BlackRock's Bitcoin White Paper

Author: Blackrock | Plain-language Blockchain

BlackRock, as one of the world's largest asset management companies, has become increasingly positive towards Bitcoin and other crypto assets. From actively applying for the promotion of Bitcoin spot ETF at the beginning of the year to dominating the market share of Bitcoin spot ETF, its recognition of the cryptocurrency market is self-evident. Yesterday, it released a 9-page white paper detailing the unique position of Bitcoin as a major crypto asset, explaining the unique value and significance of Bitcoin globally.

Here is a summary:

Is Bitcoin a "risky asset" or a "safe-haven asset"? This is one of the most common questions asked by users when they first invest in Bitcoin. We believe that the unique nature of Bitcoin makes it unsuitable for evaluation within the traditional financial framework, and its long-term return driving factors are fundamentally unrelated to the sources of return of other investment portfolios.

Although Bitcoin is volatile and has shown some correlation with the stock market in the short term (especially when there are significant changes in US dollar real interest rates or liquidity), its long-term correlation with stocks and bonds is low, and its long-term historical returns are significantly higher than all major asset classes.

In the long run, we believe that the adoption driving factors of Bitcoin may be fundamentally different from the global macro factors affecting most traditional financial assets, and may even be the opposite in some respects. This paper will provide a detailed explanation of this.

01

Why is Bitcoin important?

First, we need to fundamentally understand what gives Bitcoin its importance. Since its birth in 2009, Bitcoin has become the first widely adopted native internet currency tool globally. Its technological innovation has created a form of digital native, global, scarce, decentralized, and permissionless currency. It is these attributes, these characteristics that have enabled Bitcoin to make breakthroughs in the field of currency, solving long-standing problems that have plagued currency throughout history:

**1) Bitcoin sets a supply limit of 21 million through hard coding, which means it will not easily depreciate.

2) Its global, digital native nature means it can be transmitted globally in almost real-time and at almost zero cost, breaking down the inherent barriers to transferring value across political borders.

3) Its decentralized, permissionless nature makes it the world's first truly open-access currency system.**

Despite the creation of other crypto assets since Bitcoin's breakthrough, and the pursuit of broader application scenarios in many cases, only the top crypto asset Bitcoin has achieved global consensus. It is this point that makes Bitcoin unique in the field of crypto assets, becoming a global currency substitute and an asset with credible scarcity.

02

The path to Bitcoin reaching a market value of $1 trillion

Although Bitcoin has achieved significant growth and widespread adoption globally, it is still uncertain whether it will ultimately develop into a widely used store of value or a global payment asset, and its constantly changing market value reflects this uncertainty.

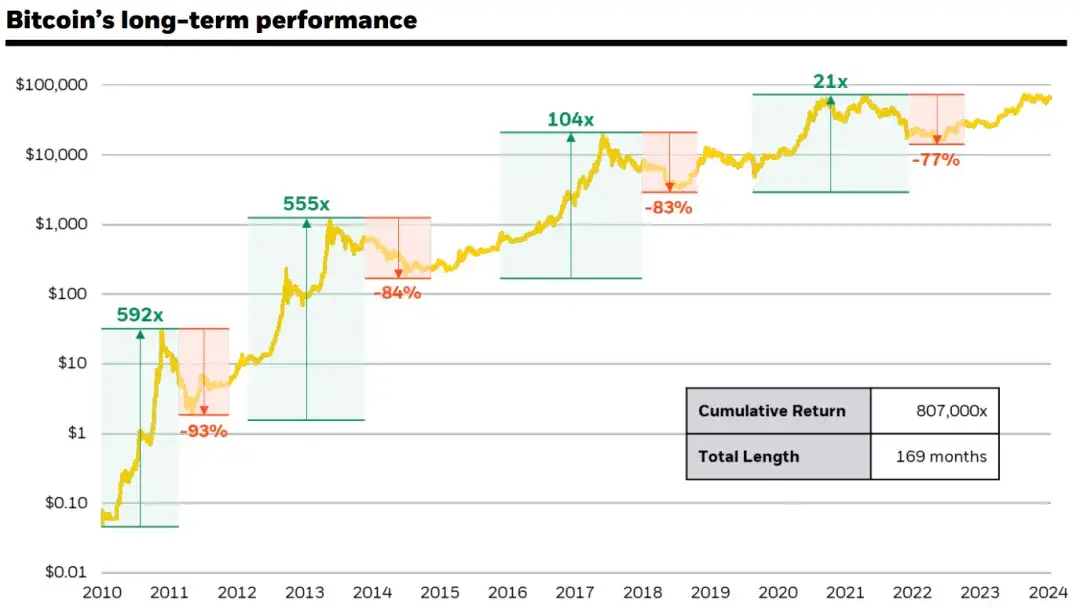

In the past 10 years, Bitcoin has outperformed all major asset classes for 7 years, with an annualized return of over 100%. However, Bitcoin has been the worst-performing asset in the other 3 years, with four significant drawdowns of over 50%. Nevertheless, after these historical cycles, Bitcoin has demonstrated the ability to recover from significant drawdowns and reach new highs, despite these cycles often being accompanied by prolonged bear markets.

The volatility of Bitcoin's price partly reflects its prospects for gradually becoming a global currency substitute over time.

This data shows the price trend of Bitcoin from July 19, 2010, to July 31, 2024, with the start date marking the launch of the first Bitcoin trading platform, Mt. Gox. Source: Bloomberg Bitcoin spot price, as of July 31, 2024.

03

An asset unrelated to macro variables

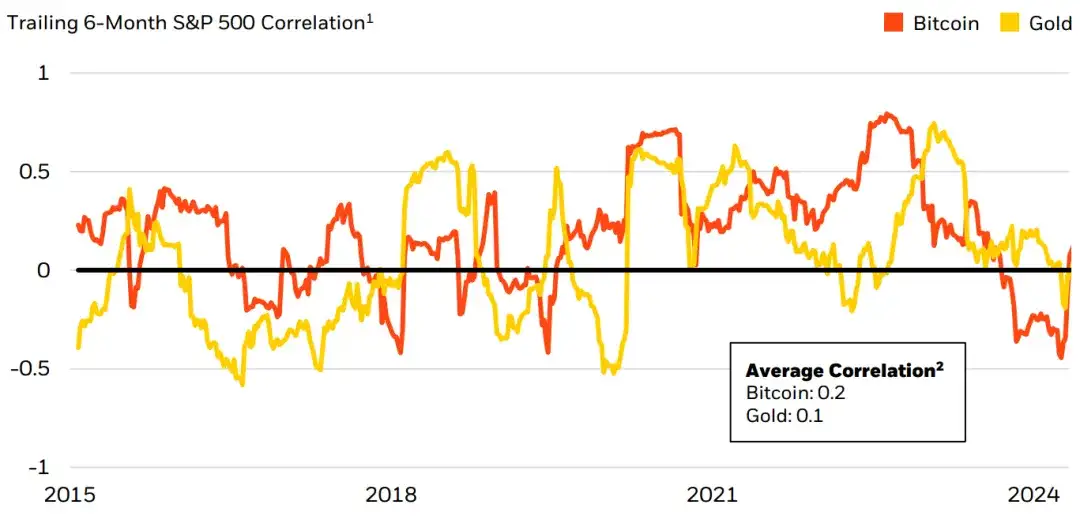

Bitcoin has relatively little fundamental correlation with other macro variables, which also explains why its long-term average correlation with stocks and other "risky assets" is low. Although there have been some periods of increased correlation with Bitcoin in the short term—especially when there are sudden changes in US dollar real interest rates or liquidity—these cases are short-term phenomena and have not formed a clear long-term statistically significant correlation relationship.

1) Bitcoin has a low historical correlation with US stocks and has experienced several periods of disconnection

From the above figure:

A. The 6-month lagged correlation of Bitcoin's weekly return rate with the S&P 500 index and the gold price, covering the period from January 1, 2015, to July 31, 2024. Source: Bloomberg Bitcoin spot price, Bloomberg gold spot price, S&P Global, and BlackRock calculations, as of July 31, 2024.

B. The average 6-month lagged correlation of Bitcoin's weekly return rate with the S&P 500 index and the gold price, covering the period from January 1, 2015, to July 31, 2024.

As the first decentralized, non-sovereign currency substitute, Bitcoin has no traditional counterparty risk, does not depend on any centralized system, and is not driven by the economic conditions of any single country. These characteristics fundamentally disconnect it from certain key macro risk factors (such as banking system crises, sovereign debt crises, currency depreciation, geopolitical turmoil, and other country-specific political and economic risks).

In the long run, the adoption path of Bitcoin may be driven by the degree of fluctuation in global currency instability, geopolitical disharmony, US fiscal sustainability, and US political stability.

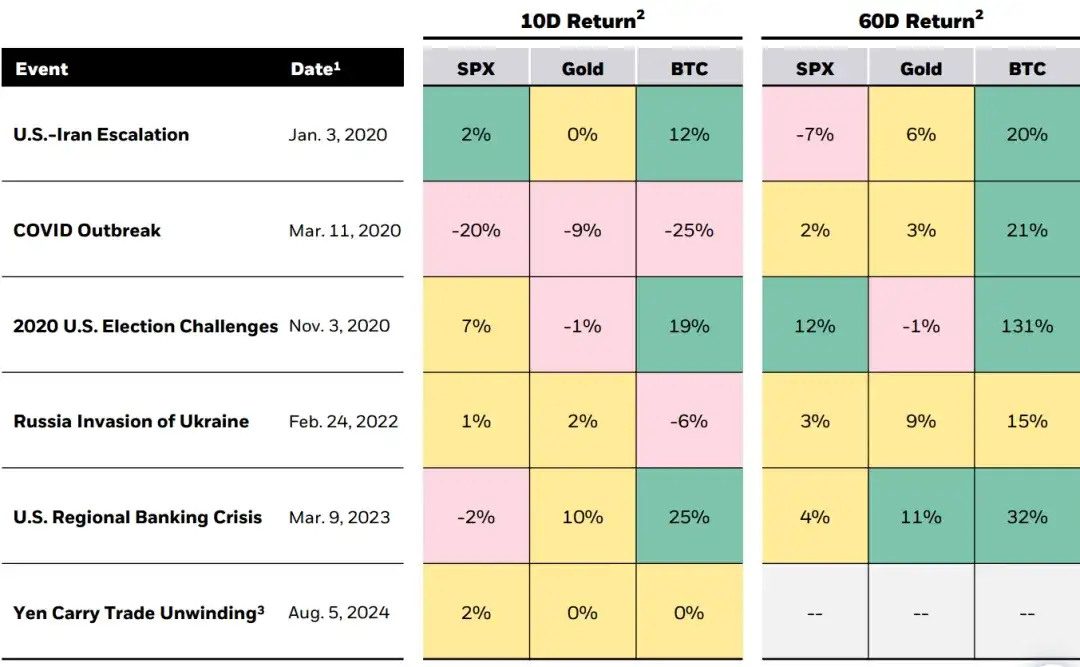

Due to these attributes, some investors view Bitcoin as a "safe-haven asset" during periods of panic, especially in some of the most disruptive global events in the past five years. It is worth noting that in these events, Bitcoin initially showed a brief negative reaction, followed by a rebound. In our view, these short-term trading reactions are often difficult to explain from a fundamental perspective and may be attributed to several factors:

A. Bitcoin, as an asset that trades around the clock and settles almost instantly, exhibits high sellability, especially during periods of tight liquidity in traditional markets, particularly over weekends.

B. The Bitcoin and crypto asset markets are still relatively immature, and investors' understanding of Bitcoin is constantly evolving.

In most cases, including the recent global market sell-off on August 5, 2024, Bitcoin rebounded to previous levels within a few days or weeks, and in many cases, it further increased, as the market began to recognize the potentially positive impact of these disruptive events on the fundamentals of Bitcoin.

2) Performance of S&P 500, gold, and Bitcoin in major geopolitical events

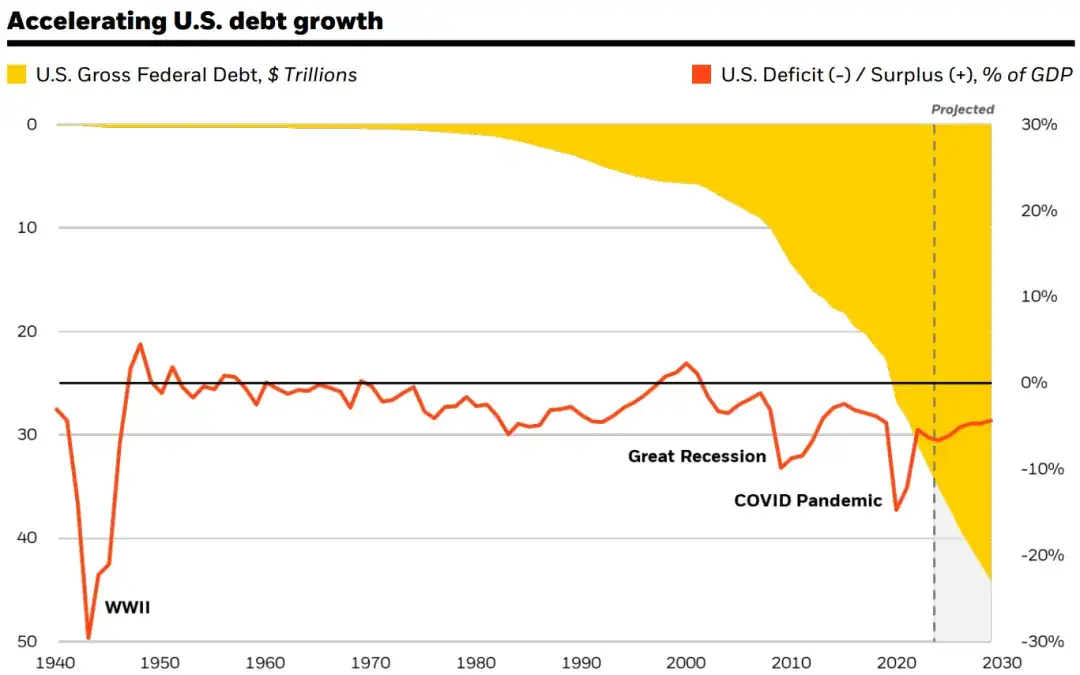

3) The Dynamics of US Debt Once Again Raises Concerns

In this context, concerns about the US federal deficit and debt situation in the US and globally have increased interest in Bitcoin as a potential alternative reserve asset to hedge against future events that may affect the US dollar. This trend also seems to be evident in other significantly indebted countries. According to our market experience, this explains an important reason for the recent widespread increase in institutional interest in Bitcoin.

Yellow section: Total US federal debt/trillions of US dollars Red line: US deficit (-)/surplus (+) as a percentage of GDP

04

Bitcoin Remains a High-Risk Asset

Although the previous analysis has shown certain characteristics of Bitcoin, this does not change the fact that Bitcoin remains a high-risk asset as an independent asset. As an emerging technology, Bitcoin is still in the early stages of widespread use, and it is still uncertain whether it will become a global payment asset or a store of value. In addition, Bitcoin has experienced significant volatility and faces various risks such as regulatory challenges, uncertainty in adoption paths, and an immature ecosystem.

However, the key is that these risks are specific to Bitcoin and not commonly present in traditional investment assets. Therefore, the simple "risk preference" and "risk aversion" framework may not apply to Bitcoin.

From a portfolio perspective, this is why Bitcoin can play a diversifying role when moderately allocated, but its high volatility significantly increases the risk of the portfolio when the position size is large.

05

Conclusion

Although Bitcoin has shown correlation with stocks and other "risky assets" in the short term, in the long run, its fundamental driving factors are significantly different from most traditional investment assets, and in many cases, even the opposite.

As the global investment landscape faces increasingly intense geopolitical tensions, concerns about US debt and deficits, and political instability globally, Bitcoin may be seen as a unique asset that can hedge against some fiscal, monetary, and geopolitical risks that other assets in the portfolio may face.

Original Title: Bitcoin: A Unique Diversifier

Original Link: https://www.blackrock.com/us/financial-professionals/literature/whitepaper/bitcoin-a-unique-diversifier.pdf

Original Authors: Samara Cohen, Robert Mitchnick, Russell Brownback, Blackrock

Translation: Plain-language Blockchain

Source: https://mp.weixin.qq.com/s/vOOAXpw4vmcSG2Y4IL9vFg

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。