear direction.

Compared to Ethereum's confusion, Kyle Samani, co-founder of Multicoin, expressed high expectations for the future of Solana in his keynote speech "Why SOL Will Flip ETH" at the Token2049 conference on September 19. The entire community has rallied around a common vision of "decentralized Nasdaq," and everyone is moving in the same direction. Golden Finance has compiled Kyle Samani's speech content for readers to enjoy.

The following is the full text of Kyle Samani's speech (subheadings added by the editor):

Good morning, everyone! I'm Kyle Samani, co-founder and managing partner of Multicoin. Today, I will discuss why we believe Solana will surpass Ethereum. Some may already agree with this view, while others may find it too radical or unlikely. My goal is to at least make everyone reconsider the driving factors behind it.

Today's speech is divided into three parts. First, I will briefly review Ethereum's history, as this is crucial for understanding its current state and issues. Then, I will discuss why Solana is in a favorable competitive position. Finally, we will analyze some key indicators together, indicating that Solana has surpassed or is close to surpassing Ethereum, all of which are of great concern to Multicoin in terms of on-chain data.

Before we begin, I need to make two legal disclaimers. First, today's remarks represent only my personal views and are not related to Multicoin. Second, the content of this speech does not constitute investment advice and should not be considered an offer of Multicoin's investment advisory services.

Ethereum's History

Now let's talk about Ethereum's history. Ethereum has been around for 9 years, officially launched in July 2015. I think this point is very crucial, and I will emphasize it repeatedly today. Ethereum has been around for 9 years, providing enough time to address its challenges and determine its development direction, which I will discuss in detail later.

So, what has happened in these 9 years? I believe there are three very important things. First, the rise of decentralized finance (DeFi) has become the most important application of blockchain. Although DeFi had some development before 2020, the real breakthrough came during the DeFi "summer" in 2020, five years after Ethereum's launch.

The second major event was Ethereum's decision in October 2020 to adopt a roll-up-centric expansion roadmap, which came a few months after the EIP-1559 update. However, a clear problem with the roll-up roadmap is that it is not friendly to DeFi, leading to issues such as cross-chain bridges and network fragmentation. This decision was made just two months after the end of the DeFi "summer," and its impact is evident.

The third key turning point is Ethereum's transition from Proof of Work (PoW) to Proof of Stake (PoS) in 2022. It is worth noting that the Ethereum community had this plan before the mainnet launch in 2015, but it took 7 years to implement. This indicates that Ethereum's actions have been very slow and have always lacked a clear direction.

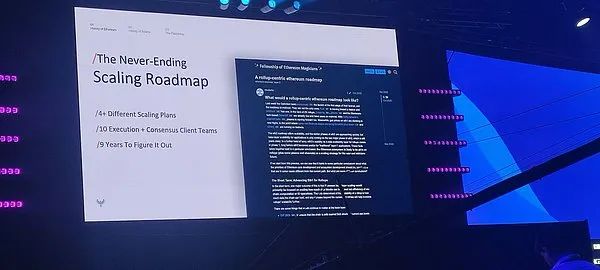

Next, I would like to briefly discuss Ethereum's expansion roadmap. To be honest, this roadmap has changed multiple times, with early proposals including concepts like Plasma and state channels. If you remember, there were also crazy ideas like Hyperledger at that time. Obviously, none of these were realized. Ultimately, it took them 5 years to officially decide to adopt a roll-up-centric roadmap in October 2020.

However, this roadmap is now being questioned, or at least there are some doubts. In recent public discussions, there are increasing questions about whether to expand L1, introduce multiple block proposals, and other ideas that are closer to the strategies of projects like Solana, which are now back in Ethereum's discussions.

We do not know what decision Ethereum will ultimately make, it may take 3 months, 6 months, or even 9 months to find out. But what I want to emphasize is that the roadmap formulated four years ago is now at least partially questioned, and may even be completely overturned. After existing for 9 years, Ethereum is now back to square one, what's going on?

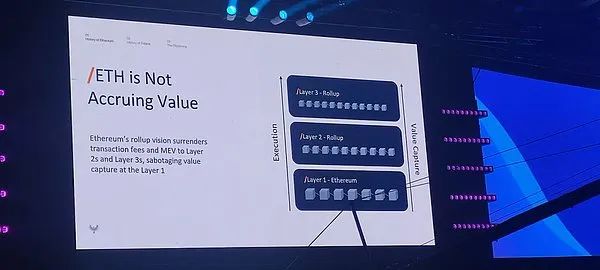

Before discussing Solana, I want to mention one more thing: Ethereum is no longer the center of value capture. The roll-up-centric roadmap explicitly moves transaction fees and MEV (Maximum Extractable Value) costs from L1 to L2, L3, or even L4. While this roadmap successfully pushes transactions to the L2 layer, it also moves most of the value creation away from Ethereum.

Ethereum Still Lacks a Clear Direction

Some people will tell you that you can still use Ethereum for data availability (DA), and that's true. But as I will show in the next few slides, the value of DA is almost zero. There are enough DAs available in Ethereum and elsewhere. People will eventually say that the value of Ethereum comes from "ETH being money," but this is completely unfounded. This claim is essentially a circular argument, unverifiable, and they are just imposing their beliefs on you, with no logical deduction.

The litmus test for determining whether something is money is simple: go to a coffee shop and ask them how they price their coffee. If they price it in ETH, then ETH is money. If it's in USD, then USD is money. That's the standard for determining money, and nothing else is the standard.

L2 Transaction Data

We can see the proportion of transactions moving from L1 to L2 over the past three to four years. It is very clear that almost all transactions are now on L2, with over 90% of transactions occurring on L2. This has been planned, and they have indeed achieved their goal, but what are the results? They have been talking about the so-called DA value rules. In reality, L2 is where the money is made.

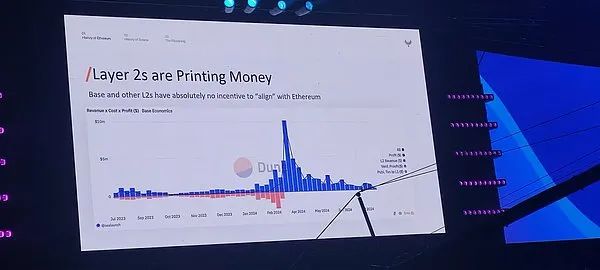

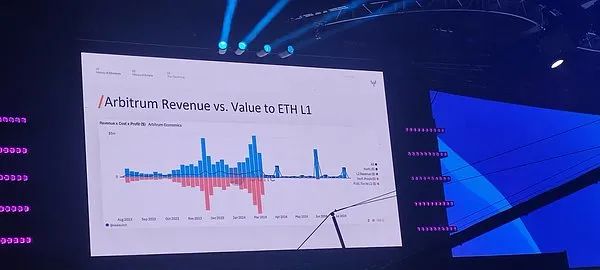

Let's take a look at the income and expenses of Base, which is currently the largest L2 in terms of key metrics. It is clear to see that Base's weekly income is approximately around $1 million, while the expenses are almost zero. The reason for the zero expenses is that they only need to pay fees for DA to L1, which may also remain at this level in the future.

One point I want to emphasize is that although people have been saying that L2 depends on L1, in reality, this chart clearly shows that they are actually opposed. The purpose of Base is simple, to create profits for Coinbase's shareholders, aiming to maximize income and minimize expenses. In fact, the incentive mechanism of Base is exactly the opposite of Ethereum L1's incentive mechanism, as Base aims to minimize the fees it pays. If we look at other major L2s, such as Optimism, the chart shows a similar situation, and the same pattern applies to Arbitrum. This trend is consistent across all L2s.

Ethereum's Ambiguous Positioning

I want to make it clear that Ethereum has never truly defined what it wants to become.

Nine years ago, it launched as the "world computer," but this concept was never clearly defined, and even now, it remains undefined. Indeed, I think they don't necessarily have to define what a "computer" is; it's just a marketing term. But after 9 years, they still haven't told us what the platform is actually for. While concepts like decentralized finance (DeFi), Web3, decentralized identity storage, etc., have emerged, Ethereum currently presents a mix of these concepts, and to be honest, it has become ambiguous and lacks a prominent direction. Even a few weeks ago, Vitalik and other members of the Ethereum Foundation publicly stated that DeFi is just a circular argument and suggested that people use Ethereum for something else.

That's great, I also hope Ethereum can do more. But the problem is, after 9 years, they still haven't provided clear guidance, haven't given any clear advice. The lack of urgency and a clear direction has filled the entire system with negative energy. DeFi is the most important thing on the blockchain, whether it's on Ethereum, Solana, or other chains. When I hear someone say "DeFi is not important," I just want to say, if you're not going to optimize DeFi, then tell us what you're going to optimize. But they haven't, because they don't know themselves.

Let's recap: Ethereum has been around for 9 years, took 5 years to determine its expansion plan, and another 7 years to complete the transition from Proof of Work (PoW) to Proof of Stake (PoS). Ethereum has never been clear about what it wants to become. The expansion plan keeps changing without a clear direction. They don't know what they are optimizing. Because of this roll-up roadmap, they have actually moved most of the value appreciation from ETH to L2, such as projects like Base.

Meanwhile, Ethereum's market value remains at around $300 billion, making it one of the top 40 assets in terms of global market value. However, this project still doesn't know what it wants to become, and this structural problem is very apparent. Next, we will turn to the history of Solana for discussion. Unlike Ethereum, which has never found a clear direction, Solana has always had a clear goal.

Origins of Solana

Solana's founder, Anatoly Yakovenko, began conceptualizing Solana in 2017 while writing trading bots for a U.S. service provider—Interactive Brokers (similar to a more advanced version of Robinhood). He found that he couldn't access real-time market data from the New York Stock Exchange and Nasdaq, while companies like Virtu and Jump Trading could easily access it. He felt this was very unfair and believed that everyone should be able to access market data fairly and openly.

This unequal experience prompted him to develop Solana, with the goal of enabling anyone to access market data in real-time 24/7, 365 days a year. The Solana system is designed to optimize information dissemination, allowing anyone with a computer and network to receive this data in real-time. This vision has become Solana's "North Star," guiding them to build a global, real-time decentralized exchange from day one.

Although this process was much more difficult than expected, Solana began development in 2018 and eventually launched version 1.0 in 2020. Despite experiencing multiple failures, network outages, congestion, and other issues, they remained committed to this vision. It wasn't until the 1.18 version upgrade in May 2023 that Solana truly realized this vision. This upgrade enabled on-chain limit orders, order cancellations, and other functions to operate normally, allowing transactions to proceed smoothly with almost zero fees.

The success of Solana lies in their perseverance with this challenging and ambitious vision. Despite experiencing failures, the end-user experience is excellent, and there are no bridging and fragmentation issues like those on Ethereum. Additionally, the asset value of Solana has significantly increased, generating annual revenues of $500 million to $1 billion, mainly from MEV (Maximum Extractable Value). Solana's success demonstrates the power of focus, as they took 6 years to turn their vision into reality.

This is also why we believe Solana's market value will surpass Ethereum. Next, we will explore some key on-chain metrics that indicate Solana's performance is close to or surpassing Ethereum.

Surpassing Ethereum

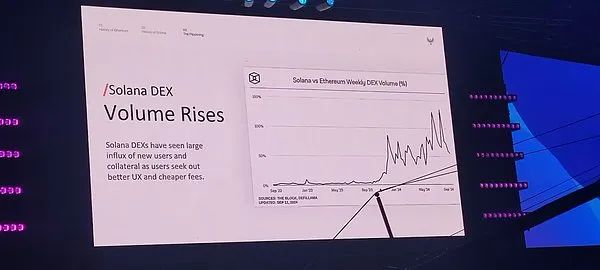

Firstly, blockchain systems are essentially financial systems. We can see that Solana's on-chain transaction volume has almost caught up with Ethereum over the past year, sometimes even surpassing it. This is the most important indicator for us, as the core function of blockchain is to facilitate transactions.

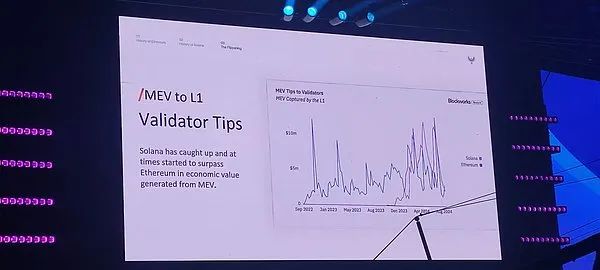

Next, let's look at the second indicator: validator rewards. Solana has also caught up with Ethereum in this regard, with some weeks where Solana's validator rewards even exceed those of Ethereum.

The last metric is the transfer volume of stablecoins. Although Solana still lags behind Ethereum in this aspect, its growth rate is astonishing. About a year ago, the on-chain stablecoin transfer volume on Solana was 1/10 to 1/20 of Ethereum's, but today it is close to half, indicating that more and more funds are flowing on the Solana network.

If you believe that these metrics will continue to follow the same growth trend, it is reasonable to speculate that Solana's market value will also grow in the same direction.

Structural Advantages of Solana

Next, I want to talk about the future of Solana and its three unique advantages, which are almost impossible to be replicated by other communities, and are the reasons why we are more optimistic about its future.

The first advantage is Token Extension

The token extension feature went live earlier this year, providing many features for payment companies or major asset issuers globally, such as built-in yield, confidential transfer (hiding sender and receiver), asset issuance, and revocation. These features were developed based on the direct needs of payment companies and Wall Street, and are now live on the mainnet.

I emphasize this because we not only have DeFi and other decentralized financial tools, but also need to meet regulated financial needs. Without these integrated features, regulated financial companies will not be able to scale on-chain. These features are fully integrated into Solana's L1 layer and can be used at any time. We believe this is a huge advantage for Solana and is almost impossible to replicate in the Ethereum ecosystem.

Ethereum's EVM (Ethereum Virtual Machine) is fragmented, with many different versions such as Optimism, ZK-rollups, Polygon, etc. Although they share about 98% of the code, they are not completely consistent. It is very difficult to establish common standards between these different EVM versions for features like confidential transfer of stablecoins, making it challenging to make these systems communicate and collaborate with each other. This is not a technical problem, but a problem of interpersonal coordination. You need to get these different teams to sit down and reach consensus, which is very challenging.

The first project to use token extension is Paypal's stablecoin PYUSD, which went live on the mainnet a few months ago. We expect that the token extension feature will become one of Solana's flagship features in the next 3 to 4 years, at which point it will set Solana apart from many other blockchain projects.

Firedancer

Next, I want to talk about Firedancer. Firedancer is a new Solana client that is about to go live and is expected to be released in the next few days or weeks. They may announce the exact date at tomorrow's Breakpoint conference. If you're not familiar, Firedancer is a new supply client developed by Jump Trading. Jump Trading is one of the world's largest high-frequency trading firms, and among all high-frequency trading firms, Jump is known for its speed.

We believe this is very important because the Jump team is applying all the knowledge and experience they have accumulated in building high-performance trading systems to this client. From the beginning, Solana's vision has been to build a decentralized Nasdaq, and now we are bringing the wisdom of this global leading trading company to build the world's fastest commission-free exchange. This system will have strong scalability and speed, and will allow the outstanding features we love about Solana—composability, no bridging issues, etc.—to shine even more under Firedancer.

Hardware Expansion

Finally, I want to talk about hardware expansion related to Firedancer. One of Solana's design principles is natural expansion through parallel hardware. Since day one of the project, Solana has been talking about this. I've been talking about it for years. The core idea is very simple: if the number of cores in the system doubles or triples, you would want the system's performance to double or triple as well. This is a very intuitive idea.

This idea not only applies to Solana, but also, due to Moore's Law, over the past 50 years, especially in the past 10 to 15 years, systems that can leverage parallelism have seen significant performance improvements as the number of cores increases. Today, this idea is particularly important because there is a renaissance happening in the AI field, with a large influx of capital into the entire semiconductor value chain, from design to manufacturing, making it the fastest-growing area in the past 30 years.

This is all thanks to the explosive growth of AI chips developed by numerous startups, Nvidia, AMD, and other companies. Most of these chips are highly parallel, and not all chips are suitable for Solana, but that doesn't matter. We only need a few chips to be compatible, which will greatly enhance Solana's performance. It's amazing that this AI renaissance has nothing to do with cryptocurrency. Anyone in the cryptocurrency field does not need to know or care about what is happening in the AI field, but the research and development investments of 30, 40, or even 50 billion dollars in the AI field will indirectly drive the performance improvement of the Solana network.

This is a key concept in system design: to win what we believe will become one of the largest markets in the world, the decentralized Nasdaq. The EVM (Ethereum Virtual Machine) is a single-threaded processor, and although they have been talking about parallelization for 9 years, there has been no substantial progress. We believe this comprehensive embrace of parallel processing will become more evident in the coming years, especially as the expansion of on-chain assets continues.

In conclusion, we are excited about the future of Solana. Everyone is working towards the same goal. Everyone is committed to building this decentralized Nasdaq. We have a strong development team, asset issuers, token extension features, and efficient clients, all working together to build a scalable network and create an appreciating asset as the network expands. We look forward to seeing further development of Solana in the coming years.

Thank you all!

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。