⛱ Research Report: How various assets have performed after each round of Fed rate cuts?

There have been certain patterns during the 7 rounds of rate cuts. Prior to the first rate cut, US Treasury bonds, gold, and other assets typically benefit.

After the first rate cut, the volatility of most asset prices tends to increase, and 2-3 months later, US Treasury bonds and stocks may show positive performance. Both before and after rate cuts, US Treasury bonds have relatively high win rates.

US Treasury bonds: Interest rates trend downward, but in the case of a "soft landing," there may be a temporary rebound 1-2 months after the first rate cut.

US Dollar Index: There is no absolute correlation between its trend and rate cuts, or whether there will be a "soft landing."

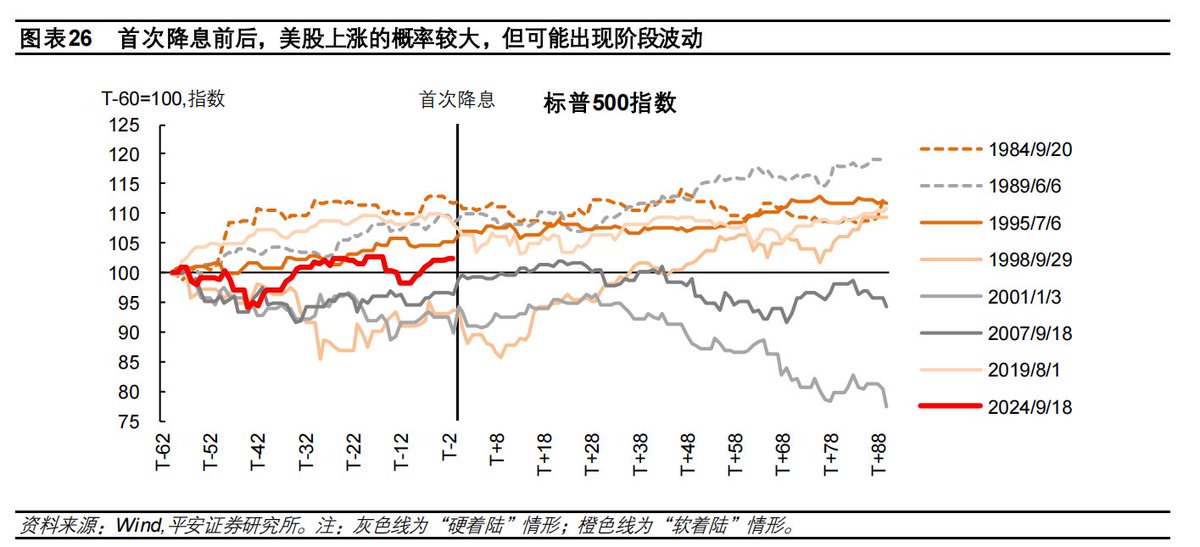

US stocks: The uptrend may "cool off" before and after the first rate cut, but typically resumes after 2-3 months.

Gold: There is a high probability of an increase before rate cuts, but its trend after rate cuts is uncertain.

Crude oil: There is a higher probability of a decrease after rate cuts, but it is not absolute.

As for assets like #Bitcoin, I have only one thing to say: "The massive surge is beyond imagination!"

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。