Arbitrage trading has always been a key driving force in the global financial market, and its application in the cryptocurrency market signifies a significant evolution of this strategy.

Authors: Chi Anh, Ryan Yoon & Yoon Lee

Translation: DeepTechFlow

Key Points Summary:

Arbitrage Trading in Finance and Cryptocurrency: Arbitrage trading refers to borrowing low-interest currency to invest in high-yield assets. This strategy is widely used in both traditional and cryptocurrency markets, where traders leverage it to enhance liquidity and influence currency valuations. In the cryptocurrency field, this often involves borrowing stablecoins to invest in decentralized finance (DeFi), which, despite offering high returns, also comes with significant risks due to volatility.

Market Dynamics and Risks: Arbitrage trading can enhance market liquidity but may lead to severe fluctuations during crises, exacerbating market instability. In the cryptocurrency market, this could trigger speculative bubbles. Therefore, risk management is crucial for investors and businesses using this strategy.

Future Trends and Challenges: Innovations such as tokenized returns and decentralized liquidity are shaping the future of arbitrage trading in the cryptocurrency market. However, the potential rise of anti-arbitrage mechanisms presents challenges, requiring the development of more resilient financial products to address them.

1. Impact of Arbitrage Trading on the Market

Arbitrage trading is a fundamental strategy in the global financial market, where investors borrow low-interest currency to invest in high-yield assets. Its core objective is to profit from interest rate differentials, which can be significant due to the currencies and assets involved.

An example of arbitrage trading in the traditional market

Source: Jefferies & Co, Tiger Research

For instance, investors can borrow Japanese yen at a rate of about 0.1% and then invest in Mexican bonds with a yield of approximately 6.5%, yielding about 5% profit without using their own capital. Arbitrage traders provide liquidity by borrowing and investing across different markets, contributing to price discovery and financial market stability.

However, this liquidity provision comes with risks, especially when market conditions unexpectedly change, such as during financial crises or sudden currency policy adjustments. During times of significant market pressure, such as the 2008 global financial crisis, arbitrage trading may collapse rapidly, leading to sharp reversals in currency value and significant losses for investors.

In stable foreign exchange rates, arbitrage trading can be highly profitable. However, during market instability, these trades may be quickly closed out. In such cases, investors are often eager to sell off high-risk assets and buy back the borrowed currency, leading to significant market adjustments. This chain reaction exacerbates market volatility. Large-scale sell-offs increase market volatility, triggering asset price declines and a vicious cycle of forced liquidation.

2. Application of Arbitrage Trading in the Cryptocurrency Market

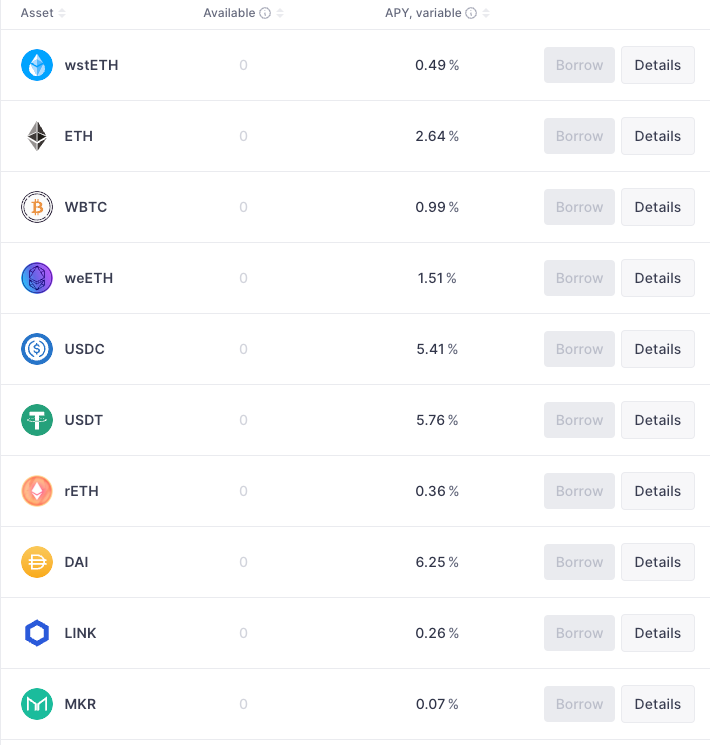

The numbers shown in the table are averages obtained from multiple platforms. Actual numbers may vary depending on market conditions, specific operations of platforms, and timing of data collection. Readers are advised to verify current data and conduct independent research when making decisions based on this information.

Table: Tiger Research, created using Datawrapper

The concept of arbitrage trading also has a significant impact in the cryptocurrency market.

A typical strategy involves borrowing USDT at an annual yield rate of 5.7% (APY) and then investing in a DeFi protocol offering a 16% return. Under stable asset values, this can yield approximately 10% profit. Compared to the approximately 6% yield from Mexican bonds, the profit margin is usually higher due to the volatility of cryptocurrencies.

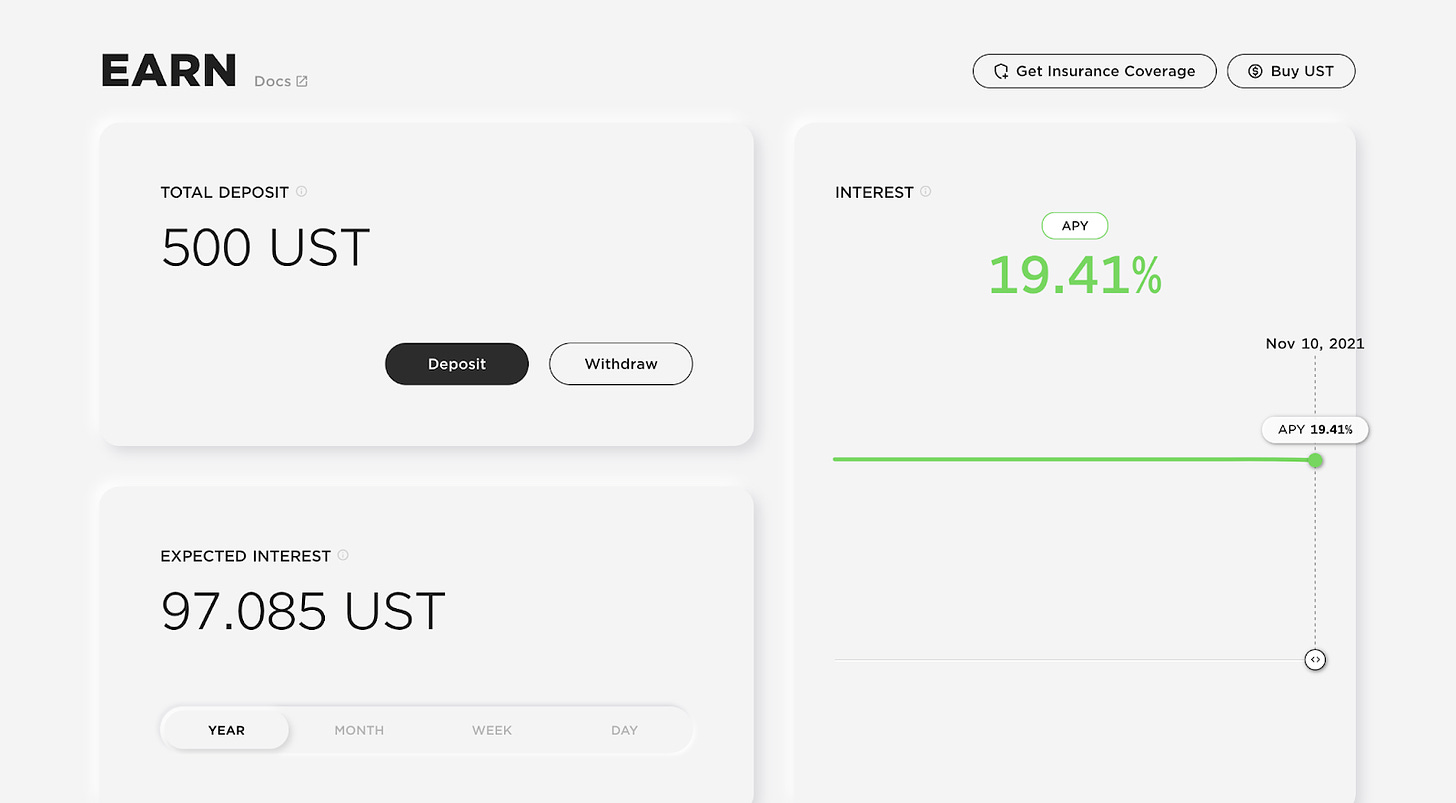

According to AAVE's data, stablecoins have become central in cryptocurrency arbitrage trading as they provide stable and low-cost borrowing options. For example, in 2021, DeFi protocols offered over 20% annual yield, making stablecoins an ideal low-cost borrowing tool for arbitrage traders.

In 2022, Anchor Protocol offered a fixed 20% annual yield for UST. However, the market is not without risks. The collapse of the Terra/Luna ecosystem in 2022 serves as a warning. Many arbitrage traders borrowed stablecoins to invest in Terra's Anchor Protocol, which promised up to 20% returns. However, when the value of $LUNA rapidly declined, these arbitrage trades were forced to close out quickly, leading to widespread liquidation and significant losses in the market.

This example reveals the inherent risks of arbitrage trading in the cryptocurrency field. In this domain, borrowing stablecoins to invest in high-yield assets has become a common strategy. The volatility of crypto assets can amplify the impact of these trades to levels rarely seen in traditional finance.

At the same time, this challenge also presents significant opportunities. The market may develop innovative financial products and services tailored to the needs of cryptocurrency arbitrage trading, such as advanced risk management tools and yield optimization platforms. However, businesses must adopt flexible strategies to quickly respond to market volatility in order to address the high volatility of crypto assets.

3. Differences Between Traditional Arbitrage Strategies and Cryptocurrency Arbitrage Strategies

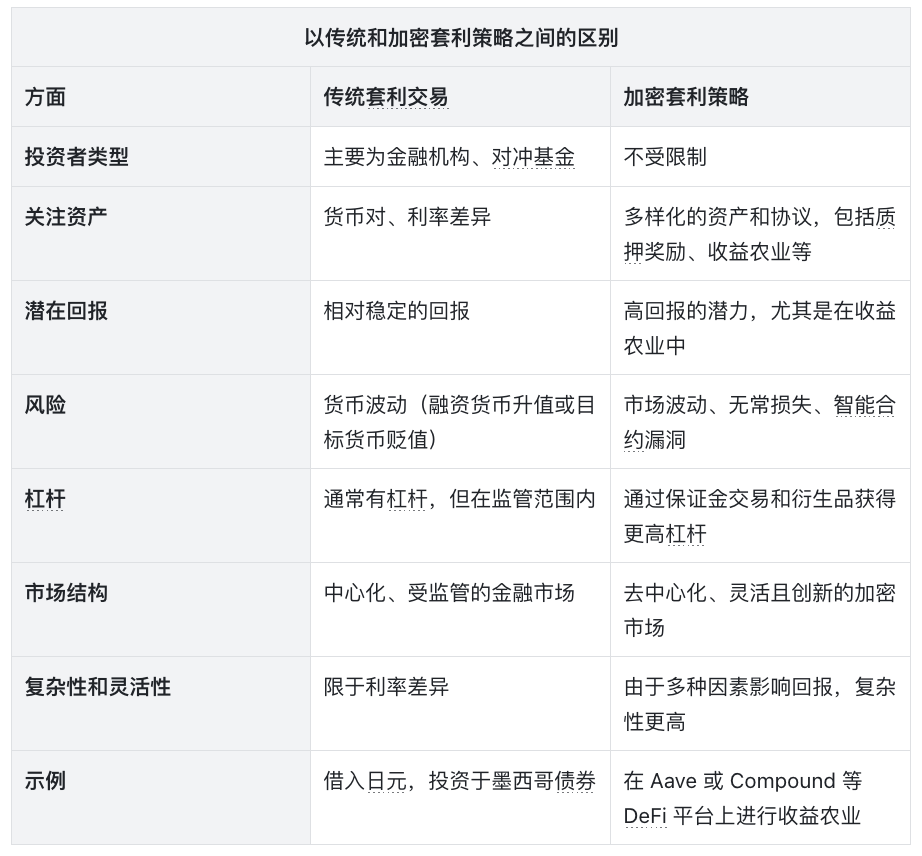

Source: Tiger Research, created using Datawrapper

While both traditional and cryptocurrency arbitrage trading are based on interest rate differentials, they exhibit significant differences in terms of investor types, target assets, and risk levels. Traditional arbitrage trading is typically the domain of institutional investors such as funds and financial institutions, while cryptocurrency arbitrage trading provides opportunities for retail investors.

In terms of assets, traditional arbitrage trading primarily focuses on currency pairs in regulated markets, typically offering stable returns and moderate risks. In contrast, cryptocurrency arbitrage strategies utilize a more diverse range of platforms, providing greater flexibility and higher potential returns, but also significantly increasing risks. The use of leverage, yield farming, and staking rewards adds complexity to cryptocurrency arbitrage trading, making it a profitable but high-risk investment strategy.

In the rapidly changing cryptocurrency market, decision-makers must carefully weigh these factors when considering arbitrage trading.

4. Impact of Arbitrage Trading on the Cryptocurrency Market

4.1. Self-Reinforcing Mechanism and Market Momentum

Arbitrage trading forms a self-reinforcing mechanism that drives market momentum. As mentioned earlier, arbitrage trading involves borrowers leveraging low-interest assets to invest in high-yield opportunities. When the market outlook is optimistic, this may trigger a cycle: rising prices attract more traders, further enhancing the profitability of trades, specifically:

More investors borrow stablecoins for market investment to gain profits.

The increase in stablecoin borrowing pushes up market prices.

As prices rise, more investors join in, forming a self-reinforcing cycle.

However, this cycle brings significant risks in the highly volatile cryptocurrency market. Sudden market changes—such as declining asset values or soaring borrowing costs—may lead to rapid closure of these trades. This mass exodus could trigger liquidity issues and significant price declines, further exacerbating market instability. While arbitrage trading can enhance liquidity and bring profits, it may also trigger sudden and severe market turmoil.

4.2. Enhancing Liquidity in the Cryptocurrency Market

During the DeFi summer of 2021, the total value locked (TVL) in DeFi experienced significant growth

Source: DeFiLlama

Cryptocurrency arbitrage trading, especially involving stablecoins, significantly enhances market liquidity. Stablecoins such as USDT, USDC, and DAI are commonly used in arbitrage trading, providing necessary liquidity for DeFi platforms, including lending protocols. This influx of funds promotes smooth trading and improves price discovery efficiency, benefiting the entire cryptocurrency market.

In 2023, the daily average trading volume of stablecoins exceeded $80 billion, demonstrating their crucial role in maintaining liquidity in the cryptocurrency market. Additionally, the improved liquidity attracts institutional investors, who typically prefer markets with higher liquidity. This, in turn, brings in more capital, promoting market stability.

5. New Trends in Arbitrage Trading

5.1. Rise of Yield-Bearing Tokens

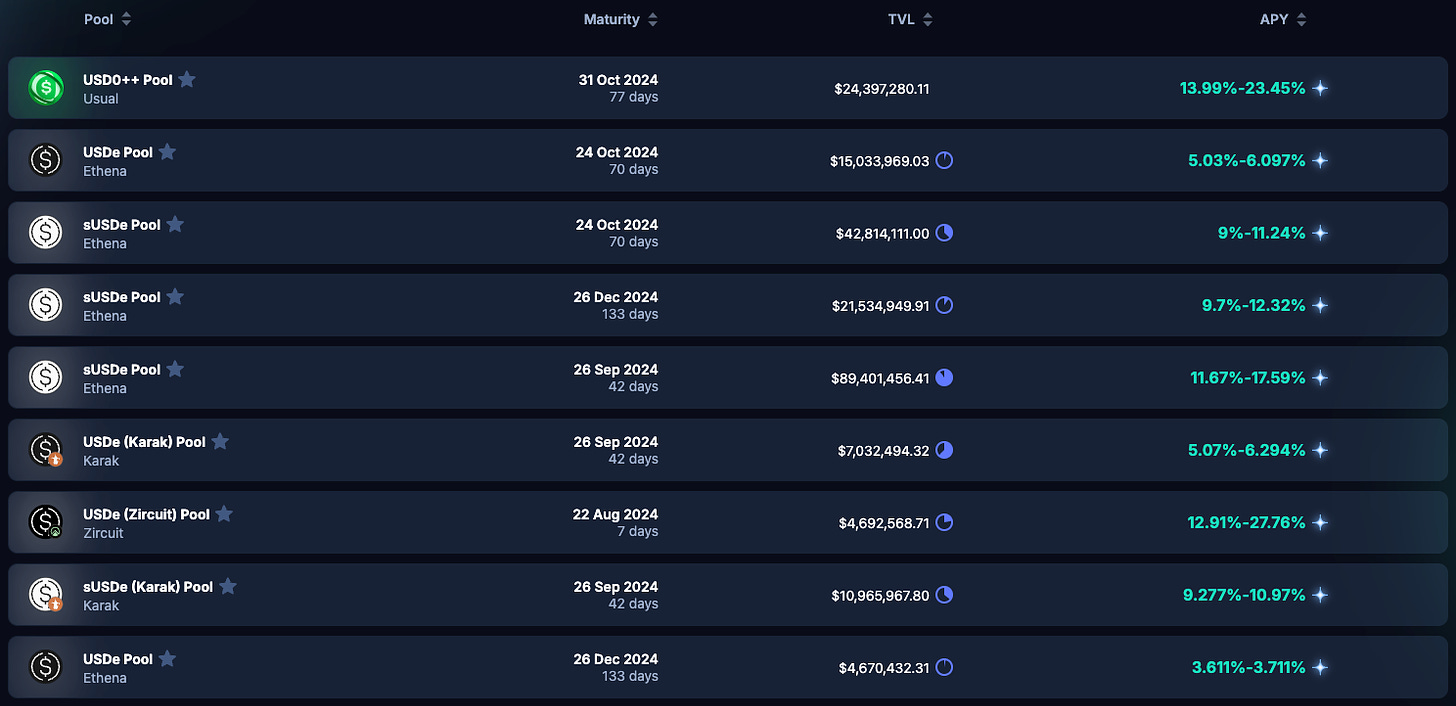

Annual percentage yield (APY) of stablecoins on the Pendle protocol, Source: Pendle

As the cryptocurrency market continues to evolve, new trends emerge in arbitrage trading. One of these trends is yield-bearing tokens, where investors can separate future returns from the principal for trading, as seen on platforms like Pendle. This innovation enables more complex arbitrage strategies, allowing investors to hedge or speculate on future returns.

5.2. Possibility of Anti-Arbitrage Mechanisms in the Cryptocurrency Market

Anti-arbitrage mechanisms refer to the market expecting future volatility to exceed current levels. This presents specific challenges for arbitrage trading, especially in the cryptocurrency market. When price volatility increases, the efficiency of arbitrage trading decreases, as it typically involves borrowing low-interest assets to invest in high-yield assets. With rising liquidity costs and increased leverage-related risks, this strategy not only reduces profits but also becomes more dangerous.

However, due to the deflationary nature of cryptocurrencies like Bitcoin (i.e., limited supply), they may perform well in an anti-arbitrage environment. Fiat currencies are susceptible to inflation, while cryptocurrencies like Bitcoin and similar assets can serve as store of value tools and hedge against the devaluation of traditional investments. In such a context, they may become a strong alternative choice for traditional arbitrage trading strategies.

6. Conclusion

Arbitrage trading has always been a key driving force in the global financial market, and its application in the cryptocurrency market signifies a significant evolution of this strategy. In the future, arbitrage trading will develop in innovation, regulatory changes, and continued interaction between traditional and cryptocurrency markets. With the increasing entry of cryptocurrency ETFs into the market, the boundaries between traditional finance and digital finance are becoming increasingly blurred, providing institutional investors with opportunities to enter the cryptocurrency market for high returns. This change may attract capital inflows from the traditional finance sector, further enhancing the legitimacy of the cryptocurrency market and expanding its influence.

However, businesses and investors in the cryptocurrency field need to carefully balance the risks and rewards of arbitrage strategies and closely monitor emerging trends that may reshape the market. The possibility of anti-arbitrage mechanisms increases the complexity of the market due to regulatory changes or shifts in market dynamics. This complexity will pose challenges to traditional approaches while also providing new opportunities for flexible participants. By identifying these changing trends and maintaining flexibility, market participants can better seize the unique opportunities brought about by the convergence of traditional finance and cryptocurrency finance.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。