The dot plot suggests that there will be a 50 basis point rate cut within the year.

By 1912212.eth, Foresight News

After 4 years, the Federal Reserve finally announced a 50 basis point rate cut at this morning's meeting. Following the long-awaited interest rate decision in the cryptocurrency market, there was another significant fluctuation. Bitcoin surged from a high of $59,000 to over $62,000, Ethereum rose from $2,200 to over $2,400, and altcoins also benefited from the market boost, with SEI skyrocketing by 22% to over $0.34 and BLUR surging by 17% to over $0.2.

According to coingrass data, there were liquidations totaling $199 million in the past 24 hours, with short positions liquidating $123 million.

Looking back at the previous cycle, when the Federal Reserve announced its first rate cut in September 2019 after many years, BTC did not immediately benefit from the positive news. Instead, the monthly chart closed with a 13.54% drop from above $10,000 to near $8,300. After this rate cut, will the cryptocurrency market once again repeat history, or is it about to usher in an uptrend after liquidity improvement?

The Federal Reserve will continue to cut interest rates in the coming months

This rate cut far exceeded the market's general estimate of 25 basis points, directly cutting 50 basis points. Powell emphasized at the press conference that a significant rate cut does not indicate that a U.S. economic recession is imminent, nor does it mean that the job market is on the verge of collapse. The rate cut is more of a preventive action aimed at maintaining the "healthy" status of the economy and labor market.

After the dust settles, it is widely expected that interest rates will continue to be cut in November and December, with an expected total cut of 70 basis points within the year. The dot plot released suggests that there will be a 50 basis point rate cut within the year.

The market's general concern about the possibility of a U.S. economic recession is diminishing, and the likelihood of a soft landing is increasing.

The rate cut will continue to have a positive impact on risk assets. Although it may not take effect immediately, as time passes and the rate cut continues, liquidity in the market will begin to flow from bonds, banks, and other sectors into stocks, cryptocurrencies, and other markets.

In addition, the upcoming U.S. presidential election in early November is expected to bring short-term volatility to the cryptocurrency market. After the official results are announced, off-market funds that have been waiting on the sidelines may begin to continuously enter the cryptocurrency market.

The current spot market trading volume remains low, fluctuating around $600 billion overall. Aside from short-term sudden fluctuations caused by special macro events, market liquidity remains mediocre.

Bitcoin has increasingly become a macro asset reflecting overall economic trends. As liquidity continues to flow into the market, the cryptocurrency market may sweep away the past gloom.

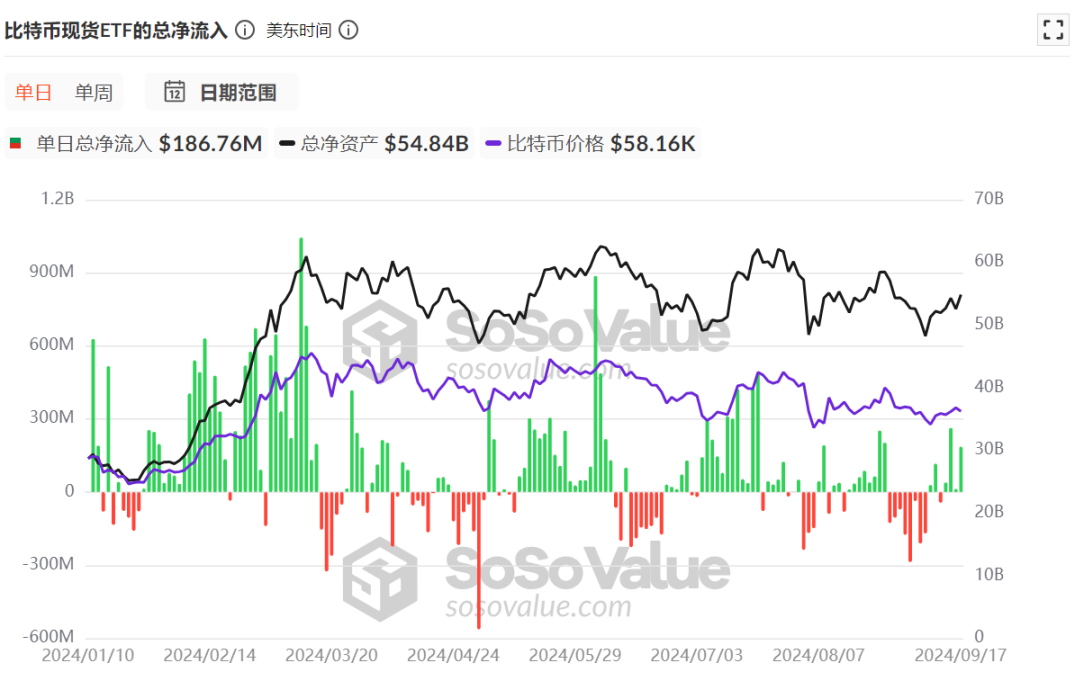

BTC spot ETF continues to see net inflows

As of September 17, the total net inflow of Bitcoin spot ETFs has reached $17.5 billion. After a continuous net outflow from late August to early September, Bitcoin spot ETFs have seen a net inflow for 8 consecutive days since September 12.

While Bitcoin spot ETFs continue to see net inflows, Bitcoin prices tend to remain stable and rise. Conversely, continuous large outflows often lead to downward pressure on prices.

At present, after experiencing long-term price fluctuations, off-market funds' confidence is gradually recovering, and they continue to buy.

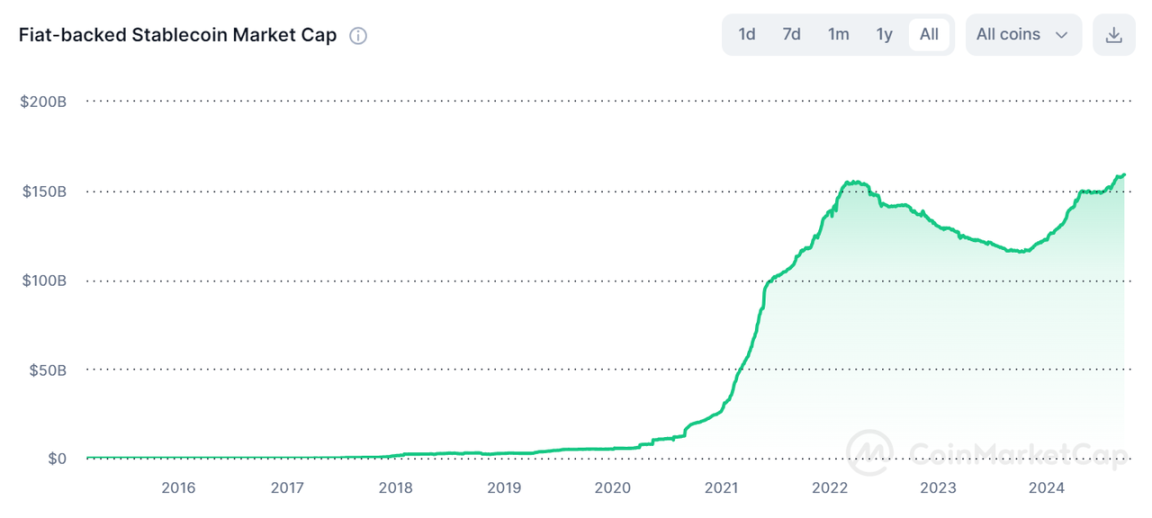

Stablecoin market cap continues to rise

Over the past month, USDT's total market cap has increased from $117 billion to $118.7 billion, with an inflow of nearly $1.7 billion. Calculated from a total market cap of $104.7 billion in April of this year, USDT's market cap has continued to increase by $14 billion amid the overall consolidation and decline in the cryptocurrency market.

Another major stablecoin, USDC, has seen its market cap increase from $34.4 billion at the end of August to $35.5 billion, with an inflow of $1.1 billion in less than a month.

The total market cap of fiat-backed stablecoins has also hit a historical high and continues to rise.

October has historically been a strong-performing month

The interesting thing about the cryptocurrency market is that, similar to some stocks, it exhibits seasonal trends. For example, the market generally performs poorly in the summer, but performs well at the end and beginning of the year. In the past 9 years, except for October 2018 when it was in a bear market, Bitcoin has achieved strong positive returns from 2015 to 2023.

In the second half of 2023, Bitcoin began to rise continuously from October, combined with the expected approval of Bitcoin spot ETFs, thus starting a bull market.

Market perspectives

Crypto KOL Lark Davis: 2025 will be the peak of this cycle, and it is advisable to sell at that time

Lark Davis, a crypto KOL with 500,000 followers on YouTube, stated in his latest video released on September 9 that 2025 will be the peak of this cycle, and it is advisable to sell and leave at that time. He gave the following reasons for this viewpoint: the global liquidity cycle is expected to peak in 2025 and then begin to decline. China's credit cycle is about four years, and 2025 may be the peak period for Chinese credit. Currently, short-term bond yields are higher than long-term bond yields, but the yield curve is gradually returning to normal, which may indicate a change in the economic cycle. Therefore, he believes that 2025 may see a huge market turmoil, followed by a bear market.

Glassnode: The Bitcoin market is in a stagnant phase, with both supply and demand showing signs of inactivity

The cryptocurrency market data research firm Glassnode stated in a post that the Bitcoin market is currently experiencing a period of stagnation, with both supply and demand showing signs of inactivity. Over the past two months, Bitcoin's realized market value has peaked and stabilized at $622 billion. This indicates that most tokens being traded are close to their original acquisition prices. Since reaching a historic high in March, the absolute realized gains and losses have significantly decreased, indicating a slight easing of overall buying pressure within the current price range.

Hyblock Capital: Bitcoin market depth depletion may indicate a bullish trend in Bitcoin prices

Shubh Verma, Co-founder and CEO of Hyblock Capital, stated in an interview with CoinDesk: "By analyzing the comprehensive spot order book, especially the order book depth of 0%-1% and 1%-5%, we found that low order book liquidity often coincides with market bottoms. These low order book levels may be early indicators of price reversals, often preceding bullish trends."

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。