The first "Board of Directors' dissenting vote" in nineteen years and a less dovish dot plot have left traders who successfully predicted the magnitude of this rate cut feeling bewildered. The upcoming employment and inflation data reports, as well as the Fed's Beige Book, will be the key factors determining the pace of rate cuts.

By: Zhu Xueying

Source: Wall Street News

The Fed cut rates by 50 basis points overnight, officially starting an easing cycle. However, the internal voting process for this decision did not proceed as smoothly as expected, and the Fed even witnessed "rare dissent."

This has led traders who previously successfully predicted the magnitude of the rate cut to start doubting the pace of future rate cuts by the Fed. Will there be further substantial rate cuts in November and December? This has also made the upcoming employment and inflation data reports potential pivotal factors influencing the Fed's rate cut pace.

Substantial rate cuts in November? Disappointed traders: It's hard to say

According to Bloomberg, despite accurately predicting the 50-basis-point rate cut several weeks ago, trader Akshay Singal is now feeling perplexed after seeing the rare dissenting vote and the less dovish latest dot plot from the Fed:

The 50-basis-point rate cut this time is quite hawkish… Overall, the Fed may be satisfied with this result, which is not considered overly accommodative, but its negative impact is puzzling to the market.

Bloomberg commented that Singal's attitude also reflects broader market sentiment in many ways.

Singal believes that although Powell wields significant power in driving policy and his own stance is clearly more dovish than other members, the existence of internal dissent raises doubts about the magnitude of future rate cuts:

Powell wields significant power, and the key in the coming months is to understand how dovish he really is.

The "root cause" of traders' confusion: the first "Board of Directors' dissenting vote" in nineteen years + a less dovish dot plot

One of the major factors that has perplexed Singal is the first "Board of Directors' dissenting vote" in nineteen years.

The decision statement for this round showed that not all FOMC voting members supported the 50-basis-point rate cut. Of the total 11 members, 11 supported the 50-basis-point rate cut, with only one member, Fed Governor Michelle Bowman, voting against it, advocating for a modest 25-basis-point rate cut to kick off this easing cycle.

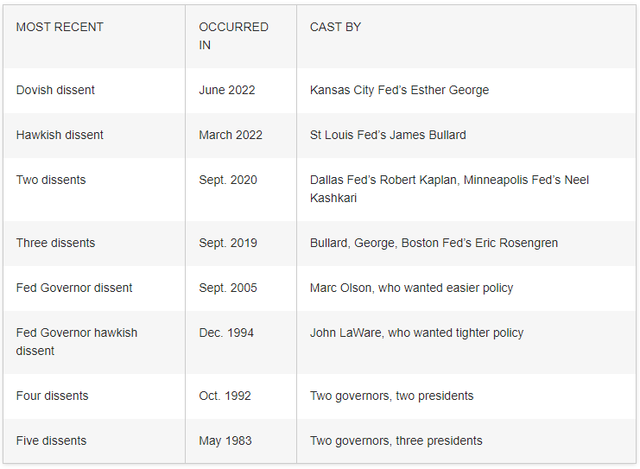

As a result, Bowman became the first Fed governor since 2005 to vote against the majority decision at an FOMC interest rate meeting.

Looking back at history, the Fed's meeting decisions have rarely encountered dissent, especially during Powell's tenure as chairman. The last time an FOMC voting member dissented from the overall decision was in June 2022, when a regional Fed president voted against it. At that time, Kansas City Fed President Esther George advocated for a modest rate hike.

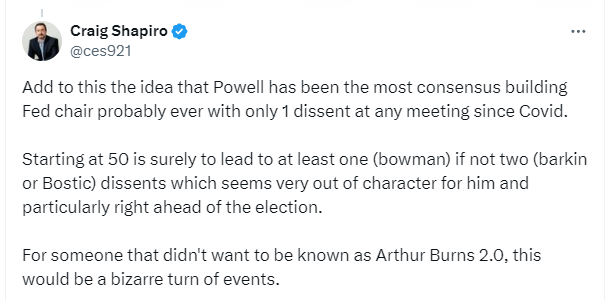

Some traders commented that, given Powell's "unity is strength" overall style, this situation actually seems quite "strange," especially on the eve of the U.S. election:

Powell may be the most consensus-oriented Fed chairman in history, with only one dissenting vote at every meeting since the COVID-19 pandemic.

Starting with a 50-basis-point rate cut will certainly lead to at least one dissenting vote (like Bowman), and possibly two (like Barkin or Bostic), which is very inconsistent with his style, especially on the eve of the election.

For someone who doesn't want to be called "Arthur Burns 2.0," this would be a rather strange turn.

Note: Arthur Burns served as Fed chairman in the early 1970s, and his policy stance was considered overly accommodative in addressing inflation issues, laying the groundwork for "stagflation" later on.

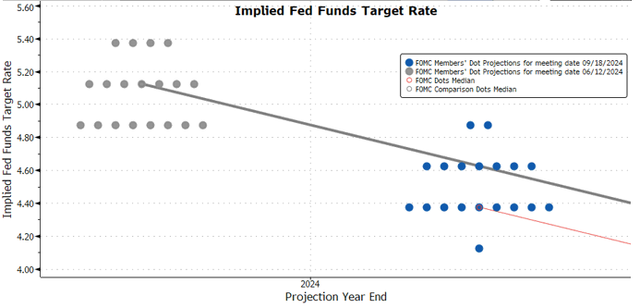

In addition, the less dovish latest dot plot has also made market traders represented by Singal find it difficult to judge the pace of future rate cuts. Currently, just over half of the decision-makers expect a total rate cut of at least 50 basis points this year.

Among the 19 officials providing forecasts, all of them expect the interest rate to be below 5.0% this time, compared to only eight who had such expectations last time. Only two people expect the interest rate to be between 4.75% and 5.0%, seven expect the interest rate to be between 4.5% and 4.75%, nine expect the interest rate to be between 4.25% and 4.5%, and one person expects the interest rate to be below 4.5%, between 4.0% and 4.25%.

In other words, among the 19 officials, only ten, accounting for nearly 53%, expect a total rate cut of at least 50 basis points this year. Slightly more than half of the officials expect that in the remaining two FOMC meetings in November and December, there will be at least a 25-basis-point rate cut each time, which to some extent contradicts the market's expectations for an accommodative pace.

What to focus on next? Data, data, and more data

Since the pace of future rate cuts by the Fed is still difficult to determine, data may once again take center stage.

As Singal put it: "Whether the Fed will cut rates by 25 or 50 basis points at the November meeting is like flipping a coin… It will depend on data dependence." He believes that the upcoming two non-farm payroll reports (October 4 and November 1) will have a significant impact on the Fed's next move.

During the overnight press conference, when Powell was asked what information should be known from now until November to determine the magnitude of the rate cut at the next meeting, he further emphasized the non-farm payroll and inflation data reports:

You know, more data. As usual. Don't look for anything else. We will see two labor reports, and we will also get inflation data, all of which we will focus on.

You know, it's always a question of looking at incoming data and asking, what impact do these data have on the evolving outlook and risk balance? Then, through our process, think about what is the right thing to do? Does the policy meet our expectations and help achieve our goals? So that's what we're going to do.

He also emphasized the importance of paying attention to the Fed's Beige Book:

Since the last meeting, we have received a lot of data, including two non-farm payroll reports for July and August, as well as two inflation reports, one of which was released during the Fed officials' quiet period. There are also anecdotal data like the Fed's Beige Book, which indicates that our non-farm payroll may have been artificially inflated and will be revised downward.

We have also seen anecdotal data like the Fed's Beige Book, so we have collected all this data, and then entered the quiet period for public speaking, thinking about what to do, and clarified that this is the right thing for the economy and for the American people we serve, and that's how we make decisions.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。