Everclear is the first settlement layer to coordinate cross-chain order flow global settlement. The mainnet was launched on September 18th.

Author: Paul Veradittakit, Partner at Pantera Capital

Translation: Golden Finance xiaozou

1. Clearing Intents

Currently, there are dozens of active L1 chains, and with the emergence of rollup services, the number of L2 chains has also exploded. Reducing the trade-offs for cross-chain cryptocurrency transfers, unlocking value for all chains, improving user experience, and creating narrower spreads for users, applications, and protocols on these chains are urgently needed. Bridges are ways for users to transfer assets and liquidity across chains. This is crucial for price stability on chains, and more importantly, for providing consumers with competitive spreads. Current crypto bridges face the dilemma of being fast, low-cost, and permissionless.

There are three types of cross-chain bridges:

- Custodial bridges: Using CEX (centralized exchanges) such as Coinbase or Binance for cross-chain bridging is immediate and low-cost, but lacks permissionless features.

- Permissionless bridges: Speeds of protocols like Hyperlane, Portal, Hop, and LayerZero are relatively fast but not cheap. They can be permissionless, charging fees to liquidity providers (LP), or rely on trusted miners to create standardized packaged assets (not trusted assets).

- Intent bridges: Current solutions are permissionless, but due to rebalancing, they are usually slower and not significantly cheaper than permissioned bridges, and are also limited to large batches of tokens.

Intent bridges are expected to solve this dilemma, but they face issues such as liquidity fragmentation, lack of standardization, and the cost of rebalancing.

Everclear's Clearing layer aims to address all of these issues and significantly reduce the friction of cross-chain transfers, lower the costs for application builders and users, and simplify the user experience for developers and users.

2. Intent Results

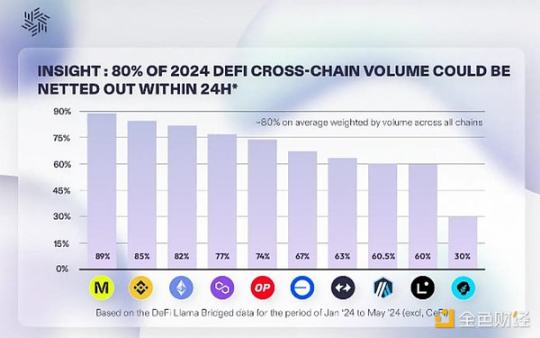

The Intent bridge noticed that 80% of cross-chain transaction volume will "flow back to the network" within 24 hours, meaning that for every dollar leaving a chain, 80 cents will return to the chain within 24 hours. There are always transactions coming in and out, but 80% of the transaction volume eventually returns to the original place.

The Intent protocol profits by exchanging liquidity on different chains rather than bridging. For example, if a protocol like UniswapX has a user transferring $100 from Arbitrum to Polygon, and another user transferring $100 from Polygon to Arbitrum, UniswapX will support the local transfer of tokens between the two users, which is much cheaper than traditional bridging.

The core problem that Everclear solves is that such perfect matches are rare. Without such perfect matches, the protocol must slowly transfer balances through traditional custodial or permissionless bridges and perform "rebalancing." This is a slow, complex, and expensive process.

3. Benefits to All Parties

The main stakeholders of the Intent bridge are:

- Permissionless blockchains, which hope to integrate bridging solutions, which is usually a lengthy process.

- Protocols (auctions) with intent order flow, but limited to their own order flow.

- Solvers (liquidity providers) executing certain intents on chains, but without an effective rebalancing method.

Everclear standardizes this process for everyone, which is a panacea. On each chain, Everclear deploys standardized contracts, where users can generate "invoices" for their intents, and solvers can "balance" with each other. If no one claims the invoice after a period of time, it starts a Dutch auction for the invoice. For example, if a user intends to transfer 10 ETH from Arbitrum to Polygon and initially no solver executes the request, the intent will be discounted to 9.99 ETH, and then lower and lower until a solver claims the invoice.

This standard benefits all stakeholders and creates a permissionless system that can aggregate order flow for applications, providing more order flow to solvers to maximize profits, and can support any chain with this standard set of smart contracts.

4. Partnerships

Everclear's goal is to benefit everyone. Existing stakeholders have a standardized system that effectively guarantees that intents are eventually executed; competition for user order flow becomes more intense, lowering prices. This also means that the more stakeholders there are, the more efficient this market becomes.

With this in mind, Everclear has collaborated with numerous stakeholders, such as aori (rebalancer), StaFi Protocol (L2 liquidity staking and staking app), Tokka Labs (rebalancer), Renzo (liquidity restaker), Anera (rebalancer), and more.

5. Mainnet Release

Everclear is the first settlement layer to coordinate cross-chain order flow global settlement, solving the liquidity fragmentation problem of modular blockchains. Everclear's mainnet was launched on September 18th. To learn more and get involved, please visit their blog.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。