By utilizing trustless off-chain computation and data, intelligent DeFi makes smarter decision-making possible.

Author: EigenLayer Research

Translation: Deep Tide TechFlow

Ethereum launched Maker in December 2017, ushering in the era of decentralized finance (DeFi). Subsequently, Uniswap and Compound were launched, establishing a new economic ecosystem around ETH and ERC20 tokens. Since then, we have witnessed the flourishing of on-chain finance, with increased capital efficiency through concentrated liquidity, the continuous evolution of perpetual contracts (perps), and even the emergence of flash loans, an innovation that was not achievable in traditional finance.

However, it seems that we have encountered a bottleneck. Since the "merge," automated market maker (AMM) liquidity providers (LPs) have lost over $700 million in miner-extractable value (MEV). In order to improve efficiency, derivative exchanges have centralized risk management and order books. In addition, we are unable to provide personalized lending services, offer more favorable rates to users with low default risks, or easily provide fixed-rate loans within fixed terms.

Many of these problems stem from the limitations of Ethereum as a finite state machine. It is constrained by gas fees, a block generation time of 12 seconds, and the inability to natively receive off-chain data. The modular architecture provides us with a way forward, allowing us to offload heavy computation and integrate external data without sacrificing the core security of Ethereum.

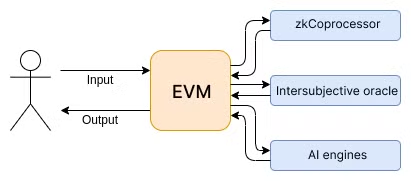

If the EVM is the glue that allows developers to write arbitrary business logic, then in what form should these coprocessors exist? Although Vitalik refers to these coprocessors as precompiles or opcodes, we need a more comprehensive solution. We need coprocessors that can handle tasks that are too costly or impractical for the Ethereum finite state machine to compute, and most importantly, these coprocessors must be verifiable.

Figure: Modified from Vitalik's glue and coprocessor architecture

Developers have been building efficient and specialized services for years, but verifiability changes everything. This is where EigenLayer's value lies: it provides the infrastructure to create decentralized node operator networks, enabling these networks to run your arbitrary node software economically.

We refer to these decentralized networks as Active Verification Services (AVSs), which significantly reduce the cost of building verifiable and trustless services.

The combination of decentralized finance (DeFi) and Active Verification Services (AVSs) has opened up a series of powerful new application scenarios:

Trustless off-chain computation (coprocessors): Executing heavy computation off-chain and returning the results to the chain with minimal gas fees, secured by zero-knowledge proofs or cryptographic guarantees. This can be imagined as free limit orders, or even AI model calls, all of which are verifiable and decentralized.

Trustless off-chain data (verifiable oracles, zkTLS): Safely introducing real-world data—such as prices, volatility, real-time liquidity, and even sports data—into DeFi.

Further advancements: Auction networks, policy layers, decentralized order books—AVSs extend DeFi into previously untouchable areas.

We refer to this new paradigm as intelligent DeFi, as it brings real-time adaptability and personalization to decentralized finance. By utilizing trustless off-chain computation and data, intelligent DeFi makes smarter decision-making possible. In this article, we will delve into 10 use cases that demonstrate its potential.

Exchanges

Exchanges are a core component of DeFi, but less than 15% of spot trading and only 6% of derivatives trading occur on-chain. Intelligent DeFi has the potential to narrow this gap, making decentralized exchanges (DEX) more competitive with off-chain exchanges.

- ### VIP Levels: Fee tiers based on trading volume

Centralized exchanges offer tiered fees based on trading volume, not only to foster user loyalty, but also to subsidize market makers so they can provide tighter spreads and better prices to retail traders, thereby bringing more trading volume to the exchange.

Implementing volume-based fees on DEX is a challenge. To calculate traders' trading volume, DEX needs to:

Dynamically calculate trading volume

Store and update the trading volume for each trader

- Tracking trading volume over the past 30 days adds complexity, requiring historical data storage and computation.

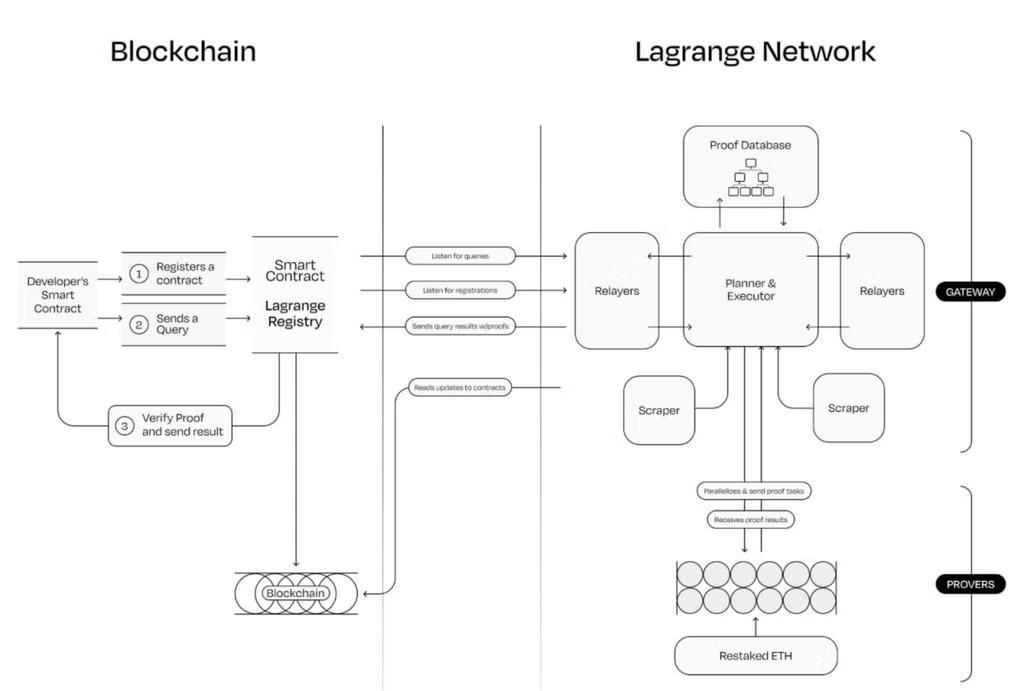

Both of these methods are very costly on-chain. However, by outsourcing the computation to coprocessors like Lagrange or Brevis, we can verifiably calculate the trading volume for each trade.

How is this specifically achieved?

The coprocessor indexes and stores part of the blockchain data in a queryable relational database.

The AMM (or Uniswap hook) smart contract calls the coprocessor to execute an SQL query to calculate the trader's trading volume over a certain period.

The coprocessor returns the verification result to the AMM through a callback, along with a zero-knowledge proof confirming the computation on historical blockchain data.

Figure: How on-chain contracts interact with zkCoprocessor Lagrange

2. Dynamic and Asymmetric Fees for AMMs

Loss and Value Rebalancing (LVR) is an important issue affecting the profitability of liquidity providers (LPs) in AMMs. LVR arises from the inconsistency in prices between continuous off-chain exchanges and on-chain AMMs, which trade every block or every 12 seconds on the Ethereum mainnet. Many changes can occur within a single block, and arbitrageurs take advantage of price differences between exchanges at the start of the next block.

To improve the profitability of LPs, AMMs can adopt dynamic fees and asymmetric fees:

1. Dynamic fees: Adjusting fees based on market volatility. LPs typically perform poorly in high volatility periods. Increasing fees in high volatility periods can protect LPs from adverse trades, while reducing fees in stable periods can stimulate trading volume. This can reduce the dispersion of liquidity across different fee tiers, providing a smoother user experience for LPs. You can refer to this very basic concept validation.

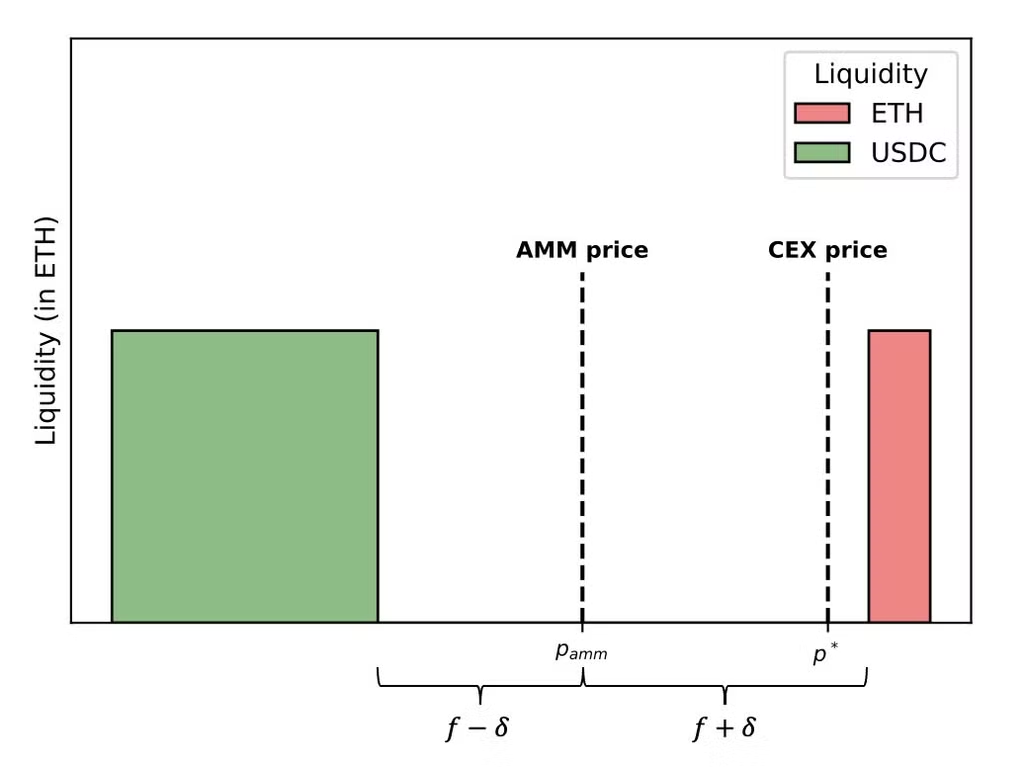

- Asymmetric Fees: Inspired by Alex Nezlobin, asymmetric fees adjust the spread based on external price data. For example, if the price of ETH on a decentralized exchange (DEX) is $1000, and on a centralized exchange (CEX) it is $1050, the AMM can choose to buy at $980 and sell at $1060, instead of maintaining a symmetric spread around the DEX price, which can more accurately reflect the market conditions.

Figure: From Alex Nezlobin's Twitter discussion

In both cases, the AMM needs reliable external data—such as CEX prices or volatility—to adjust fees. However, traditional oracles pose risks: centralized operators may fail or provide outdated data. In contrast, zkTLS (network proofs) offers a better solution. By cryptographically verifying data directly from network servers, zkTLS eliminates the need to trust third parties. This provides you with real-time tamper-proof data, ensuring that AMMs can securely calculate dynamic and asymmetric fees, whether on-chain or through coprocessors.

3. Auctions to Redistribute MEV to AMM Liquidity Providers (LP)

Another way to enhance LP profitability involves not only off-chain computation but also a decentralized auction network. Currently, searchers compete in auctions to have their trades included at the front of a block. In practice, arbitrage profits are allocated to searchers, builders, and proposers, rather than LPs and traders. Instead, AMMs can auction the right to be the first to trade through a liquidity pool. If the auction competition is fierce, most of the loss and value rebalancing (LVR) will be recaptured. These profits can be proportionally distributed to the underlying LPs involved in the trades, reducing overall arbitrage and enabling LPs to provide tighter spreads. Sorella is developing this feature in the form of a Uniswap v4 hook.

The challenge lies in running a low-latency, censorship-resistant auction. Conducting auctions on-chain is too complex and costly: each bid requires gas fees. A block is processed before a winner is chosen, making it impossible to complete the auction. While a centralized entity can conduct auctions off-chain, this goes against the principles of decentralized finance (DeFi) and provides them with a final opportunity to extract value.

The solution is a group of decentralized operators running a leaderless auction, eliminating reliance on a single entity and ensuring the integrity of the process. Operators are responsible for selecting winning bids and returning profits to LPs.

Figure: From Paradigm's leaderless auction

Derivatives

While most derivatives are traded on exchanges, intelligent DeFi unlocks unique use cases for this asset class. Let's delve into it!

4. Advanced Margin Systems

Currently, traders cannot express cross-asset views without heavily limiting leverage, such as SOLETH or cross trades. Most decentralized perpetual contract exchanges (perp DEX) linearly calculate margin based on the total open contracts across different positions for a trader.

For example, if I deposit $10,000 and go long $50,000 on ETH and short $50,000 on BTC, this is considered 10x leverage. But this is different from the risk profile of someone simply going long $100,000 on ETH, and these two accounts should not be treated the same. Ideally, traders should be able to leverage more than 5x on ETHBTC without such strict limitations.

The issue lies in the limited on-chain computational capacity. Specifically, the system needs to consider collateral for each spot asset, positions for each perpetual contract asset, unrealized P&L, initial and maintenance margin requirements for each perpetual contract, and correlation and delta hedging. As decentralized exchanges (DEX) expand to multiple asset types, such as perpetual contracts and options, this problem becomes even more critical.

By utilizing coprocessors for more complex calculations to determine account margin factors, decentralized exchanges (DEX) can create a customized risk engine that better meets user needs. This enables more flexible delta-neutral strategies and ensures liquidation only occurs when truly necessary.

To provide greater flexibility, coprocessors can dynamically adjust margin requirements, taking into account liquidity from major centralized exchanges (CEX) and the open contracts situation for each pool in real-time.

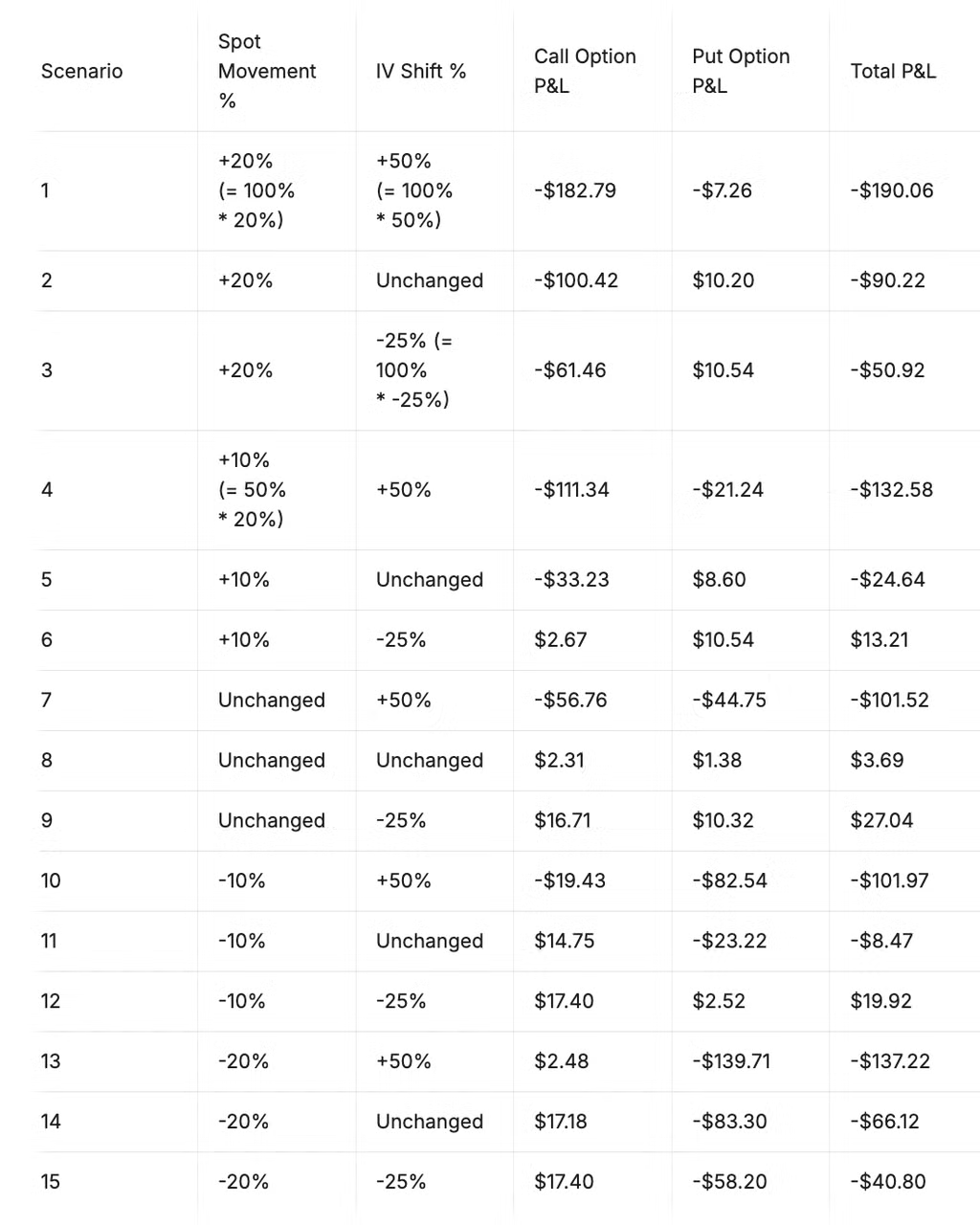

Figure: Aevo relies on a centralized risk engine to assess the worst-case market scenario, providing more reasonable margin parameters for high-value traders. The coprocessor offers a unique margin calculation method without compromising decentralization, excerpt from Aevo's documentation

5. Pricing for Automated Market Makers (AMM) for Options

Automated market makers (AMMs) for derivatives, especially options, are both exciting and controversial. Some believe they cannot be accurately priced, while others argue that derivatives are only suitable for high-volume assets, and order books are more effective for these assets. Nevertheless, Panoptic, Deri, and others believe that AMMs are the best way to provide liquidity, including for options.

To truly succeed with options AMM, a key factor is the introduction of off-chain data, such as volatility, historical prices, and real-time market signals. Additionally, off-chain computation is essential for building more advanced pricing models (such as Black-Scholes). Combining this external data with on-chain trading mechanisms is crucial to ensuring accurate pricing, reducing slippage, and improving capital efficiency for options traders.

Lending

Lending protocols face unique challenges, and artificial intelligence (AI) and off-chain computation can drive smarter and more flexible solutions.

6. AI Systems for Parameters

Currently, governance teams of protocols like Aave and Compound manually update relevant parameters for the lending markets. Typically, risk service providers like Gauntlet conduct model-based simulations and suggest adjustments to benchmark rates, collateral factors, liquidation factors, and other parameters. In more severe events, they may recommend delisting or freezing certain assets.

This approach has two main drawbacks:

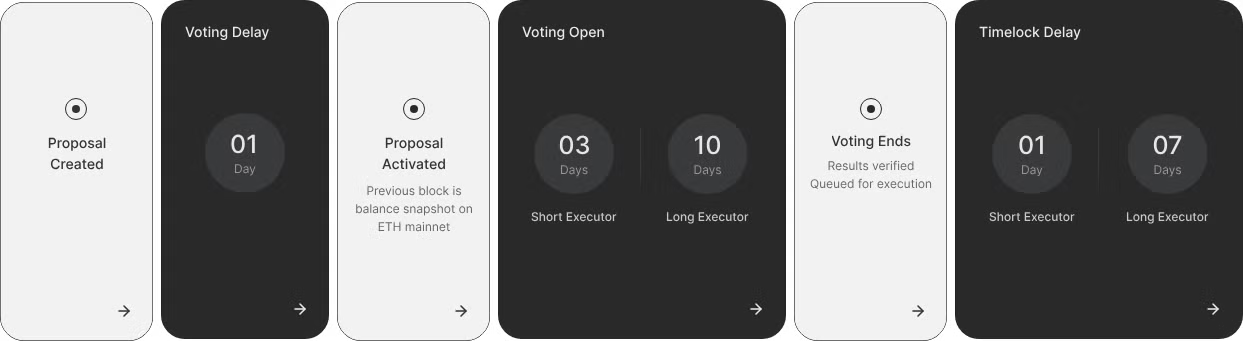

Long delay times. When I served as an Aave DAO representative, proposals took at least a week to be approved.

Governance teams have insufficient insight into voting information on lending parameters, and not all members actively participate. The recent Compound governance attack is a typical example.

Figure: According to Aave's documentation, its governance process takes at least 5 days

Morpho and Euler v2 have taken an important step in the right direction. They modularize the risk management section, allowing anyone to create their own lending platform instance. Users can choose where to deposit assets based on the curator's history and reputation. This approach can effectively reduce the time required to update parameters.

But in an ideal system, parameters would update automatically, responding in real-time to on-chain and off-chain liquidity. AI-based models can simulate multiple scenarios, predict and prevent the worst-case scenarios. These models rely on AI-specific coprocessors such as Ritual, Sentient, Hyperbolic, Ora, and Valence, processing large amounts of data off-chain, considering volatility, liquidity changes, and risk correlations, and then publishing results on-chain in a verifiable manner.

7. Customizing Loans Based on Account History and Liquidation Risk

In traditional finance, borrowers with good credit usually receive more favorable loan terms, while in decentralized finance (DeFi), all borrowers enjoy the same loan terms, regardless of their risk profile or credit history. While this model has its advantages, I believe DeFi can combine the best of both worlds: providing fair, trustless loans for anyone, while offering more favorable loan terms for repeat borrowers with good credit records and low liquidation risk.

The lack of differentiation in DeFi lending protocols prevents them from offering personalized terms for low-risk borrowers, such as lower collateral requirements or more favorable interest rates. This lack of personalization not only limits the potential earnings for repeat users but also leads to inefficiencies in the lending market.

Providing personalized loans first requires an anti-Sybil solution to ensure that only verified users can access more favorable loan terms. Solutions like WorldCoin or Coinbase verification can effectively prevent malicious actors from exploiting the protocol through bad debts.

Once borrowers are verified, the protocol can collect on-chain information to build liquidity profiles, including:

Current and historical loan records

Repayment status of previous loans

On-chain net assets and outstanding debts

Owned NFTs (if the lending protocol collaborates with NFT projects to offer preferential terms)

The protocol can even look at other addresses associated with the same identity for a more comprehensive view.

Finally, coprocessors can assess liquidation risk and generate customized collateral factors and interest rates, ensuring tailored loan terms for each borrower.

8. Compliant Privacy Mixers

In August 2022, the U.S. Office of Foreign Assets Control (OFAC) sanctioned Tornado Cash for facilitating money laundering. However, privacy is a fundamental right and has legitimate uses: people should be able to transfer funds to other accounts or friends without revealing their complete transaction history. The problem is that existing privacy mixers cannot distinguish between legitimate users and malicious actors. This lack of compliance makes them targets for sanctions and hinders wider adoption.

What if we could create a privacy protocol that only accepts compliant funds? This protocol would manage risks and comply with regulations, attracting privacy-focused users. However, determining compliance requires various on-chain and off-chain data, which is not a simple task. Ideally, smart contracts could call an API that only approves valid transactions, ensuring compliance.

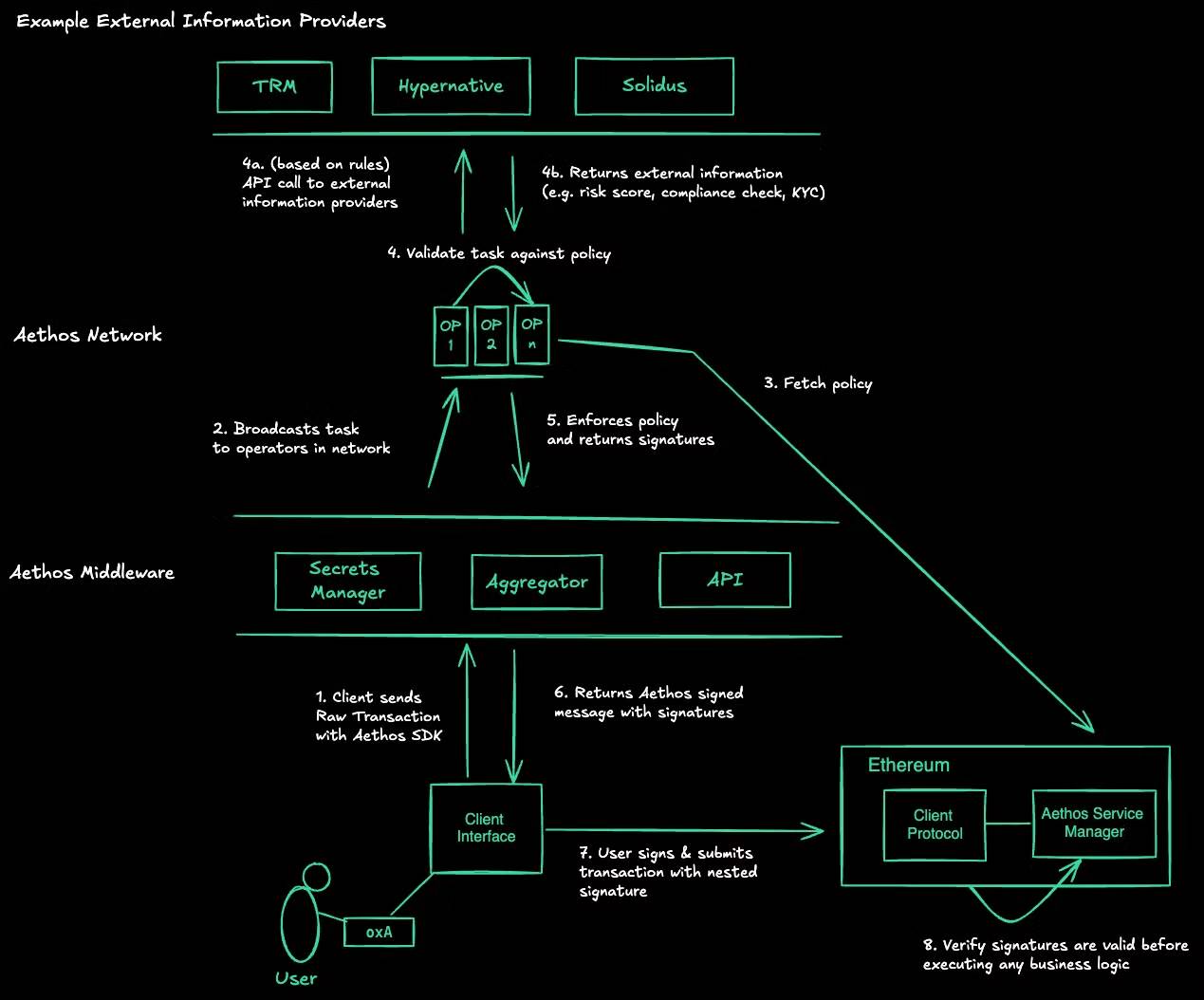

Aethos is a policy layer aimed at achieving this goal. It enables developers to set rules at the smart contract level to ensure that transactions comply with specific regulatory policies. For example, a compliant privacy mixer could set transaction limits, time locks, and block transactions involving addresses sanctioned by OFAC or related to DeFi hacking events.

Figure: From Aethos's documentation

Integrating real-time, rule-based policies into smart contracts opens a new era of institution-friendly DeFi, where compliance and the values of DeFi are no longer mutually exclusive.

9. Automated Rebalancing Yield Protocols

DeFi offers a wealth of yield opportunities, covering various assets and protocols, including staking, restaking, lending, automated market maker (AMM) liquidity pools, real-world assets (RWAs), and more. Users have different risk preferences, closely related to protocol types, chains (such as Ethereum, Solana, etc.), asset denominations, and external market risks. Faced with so many choices, some traders opt for yield protocols to automate their fund allocations.

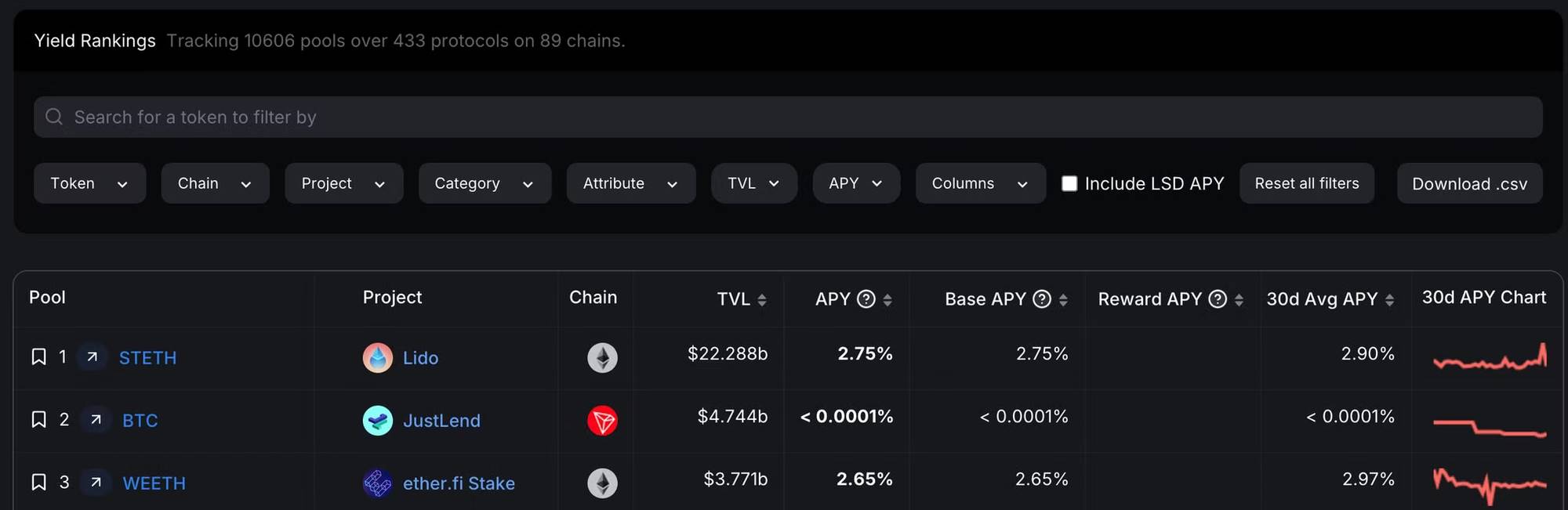

Figure: Such a wealth of yields, not financial advice, from DeFiLlama

These protocols can leverage AI models to optimize yields across multiple sources. Developers set predefined risk parameters, such as limiting the risk exposure of each protocol to 15%, or avoiding protocols with a total locked value (TVL) below $100 million, and the AI model is responsible for adjusting the portfolio to meet these standards and maximize yields.

Furthermore, AI models can create personalized yield strategies for each user based on their on-chain activities and preferences collected through a short questionnaire. This previously unimaginable personalized service, thanks to the scalability of AI, has become within reach.

In the background, AI-driven coprocessors monitor and rebalance the investment portfolio. They only make adjustments when the yield can offset gas fees, ensuring efficient data-driven portfolio management.

10. Ultra-Precise Incentive Programs

Incentives are at the core of cryptocurrencies and DeFi. The true start of the DeFi summer was after Compound introduced liquidity mining in 2020. By rewarding specific user behaviors, protocols are able to drive growth and activity.

But as this field matures, protocols are seeking more precise targets, often turning to off-chain programs. Automated market makers (AMMs) may focus on incentivizing active liquidity providers. NFT markets and prediction markets may reward liquidity close to order book prices. Lending protocols may encourage non-recurrent borrowers to take out loans, at least accounting for 20% of their interest.

Through coprocessors, protocols can define complex incentive conditions and distribute rewards in real-time. This moves away from increasingly unpopular point systems, providing users with certainty in reward payments, thus reducing the capital costs of protocols. Gearbox has started using Lagrange's coprocessor to handle multi-asset rewards with different payment mechanisms. By increasing the efficiency of incentives, DeFi can continue to grow while rewarding the most valuable behaviors.

In Conclusion

The combination of DeFi and AVS will spark a new financial revolution. From MEV-recovering automated market makers (AMMs) to real-time policies in privacy protocols, these use cases are just a small part of the potential of decentralized finance.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。