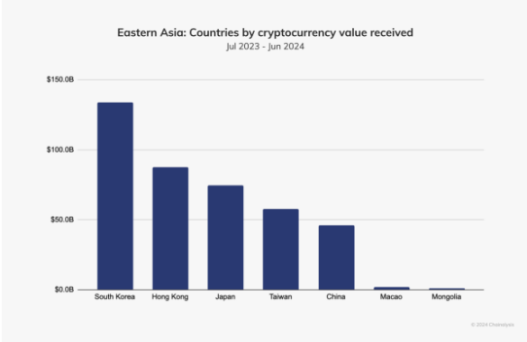

The adoption rate of digital currencies in Hong Kong ranks 30th internationally, indicating its potential to become a major player.

Source: bitcoinist

Translation: Blockchain Knight

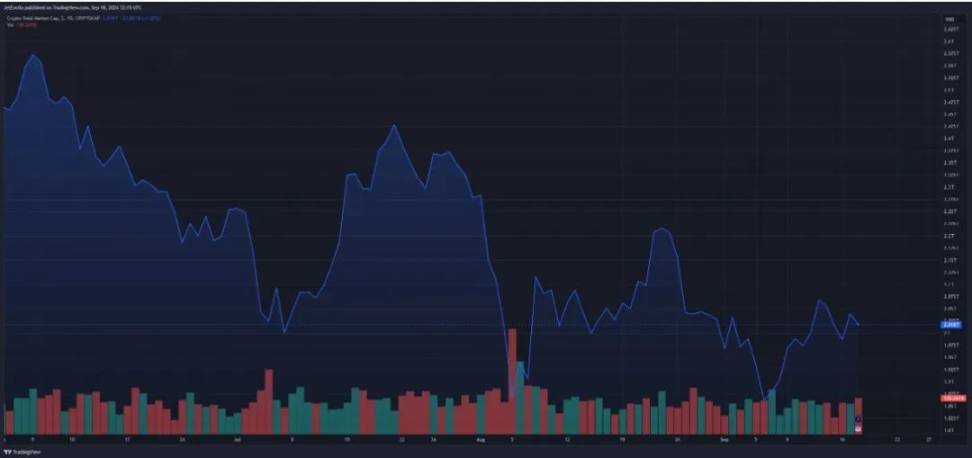

Impressively, the trading volume of crypto assets in Hong Kong has increased by 86% year-on-year. According to a report by Chainalysis, the adoption rate of crypto assets in Hong Kong leads the way in the East Asian region.

The region's adoption rate of digital currencies ranks 30th internationally, indicating its potential to become a major participant.

Several factors have contributed to this remarkable growth. Firstly, Hong Kong's regulatory environment is unique. For example, compared to the strict regulations in mainland China, Hong Kong has taken a more lenient approach to crypto assets.

This adaptability has promoted financial innovation, attracting the attention of institutions and individual investors hoping to enhance their crypto asset portfolios.

The total value obtained in the market mainly comes from centralized exchanges, accounting for approximately 64% of the total value obtained in the East Asian region.

This pattern indicates that investors are using these centralized platforms to meet their trading needs.

In East Asia, there is a profound divergence in the landscape of crypto assets. Centralized trading platforms remain the most popular, capturing 65% of the market value.

The convenience and reliability of these platforms attract retail traders, but behind this lies an unknown truth—an increasing number of institutional players are moving away from these centralized platforms.

Decentralized exchanges (DEXes) and decentralized finance platforms are becoming increasingly popular among institutional investors, although ordinary traders prefer centralized exchanges.

This shift indicates that larger participants are seeking various investment methods that can take advantage of market inefficiencies, and decentralized markets are often the case.

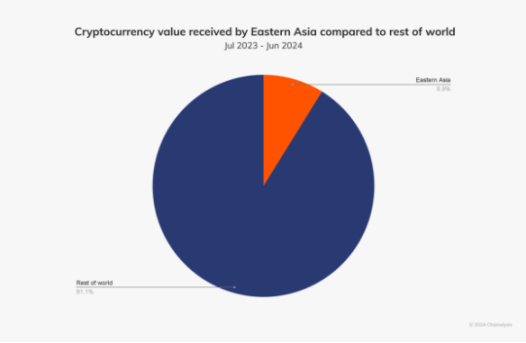

In recent years, the use of crypto assets in East Asia has increased significantly. From July 2023 to June 2024, the trading volume of crypto assets in the region accounted for approximately 9% of the total trading volume of crypto assets.

During this period, the transaction volume executed on the blockchain exceeded 400 billion US dollars.

During the research period, the value of crypto assets in South Korea was approximately 130 billion US dollars, maintaining the leading position in the East Asian region.

Although Hong Kong is developing rapidly, it will still face significant challenges in the near future.

The recent approval of an Ethereum ETF by the U.S. Securities and Exchange Commission (SEC) has disrupted some of Hong Kong's competitive advantages as a destination for global crypto assets.

Crypto asset investments will attract more attention from other financial centers, and Hong Kong must continue to innovate in order to remain a focus as a top destination for digital currencies.

Despite the promising prospects, the future development of crypto assets in Hong Kong remains uncertain. While consolidating its dominant position in East Asia, the region must negotiate the ever-changing domestic and offshore policies.

Investors are eagerly watching the financial district's response and whether it can maintain a stable growth rate. Supportive regulatory environment and increasing institutional interest in the region and its surrounding areas contribute to further development in the region.

However, to maintain its advantage, innovative ideas and clearer laws will be needed to address new issues brought about by domestic policies and foreign competition.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。