Author: Nancy, PANews

As one of the important promoters of the mainstreaming of cryptocurrencies, the DePIN ecosystem has shown strong development momentum and has become one of the main investment themes attracting capital influx. However, at the current stage, the expansion of the DePIN market is mainly driven by the leading projects "striding forward," with limited overall profitability and facing risks such as regulation and network security.

Overall scale has exceeded 20 billion US dollars, with Ethereum and Solana ecosystems as the main focus

Data from DePINscan shows that as of September 19th, there are approximately 276 DePIN projects, mainly categorized into AI, wireless, energy, services, sensors, data, and computing. The overall market value of DePIN has now reached nearly 21.23 billion US dollars, an increase of 17.1% from the beginning of the year. Among them, the top ten projects account for approximately 80.5% of the market value, reaching 17.08 billion US dollars.

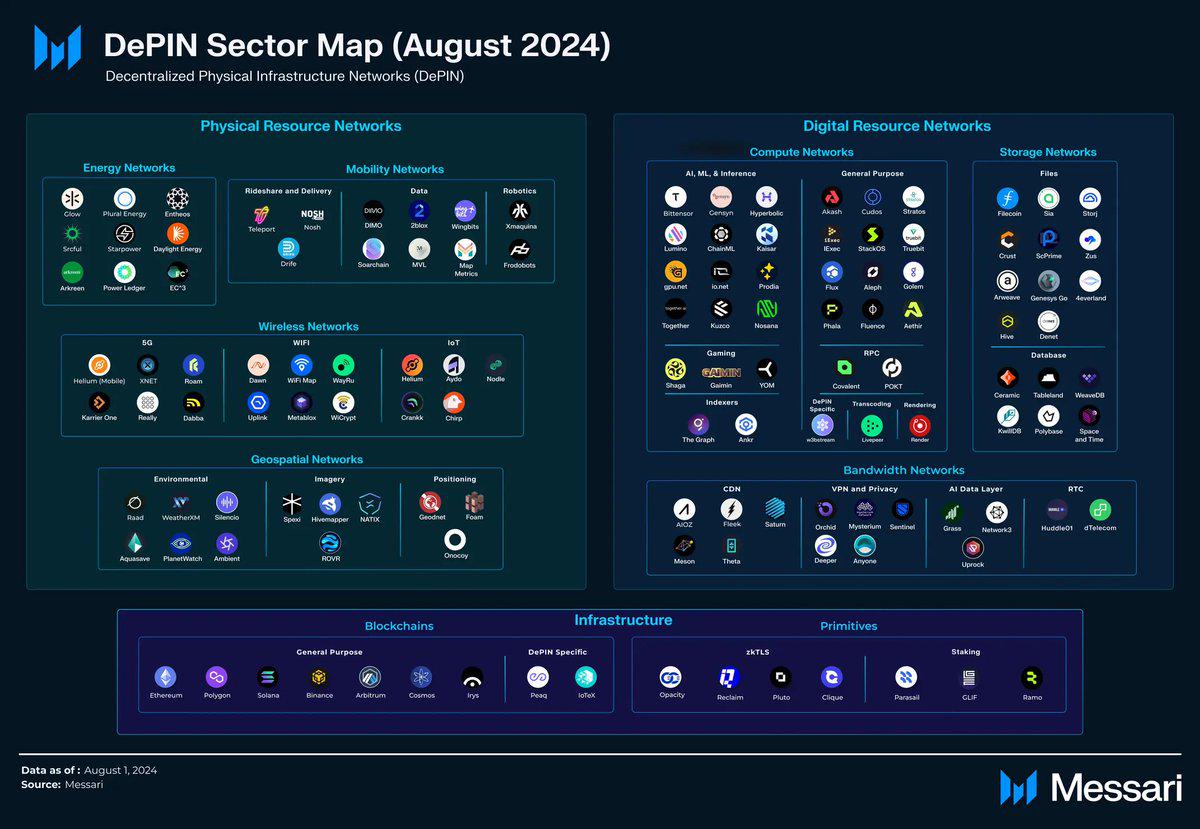

DePIN ecosystem map Source: Messari

In terms of the distribution of DePIN projects on various chains, they mainly come from Ethereum, Solana, IoTeX, and Polygon. Among them, there are 54 and 36 DePIN projects on Ethereum and Solana, respectively. At the same time, DePINscan data shows that the current total number of DePIN devices has exceeded 18 million, with nodes spread across 195 countries and regions globally, mainly concentrated in Asia, the United States, North America, India, Southeast Asia, Africa, and Europe.

In addition, the financing scale of DePIN is also growing significantly. According to the August DePIN industry report released by Messari, the financing scale of the DePIN field has increased by 296% year-on-year, with the largest single financing being the 50 million US dollars raised by IoTeX in April, and the other top five projects including io.net, DIMO, and Daylight have deep cooperation with IoTeX in data verification, off-chain computing, or capital layer.

However, the overall income situation in the DeFi field is not optimistic. Data from Depin.Ninjia shows that as of September 19th, the cumulative income of the top 10 DePIN projects is only 1.023 million US dollars.

Capital influx, competitive landscape may bring significant variables

Currently, the DePIN market is welcoming more competitive variables and growth space.

On the one hand, some institutions have launched DePIN investment funds with large capital scale, such as Borderless Capital's recent launch of a 100 million US dollar DePIN fund, with LPs including blockchain Peaq, Solana Foundation, and Jump Crypto focusing on DePIN; investment companies Hodler Investments and Gawan Holding, headquartered in the United Arab Emirates, plan to launch a 500 million US dollar fund to invest in DePIN and other fields; Bitrue Ventures has launched a 40 million US dollar investment fund focusing on DePIN, RWA, and other fields; the SOLLONG Foundation has announced a 30 million US dollar new funding plan dedicated to promoting the development of DePIN and AI; investment company Lemniscap announced that it has raised a 70 million US dollar fund, focusing on early Web3 projects such as DePIN.

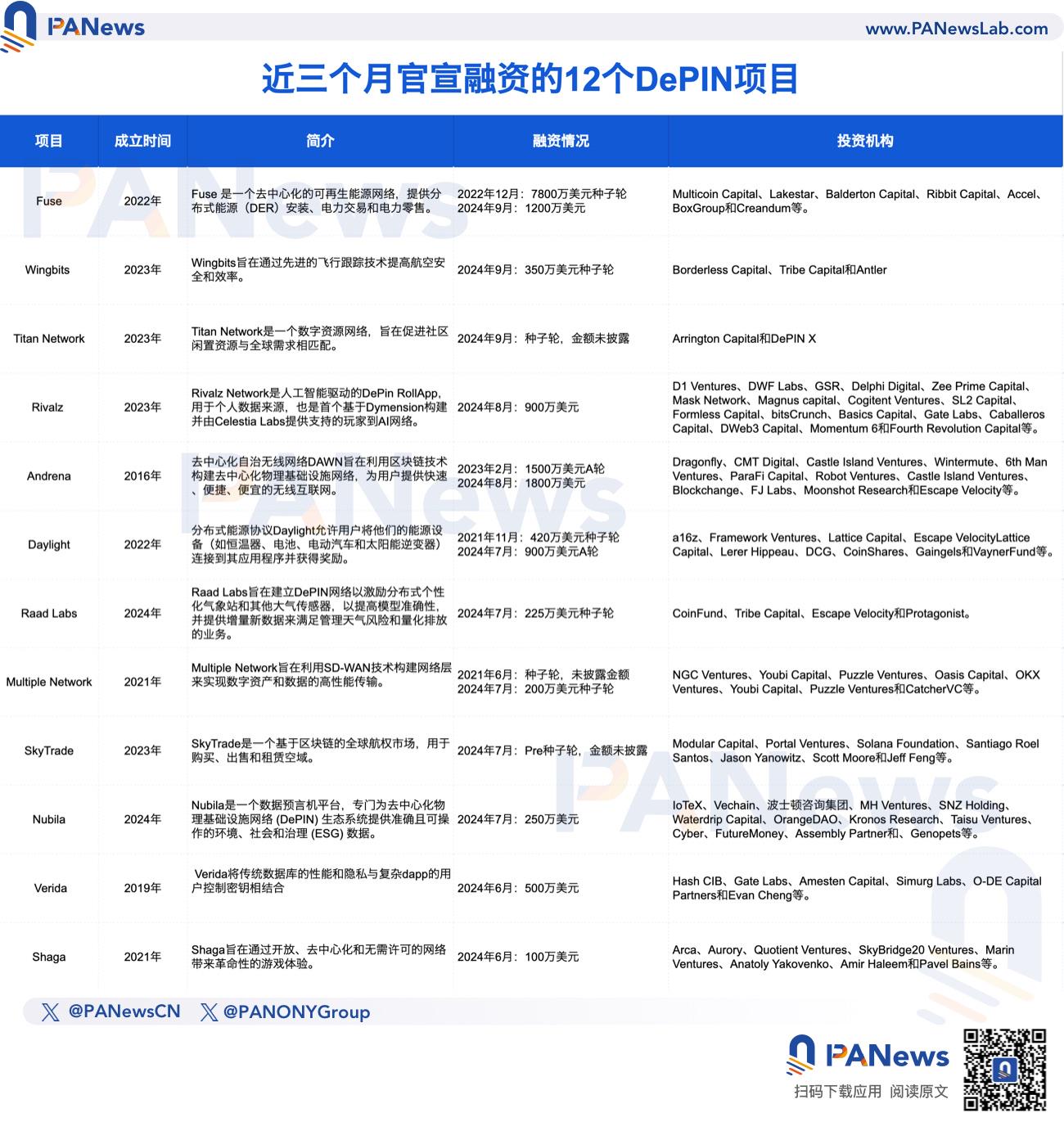

On the other hand, a large number of capital-backed new DePIN projects have also entered the market in recent times. For example, the parent company of the renewable energy DePIN project Project Zero, Fuse, recently announced the completion of a 12 million US dollar strategic financing led by Multicoin Capital; DePIN flight tracking network Wingbits protocol completed a 3.5 million US dollar seed round financing led by Borderless Capital and Tribe Capital; the Solana-based DePIN project Andrena completed an 18 million US dollar financing led by Dragonfly; the Base-based DePIN project Daylight received a 9 million US dollar Series A financing led by A16z Crypto; DePIN network developer Verida completed a 5 million US dollar seed round financing with participation from Simurg Labs, O-DE Capital Partners, ChaiTech Ventures, etc.; DePIN Layer1 protocol Peaq raised 20 million US dollars through CoinList; DePIN project Blockless completed a total of 8 million US dollars in seed pre-round and seed round financing, including seed round financing led by NGC Ventures, and seed round financing jointly led by M31 Capital and Frachtis, etc. The market's pursuit of capital also confirms the strong development potential and attractiveness of DePIN.

Regarding the rapid development of DePIN, Helium CEO Abhay Kumar pointed out in a roundtable discussion at Token2049, using his own case as an example, that traditional markets that use advanced precision location services have to some extent driven the development of DePIN, providing customers with more competitive value propositions, including lower costs, better coverage, and ease of integration, with application scenarios including civil measurement, high-definition map drawing, construction, agriculture, and other fields. The attention of the cryptocurrency market has now expanded from entertainment such as trading or storing value to real-world applications. In the case of Helium alone, there are already tens of billions of consumers and millions of enterprises relying on map services. For the cryptocurrency field to become more important and popular in the next 5 or 10 years, both cryptocurrency products and services need to be successful. GEODNET CEO Mike Horton added in the roundtable discussion that a healthy token economy is a powerful tool for DePIN, which can return the actual usage and value of the network to users. As network utility grows, the value of tokens will also increase.

Rating agency Moody's also pointed out in its recent first report on the DePIN field that DePIN can help existing networks expand and innovate. Specifically, existing network operators such as telecommunications companies and utilities face growing user demand, which requires capital-intensive infrastructure development. Using a decentralized model can help them alleviate some of the pressure and maintain competitiveness while disrupting old business models in artificial intelligence and the Internet of Things (IoT). By combining the established parts of the system backbone with the construction modules of distributed ledger technology (DLT), DePIN has the potential to improve the reliability and efficiency of networks, reduce operating costs, optimize resources, and industry collaboration.

However, Moody's also pointed out that widespread adoption of DePIN faces significant obstacles, including regulatory and interoperability issues, network security risks, and the huge investment required for infrastructure and skills, as well as unclear regulations, which may inhibit its growth.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。