Author: Arain, ChainCatcher

The shoe has finally dropped. In the early morning of September 19th, Beijing time, the Federal Reserve announced a 50 basis point cut in the federal funds rate target range, lowering it to a level between 4.75% and 5.00%. This is the first rate cut by the Federal Reserve since March 2020. Prior to this, in order to alleviate domestic inflation in the United States, the Federal Reserve raised interest rates 11 times from March 2022 to July 2023, with a cumulative increase of 525 basis points.

This means that the monetary policy in the United States has shifted from tightening to easing. Bitcoin temporarily bid farewell to its slump, rebounding near the rate cut decision and returning to $60,000 per coin. Subsequently, it surged to nearly a 20-day high. Before the U.S. stock market opened today, stocks related to cryptocurrencies rose, with Coinbase (COIN.US) up over 3% and MicroStrategy (MSTR.US) up over 4%.

Unusually Large Rate Cut, Mixed Market Reaction

Historically, a significant rate cut by the Federal Reserve often leads to economic growth, stimulates inflation, and gives rise to asset bubbles.

The announcement of a 50 basis point rate cut by the Federal Reserve this time is historically rare. Bank of America had previously warned that a 50 basis point rate cut "makes no sense, is difficult to communicate, and may trigger a flight to safety."

In the history of the United States, there have only been three instances of rate cuts without an economic recession: during the Greenspan era from 1994 to 1996, during the Asian financial crisis from 1998 to 1999, and during the money market shortage in 2019. Each of these three rate cut cycles consisted of three 25 basis point cuts. Some analysts believe that this rate cut may be compensating for the rate cut in July, showing that the Federal Reserve's action is not lagging behind the economic situation. However, Federal Reserve Chairman Powell denied that the rate cut was delayed and did not believe that this action was lagging behind the interest rate curve. He stated that this rate cut is precisely a reflection of the "Federal Reserve's commitment to not lag behind the economic situation."

Nomura Securities studied the performance of assets in several historically significant rate cut cycles and stated that three months after a 50 basis point rate cut by the Federal Reserve, the S&P 500 index remained basically unchanged, but small-cap stocks surged, technology stocks performed well, value stocks outperformed growth stocks again, the U.S. dollar rose, metal prices soared, and the yield curve showed a steepening trend in a bull market.

JPMorgan Chase expects the Federal Reserve to continue cutting rates and also points out that the beginning of a loose monetary policy by the Federal Reserve often "coincides with poor performance of risk assets."

On the day the rate cut information was announced, the U.S. stock market reached new highs but ultimately closed lower. The Dow Jones Industrial Average fell by 0.25%, the S&P 500 index fell by 0.29%, and the Nasdaq Composite Index fell by 0.31%.

Based on the current market reaction, the performance of the cryptocurrency market has benefited from the Federal Reserve's rate cut. Tradingview data shows that the current technical aspect of Bitcoin is in a buying state, while the moving average indicates a strong buying state.

Leena ElDeeb, a research analyst at 21Shares, stated, "Retail sales exceeding expectations are welcomed by the market and temporarily alleviate concerns about an economic recession. We may see investors regain interest in risk assets such as cryptocurrencies, thereby stimulating more funds flowing into Bitcoin spot ETFs."

Ki Young Ju, the founder of CryptoQuant, stated that institutions are no longer actively shorting Bitcoin. CME futures net positions have decreased by 75% over the past 5 months.

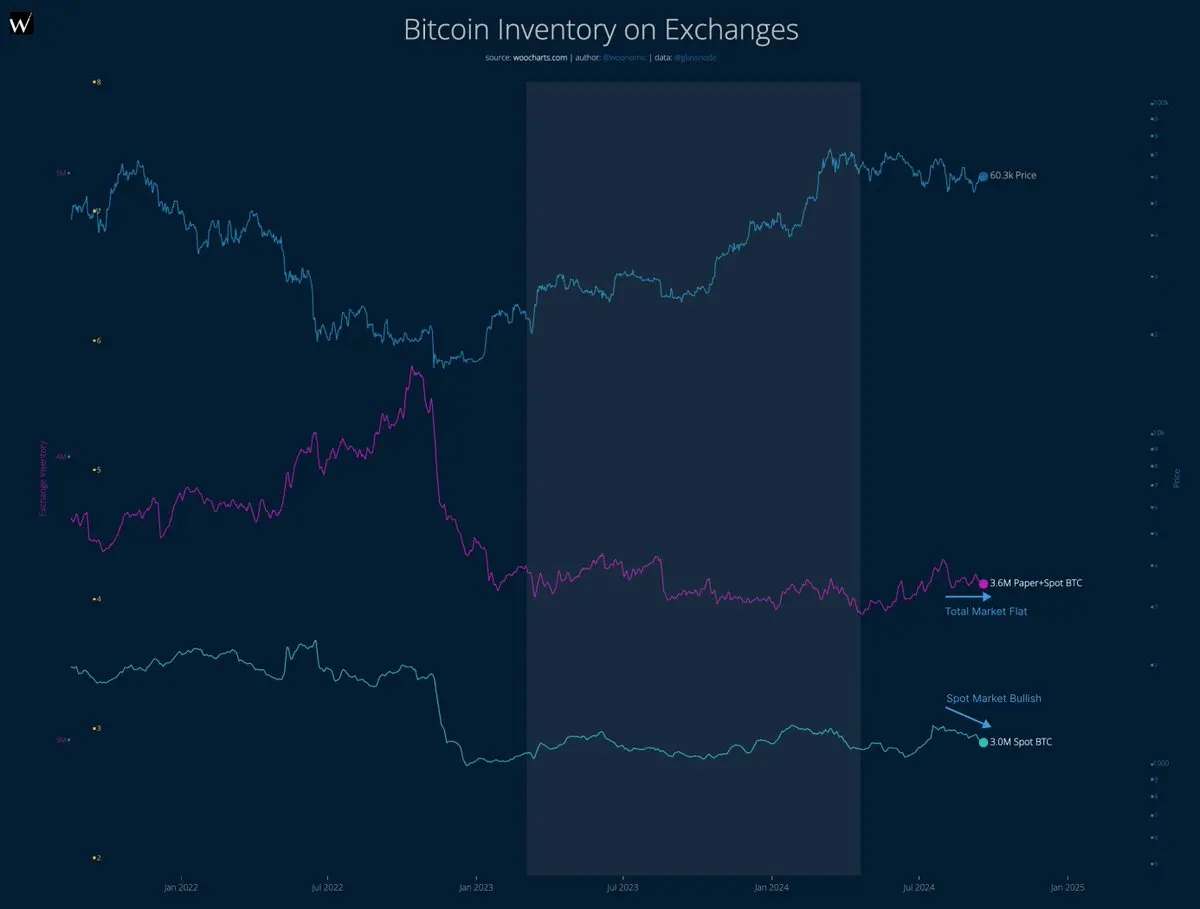

Bitcoin on-chain analyst @Willy Woo expressed his views on X, stating that the short-term bullish trend remains, but "there may be only a week left": "We see a large amount of spot BTC being bought up, and the proportion of exchange derivative inventory remains stable. However, if there is a short squeeze, this situation may change rapidly. Chart patterns are forming a bull market flag. Current demand and supply are neutral to bearish, but if there are some liquidations, there are signs that it may enter a bullish structure. Cautiously optimistic."

The latest report from Glassnode states that according to on-chain data, the Bitcoin market is currently in a state of balance, with investors mainly holding, but future market volatility may intensify: "The supply side is tightening, and the amount of stablecoins available is significantly decreasing. However, the increase in the supply of stablecoins brings greater future purchasing power, creating tension between current inactivity and potential future demand in the market. This has created a spring-like effect in the market, implying that future volatility will further intensify."

It should be noted that institutional interpretation of the rate cut information still needs to continue to monitor the subsequent net inflows of ETFs. According to data from SoSoValue, the U.S. Bitcoin spot ETF reported a net outflow of $52.83 million on September 18th, ending a streak of over 500 million dollars in net inflows for four consecutive days, with Ark Invest and 21Shares' ARKB leading the outflow, with an outflow amount of $42.41 million.

Focus on Subsequent Rate Cut Pace and U.S. Presidential Election

The Federal Reserve may continue to cut rates in the future.

19 members of the Federal Open Market Committee expect the Federal Reserve to further cut rates before the end of this year, with 9 members expecting a 50 basis point cut and 7 members expecting a 25 basis point cut.

Several institutions have expressed the view that the Federal Reserve will continue to cut rates. Brian Coulton, Chief Economist at Fitch Ratings, stated that this round of loose policy will continue with 10 rate cuts over 25 months, totaling a 250 basis point cut. JPMorgan Chase and Citigroup expect the FOMC to cut rates by 50 basis points at the November meeting, with JPMorgan Chase believing that subsequent meetings will each see a 25 basis point cut. The Global Research Department of Bank of America expects the Federal Reserve to implement a 75 basis point rate cut in the fourth quarter of this year.

The magnitude of the rate cut in this cycle has sparked discussions about whether it reflects the "strength of the U.S. economy."

Biden stated on social media X, "We have just reached an important moment: the inflation rate and interest rates are falling, and the economy remains strong… Our policy is reducing (consumer) costs and creating job opportunities."

U.S. Vice President Harris also stated that the rate cut is welcome news. In a statement, she said, "While the statement is good news for Americans who are facing high prices, my focus is on continuing to lower prices."

Former U.S. President Trump questioned the rate cut by the Federal Reserve. When asked about his reaction to the rate cut during a campaign event in New York on the 18th, Trump responded that it either reflects that the "economy is very bad": "I think, if they're not just playing politics, such a large rate cut indicates that the economy is very bad. It's either that the economy is very bad, or they are playing politics, those are the only two possibilities. But this is a very large rate cut."

Powell stated at a press conference on the same day that there are currently no signs indicating a high likelihood of a downturn in the U.S. economy.

Emmanuel K. of Barclays Capital Securities believes that after the first rate cut, it may take two to three quarters for economic growth to rebound, so it is uncertain whether the U.S. economy can avoid a recession.

It is worth noting that the phenomenon of a "U.S. economic recession" will also affect the future price trend of Bitcoin. Grayscale predicts that if the U.S. economy avoids a recession and maintains a path of controlled slowdown, Bitcoin may retest its previous historical highs.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。