Author: Nan Zhi, Odaily Star Daily

Since its launch on Binance, Nerio (in lowercase) has gained more than 20 times in value, demonstrating the listing effect of Binance on one hand, and breaking the previous impression of continuous decline after the listing of VC coins on Binance on the other. If listing on CEX is considered as the ultimate goal and positive factor, which token sectors have the most advantages? What is the listing effect of top exchanges really like? In this article, Odaily will summarize the listing situation of top exchanges since August 1st and attempt to answer the above questions.

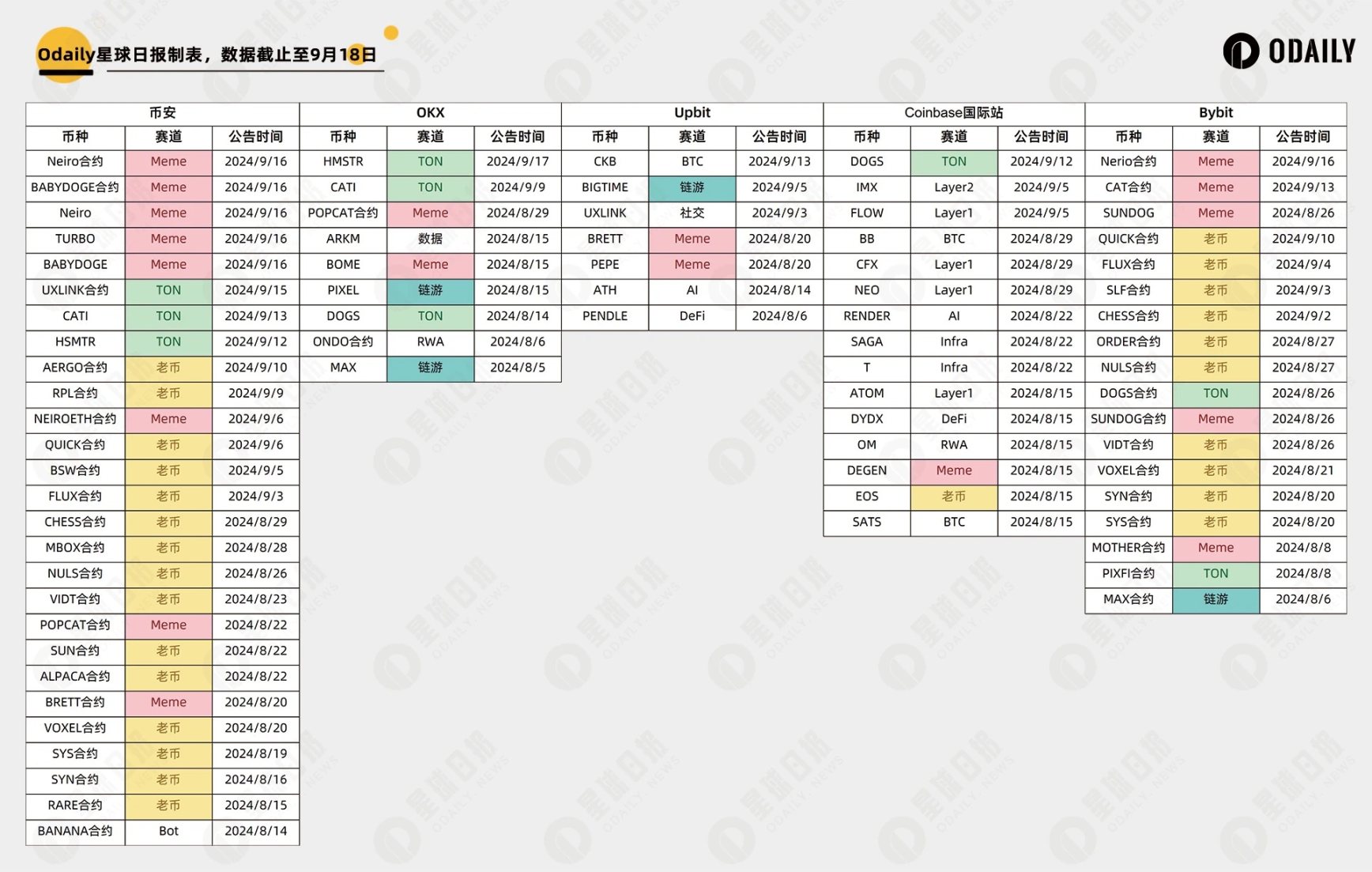

What are the exchanges listing?

This article compiles the listing announcements of the following exchanges:

- Binance, excluding coin-based markets such as SUI;

- OKX, excluding pre-market;

- Upbit, including Korean won, BTC, and USDT markets;

- Bybit;

- Coinbase International Exchange, only for futures.

The results are as shown in the following figure:

The conclusions are as follows:

- The only sector that can be listed on all exchanges is Meme;

- The second most covered variety by exchanges is the TON ecosystem, with Coinbase being the only one not involved in this sector;

- In terms of frequency, the top few are established coins (34.2%), Meme (23.6%), TON (11.8%), and blockchain games (5.3%);

- CEXs usually do not list the same token in a short period of time, and they wait for several months after another CEX lists it, emphasizing "not competing with each other".

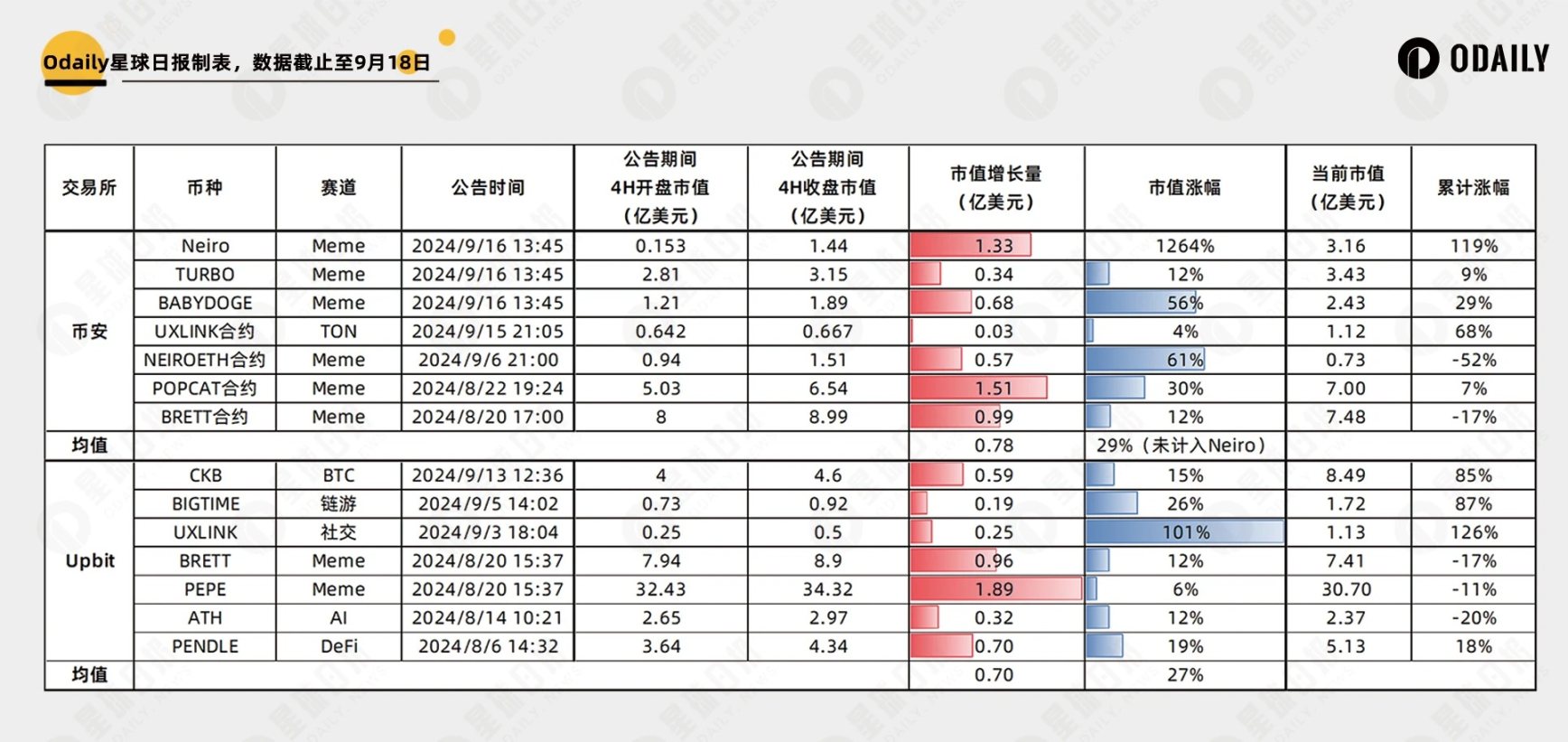

Listing effect of top exchanges

It is well known that listing on Binance and Upbit usually leads to a short-term surge, but how high can it rise in the short term? Can this trend be maintained in the medium to long term?

Odaily has conducted statistics on non-TGE listings on Binance and Upbit. The initial price is taken as the opening price of the 4HK line where the listing announcement was made, and the impact on the price is taken as the closing price of the same line. The price at 14:00 on September 18th is taken as the current market value.

The results are as shown below:

- Firstly, in terms of the increase in value, there is a significant difference among different tokens, with the larger the market value, the smaller the increase. For example, the largest market value token, PEPE, only rose by 6%, while the smallest market value tokens, Neiro and UXLINK, rose by 1264% and 101% respectively;

- In terms of the net increase in market value, there is still a significant difference among different tokens, with the more popular and widely accepted the token, the greater the net increase in market value. For example, the Meme token has the largest increase in value, with the strongest "community" attributes of PEPE, POPCAT, and Neiro ranking in the top three, while ATH (Aethir) mainly targets consumers and BIGTIME mainly involves studios, with a relatively smaller audience, resulting in a smaller increase in value;

- The average net increase in market value of the five tokens listed on the two exchanges in August is $78 million and $70 million respectively. Readers can consider this market value when deciding whether to participate in short-term speculation for subsequent listings;

- Three of the five tokens listed on the two top exchanges in August have a market value lower than before listing (BRETT, PEPE, ATH), and the other two tokens, POPCAT and PENDLE, have also experienced some decline, indicating that the listing effect of top exchanges is not long-lasting and cannot be the fundamental driving force for long-term growth. After experiencing short-term FOMO, they often return to their original positions.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。