Represented by Azuro and Polymarket, the future of the prediction market seems promising.

Source: cryptoslate

Compiled by: Blockchain Knight

With the development of platforms like Polymarket, the crypto prediction market is continuously growing.

In its latest in-depth research report, Castle Capital pointed out that prediction markets enable users to bet on future events using crypto assets, shifting traditional gambling to the decentralized field.

This shift allows participants to trade with each other rather than through centralized institutions, thereby increasing transparency and resistance to manipulation.

Castle Capital outlined how prediction markets have historically been centralized, limiting user participation and flexibility.

The introduction of blockchain technology has decentralized these markets, allowing users to create their own markets and conditions.

Since the launch of another prediction market, Augur, in 2015, prediction markets have been recognized as a prominent application of blockchain technology, although mainstream attention has only recently increased.

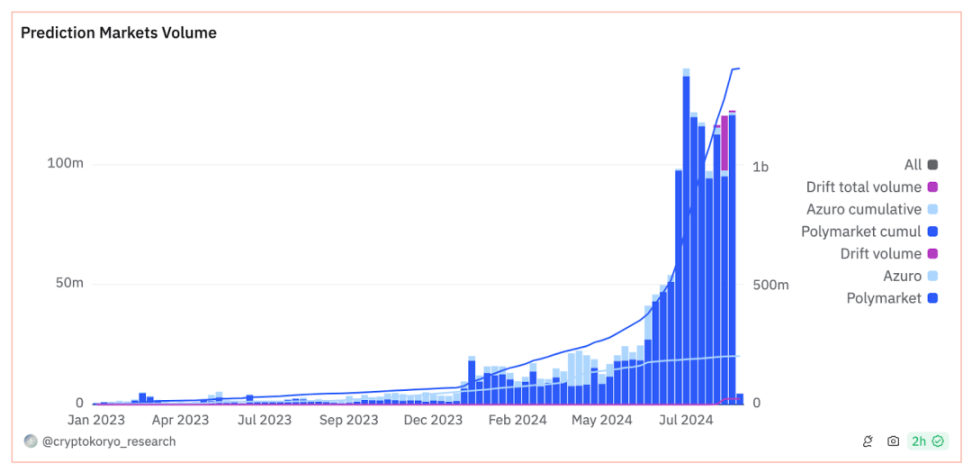

The total locked value in this industry has reached $162 million, with significant increases in user participation and trading volume.

Platforms like Azuro and Polymarket have facilitated this growth by offering different approaches.

Polymarket, based on Polygon, operates using an order book model and focuses on major political and news-related events.

Currently, Polymarket has processed over $1.4 billion in trading volume, becoming a significant betting platform for events such as the U.S. presidential election.

Castle Capital explained that Azuro adopts a peer-to-peer pool design, allowing users to provide liquidity for pools serving multiple markets. This model diversifies risk, improves capital efficiency, and primarily targets sports betting.

Azuro has already processed over $200 million in prediction volume, attracting users who repeatedly bet on various sports events.

Both platforms aim to expand their market share.

Polymarket seeks to reduce reliance on political events by adding more diverse markets, while reportedly, Azuro plans to expand beyond the sports market to include political and news markets.

The development of these platforms highlights the growing interest in decentralized prediction markets as a tool for gauging public sentiment.

Castle Capital outlined the challenges still faced by mainstream applications, including liquidity issues, regulatory uncertainty, and the necessity of improving user experience.

Ensuring reliable orders and data accuracy is crucial, as is addressing the scalability issues of blockchain networks. Overcoming these obstacles requires innovation and cooperation with regulatory agencies.

As pointed out by Castle Capital, prediction markets have the potential to provide accurate public sentiment on various topics, surpassing seasonal speculation to become an indispensable decision-making tool.

Integrating artificial intelligence and expanding market products may enhance their utility and appeal. Prediction markets can provide decentralized sentiment data for news organizations and influence political discourse.

Represented by platforms like Azuro and Polymarket, the future of the prediction market seems promising.

Their continued growth and adaptability may solidify their position in the crypto asset field, providing valuable insights and opportunities for users predicting future events.

Castle Capital's report indicates that the development of prediction markets reflects the increasing adoption of decentralized applications.

However, whether these platforms can maintain their momentum, address future challenges, and gain mainstream recognition remains to be seen.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。