Original author: Zhang Yiwei

Original source: 智堡投研

Abstract

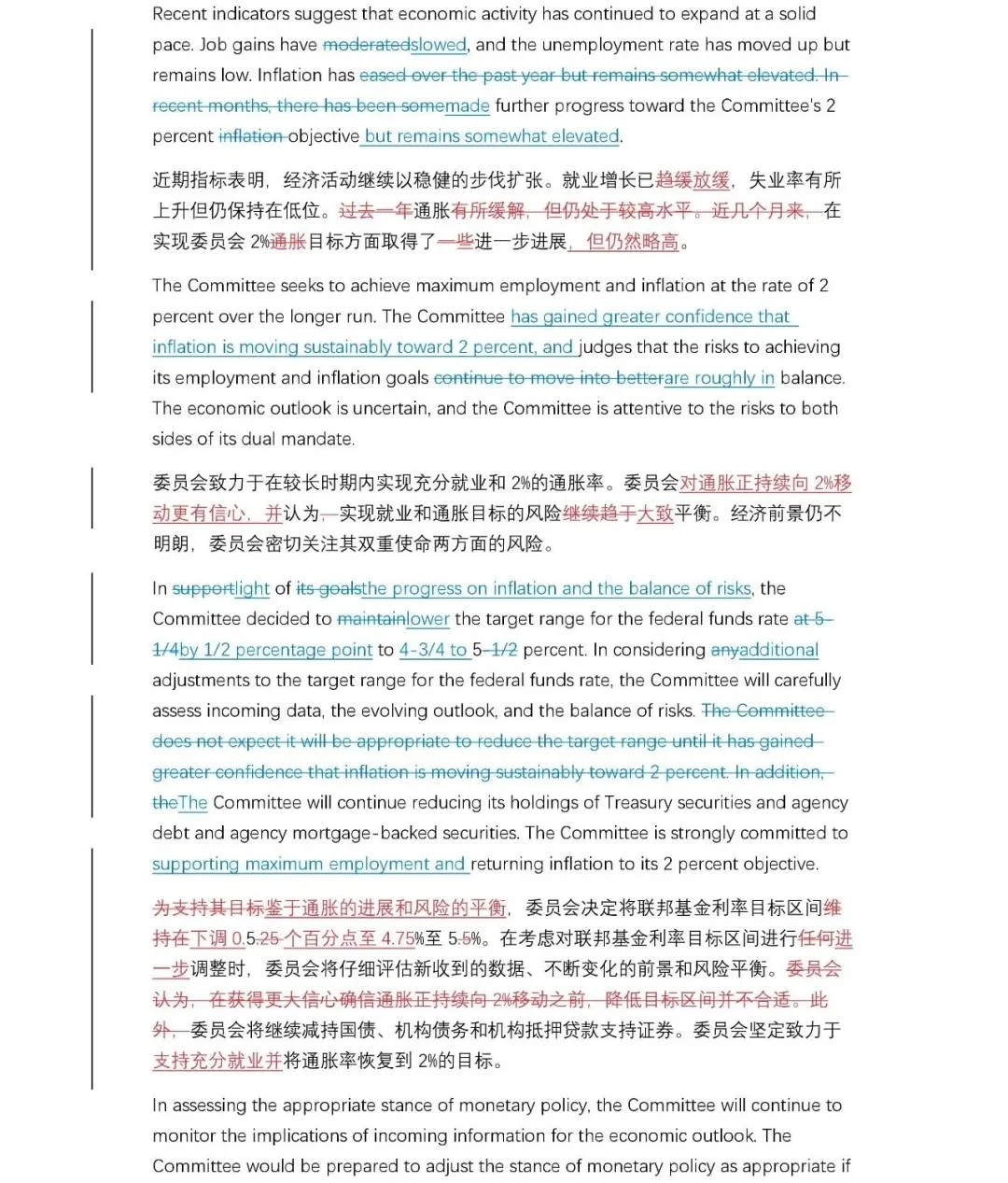

In this meeting, the Fed cut interest rates for the first time, opening a new cycle, by 50 basis points to 4.75%-5.0%.

There were significant changes in the wording of the meeting statement, emphasizing "has gained greater confidence in inflation continuing to decline to 2%".

Regarding the job market, the statement pointed out that "job growth has slowed", and the unemployment rate has risen but remains low.

In terms of risk management posture, the statement announced that the risks of achieving the dual goals of employment and inflation are "roughly in balance".

The committee is firmly committed to "supporting maximum employment", alongside "returning the inflation rate to 2%" and placing the employment target in the forefront.

The FOMC interest rate decision saw the first dissenting vote since September 2005: Michelle W. Bowman, who leaned towards a 25 basis point rate cut at this meeting.

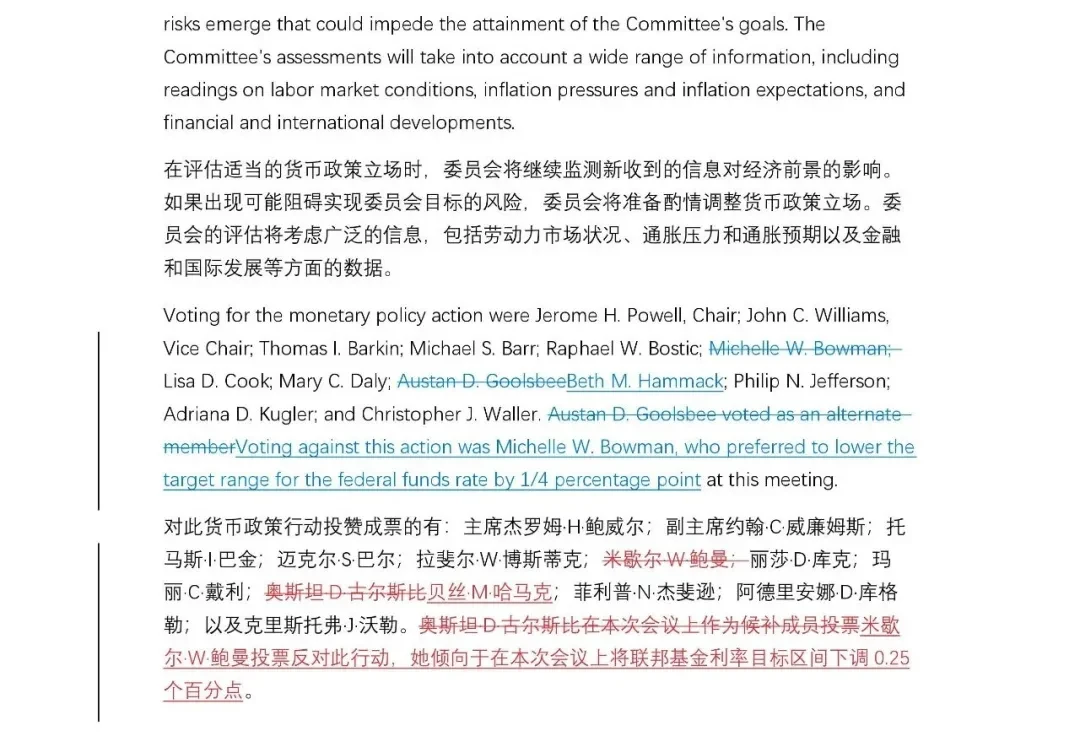

The main changes in economic forecasts are reflected in the upward revision of the unemployment rate forecast, with the unemployment rate expected to remain at 4.4% in 2024 and 2025 (compared to 4.0% and 4.2% in the June forecast, respectively), and 4.3% in 2026 (compared to 4.1% in the June forecast), reflecting the digestion of new information provided by QCEW. There is a slight downward revision in the inflation forecast, with the core PCE expected to be 2.6% in 2024 (compared to 2.8% in the June forecast), 2.2% in 2025 (compared to 2.3% in the June forecast), and unchanged at 2.0% in 2026.

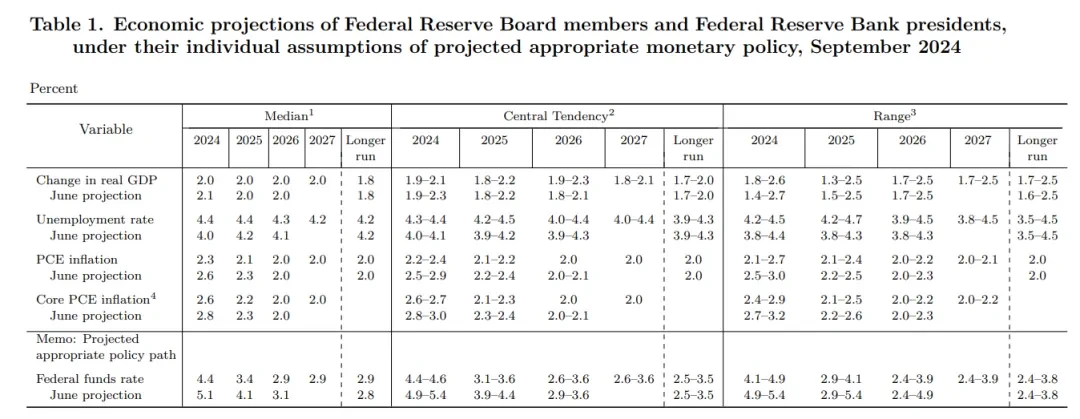

The dot plot shows that most members predict there is still room for a 50 basis point rate cut this year, considering the two meetings remaining in 2024 on November 6-7 and December 17-18 (including the dot plot and economic forecasts), reflecting that the Fed's decision this time is a pre-cut interest rates.

Powell released a significant hawkish signal at the press conference, emphasizing multiple times that the committee is "in no rush", and will "recalibrate" the Fed's monetary policy stance gradually.

As the market digested the Fed's meeting statement and Powell's press conference information, the three major U.S. stock indexes all gave up their intraday gains and ended slightly lower; U.S. bond yields rose sharply; the U.S. dollar index hit a low and then rebounded. Gold prices surged to a new high and then plummeted, with an intraday fluctuation of over $50.

Original statement

The wording deleted from the June statement is shown in blue with a strikethrough

The wording added to the September statement is shown in blue with an underline

The red text is the corresponding Chinese translation

Dot plot and economic forecast

No more rate cuts this year (2 members)

25bps rate cut later this year (7 members) vs. 50bps rate cut later this year (9 members)

75bps rate cut later this year (1 member)

Key points of the press conference

The decision to cut rates by 50 basis points reflects our increasing confidence that by appropriately recalibrating our policy stance, we can maintain a strong labor market in the context of moderate growth and inflation continuing to decline to 2%. We also decided to continue to reduce our holdings of securities.

With inflation declining and the labor market cooling, the upside risks to inflation have diminished, and the downside risks to employment have increased. We now believe that the risks of achieving our dual mandate are roughly in balance, and we are closely monitoring the risks at both ends of the dual mandate.

We do not have a preset path and will continue to make decisions meeting by meeting.

Q&A

CNBC: What changes have occurred that led the committee to choose a 50bps rate cut? Will there be another 50bps rate cut, and how should the market judge this?

Answer: Since the last meeting, we have received a large amount of data. We received two employment reports for July and August. We also received two inflation reports, one of which was released during the blackout period. We also received the Quarterly Census of Employment and Wages (QCEW), which indicates that the nonfarm payroll data we currently have may be overstated and will be revised downward in the future, which everyone is aware of. We also saw anecdotal data, including the Beige Book. We collected all this data, entered the blackout period, and considered what action to take. Our conclusion is that (pre-cutting interest rates) is the right thing to do for the U.S. economy and the people we serve, and we made the decision based on this.

To judge the pace of future rate cuts, a good entry point is the Summary of Economic Projections (SEP). We will make decisions meeting by meeting based on the new data received, the evolving economic outlook, and the balance of risks. Looking at the SEP, this is a process of "recalibrating" our policy stance, from a year ago when inflation was high and unemployment was low, to a stance that is more in line with our current situation and expected to achieve our goals. The process of recalibration will be gradual. There is no indication in the SEP that the committee is in a rush. The process of recalibration will evolve over time.

Of course, the SEP is a forecast, a baseline forecast. As I mentioned in my speech, the actions we actually take will depend on the direction of the economic evolution. We can speed up, we can slow down, and we can pause, if appropriate, but that's what we have to consider. Again, I suggest that you only take this SEP as an assessment of the committee's current thinking, but the thinking of each member of the committee is based on their respective assumptions.

Associated Press: The SEP shows that the federal funds rate will still be above the long-term neutral rate estimate by the end of next year. Does this reflect a restrictive level of interest rates? Does this threaten the continued softening of the labor market, or does it mean that people believe the short-term neutral rate is too high?

Answer: Under the baseline scenario, we expect to continue to remove restrictive policies and monitor the economy's response to this. Looking back, the policy stance we took in July 2023 was in a situation where the unemployment rate was 3.5% and the inflation rate was 4.2%. Today, the unemployment rate has risen to 4.2%, and the inflation rate has fallen to slightly above 2%.

It is time to recalibrate our policy stance to make it more in line with the progress towards a more sustainable level of inflation and employment. The balance of risks is now even. The direction of the recalibration process is towards the neutral interest rate, and our pace will depend on the situation in real time.

Reuters: For the first time since 2005, a member voted against the decision, was it difficult to choose between 25bps and 50bps? Will the pace set this time guide every meeting until next year?

Answer: The decision made by the committee has broad support.

We will make decisions meeting by meeting. The committee is in no rush. We have made a good start, and frankly, this is a demonstration of our confidence. We are confident that inflation will continue to decline to 2%. From an economic and risk management perspective, the logic of (pre-cutting interest rates) is clear to me. We will cautiously proceed meeting by meeting and make decisions in real time.

The New York Times: The SEP shows that the unemployment rate will climb to 4.4% and then remain at that level, but historical experience shows that once the unemployment rate climbs to this level, it will not stop midway, but continue to rise. Why do you think the labor market will stabilize?

Answer: The labor market is in good condition. The policy action we took today is aimed at maintaining this status. The entire economy is the same. The U.S. economy is in good shape, steadily growing, and inflation is declining. The labor market is performing strongly. We want to maintain this status. This is what we are doing.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。