Original | Odaily Planet Daily ( @OdailyChina )

Author | Wenser ( @wenser2010 )

The "capitalization dispute" of the meme coin Neiro has once again put Binance in the spotlight.

However, this time, the response from Binance co-founder He Yi was unusually calm and restrained, which may also imply that the listing strategy for meme coin projects on Binance will be more cautious in the future. In a recent article titled "He Yi responds to the listing controversy: considering the community's voice, several relatively dispersed and low market value MEME tokens have been listed", we can clearly see that the community's voice still has a significant impact on Binance's decision-making. At the same time, the internal organization of Binance is not as "unprofessional" as previously imagined by the outside world.

The simultaneous listing of the new Shiba Inu coin Neiro and NEIRO on Binance is indeed a rare "grand occasion" in the meme coin arena, and to some extent, it can be seen as a "turning point" for meme coins. Odaily Planet Daily will briefly review and analyze the relevant events in this article. (Odaily note: For background information on the Neiro token, it is recommended to read "New Shiba Inu Neiro debuts, taking over as the 'new king' of meme coins?")

Retrospect of the event: The uppercase NEIRO contract was launched first, followed by the lowercase Neiro spot contract

If the initial "Neiro token capitalization dispute" was still at the stage of confrontation between the "conspiracy group" and the "decentralized community," then the "joining" of Binance, which has the title of "the world's largest exchange," undoubtedly added fuel to the fire of this dispute.

Uppercase NEIRO contract launched first: Did the conspiracy group defeat the crypto community?

On September 6, Binance issued an official announcement, stating "Binance Futures will launch NEIROETH 1-75 times USDT perpetual contract." As soon as the news came out, the market quickly reacted—NEIRO's price quickly broke through $0.16, with a 24-hour increase of up to 139.25%, and subsequently surpassed $0.2 in the following days.

It is worth mentioning that at that time, the NEIRO token had been criticized by many users of platform X, claiming that the "conspiracy group" behind it had previously distributed tokens to multiple addresses and gradually sold them off, followed by a prolonged washout period of 2 months. Before the launch of the Binance contract, NEIRO also experienced a slight increase, leading some to question the existence of "insider trading."

Despite NEIRO's trading volume reaching hundreds of millions of dollars on platforms like Bybit, the project's previously high "internal holding amount" of up to 78% made crypto players who joined due to the relatively fair entry barrier of meme coins sneer at it. There were also voices in the market and community criticizing Binance's listing behavior and expressing disappointment.

However, things quickly took a turn.

Lowercase Neiro spot contract followed closely: Can the fire of the community spread?

On September 16, 10 days after the announcement of the "uppercase NEIRO contract listing on Binance," Binance once again announced that "Binance will list First Neiro on Ethereum (NEIRO), Turbo (TURBO), and Baby Doge Coin (1MBABYDOGE) and add seed labels for them."

As the token ID in the official announcement was also in uppercase NEIRO, many people mistakenly thought it was the previously listed NEIRO project and did not pay too much attention to it. However, the contract address showed that this project was actually the lowercase Neiro project, with the market value of the project at that time being only around $20 million.

Moreover, not only the capitalization of Neiro was confusing, but Binance's "one-click three coins" operation also left many users puzzled—although in terms of trading volume, project operation, and market recognition, TURBO and BABYDOGE can indeed be classified as "established meme coin projects," the dense "spot listings" of these meme coins, and all being meme coins, are as rare as the previous "BOME listing on Binance in 3 days."

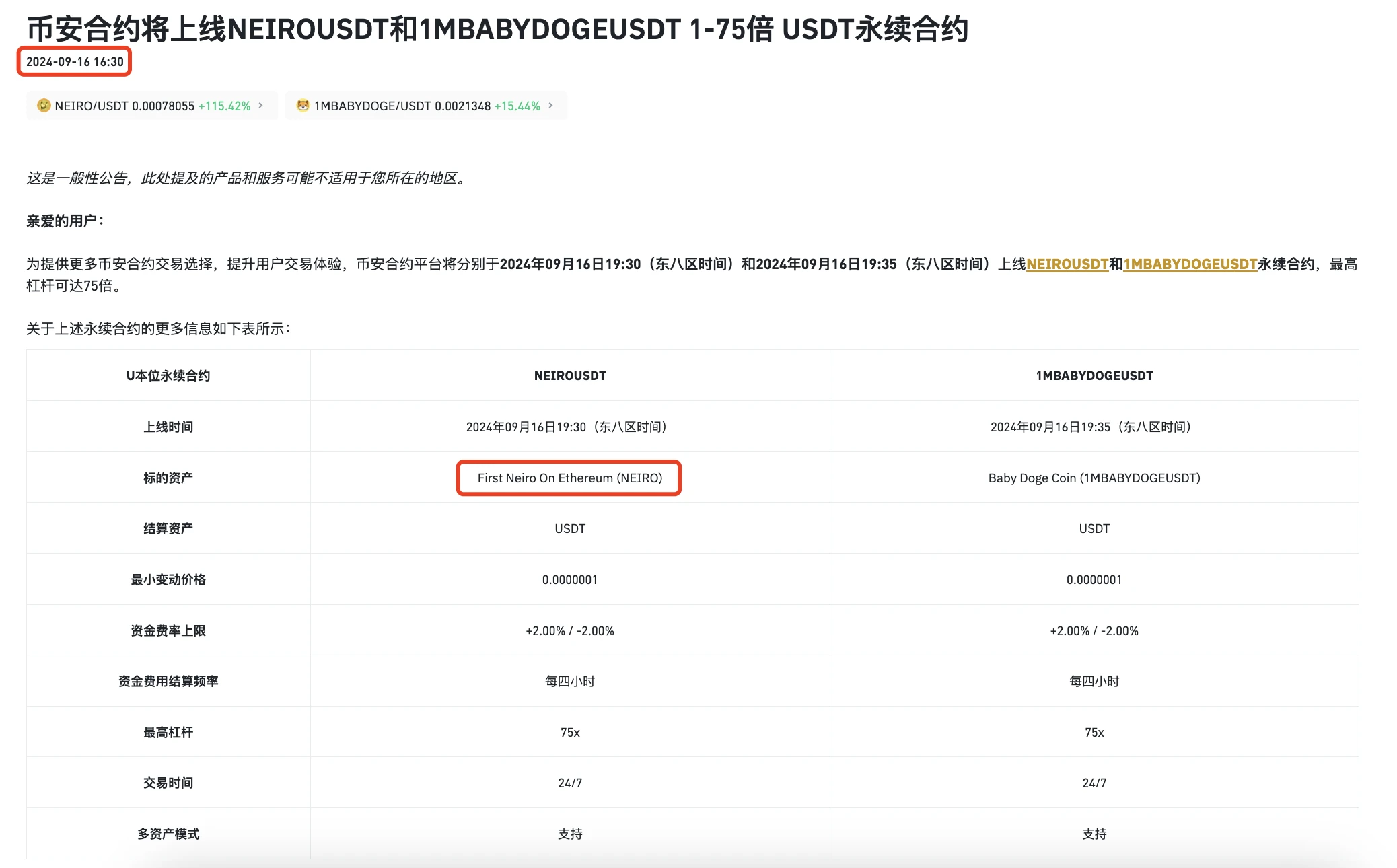

At 4:30 PM on the same day, Binance once again announced, stating "Binance Futures will launch NEIROUSDT and 1MBABYDOGEUSDT 1-75 times USDT perpetual contracts." Furthermore, the official announcement from Binance specifically reminded: "Please note that this contract is for 'First NeiroFirst Neiro On Ethereum' (NEIRO), with the address 0x812ba41e071c7b7fa4ebcfb62df5f45f6fa853ee. It is different from the NEIROETHUSDT contract that was launched on September 6, 2024".

Many people at this point felt as if they were waking from a dream: "Indeed, the lowercase Neiro token, supported by many members of the Chinese community, has both spot and contract listings on Binance." The market value of the Neiro project also rapidly increased in just a few hours, skyrocketing from $20 million to over $120 million; in contrast, the price of the uppercase NEIRO token rapidly declined, falling below $0.1 in just a few hours, dropping to around $0.072, with a maximum daily decline of over 50%, and currently maintaining around $0.076.

Many people exclaimed: "In the end, the crypto community has defeated the 'conspiracy group'."

After the successful simultaneous spot and contract listing of Neiro on Binance, Binance subsequently released two announcements, “Binance will list NEIRO, TURBO, and BABYDOGE on Earn, Swap, and Margin Trading” and “Binance Staking and Borrowing adds NEIRO, POL, TURBO, and other borrowable assets”, showing much stronger support for the lowercase Neiro project compared to the uppercase NEIRO project.

Although some criticized Binance for once again lowering the "listing standards," in the current volatile and increasingly liquidity-constrained market environment, considering the main demands of exchanges, meme coin projects with high market attention, active trading volume, and stable operation are indeed within the "range of fire," which is understandable.

Community Voices: Some act on rumors, some go all in, some play both sides

The response and reactions from the crypto community to the simultaneous listing of the uppercase and lowercase NEIRO/Neiro tokens on Binance are quite intriguing.

When the NEIRO contract was launched, some people "wished to be part of the conspiracy group," some engaged in short-term trading and successfully profited, while others overly believed in the "Binance effect" and ended up chasing highs and getting trapped. After the spot and contract listing of Neiro, the "diamond hands" finally received their corresponding rewards, all feeling jubilant. Some lucky individuals made tens of thousands of dollars in floating profits by taking advantage of the early ambush. Of course, there were also those who sold their Neiro holdings to buy NEIRO tokens, only to miss out on the gains from Neiro and could only lament their missed opportunity.

Lucky or Insider? Whale accumulates over 20 WETH to buy Neiro, floating profit of $355,000

On September 16, according to on-chain analyst Ai Yi's monitoring, an address that coincidentally accumulated 13 billion Neiro tokens on September 15 made a 694% profit in just one day. The lucky individual, address 0x4bb, previously withdrew 21.667 WETH from a CEX and bought 13 billion Neiro tokens at an average price of $0.00003924, currently floating a profit of $355,000.

KOLs who "dug in": BitCloutCat, Philanthropist

According to Chinese crypto KOL and Tinfun NFT founder "BitCloutCat," in a post on X platform, he realized nearly $2 million in profits from a single meme coin project due to the price increase brought about by Binance's listing of the Neiro project. Previously, he also retweeted a tweet from on-chain monitoring account Onchain Lens tracking his personal address's purchase of Neiro tokens. Additionally, another Chinese crypto KOL, "Crypto Philanthropist," also reaped substantial gains. He had previously expressed a preference for the community-supported Neiro project and summarized, "I initially bought $50,000 worth of Neiro, at a cost of around $17 million in market value; when the $50,000 increased to $100,000, I sold $50,000 to break even, and the remaining $50,000 holding is all profit. Recently, the profit is now worth around $400,000 (about 9 times profit), and I just took out half of the profit; now there is still $200,000 in profit remaining."

"Victim" of market news: Loss of $250,000 in just a few days

Of course, not everyone was able to "enjoy the fruits of victory" at this feast; some ended up "paying the bill." Crypto KOL Jiujinshan2022 posted on X platform, stating, "I lost around $250,000 due to trading related to the uppercase and lowercase NEIRO/Neiro tokens."

Early SHIB sellers enter the scene, Neiro continues

Although the dispute between the uppercase and lowercase NEIRO/Neiro token projects has temporarily come to an end, the development of the Neiro project continues.

According to Spot On Chain's monitoring, on September 18, an early buyer of SHIB exchanged 1,003 ETH ($2.31 million) for 28.6 billion Neiro tokens.

It is worth noting that although this whale made $145 million from SHIB in 2021-2022, two of the recent three transactions (including NEIROETH and the second SHIB transaction) resulted in a loss of $13.48 million.

As of the time of writing, the price of the NEIRO token is stable at around $0.073, with a market value of approximately $73.7 million; the price of the Neiro token briefly approached $0.0009 and has now fallen to around $0.0008, with a market value of approximately $337 million.

Binance's Shift: Multiple Considerations, Community Focus, Second Half of the Meme Coin Race Approaches

Finally, we will briefly analyze the event of the dispute between the uppercase and lowercase NEIRO/Neiro tokens, and take a glimpse at the future direction of the meme coin race from the perspective of the industry leader Binance's attitude and operational shift from the beginning of this year's hype to the present. In some respects, the second half of the meme coin race may already be underway.

Binance's Shift: From "You Can Short" to "Considering Hotspots" to "Admitting Shortcomings"

In March of this year, with the approval of a Bitcoin spot ETF, market sentiment soared, Bitcoin prices reached new highs, and Ethereum prices briefly approached $4,000. Additionally, the Solana meme coin craze led by BOME completely ignited the entire market, leading to a phase of high liquidity and extremely active trading in the "bull market sentiment stage."

Seizing this opportunity, as a leading exchange with over 200 million users and a cryptocurrency trendsetter, Binance initiated a round of what now seems somewhat "crazy" listings—listing over a dozen high market value projects in just a few months. At that time, "high FDV, low circulation" "VC coins" also became the focus of market discussion.

Furthermore, at a time when the U.S. SEC was conducting a highly tense investigation into Binance, Binance ultimately reached a settlement of up to $4 billion with the SEC, and founder CZ ultimately temporarily left the market with a three-month prison sentence and a phased result of stepping back from the front line of Binance management.

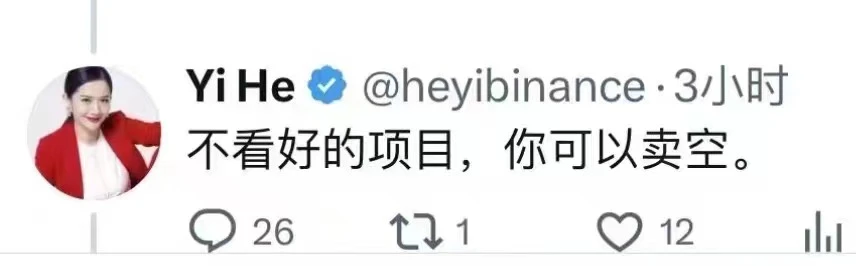

At that time, many people were extremely dissatisfied with Binance's "crazy market bloodsucking" practices. In response, He Yi, co-founder of Binance, bluntly stated, "For projects you don't like, you can short them," displaying the dominance of the market leader and the ruthless style of market survival of the fittest.

Fast forward to September, with the Federal Reserve's interest rate cut information still shrouded in secrecy, the market showed signs of exhaustion after experiencing waves of volatility. He Yi, as one of the "spokespersons" for Binance, may have also realized the different impacts brought about by changes in the market environment. At the same time, he also paid more attention to "community feedback," and his statements, in contrast to his previous sharpness, now seem more like heartfelt communication with community members.

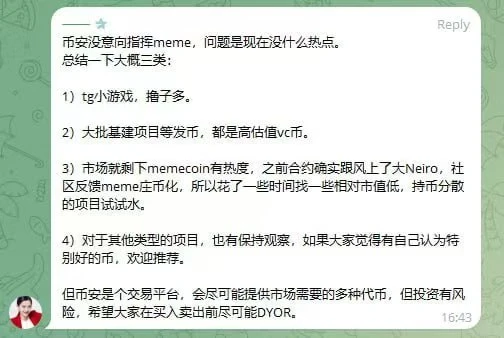

Just in the past two days, He Yi made a statement in a certain Telegram group, saying, "Binance has no intention of commanding memes. The problem is that there are currently no hotspots. In summary, there are roughly three categories:

- Telegram mini-games, lots of rug pulls.

- A large number of infrastructure projects and other token launches, all high valuation VC coins.

- The market is left with only meme coins with heat. Previously, we followed the trend and listed the large Neiro contract, but the community feedback indicated that meme coins were becoming like a 'meme pump and dump scheme,' so we spent some time looking for relatively low market value, diversified projects to try out.

- We are also keeping an eye on other types of projects. If you think there are coins that you believe are worth waiting for, feel free to recommend them.

But Binance is a trading platform and will provide a variety of tokens that the market needs as much as possible. However, there are risks in investing, and I hope everyone will DYOR as much as possible before buying and selling."

On the one hand, this statement indirectly indicates the recent listing of TON ecosystem tokens such as DOGS, HAMSTER, and CATI; on the other hand, it also reveals Binance's goodwill and sincerity towards the community: while considering hotspots, they will also listen to community opinions and suggestions.

Moreover, He Yi's latest post is extremely sincere and humble, stating, "Everything I have gained today is a product of the times, the rapid economic development brought about by globalization, the flat information landscape rising with the advent of the internet, and the opportunities created by the blockchain industry from scratch. It's not because I have extraordinary talent, but rather because in the early days of the industry, 'when there are no heroes, even a mediocre person can become famous.' This means: 'I may not necessarily be right.'

Second Half of the Meme Coin Race Approaches: Active Trading, Market Attention, Continuous Topic Relevance are All Essential

In addition, the dispute between the NEIRO/Neiro uppercase and lowercase tokens may also signify that after experiencing the Solana meme coin craze represented by BOME and SLERF, the PVP meme coin craze led by pump.fun, the celebrity meme coin craze led by MOTHER, DADDY, and the "new Shiba Inu Neiro" meme coin craze, the meme coin race has entered the second half.

On the one hand, the trend of rapidly declining and decaying meme coins will become fewer and fewer, and meme coin projects are beginning to consider "topic relevance," "breaking out of the circle," and short-term "wealth creation effects." On the other hand, meme coins no longer have the strong appeal to outsiders as they did before. In the increasingly liquidity-constrained environment, the "ultimate destination" for meme coin projects may enter the "To VC" and "To Exchange" entrepreneurial stage.

Just as we mentioned in the article "Evolution of the Crypto Venture Capital Cycle (Part 1): Creating a New World" earlier, "VC coins were once meme coins," and now meme coins and subsequent meme coin projects may have to face the situation of "Meme coins are also VC coins."

The latest news indicates that according to monitoring by The Data Nerd, Wintermute has accumulated NEIRO tokens worth approximately $3.4 million since September 10. As of now, the address holds a total of tokens worth approximately $4.55 million, accounting for about 6.2% of the total supply. (Odaily Planet Note: Some people speculate that Wintermute may be a market maker for the NEIRO project, but this information has not been verified.)

After all, whether a successful meme coin can stand out from the thousands of projects depends not only on its "original narrative," but also on the "strength of the market maker," "a community with strong cohesion," and "the 'project team' or 'volunteers' who advocate for it." In other words, a meme coin without fighting power loses from the start, losing in a complete and miserable manner.

This may also be an important reason why, after experiencing high-intensity PVP, despite the emergence of one-click token issuance platforms in various ecosystems and platforms like mushrooms after the rain, the meme coin race is gradually cooling off.

Conclusion: Meme Coins Move Beyond the "Grassroots Development Period"

Finally, please allow me to make a somewhat arbitrary conclusion: the era when three to five people could start a meme coin project and, with the help of the market and the community, achieve a market value of tens of millions or even hundreds of millions of dollars, may be difficult to reappear. Meme coins have moved beyond the previous "grassroots development period."

Just as we wrote in the article "After the Meme Summit, the Base Meme Coin Ecosystem Officially Enters the Second Half" in June of this year, the success of a meme coin project that can be achieved single-handedly is now very difficult in the Base ecosystem. The market performance of representative meme projects in the Base ecosystem, such as DEGEN, and the subsequent market performance of the "NFT artist's second entrepreneurial project" MFERCOIN, which imitated the rise of BOME, also indirectly confirms our judgment.

Now, this viewpoint extends to the entire crypto industry—perhaps it is time for meme coins to be joined by the "regular army."

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。