Analysts turned bullish after the Fed's rate cut and believe that Bitcoin could rebound to $130,000.

By BitpushNews

After the Federal Reserve cut interest rates by 50 basis points yesterday, the loose monetary policy boosted market sentiment, and both the US stock market and the cryptocurrency market rose.

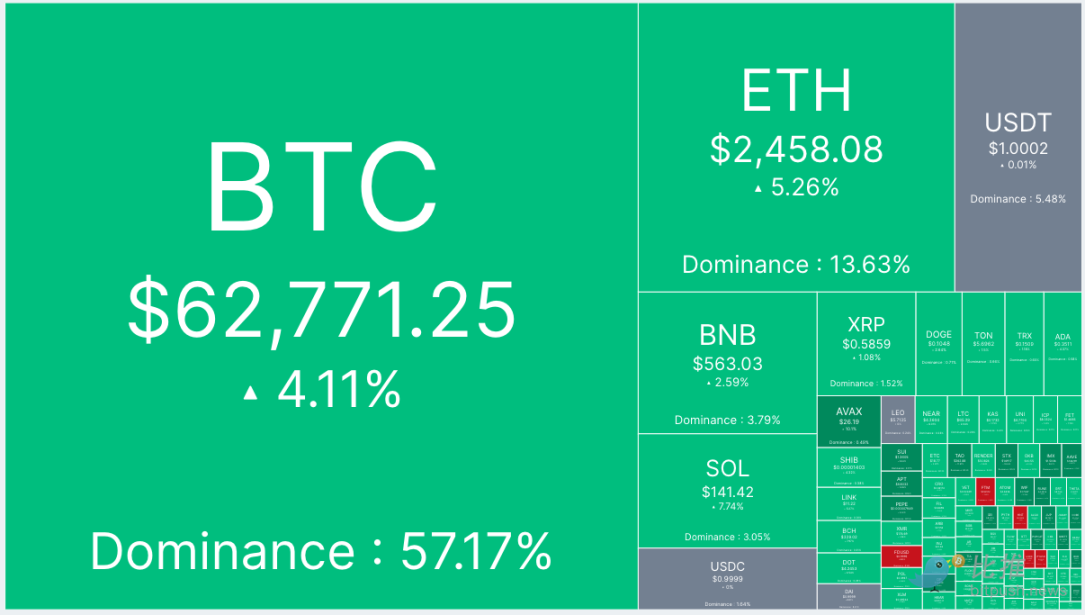

Data from Bitpush shows that after the initial volatility caused by the rate cut subsided, the Bitcoin bulls began to exert force. BTC rose from the support level of $60,000 to a high of $63,903 during the day, and at the time of writing, it had fallen back to $62,771, with a 24-hour increase of 4.11%.

Altcoins saw significant gains, with dozens of tokens in the top 200 by market capitalization experiencing double-digit increases.

Altlayer (ALT) led the gains, rising by 42.1%, while Popcat (POPCAT) and cat in a dogs world (MEW) both saw increases of 27.5%.

The total market capitalization of cryptocurrencies is currently $2.19 trillion, with Bitcoin's market share at 57.1%.

At the close of the US stock market, the Dow Jones Industrial Average initially rose by 1.2%, the S&P 500 Index rose by 1.7%, both reaching new highs, and the Nasdaq rose by 2.5%. Leading tech stocks rose across the board, with Tesla (TSLA.O) up 7%, Nvidia (NVDA.O) up 4%, and Apple (AAPL.O) up 3.7%.

Bullish sentiment returns, next key level for BTC: $65,000

Market analyst Bloodgood stated in his weekly update, "In last week's report, I pointed out that the Federal Reserve is about to enter a steady, slow, and orderly rate-cutting cycle, as the market believed that the likelihood of a 25 basis point rate cut was very high. However, when the meeting finally took place, the Federal Reserve decided to cut rates by 50 basis points, which was unexpected by most people. This should be better for the market—after all, we are lowering interest rates more quickly—but things are not that simple."

"Under normal circumstances, the expected process for a well-performing economy is a 25 basis point rate cut to achieve a soft landing, because a too rapid rate cut means that the Federal Reserve is concerned about an economic recession, which is not a good sign. It can be said that the last two times the Federal Reserve started a rate-cutting cycle with 50 basis points were in 2001 and 2007."

He pointed out, "Nevertheless, Powell repeatedly emphasized the word 'adjustment,' trying to emphasize that this is a deliberate adjustment of 50 basis points, not a panic move. From the market performance so far, the reaction seems mixed, although very robust economic data has greatly suppressed concerns about an economic recession."

Bloodgood stated that the Bitcoin bulls could "break through the key weekly level without falling below the previous low of $49,000," which could be a "sign that the trend is shifting from bearish to bullish."

The analyst believes, "Time will tell, but I am now expecting higher prices, which means breaking through $65,000. If it breaks through, more funds are expected to flow in, and it may reach $70,000 within a few weeks. If $65,000 is rejected, we may test $60,000 again. If it fails, there may be months of pain ahead."

TradingView analyst Arman Shaban also emphasized that $65,000 is a key level to watch and tends to agree with Bloodgood's bullish outlook based on Bitcoin's past performance.

Shaban wrote, "By analyzing the Bitcoin chart within a weekly time frame, we can see that, based on previous analysis, Bitcoin did not stabilize below $57,870. After a short-term correction wave, demand strengthened again. Last night, after the Federal Reserve announced a half-point rate cut, demand further increased and successfully rose to $62,500. Now, we must see if the price can break through $65,000 at the end of this week's candlestick chart. Bitcoin and other altcoins are likely to start their major bullish wave soon, with a mid-term potential target for Bitcoin at $80,000."

Previously bearish TradingView analyst Xanrox also turned bullish after the Federal Reserve's rate cut and believes that Bitcoin could rebound to $130,000.

Xanrox stated, "Bitcoin has been consolidating for over 6 months, but this situation should come to an end. On the chart, we can see a bullish flag, and the recent price action greatly increased the likelihood of a bullish breakout. Although I have been bearish from May ($72,000) until now, the recent price action has changed my perspective and turned me into a completely bullish mode."

He pointed out, "From the perspective of Elliott waves, we are starting another strong impulse wave (5), and the sideways price action (wave (4)) seems to be a very complex WXYXZ triple correction pattern. On the chart, you can see the price movement of the entire bullish cycle starting from $15,476. From a timing perspective, this makes sense, as the time range is almost the same as wave (2)."

To determine the price target, Xanrox used the Fibonacci extension tool to determine the 0.382, 0.618, 1.000, 1.382, or 1.618 extensions. He said, "Wave (5) is always measured from the start of the uptrend to the end of wave (4), and I estimate the target to be around $130,000."

Despite the improved market sentiment, analysts at Secure Digital Markets warned that the timing of the Federal Reserve's rate cut could raise concerns.

They stated, "If economic indicators deteriorate at the same time as the rate cut, this may signal deeper economic problems. Traders should closely monitor key indicators such as employment data and leading economic indicators. Historically, significant rate cuts, such as those in 2001 and 2007, have led to major market declines—both times, the S&P 500 index fell by over 40% within 350 days due to a significant increase in the unemployment rate."

They concluded, "While this does not necessarily mean that history will repeat itself, being aware of these patterns is crucial, especially as we go through a rate-cutting cycle. Unlike in recent years, where soft economic data has been seen as a positive catalyst for rate cuts, in this environment, deteriorating data could have the opposite effect, potentially dragging the market lower."

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。