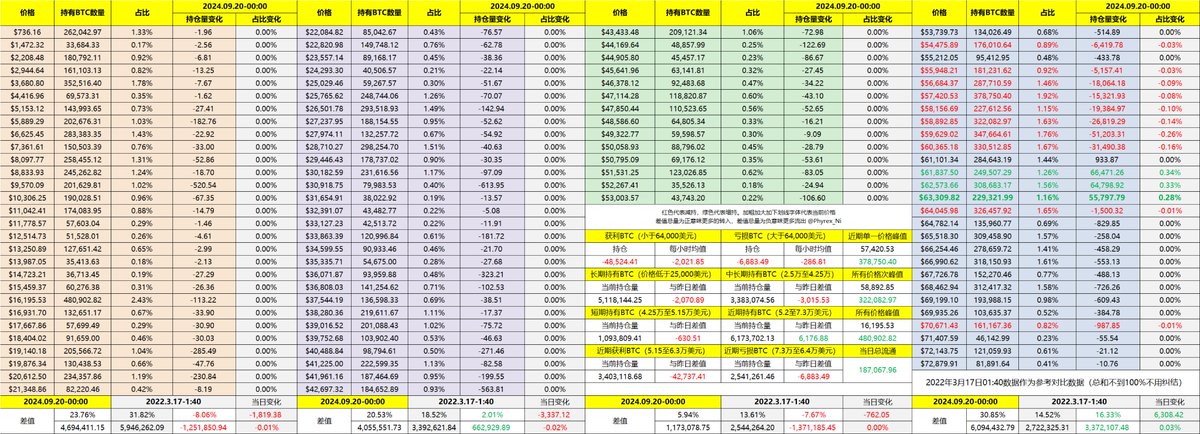

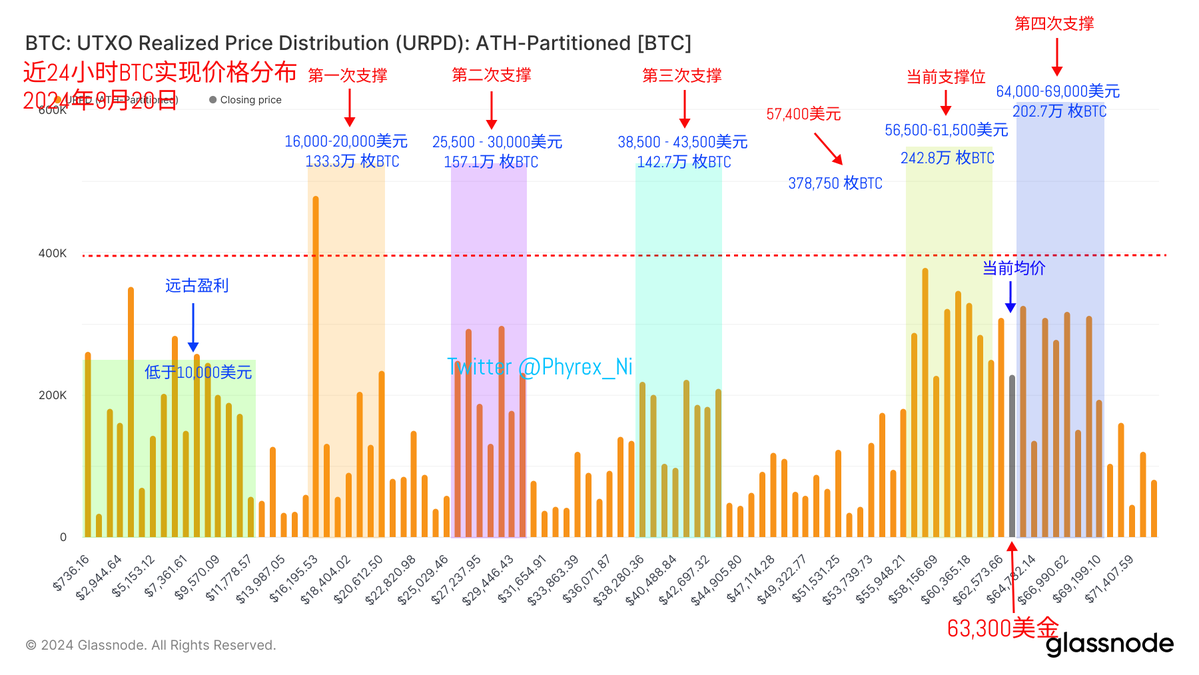

Homework is due. After counting, this is the eighth time in the past six months that the price has touched or exceeded $64,000. Since the fourth time, it has been said that this is a support level, but this support is not seen by many technical analysts based on price support, but rather through on-chain data showing a dense support area of chips. This time, it is not just the support from $64,000 to $69,000, and we often say that investors at this level are basically not considering exiting.

Moreover, from the current URPD data, the entire range between $56,500 and $69,000 is a concentrated area of dense chips. Of course, the range between $56,500 and $61,500 still belongs to short-term holders, and the #BTC in this range is likely to decrease with price changes. It will take a longer period of oscillation to determine if it is a support level.

In terms of the data itself, with the rise in BTC price, there are signs of a large number of short-term investors exiting, especially those who have made short-term profits. I have also heard many voices saying that $65,000 may be a hurdle.

I don't know if it is, but from the current trend, the market has already accepted the 50 basis point rate cut by the Fed and Powell's description of the current stable economic situation. Through the price, it is already known that investors' sentiment is stable and optimistic about the economy. The recent concern may be whether the Bank of Japan will adjust interest rates on Friday.

Theoretically, the likelihood of the Bank of Japan adjusting interest rates in September is not high, but if it does, it may not be a good thing for the short-term market. However, even if it is adjusted to an increase of 25 to 0.5%, it is still a relatively low interest rate and is unlikely to have a significant impact. So even if it does adjust, it may indeed cause short-term fluctuations in the market, but it is very likely to be understood by investors in the end.

Data has been updated, link: https://docs.google.com/spreadsheets/d/1E9awSVwrVOxKOiaMdYT5YZvfveeFd9ENU-iO6dVcGj0/edit?usp=sharing

This post is sponsored by @ApeXProtocolCN | Dex With ApeX

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。